Pipeline Buybacks and ESG Flexibility

Targa Resources, a perennial mis-allocator of capital, is not an obvious candidate to initiate a buyback program. Nonetheless they did on Monday, and the stock rose almost 11% on the news. In February last year, when Joe Bob Perkins was CEO, he responded to questions about their capex plans by arrogantly calling them “capital blessings.” This reflected an attitude that building new infrastructure and buying assets was part of their mission, regardless of whether such projects made financial sense.

TRGP’s stock performance says much about how they have allocated capital in recent years. It’s lost almost two thirds of its value over the past year, and 88% from its all-time high in 2014 when Energy Transfer was believed to be interested in acquiring them. Perkins remains with the company as Executive Chairman, having undelivered and been overpaid.

If the buyback reflects a new respect for the math behind how the company deploys its cash, it represents an overdue shift. TRGP is on track to begin generating Free Cash Flow (FCF) next year. Although buybacks allow plenty of discretion around timing, the market welcomed the announcement that $500MM would be dedicated to repurchasing stock.

TRGP’s buyback program is roughly equal to their expected 2021 FCF, so they’re to complete the program quickly. But it’s worth noting that, if the industry similarly dedicated its 2021 FCF to buybacks, that would amount to $40BN in purchases, twice the size of all the mutual funds, closed end funds and ETFs in the sector. There’s much more FCF available than what’s at TRGP.

In another sign that the MLP structure retains few friends, TC Energy (TRP) announced they’d be buying in the rest of TC Pipelines (TCP) that they don’t already own. With a 9% yield and limited investor base, TCP isn’t much use as a source of capital. It’s down 23% over the past year, whereas TRP has dropped 15%. Without a ready pool of K-1 tolerant income-seeking buyers, TRP concluded there was little value in maintaining their MLP.

Both TRGP and TRP are buying their own securities, which they deem undervalued. This is positive news. As more of the industry follows suit, it will provide further support for a beaten-down sector.

On a different topic, Jared Dillian wrote an informative article (see ESG Investing Looks Like Just Another Stock Bubble) highlighting how much of the interest in ESG investing is a fad. Picking companies that possess good ethical values seems pretty reasonable – except that the beauty of ESG lies in the beholder. Because there are no agreed criteria, just about every company can claim such credentials, and most do. For example, coal producer Peabody Energy publishes an ESG report.

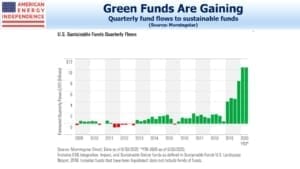

Dillian notes that much of the returns to ESG investing have been driven by liquidity. Inflows have surged over the past year, with Morningstar estimating almost $200BN invested in ESG funds.

Given the numbers involved, few companies can risk being non-ESG. Pipeline corporations are included (watch ESG Investors Like Pipelines), as they should be since increased use of natural gas is replacing coal in power generation. This is the biggest driver of reduced emissions in the U.S.

Confusingly, this means that Williams Companies’ (WMB) ESG credentials are based on successfully reducing demand for Peabody’s product.

MLPs generally don’t show up in ESG lists, because their weak governance (the “G” in ESG) disqualifies them.

The infinite flexibility of ESG is shown by Lockheed Martin’s (LMT) regular inclusion in the Dow Jones Sustainability Index. Manufacturing products that blow people up sustainably meets the threshold. This is why Jared Dillian is right to say, “…ESG is nothing but a passing investment fad.”

We are invested in LMT and all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

CEQP has –and has had for several years–a very advanced and sophisticated ESG program and an impressive annual ESG report, which is sincerely advanced by management.