Investors Like Less Spending

Growth isn’t always good. The Shale Revolution led to enormous growth in U.S. oil and gas output, but abundance pressured prices and, for investors in U.S. exploration and production, it’s been a bust. Midstream energy infrastructure joined in the race for growth projects – but not every investment was accretive. Some, like Plains All American (PAGP), have seen their stock price lose 90% of its value since 2014. It’s the result of serial bad capital allocation decisions. The drop in Permian crude output caused by Covid will leave PAGP with excess pipeline capacity in the region.

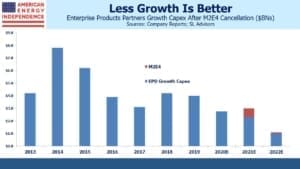

Energy investors have become so wary of growth capital expenditures that they now cheer when a company reduces future spending. Enterprise Products Partners (EPD) has managed their business better than most over the past few years. Their investment in new infrastructure plus acquisitions peaked in 2014, and had already resumed its downward trend last year before the pandemic caused an industry-wide reassessment.

EPD last week canceled their planned Midland to Echo 4 (M2E4) pipeline carrying crude from the Permian to storage facilities on the Gulf of Mexico. Although much of the 450,000 barrels per day of capacity was already committed, EPD was able to get its customers to agree to extend the term of their agreements while reducing near term volume commitments. The crude oil originally intended for M2E4 will now move on other parts of EPD’s pipeline network.

Excess pipeline capacity out of west Texas is the most visible consequence of Covid on U.S. oil output. EPD’s move helps them but doesn’t solve the problem for other pipeline operators. “The Permian will still be significantly overbuilt” warned Ethan Bellamy, managing director of midstream strategy at East Daley Capital Advisors.

On Wednesday morning when the news was announced, EPD’s stock opened strongly and outperformed the American Energy Independence Index (AEITR) by 2% on the day. EPD estimates its growth capex will be $800MM lower over the next couple of years as a result, continuing the trend of recent years.

Lower growth spending means more free cash flow. CEO Jim Teague commented that, “The capital savings from the cancellation of M2E4 will accelerate Enterprise toward being discretionary free cash flow positive, which would give us the flexibility to reduce debt and return additional capital to our partners, including through buybacks.”

This is welcome news, and represents the new normal in the pipeline business.

We expect free cash flow for the industry to more than double this year. From our calls with investors, there’s substantial interest in today’s attractive yields, especially following 2Q earnings. EPD stands out with a distribution yield 3X their 30 year debt. As the industry continues to generate more cash, equity buyers will start to appreciate the long term stability of the best run businesses, as bond buyers already do.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance. We are also invested in PAGP and EPD via the SMAs and mutual fund we manage.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

I enjoy your articles and read them every week. I added to both my EPD and PAGP holdings on Friday. Morningstar reaffirmed their Fair Value for EPD last week at 25.50.

tennis111

Comments694 | Following

I added to my large EPD position today near 17. Morningstar just updated their report on EPD, and reaffirmed their Fair Value of 25.50 for it.

Fair Value and Profit Drivers | by Stephen Ellis Updated Sep 09, 2020

After updating our model to the Midland-to-ECHO 4 cancelation, we retain our $25.50 fair value estimate. Our fair value estimate implies a 2020 EBITDA multiple of 10.6 times, a 2021 enterprise value/EBITDA multiple of 10.8 times, and a 2020 distribution yield of 7%.

We expect the main driver for Enterprise will be its NGL segment, as the demand pull from the Gulf Coast and international markets lets Enterprise take advantage of the export opportunities and lucrative differentials via its comprehensive asset base. We also expect increased demand for ethane will benefit Enterprise as well. However, the diversity of Enterprise’s asset base, its ability to take advantage of just about any profitable opportunity that appears in U.S. midstream, and its largely fee-based earnings stream all support healthy single-digit growth prospects over the next few years. We expect EBITDA to increase about 1% annually over the next five years and distributions about 1-2% annually on average over the same time frame.

Simon,

The variable I think the majority of investors struggle with oil/gas midstream/producers is the ongoing transition to renewables. What’s your intuition on the profitable Lifespan of pipeline stocks in general. ie Is it X years and than a rapid decline in share price to zero? Is it 10,15,25?