For MLPs, Index Is Everything

Long-time MLP investors need little reminding that the sector is out of favor. The Alerian MLP ETF (AMLP), with its tax-inefficient structure (see MLP Funds Made for Uncle Sam) has been shedding clients for years (see AMLP’s Shrinking Investor Base). Its focus on MLPs while they dwindle in number means it omits most of the biggest pipeline companies, as they’re corporations. AMLP’s distributions are down by a third (see Why Are MLP Payouts So Confusing?).

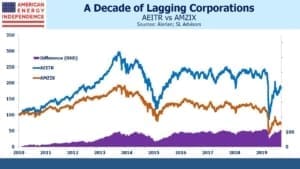

AMLP is designed to provide passive exposure to the Alerian MLP Infrastructure Index (AMZIX). It turns out that pipeline companies haven’t done nearly as badly as this index. The focus on MLPs has always excluded corporations – for many years, when MLPs were controlled by a General Partner (GP), Incentive Distribution Rights (IDR) allowed generous payments from the limited partners in AMZIX to the GP’s. Because AMZIX excluded corporations, it left out many of the GPs who were receiving IDRs payments. Although this model has largely disappeared, the exclusion of most GPs meant that AMZIX included the inferior side of the GP-LP equation. And there remain a handful of MLPs that still labor under the burden of making IDR payments to their GP — all unfortunately included in AMZIX. These include MLPs Cheniere Energy Partners (CQP, controlled by Cheinere Energy Corp, LNG) and TC Pipelines (TCP, controlled by TC Energy, TRP). Avoiding MLPs that owe IDR payments to a parent would have helped AMZIX perform better.

The GP-LP relationship has always looked more like the one between a hedge fund manager and its hedge fund. Hedge fund managers and MLP GPs both fared much better than investors in MLPs and hedge fund (see MLPs and Hedge Funds Are More Alike Than You Think).

Canadian pipeline companies are among the best run in North America. In recent years they have been acquiring MLPs, rolling them up into the corporate parent. For example, Enbridge acquired U.S. pipeline company Spectra Energy, which included Spectra Energy Partners, its MLP, in 2016. Transcanada (TRP) bought Columbia Pipeline Group the same year, and later rolled up their MLP. All these acquisitions led to the assets leaving AMZIX, because they were no longer housed in MLPs. Excluded from AMZIX but still significant was when Pembina (PBA) bought Veresen in 2017 and also acquired Kinder Morgan Canada after it has sold its Trans Mountain Express pipeline expansion to the Canadian Federal government.

In early 2018, the Federal Energy Regulatory Commission (FERC) surprised investors with a tax ruling that prevented MLPs from including investors’ imputed tax liability in setting natural gas pipeline tariffs. Although FERC later walked back this hasty ruling, the damage was done and natural gas pipelines are largely housed in corporations, where FERC’s tax ruling has no effect.

The general shift from MLPs to corporations as the desired corporate form, so as to access a broader set of investors, has taken place throughout this time. The result is that AMZIX doesn’t reflect the North American pipeline industry (see MLPs No Longer Represent Pipelines). It has the last three big pipeline companies that maintain their MLP status, and a bunch of small gathering and processing names that are more risky. It also has an overweight to crude oil and refined products pipelines, with a corresponding underweight to natural gas pipelines.

AMZIX has wound up with a form of adverse selection – seemingly always on the wrong side of the trade. Holding MLPs that paid IDRs to GPs, rather than GPs themselves; gradually becoming more concentrated as MLPs were rolled up into corporations; and drifting away from natural gas pipelines, leaving them with commensurately more crude oil risk at a time when transportation demand faces a lot of uncertainty.

The American Energy Independence Index (AEITR) was always designed to reflect the better side of the historic GP-LP relationship, and to be broadly representative of the North American pipeline industry. MLPs, as defined by AMZIX and its associated investment product AMLP, have had a miserable decade. But the broad North American pipeline industry as defined by AEITR has done substantially better over multiple timeframes, because of the construction advantages noted above. For almost the past decade it’s performed 14% p.a. better

When an investor complains about lousy MLP performance, they’re right, but they’re also revealing that they’ve had too much exposure to the wrong index.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

On the other hand, there are MLPs that pay no IDRs and which emphasize natural gas over crude oil. For example, EPD, DCP, USAC and CEQP.

Yep; although SL mostly favors corporations, EPD and ET are among the top ten constituents of the AEI.