Pipeline Earnings Should Confirm Growing Cash Flows

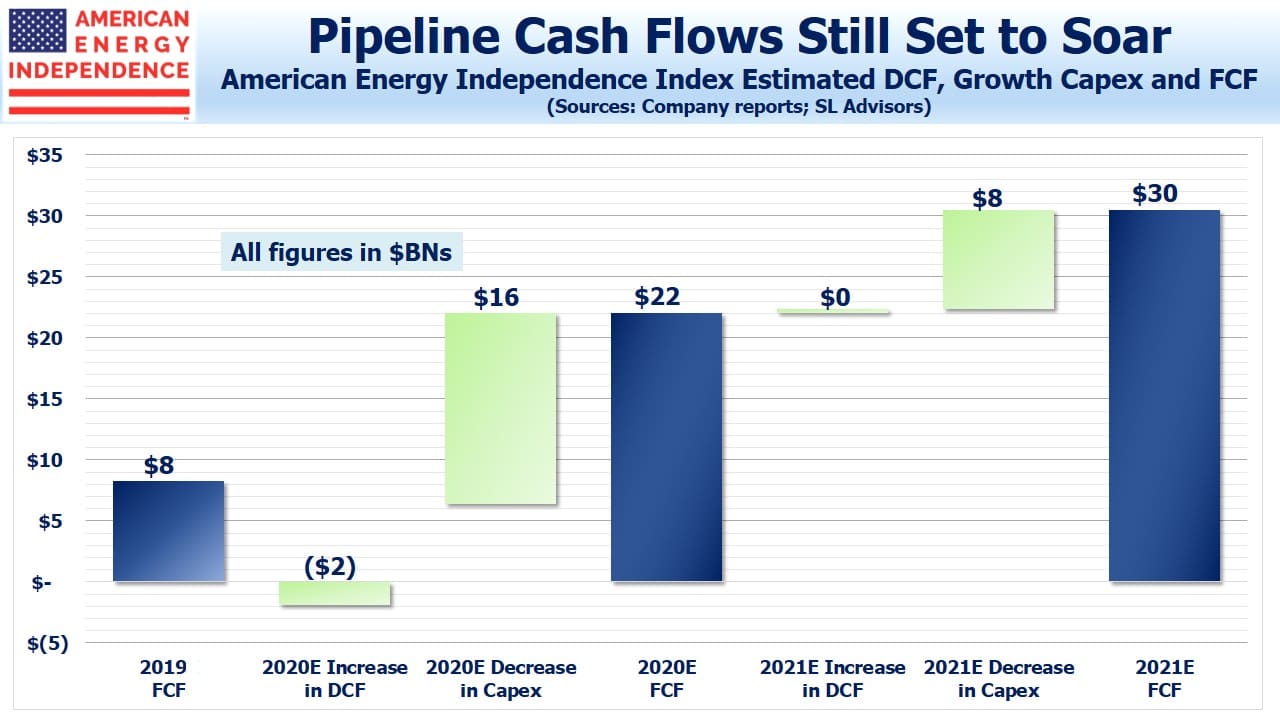

Earnings season for pipeline stocks begins on Wednesday 22nd, with Kinder Morgan (KMI) reporting after the market close. We expect the quarterly updates from the sector’s biggest companies will confirm the progress towards improved profitability (see Pipeline Cash Flows Will Still Double This Year). We’ll also hear from management teams how they regard the prospects for new projects.

Last year, a stand-off over Kinder Morgan Canada’s proposed Trans-Mountain Expansion halted construction. Opposition from environmental extremists in British Columbia thwarted oil-rich Alberta’s goal of increasing its access to export markets. The Canadian government bought the pipeline, saving KMI from a costly, intractable problem between two Canadian provinces. Enbridge commented in a call that they wouldn’t attempt to build a new oil pipeline in Canada, unless it was wholly within energy-friendly Alberta (see Canada Looks North to Export its Oil).

Following the cancelation of the Atlantic Coast Pipeline (see Pipeline Opponents Help Free Cash Flow), the continued legal uncertainty over already completed Dakota Access Pipeline (listen to Judicial Over-Reach on the Dakota Access Pipeline) and the perennially delayed Keystone XL, big projects look similarly stymied in the U.S. Given the trends in election opinion polls and economic uncertainty over Covid, we expect few new initiatives for the balance of the year and possibly some further cancelations.

Although management teams will be frustrated, long-time investors in pipelines are realizing that poorly informed yet effective environmental extremists are an unlikely ally in leaving the sector with few options for its excess cash beyond returning it to investors through dividend hikes and buybacks. We expect this theme to play out over a couple of years. We suspect Berkshire’s interest in acquiring Dominion’s natural gas pipeline network is to redeploy the cash it generates to other Berkshire subsidiaries where capex is not controversial.

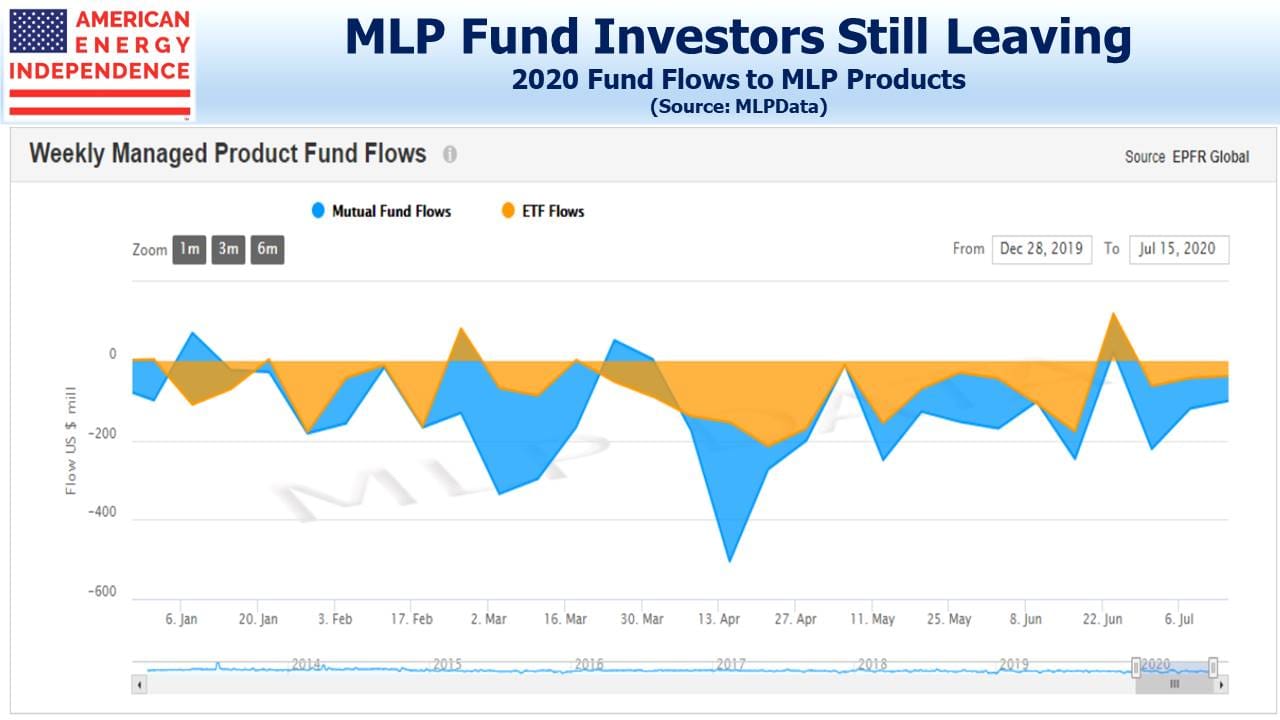

Investors continue to withdraw money from MLP-dedicated open-end funds. JPMorgan recently reported that during the first half of this year such outflows totaled $764MM, with June marking the fifth straight months of redemptions.

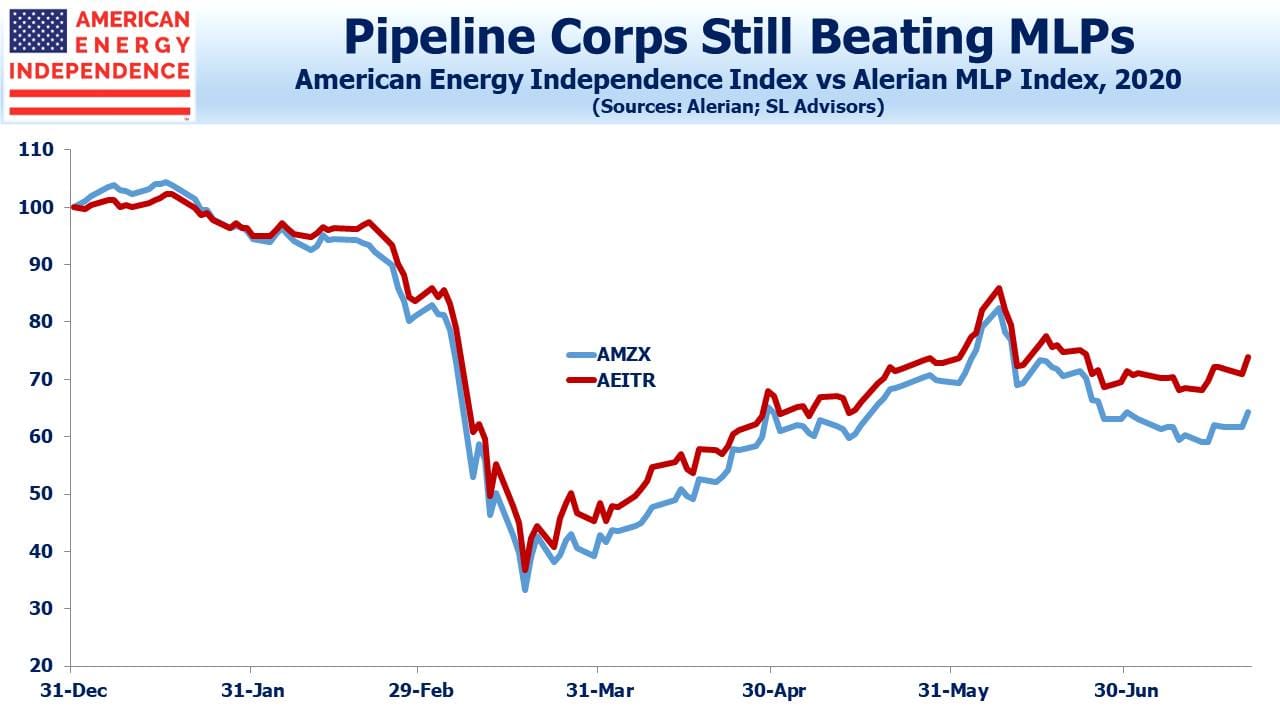

This is clear from relative performance, which shows the Alerian MLP Infrastructure Index (AMZIX) down 33% so far this year, lagging by 10% the more broadly representative American Energy Independence Index (AEITR). Corporations, which dominate the AEITR, have more numerous buyers than MLPs, which is why AMZIX is slumping. A broader set of investors and better governance are widely regarded as favoring corporations. Investor behavior is confirming this trend, which we expect to continue.

Stocks and bonds have appeared to reflect wildly different economic forecasts for years, which is why stocks always look cheap. The contrast between fixed income and equity investments is most dramatic in pipelines (see Pipeline Bond Investors Are More Bullish Than Equity Buyers). To cite one example, Enterprise Products Partners (EPD) has several 30-year maturity bond issues outstanding with yields from 3-3.2%. The company is a third owned by insiders, never cut its distribution and pays a 9.8% dividend. Skeptics of its equity might benefit from chatting with a few EPD bond holders.

We are invested in EPD and KMI, and all the holdings of the American Energy Independence Index via the ETF that tracks it.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Investors who choose C corporations over MLPs clearly are not motivated by deferral of taxes.Those who choose MLPs clearly are.