AI Moves The Energy Sector

Forty years ago, when I was trading eurodollar interest rate futures, it was routine to respond to a sudden unexplained move in the market by calling the floor of the CME and talking to our broker. Caught up in the excitement of the loud heaving mass of brokers and locals in the pit*, he would breathlessly explain that, “Refco came in to sell 10,000 and Goldman followed with 15 after that. Cargill pulled their bid and it was all offered.”

This nugget of market intelligence was somehow intended to help guide me as I managed our interest rate risk. The broker was telling me what happened but had no idea why. This market color was almost completely useless, but somehow the broker and I felt that we were better off sharing the information.

Sometimes it feels like that when explaining moves in the energy sector. Prices fluctuate, and often out of all proportion to developments. There can be days with little news of importance, and yet pipeline stocks react as if there was.

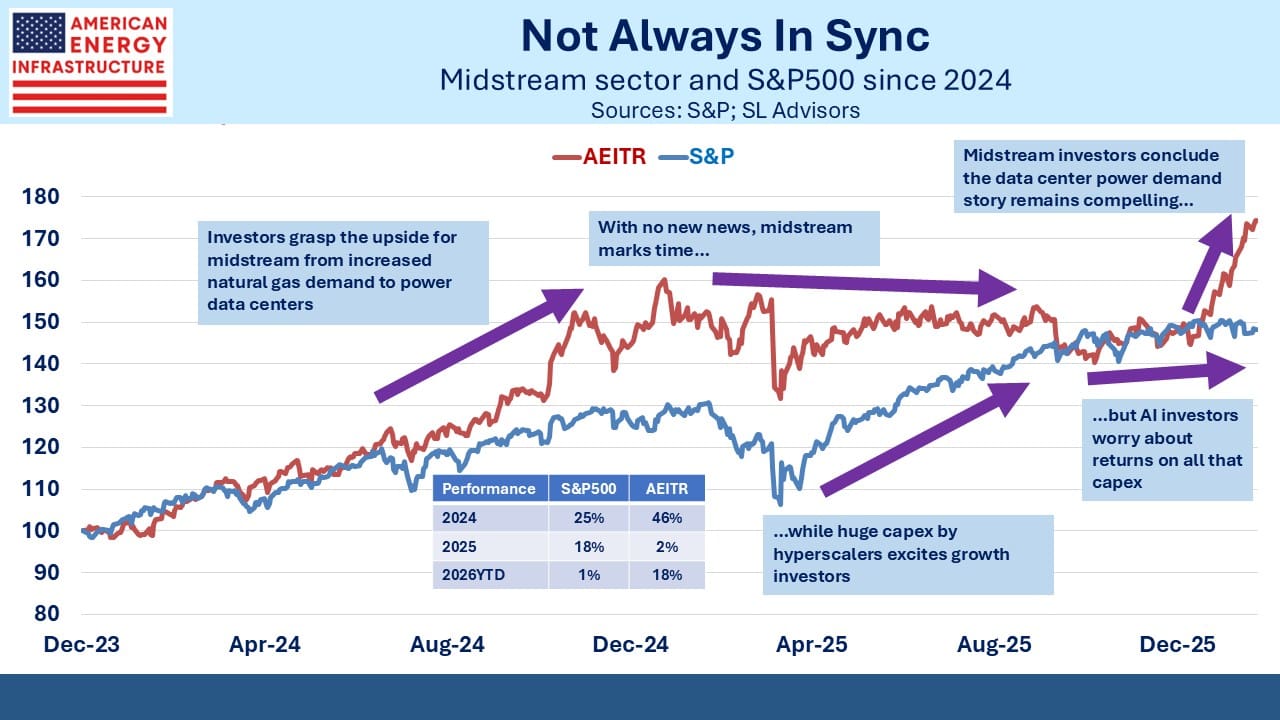

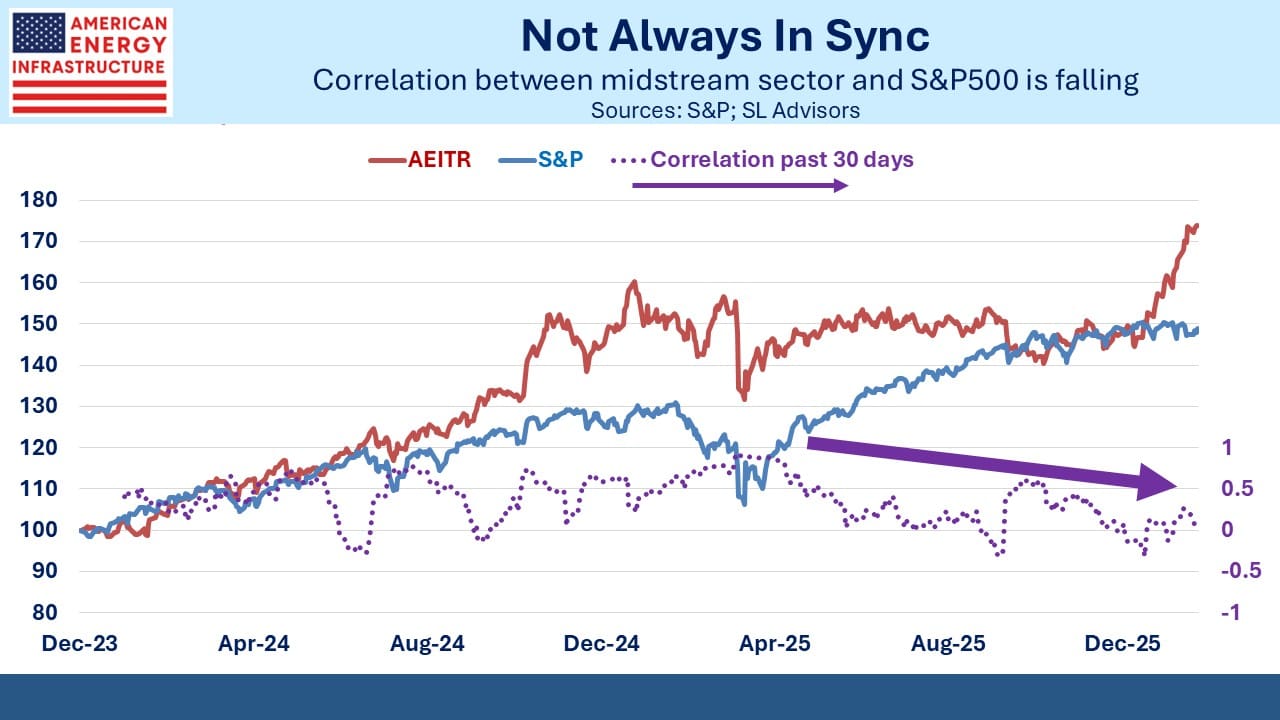

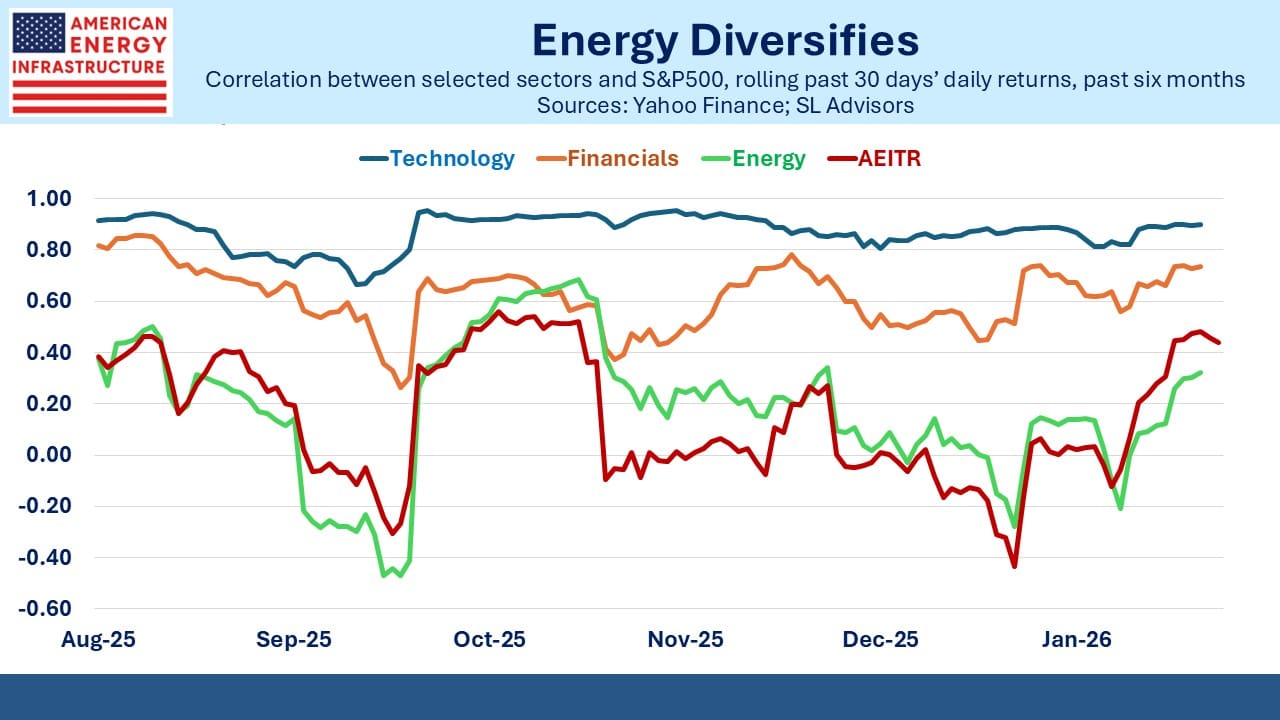

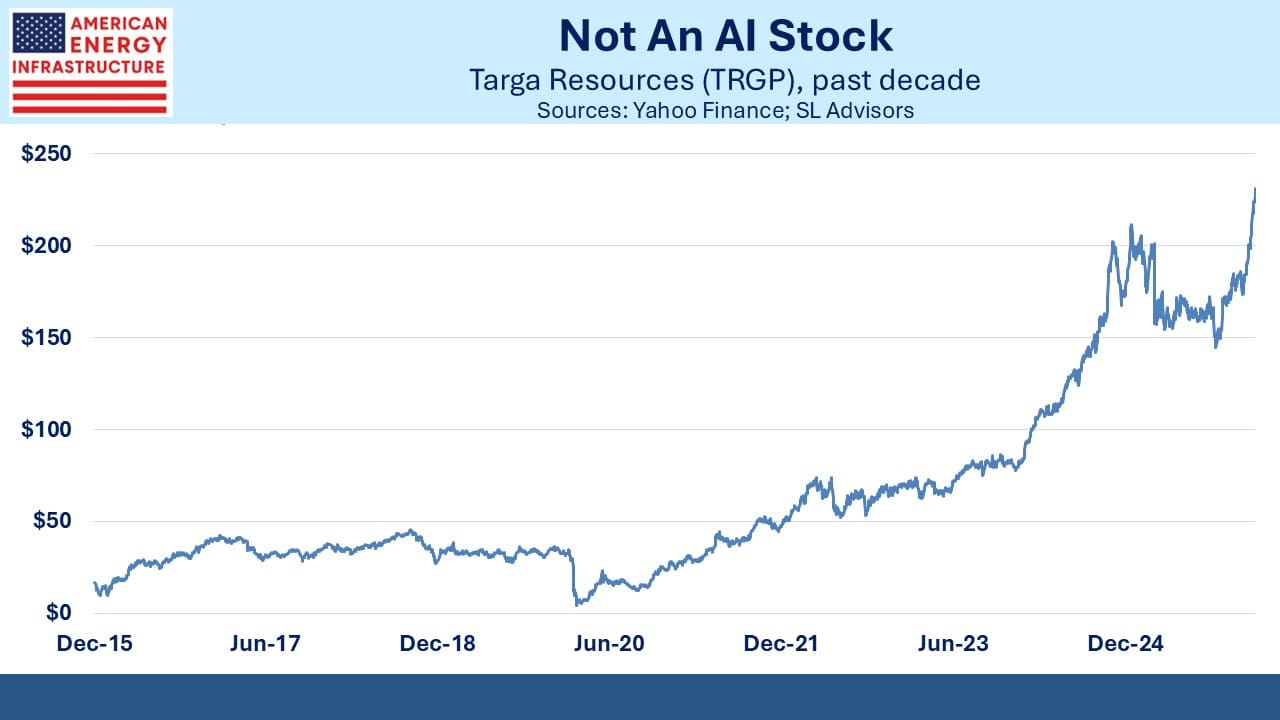

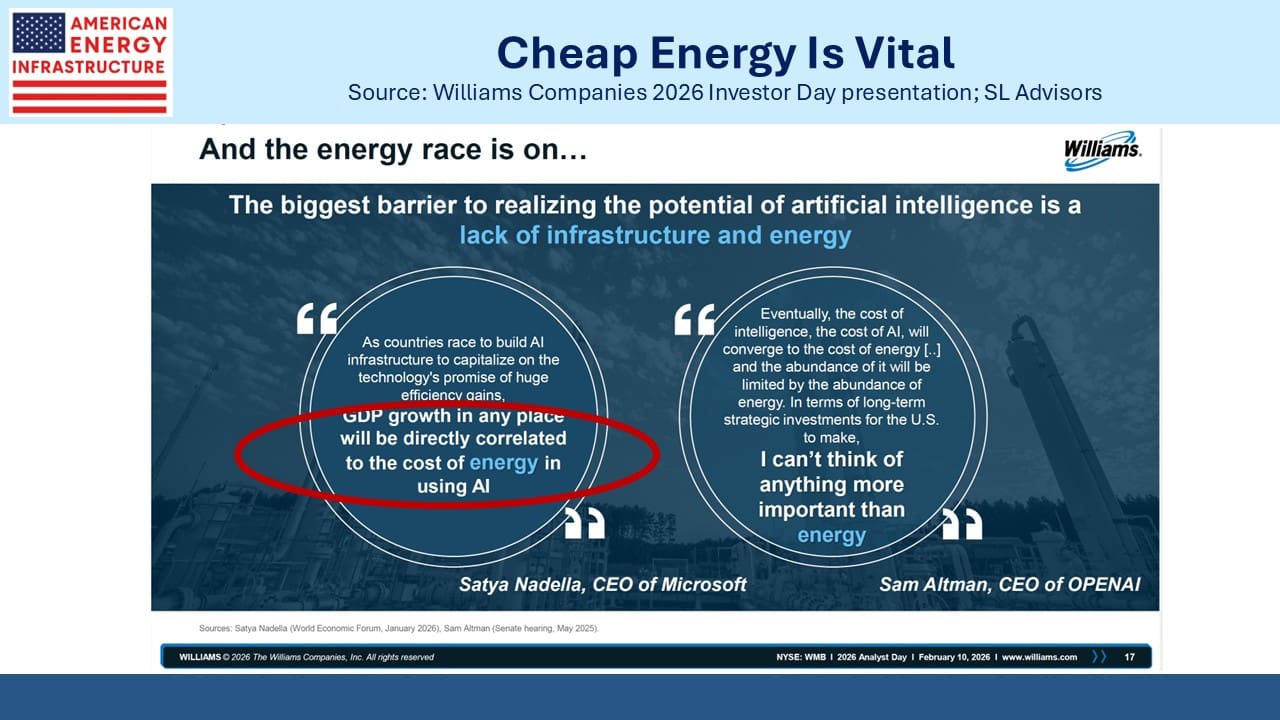

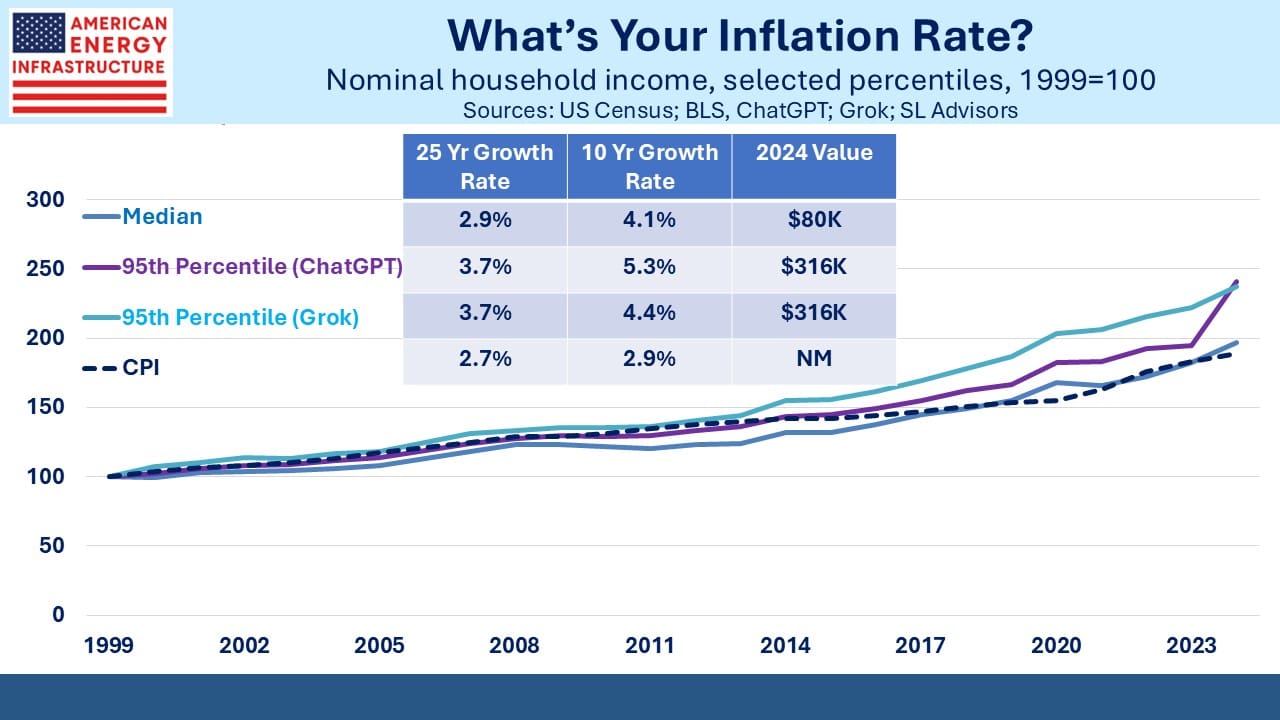

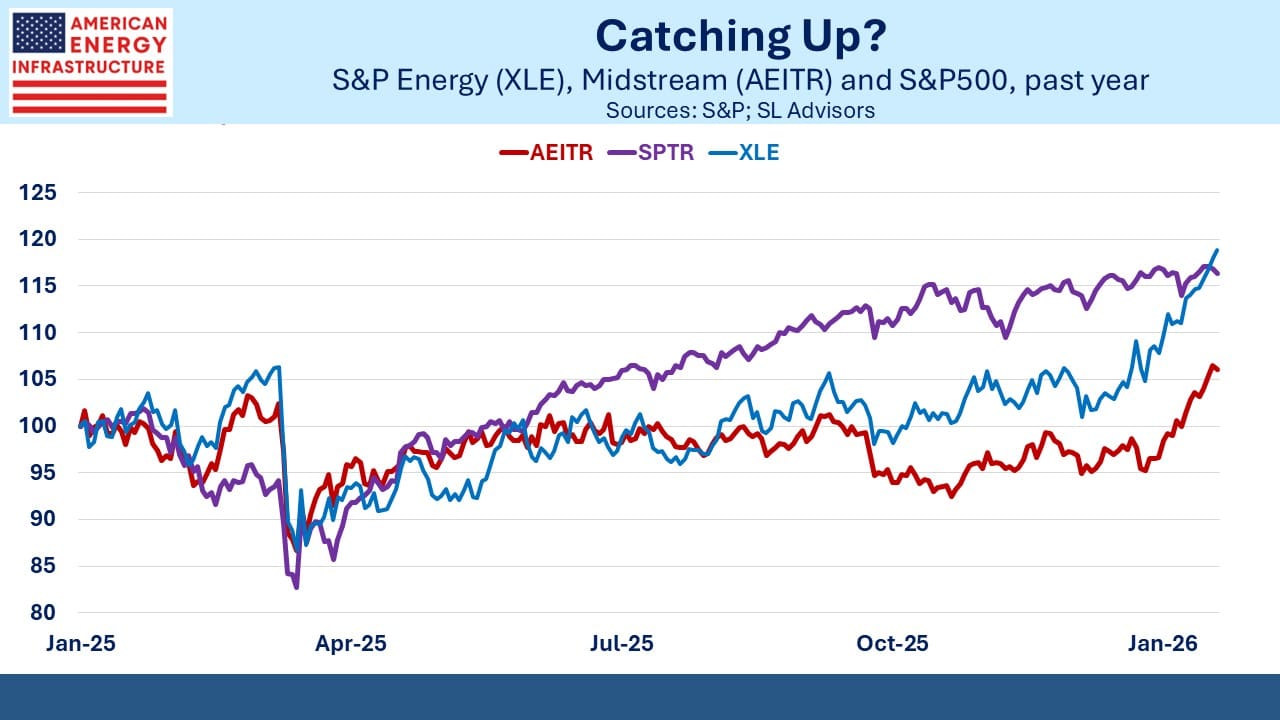

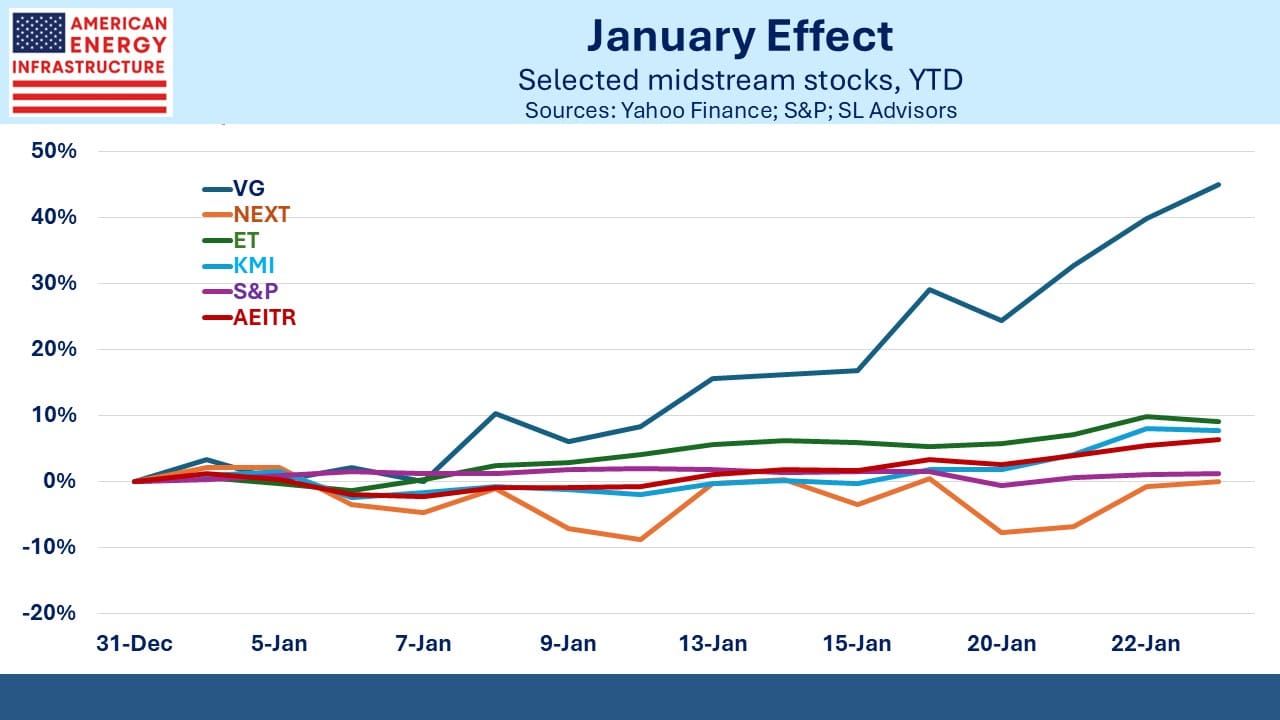

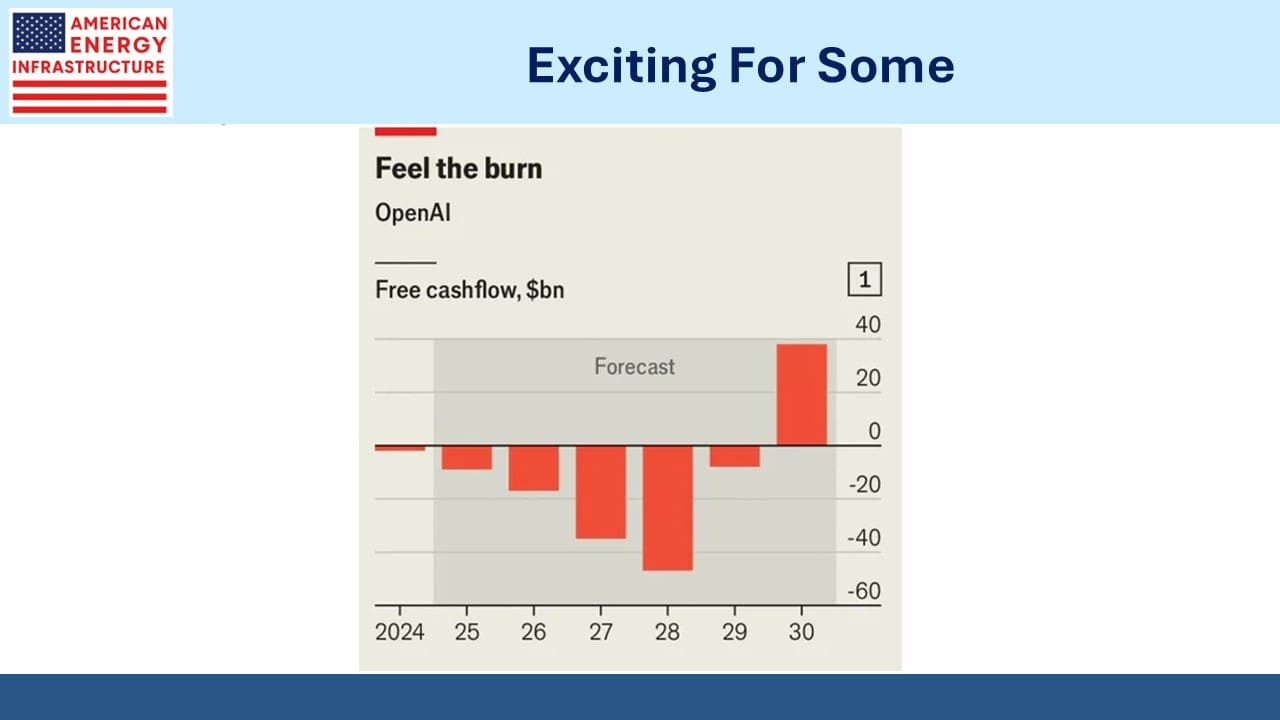

Last week was one of those times. We recently highlighted the low correlation between energy and the overall market (see Midstream Dances To A Different Tune). There’s a great AI story for midstream since data centers will rely principally on natural gas to generate power. But it’s still a value sector, and the emotional turbulence of growth investors remains dominant.

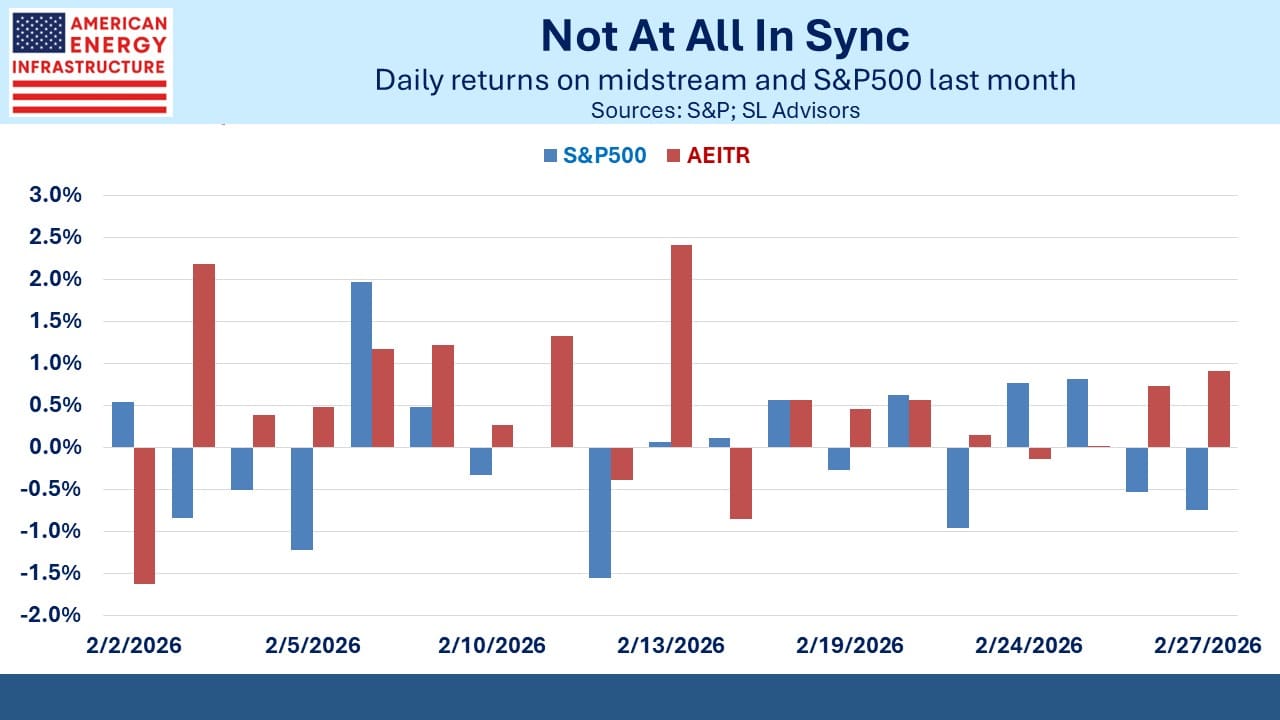

The low correlation between energy and the market means their daily moves are less in sync. February showed this dramatically: midstream and the S&P500 moved in the same direction on fewer than half the days of the month. In other words, a bad AI day was more likely than not a good day for midstream.

Over the past decade, changes in the American Energy Infrastructure Index (AEITR) have matched the market’s daily direction over two thirds of the time. Last month it was only 37%, 7 out of 19 trading days. It’s as if when AI stocks are down traders rush for the security of midstream with its stable cash flows. When AI stocks are up they dump these slow moving cash machines. I doubt such manic behavior is very satisfying or profitable.

The driver of returns in energy lies outside the sector.

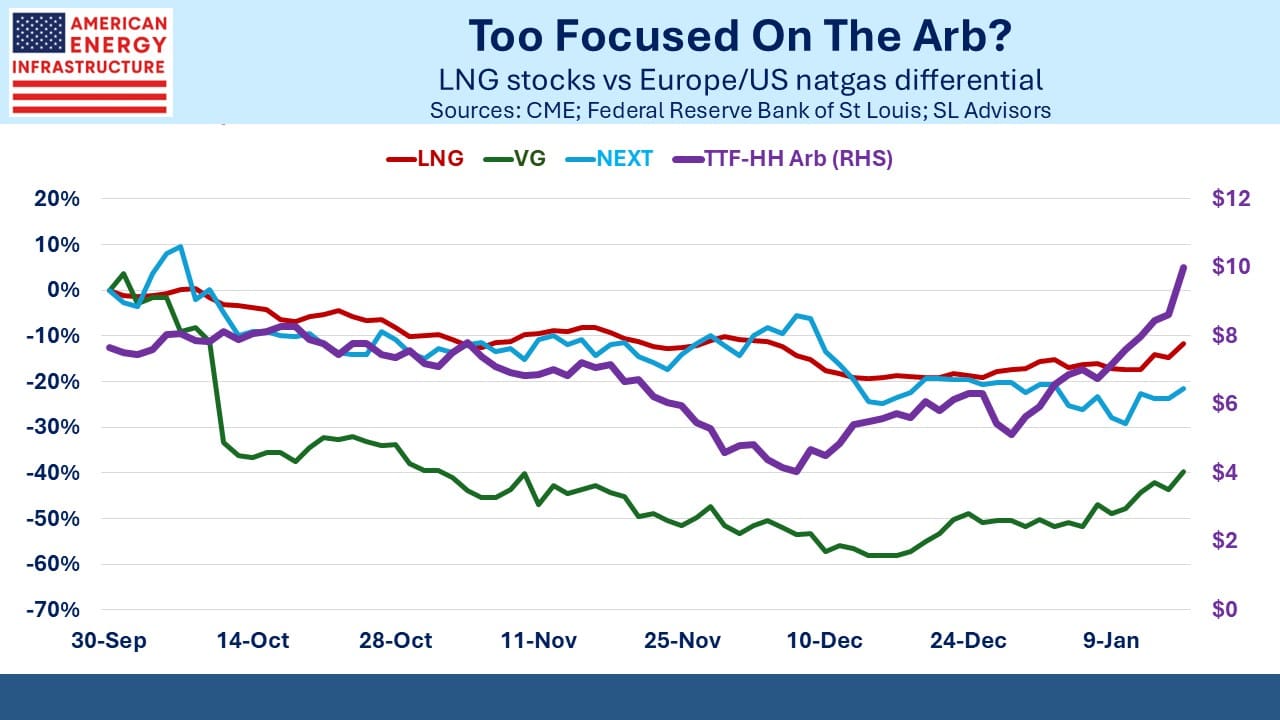

Midstream wasn’t completely the marionette to the AI puppeteer. Cheniere reported strong earnings, repurchasing $1BN in stock during 4Q25, more than expected, making it $2.7BN for the year. They also announced authorization for $10BN more in repurchases through 2030.

Cheniere expects Asian LNG demand to grow at 12-15% through 2030, which would take it from 270 Million Metric Tonnes (MMTs) to 400. Global LNG trade last year was around 430 MMTs.

Nonetheless, we think Cheniere’s buyback program suggests their capex plans may slow somewhat, a development welcomed by investors concerned about excess capacity among LNG exporters in the years ahead. Cheniere rose over 5% on Thursday following their earnings release and conference call.

Kinetik (KNTK) is an acquisition target of Western Gas (WES), and the interest has prompted KNTK to explore a sale process, inviting other companies to make proposals. The stock has rallied 14% since the news of WES’ interest first broke.

The American Energy Infrastructure Index (AEITR) is +20% YTD and the S&P500 is flat, approximately reversing last year’s relative performance (+2% and +18% respectively).

Regular readers know we often refer to the American Energy Independence Index. We started publishing it in 2017 because we recognized that the market was missing a truly representative index for midstream energy infrastructure, one that wasn’t dominated by Master Limited Partnerships (MLPs) but also didn’t omit them entirely.

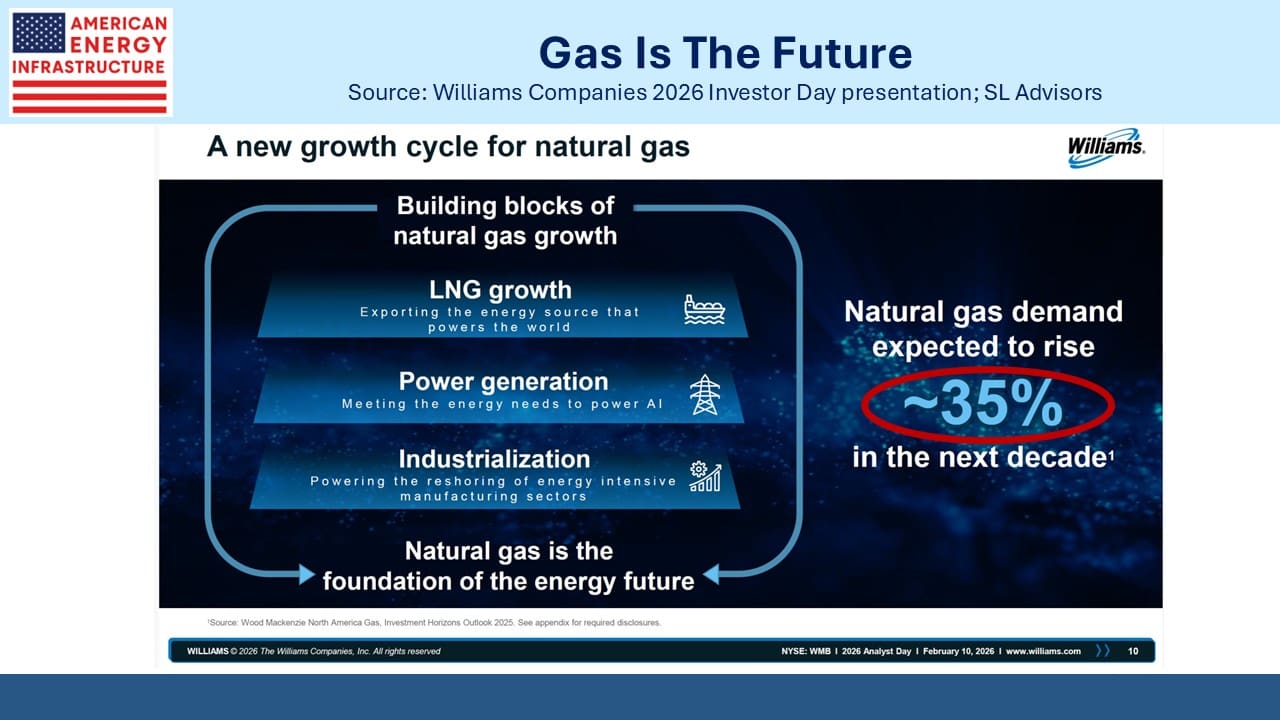

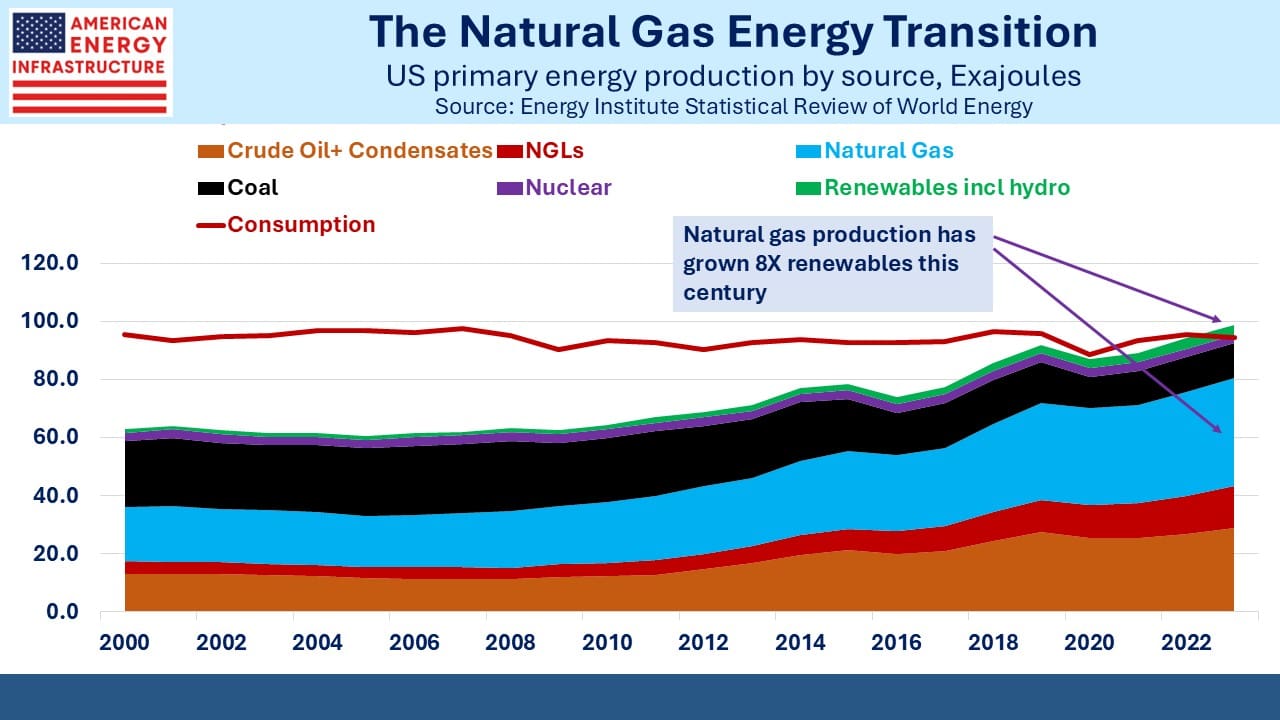

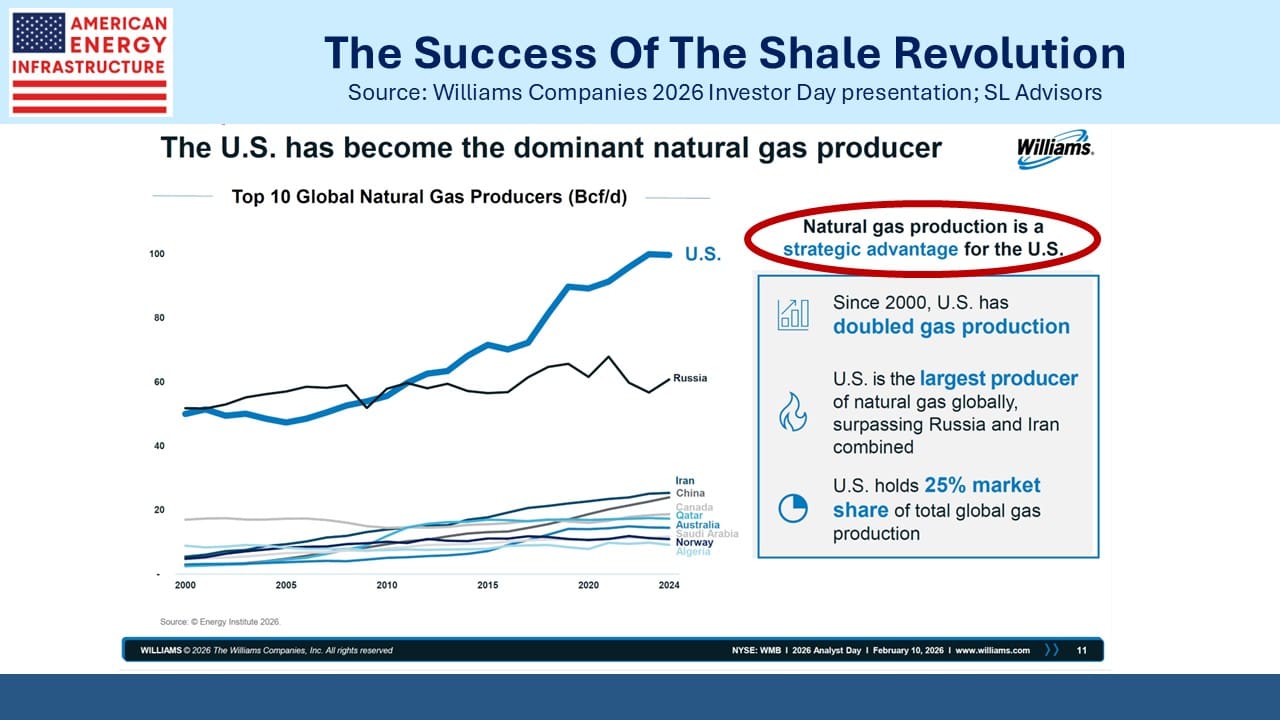

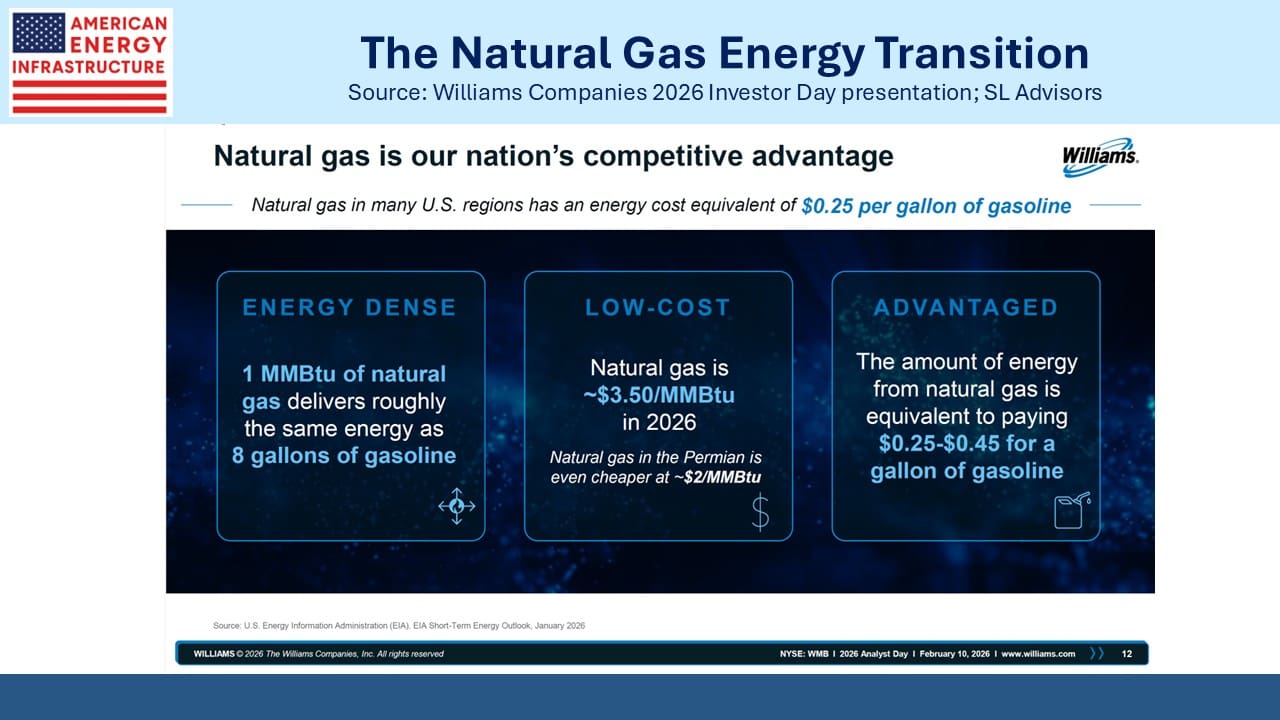

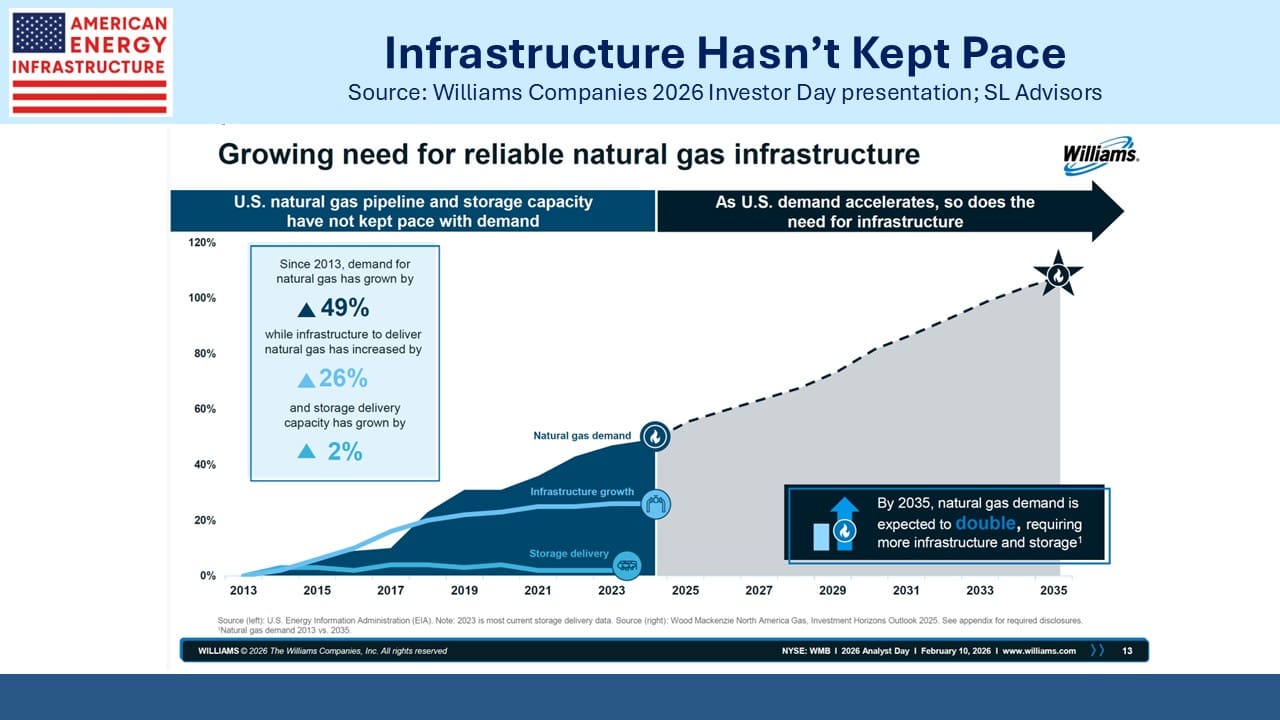

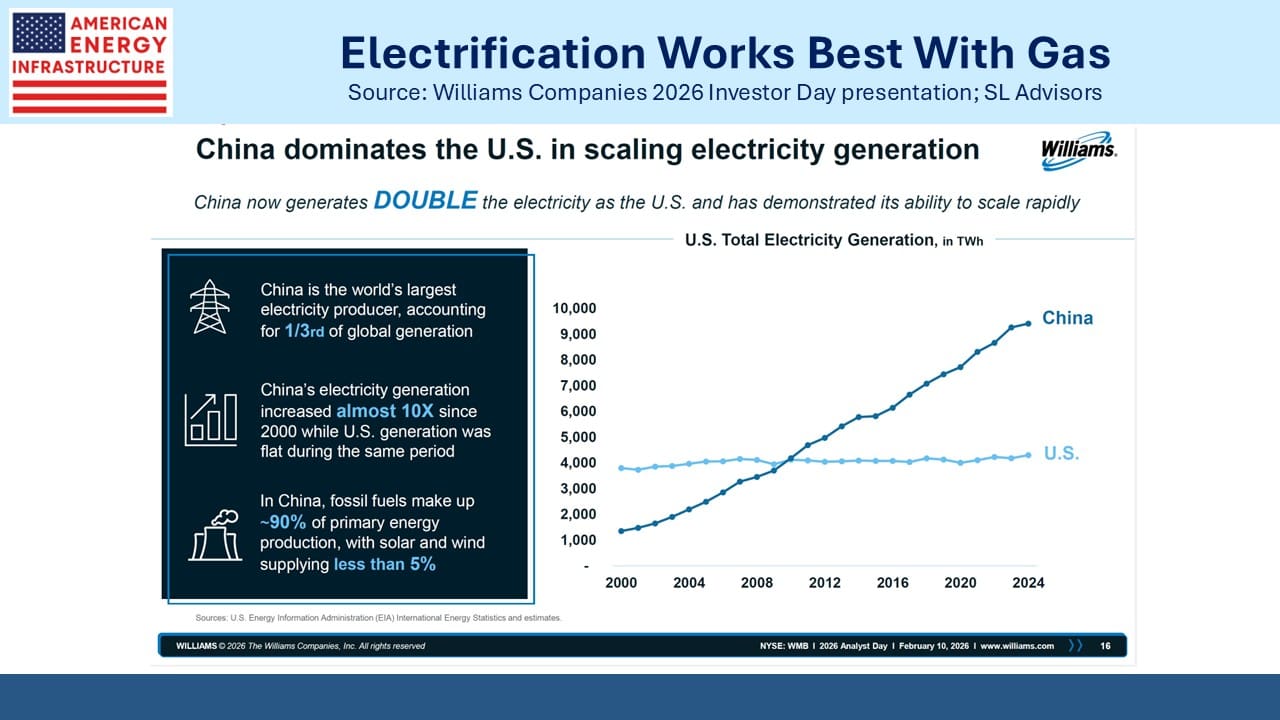

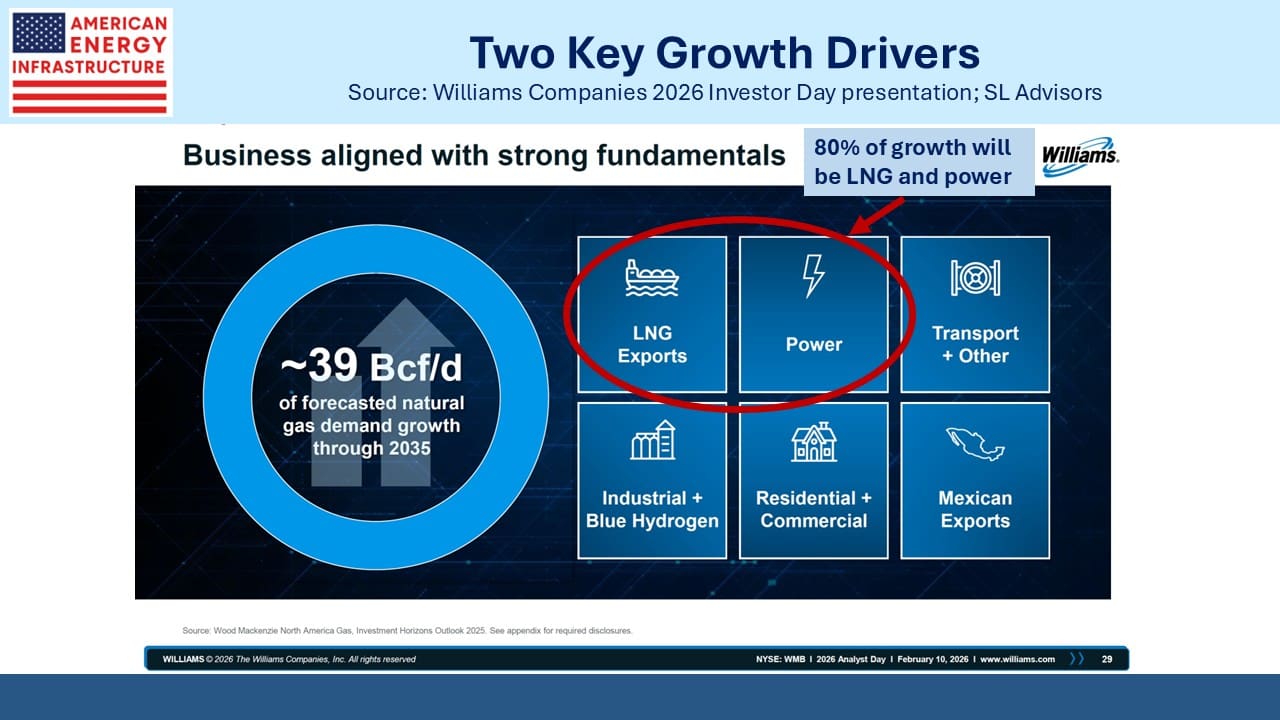

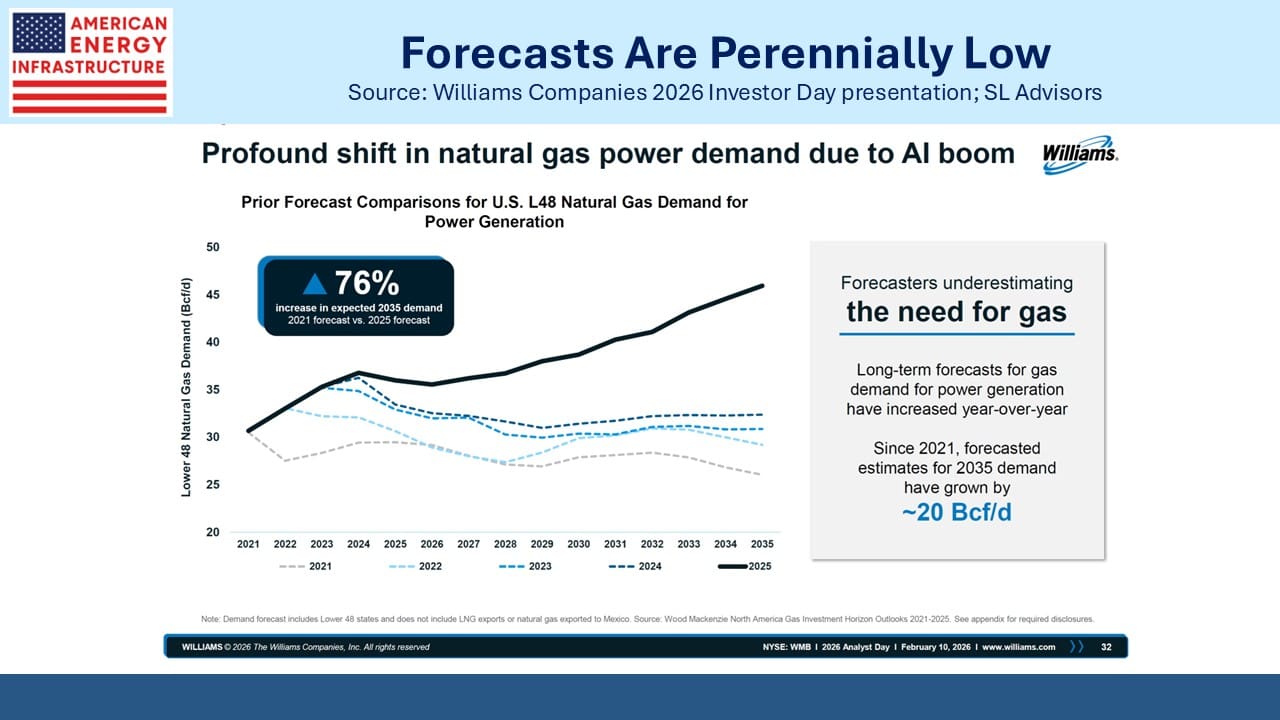

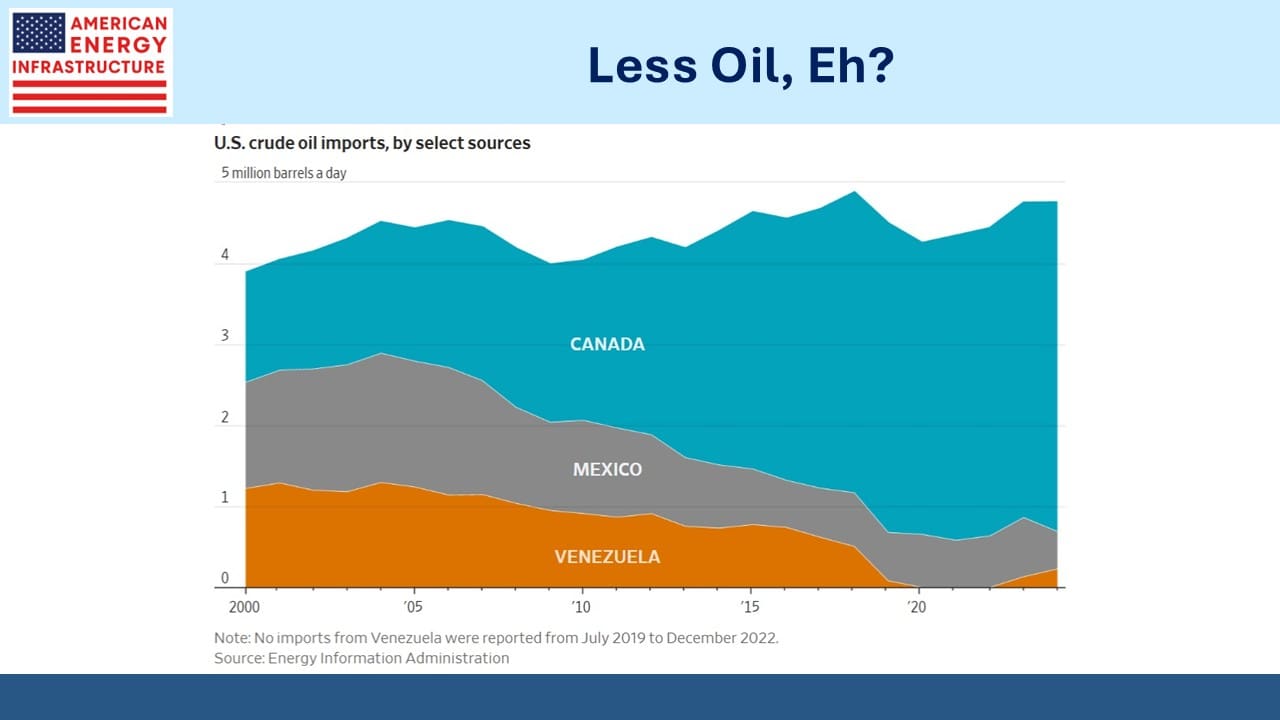

The AI revolution is boosting the demand for natural gas to generate power, benefiting those midstream companies that focus on gas. America’s shale revolution is also creating more opportunities to export Liquefied Natural Gas (LNG). The large price difference between the US and overseas markets is driving a substantial increase in US liquefaction capacity to meet foreign demand.

These two trends are more beneficial to midstream gas companies than those focused on oil, and investors are recognizing the opportunity to benefit from these twin growth stories. Therefore, we have modified the AEITR to become the American Energy Infrastructure Index, with an overweight towards names that we believe will benefit from increased gas consumption for power and LNG exports. The ETF that seeks to track this index will similarly rebalance at the end of the first quarter.

We are long term bulls on US natural gas consumption. Our index and our investments are aligned with this outlook.

*for those too young to remember, the Chicago futures exchanges were once cavernous rooms with several “pits”, consisting of ledges arranged in an octagon that descended in steps towards the center. Brokers were arranged around the periphery where they could easily see and communicate with their colleagues on the phone with clients, and locals (independent market makers) were within although the best spots were near the brokers executing the biggest volume. In this tightly packed environment, physical heft offered a commercial advantage. It’s now all computerized and impersonal.

We have two have funds that seek to profit from this environment:

Energy Mutual Fund Energy ETF