Electric Vehicles Are Picking Up Speed

Last month saw U.S. Electric Vehicle (EV) sales up 40% year-over-year. Every Tesla owner I know loves their car – although the February jump was helped by the launch of Ford’s Mustang Mach-E. EV market share (which includes hybrids as well as all-electric vehicles) rose from 1.8% to 2.6% in February. Nonetheless, EV sales fell last year due to Covid, from 331K to 296K.

Forecasts of booming EV sales are so common as to scarcely be news anymore. It’s possible to go back and find old forecasts that were way off. This one from 2011 looking ahead to 2020 includes a few the authors would like us to forget. Deutsche Bank’s forecast of U.S. sales was off by 2X. However, McKinsey’s global estimate was only slightly high.

David Victor recently published Energy Transformations in association with Engine No. 1, the activist investor pushing for Exxon Mobil to respond more quickly to the energy transition. The chart below is from his report – the small chart in the inset is a 1992 forecast from Shell on EV sales which has turned out to be wildly inaccurate. But the point of the main chart is that sales really are going to take off over the next decade.

It’s possible to find other old forecasts that were wildly inaccurate. Futurist Tony Seba predicted in 2017 that by 2030 100% of auto sales would be autonomous (self-driving) EVs (see A Futurist’s Vision of Energy). It’s still nine years away, but for autonomous EVs in the U.S. to reach that level would require their market share to double approximately every 20 months.

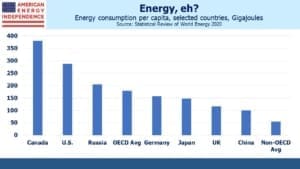

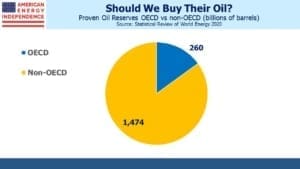

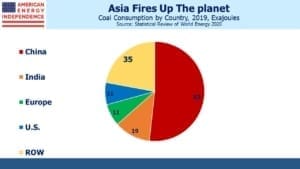

Growth in renewables and EVs have been about to break out for years. The world will need more energy – the U.S. Energy Information Administration (EIA) expects global energy consumption to increase by 50% over the next three decades. They expect every source to increase, including coal.

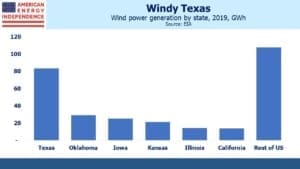

High among Elon Musk’s many talents is marketing, because he’s successfully linked EVs with clean energy in the minds of consumers. America generates around 60% of its power from coal and natural gas, with renewables (including hydro) and nuclear each providing around a fifth.

There are substantial variations – California is required to reach 100% emission-free power by 2050, and is about two thirds of the way there, even if their grid sometimes fails (see California Dreamin’ of Reliable Power). The state leads in EV sales. But Wyoming residents who buy a Tesla thinking they’re contributing to a cleaner planet overlook that over 80% of the state’s power comes from coal.

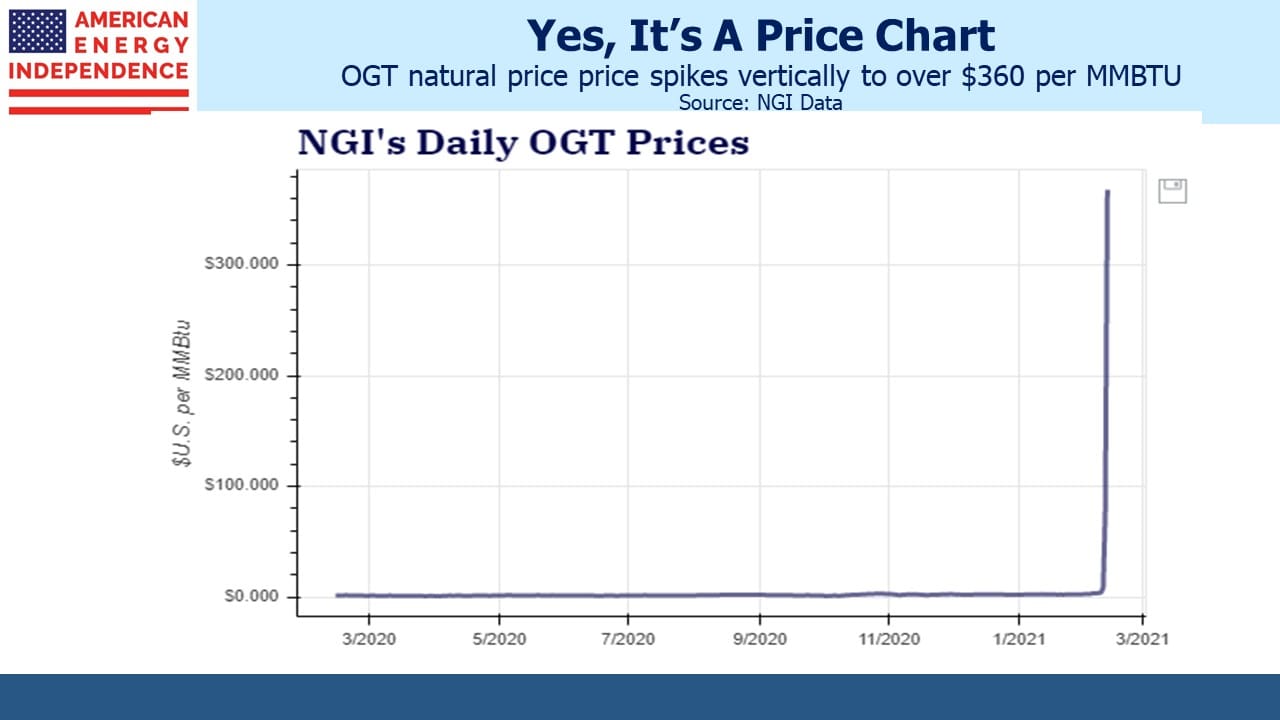

America’s coal consumption is heading in the wrong direction – the EIA expects coal’s market share of power generation to rise from 20% last year to 23% this year and next, matching the growth in renewables. Some of the growth in coal is due to higher natural gas prices – Democrat policies are intended to raise energy prices, although using more coal is an unintended result. And nuclear continues to drop, which is a big missed opportunity.

EV sales globally reached a 6.9% market share last year. President Biden is planning for the U.S. government to only buy EVs in the future. As my partner Henry pointed out, today’s internal combustion engine automobiles are built around a small power generator, which does seem less efficient than simply a battery.

Although insufficient charging stations and the time required to recharge remain impediments for many buyers, these challenges can be surmounted. A battery that lasted an entire day’s drive would certainly help. There are also fewer moving parts, which keeps maintenance costs down. And every EV owner loves the acceleration.

EVs are selling because they’re providing consumers what they want, and are growing market share as a result. By contrast, growth in renewable energy is more reliant on utilities increasing the portion of the power they supply from solar and wind. The absence of a carbon tax from the Democrats’ planned clean energy legislation reveals that, although many voters express concern about climate change, they’re unwilling to spend much to solve the problem.

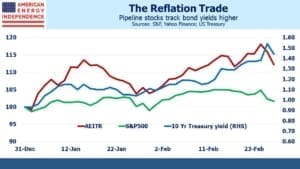

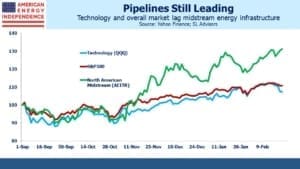

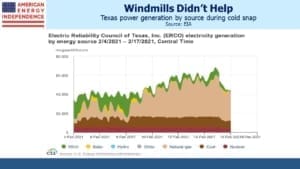

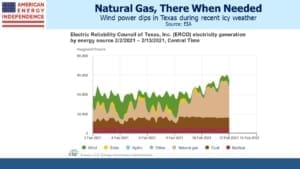

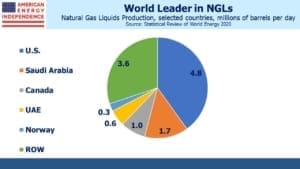

Meanwhile, pipeline operators such as Williams Companies (WMB) have found that increased use of renewables is boosting natural gas demand – weather-dependent power needs something reliable when it’s not sunny and windy.

Increased EV penetration is part of the electrification of the transportation sector. Since natural gas remains America’s biggest source of power generation, this trend will tend to constrain growth in crude oil demand in favor of natural gas, although the impact remains years in the future. In emerging countries, EV growth adds to the urgency to lower their dependence on coal for power generation. The energy transition continues to rely on natural gas.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.