Pipeline Companies Should Buy More Stock

The energy sector has long been criticized for reinvesting too much capital back into its business, without ensuring that such investments exceed their cost of capital. No business can survive unless its return on investments is more than the cost of financing them.

Equitrans Midstream Corporation (ETRN) has an opportunity to demonstrate that they understand this.

ETRN’s major initiative is the Mountain Valley Pipeline (MVP) project, a natural gas pipeline with 2 Billion Cubic Feet per Day (BCF/D) of capacity connecting the Marcellus shale in West Virginia with customers in southern Virginia. Environmental extremists have been using the courts to block MVP for years, but ETRN management remains confident in its ultimate completion — albeit less so on the timing.

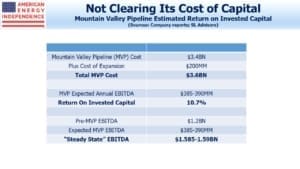

The first stage of the project, including feeder systems Hammerhead and the Equitrans Expansion Project, is expected to cost $3.4BN and generate $320MM in EBITDA. So the initial investment has a cash-on-cash return of 9.4%, well below the company’s target of a mid-teens IRR.

ETRN management believes they could add another 0.5 BCF/D of capacity for just $200MM. This would generate an additional $65-70MM in EBITDA, a whopping 33.7% Return On Invested Capital (ROIC). Expansion projects often have high returns, since they leverage off existing infrastructure and face less uncertainty.

The expanded MVP should generate $385-90MM on $3.6BN of capital, a 10.7% return. ETRN clearly needs to complete MVP – most of the capital has already been deployed. And the expansion, with its 33.7% ROIC, is an easy decision. But how should they think about allocating capital in the future, once this project is done?

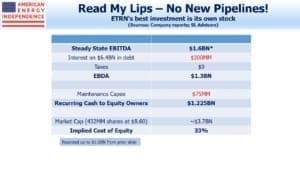

Currently, ETRN generates EBITDA of around 1.2BN. Following MVP’s completion, this will increase to $1,587MM, which we’ll round up to $1.6BN. A reasonable estimate of the sustainable cash flow to the owners is to start by deducting interest expense ($300MM on $6.4BN of debt) and taxes (which are currently zero as depreciation charges offset its taxable income). The company spends $75MM on maintenance capex, which is generally intended to offset depreciation and amortization, both of which are non-cash expenses. So the company will be generating $1,225MM for its owners.

ETRN’s 432 million shares at $8.60 give it a market capitalization of just over $3.7BN. Its cost of equity is therefore 33%.

A company is supposed to invest so that its ROIC is more than its Weighted Average Cost of Capital (WACC). In this case, assuming ETRN finances its assets with 50% debt which costs 4.7%, its WACC is 18.85%. Any project that fails to earn a return above this WACC is destroying value for the owners.

The disconnect between ETRN’s cost of equity and debt isn’t unique to them – it’s common across midstream energy infrastructure. Enterprise Products Partners (EPD) common units pay over a 10% dividend and trade at a 17% distributable cash flow yield, while it has 30 year debt outstanding yielding under 4% (see Tech Stocks Have Energy). Stock and bond investors hold sharply different views on pipeline stocks.

When EPD canceled an $800MM investment in a crude oil pipeline recently, the stock rose because this meant more cash for buybacks (see Investors Like Less Spending).

What it means is that ETRN should consider buying back equity as a use of capital competing with any other investment they might consider. Although the MVP expansion offers an ROIC comparable to the company’s cost of equity, they don’t have any other projects that come close to earning that type of return. In fact, the company has indicated they are seeking a mid-teens internal rate of return on new projects, so they’re not even trying to beat their WACC.

This makes no sense, based on ETRN’s stock price. Too many companies regard growth projects as an unassailable part of their business, almost a raison d’etre. They have a culture of always building. It’s because they’ve ignored this type of math that pipeline stock prices are so low.

Once MVP is finished, ETRN will demonstrate their grasp of corporate finance based on whether they recognize that buying back their stock is the best use they can make of their cashflow. If instead, they pursue the next growth project with a projected return half their cost of equity and even below their WACC, they’ll be confirming their financial innumeracy.

Too many midstream CFOs find grasping their cost of equity an elusive concept. If the components of WACC were reversed such that the cost of debt was 32%, few projects would be more attractive than paying down debt.

The distortion in capital markets between debt and equity should compel the entire midstream sector to reassess how they deploy their free cash flow, which is set to grow substantially (see Pipeline Cash Flows Will Still Double This Year).

Even Targa Resources, a company with a long history of flunking the math of capital allocation (see Pipeline Buybacks and ESG Flexibility), recently surprised many by correctly initiating a buyback. As others follow, the boost to their stock prices will be substantial.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

An excellent and insightful analysis.

Of course, the decision to build a pipeline is not just a financial one, it’s a business one. Given that permits are getting much harder to get, not to mention that the build itself is much harder even with the permits in hand, and that a pipeline from point A to point B is at least a quasi-monopoly, the decision to build or not gets complicated with some difficult to quantify considerations. If a company decides not to build a particular pipeline for now, it might forever forego being able to build it, either because of permitting or by another company building it instead.