Gassy Isn’t Happy

/

The last few weeks have been challenging for the bullish story on natural gas. On Thursday evening Venture Global (VG) disclosed that they’d lost an arbitration case with BP over their Calcasieu Pass LNG terminal. The International Chamber of Commerce (ICC) found that VG had breached its obligation to make a timely declaration of the start of commercial operations.

BP and other buyers had signed Sale and Purchase Agreements (SPAs) that would start delivering LNG once VG decided the terminal was “operational.” When Russia invaded Ukraine in February 2022, global LNG prices soared as Europe struggled to replace lost pipeline imports of natural gas from Russia.

VG interpreted their agreements as giving them enough latitude to delay fulfilling LNG shipments under their SPAs, which allowed them to sell the LNG the terminal was already producing into the high-priced spot market (see Nothing Ventured, Nothing Gained).

Shell, BP and other expectant recipients of LNG cried foul and took VG to arbitration, claiming that VG’s windfall gains of $3.5BN were rightly theirs. VG plowed the cash back into their business, building the Plaquemines terminal, reducing their reliance on debt markets.

In August, VG won a similar arbitration dispute with Shell, also before the ICC. It’s unclear how the same facts and circumstances were interpreted differently by the same tribunal. It seems arbitration can be arbitrary. Following the August victory, VG not unreasonably said they expected similar outcomes in other cases. In an SEC filing submitted just before the Shell ruling, VG warned of $6.7-7.4BN in exposure if all the arbitration cases were lost.

On Friday, investors reacted to the news by wiping over $7.5BN from VG’s market cap. Assuming the market was 100% sure of positive arbitration outcomes prior, this exceeds the worst case they warned of in August since the Shell ruling was found in their favor. Wells Fargo estimates the worst case including damages of $5.5BN. JPMorgan thinks $4.8BN.

VG is on track to generate over $6.4BN in EBITDA this year, growing by perhaps $300MM next year. If arbitration awards reduce EBITDA by $1BN annually over the next five years, the company is at around 11.8X Enterprise Value/EBITDA. Cheniere is at 12.4X. The ruling was a big surprise and disappointment, but it leaves the stock fully priced for the worst case.

We avoided buying at the January IPO and even after Friday’s collapse, the stock is only modestly below our entry point. Since its IPO VG is –60%.

I’m going to be traveling to see clients over the next two weeks. A year ago, at one client’s annual conference, I received applause before even beginning my presentation. Four years of sparkling returns were warmly received, but this year has been tough. This time around I anticipate a friendly but less exuberant welcome.

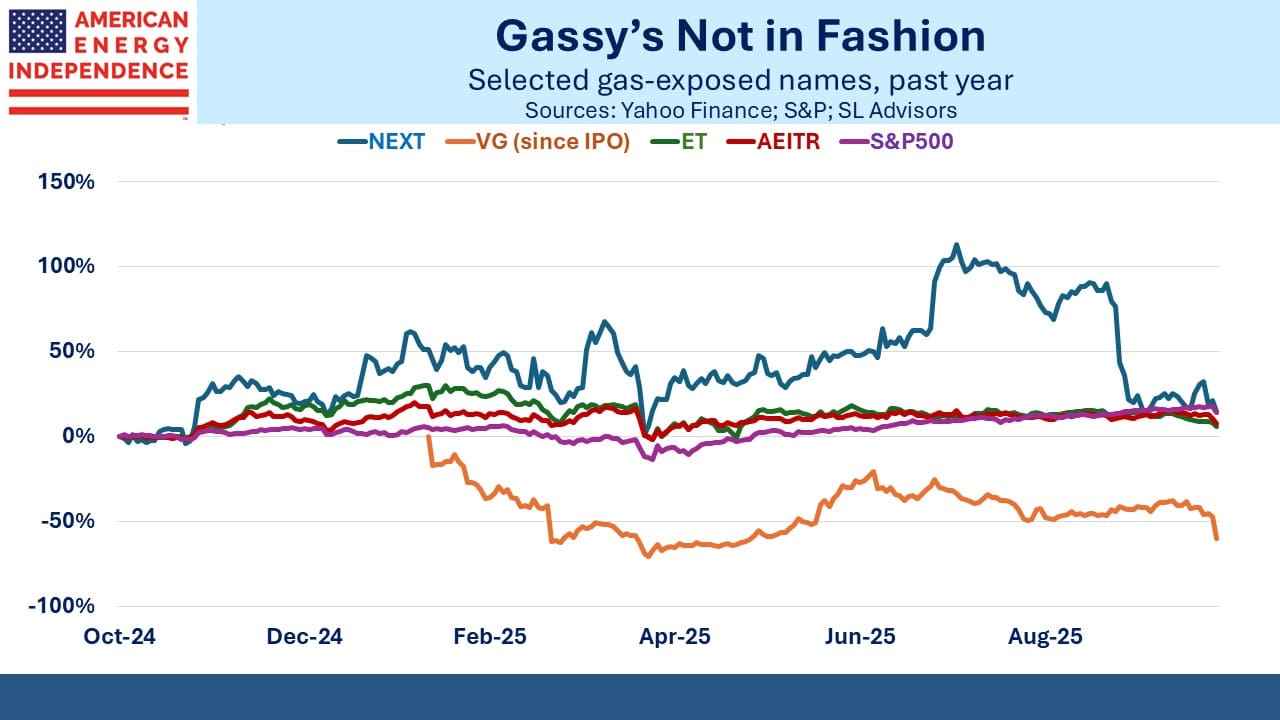

NextDecade (NEXT), whose Rio Grande LNG terminal should start shipping LNG in 2027, recently lost their CFO, an event that algorithms duly interpreted as a reason to sell. It’s been a volatile stock, losing almost half its value following Liberation Day in April. It recovered in the summer, then swooned again when it announced Final Investment Decision on Train 4 with a modestly lower projected EBITDA.

NEXT doesn’t generate any cash today, but $800MM of Distributable Cash Flow (DCF) in 2030 discounted to today at 15% pa is worth about $400MM, which is a multiple of around 4X on today’s $1.7BN market cap. It looks cheap.

YTD it is -16%.

Energy Transfer (ET) has disappointed the many financial advisors we know that own it directly. Its 7.8% distribution yield is almost 2X covered by DCF. YTD it is –12%. It looks attractive to us.

Midstream as defined by the American Energy Independence Index (AEITR) is –1% YTD. Natural gas exposed names have lagged. Gas demand for data centers was last year’s story. Concerns about excess LNG capacity have weighed on exporters this year. The AI-laden S&P500 is +13%.

Over the past twelve months relative performance is better than YTD, but the calendar year is typically how investors assess outcomes.

The possible resumption of a trade war with China dominated Friday’s news. Even Trump’s biggest critics have praised the peace agreement between Israel and Hamas. It looks as if we’re moving from that victory to more capricious “slapping” of tariffs.

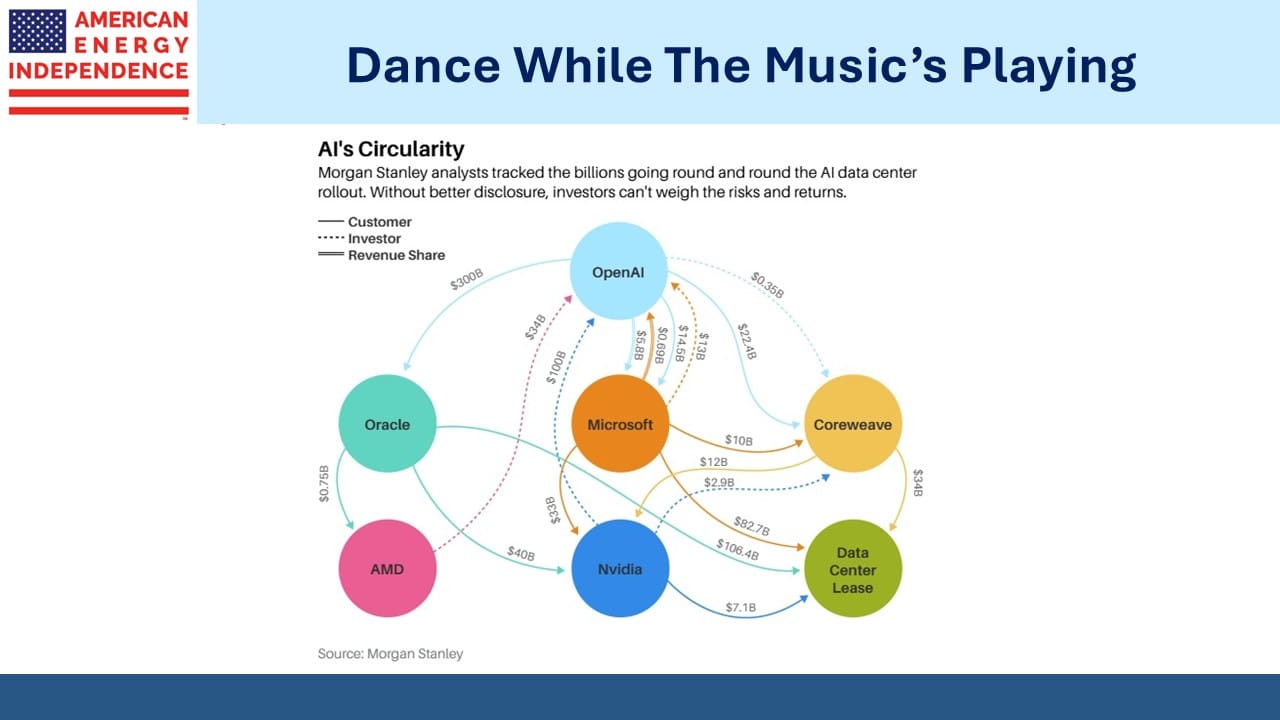

The AI bubble is so commonly referenced that it’s hard to believe anyone is unaware of the circular deals identified by Morgan Stanley. As former Citigroup CEO Chuck Prince memorably said in 2007 shortly before the Great Financial Crisis, “As long as the music’s playing, you’ve got to get up and dance.” You’ll probably see that quote remembered elsewhere before too long.

If either or both of these stories cause a further unraveling, midstream infrastructure will still be generating growing cashflows, untarnished by the froth of this year’s market.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!