MLP Yields Look Better Than Cash

/

Your blogger is routinely critical of the Alerian MLP ETF (AMLP) — for good reason, as its narrow universe and tax-paying structure offer ample points of weakness. They’ve even struggled to calculate taxes owed, which resulted in two downward NAV adjustments in 2022-23 (see AMLP Fails Its Investors Again).

At times I’ve even been critical of MLPs, wondering if the tax deferral on distributions adequately compensates for the complexity of a tax return with multiple K-1s.

I’ve suggested that few MLP holders can even state with confidence how much that tax deferral saves them. At such times my good friend and tax expert Elliot Miller intervenes, usually through a comment on this blog, to assure that MLPs are truly worth the trouble.

But only those with a pathological aversion to reliable income can ignore the MLP yields on offer today. Midstream earnings for both MLPs and corporations have as usual offered few surprises while generally confirming the positive outlook. As this blog noted recently (see Debt Monetization And Pipelines), if these companies were private, we’d conclude that operating performance was satisfactory and that would be the end of the matter.

However, public market prices have been interposing a lugubrious overlay on an otherwise agreeable situation.

MLP yields are approaching levels that demand justification for holding cash, where returns remain adequate but perhaps not for much longer.

Start with Energy Transfer (ET), yielding 8.1% and with a Distributable Cash Flow (DCF) yield twice as high. Some mutter about Kelcy Warren putting his own interests ahead of unitholders, as he did nine years ago (see Will Energy Transfer Act with Integrity?).

Although ET won the subsequent Delaware lawsuit, the stock’s persistent cheapness since then shows that their reputation as fiduciaries has not been restored. Nonetheless, 2016 is a long time ago. Today ET is led by co-CEOs who regularly demonstrate their skill at running the business.

MPLX reported earnings that were in-line. Its payout is up 12.5% year-on-year, yields 8.5%, and has a 2026 DCF yield of 11.5%. They raised their full year guidance.

Hess Midstream’s payout is +10.3% yoy and yields 9%.

Enterprise Products Partners’ payout is +4% yoy and yields 7.4%.

It’s not just the MLPs that have attractive yields. Pipeline corporations do as well. Oneok yields 6.6% and has raised its payout 4.4% over the past year. Kinder Morgan, a persistently poor allocator of capital but well positioned for the needs of data centers for gas-generated power, yields 4.6%.

Cheniere spent $1BN repurchasing stock during 3Q25 and a further $300MM in October.

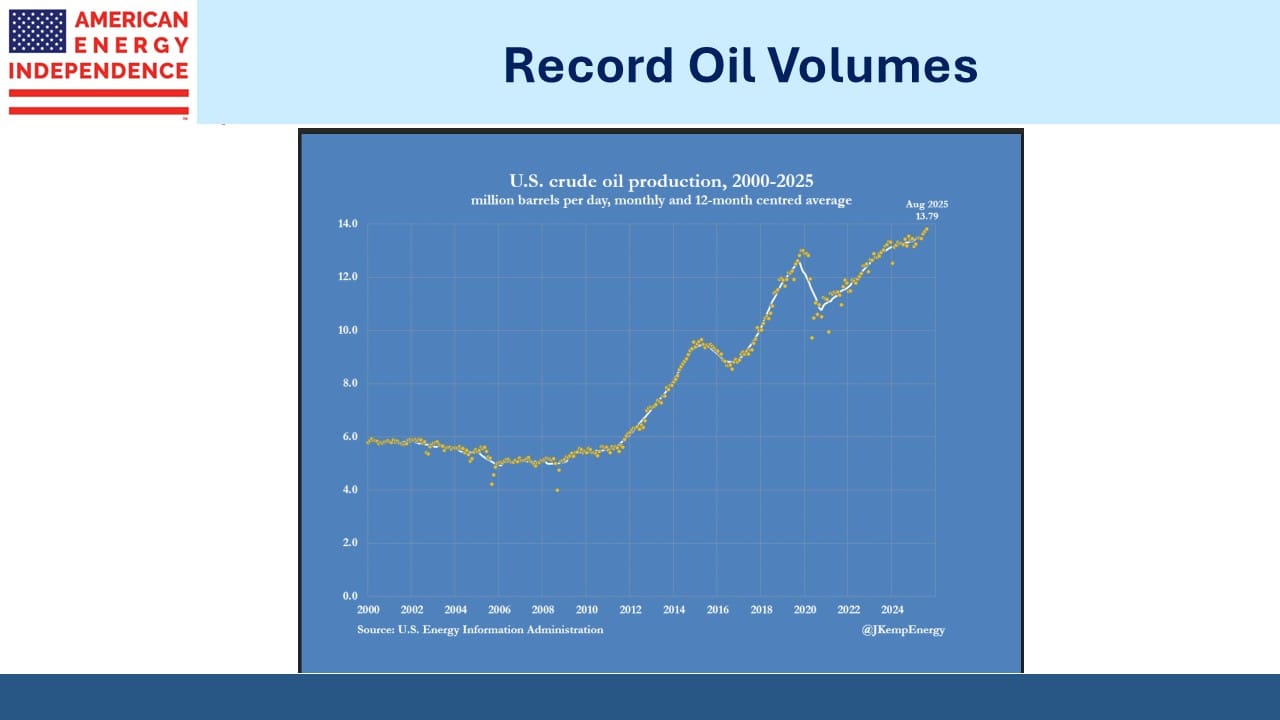

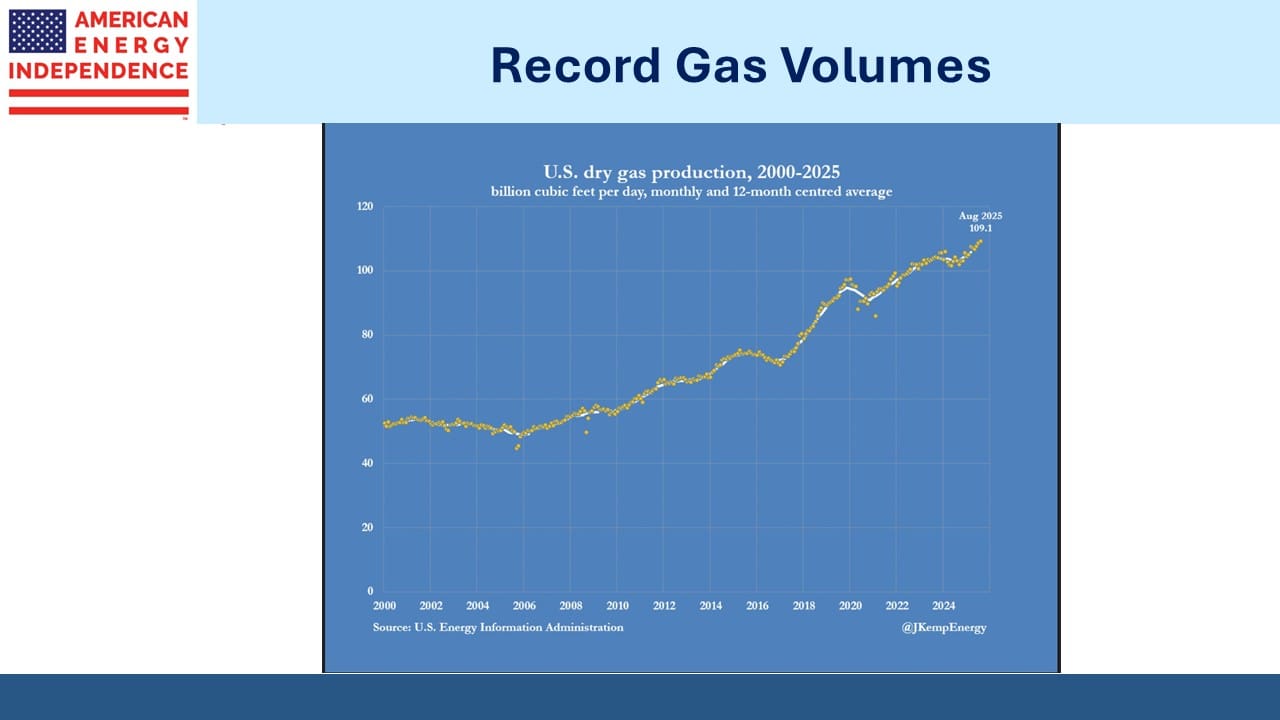

The reason operating performance is good for midstream companies is because volumes are growing. Both oil and gas production hit new records this year, with 13.8 Million Barrels per Day of crude output and 109 Billion Cubic Feet per Day of gas output as of August. Once the indefensible government shutdown is over we’ll get more recent data.

In brief, this is a good environment for midstream companies.

However, the consequent pressure on oil prices has weighed on energy sentiment. By contrast, US gas prices are already so low that the increased production has not hurt. Moreover, it’s come in time to provide more feedstock to our growing LNG export capacity.

Global crude prices drive sentiment more than regional gas prices. Oil-focused Oneok is –34% YTD. The synergies from their acquisition of Magellan Midstream look likely to reach $700MM, which is pretty good for a merger few analysts, us included, were happy about. Weak oil is making energy investors miserable.

The knock-on effect on midstream is at odds with their operating results. If anything, increased volumes should be creating investor enthusiasm. That it’s not is creating an opportunity for those looking beyond the next hot AI trade.

Cash provides the option to do something when prices are attractive. Your blogger’s investments are overweight towards pipelines and t-bills with very little else. But the case for less cash and more dividend-paying securities is gaining strength as the Fed does Trump’s bidding by reducing short term rates.

The futures market is priced for a 3% Fed Funds rate in a year’s time. The need for investment income will be no less urgent by then. Buying these high yielding securities now means in our opinion you’ll beat the rush that is assuredly coming in the months ahead.

It’s happened before. The Fed’s rock-bottom rates coming out of the pandemic were a cause of inflows into midstream. Compelling valuations helped. Several years of strong returns followed. Many of our investors were initially drawn to midstream because of the stable income.

The market is setting up for a repeat performance.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!