The MLP Yuletide Spirit

/

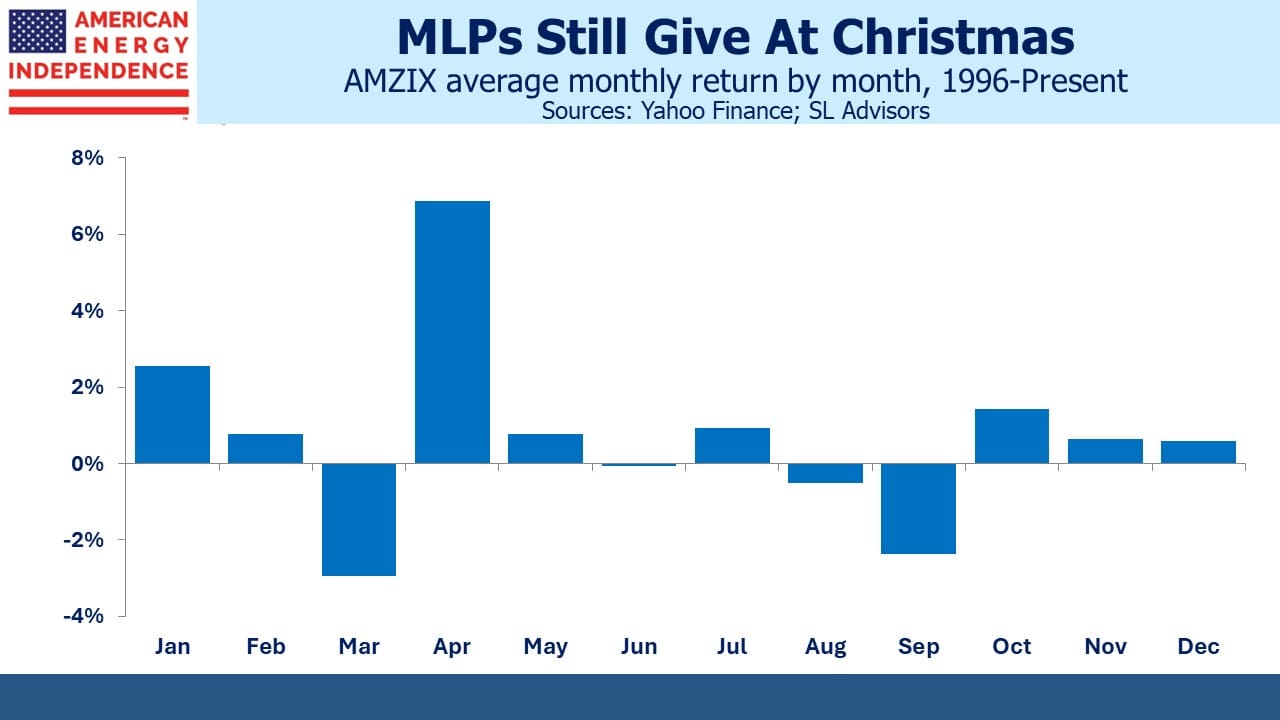

This time of year usually prompts a blog post on MLP seasonals. It’s been a reliable topic (see 2015’s Why MLPs Make a Great Christmas Present or 2016’s Give Your Loved One an MLP This Holiday Season). The Alerian MLP Infrastructure Index (AMZI), which is tracked by the Alerian MLP ETF (AMLP) has long displayed a pronounced January effect. Individual investors tend to assess their portfolios around the calendar year end, but the K1s accentuate this effect for MLPs.

If you’re considering selling an MLP, doing so in December instead of January avoids an extra K1 for the stub year. Similarly, a purchase delayed from December to January avoids a one month K1 from the prior year. Using AMZIX data since 1996, the January effect is clearly visible.

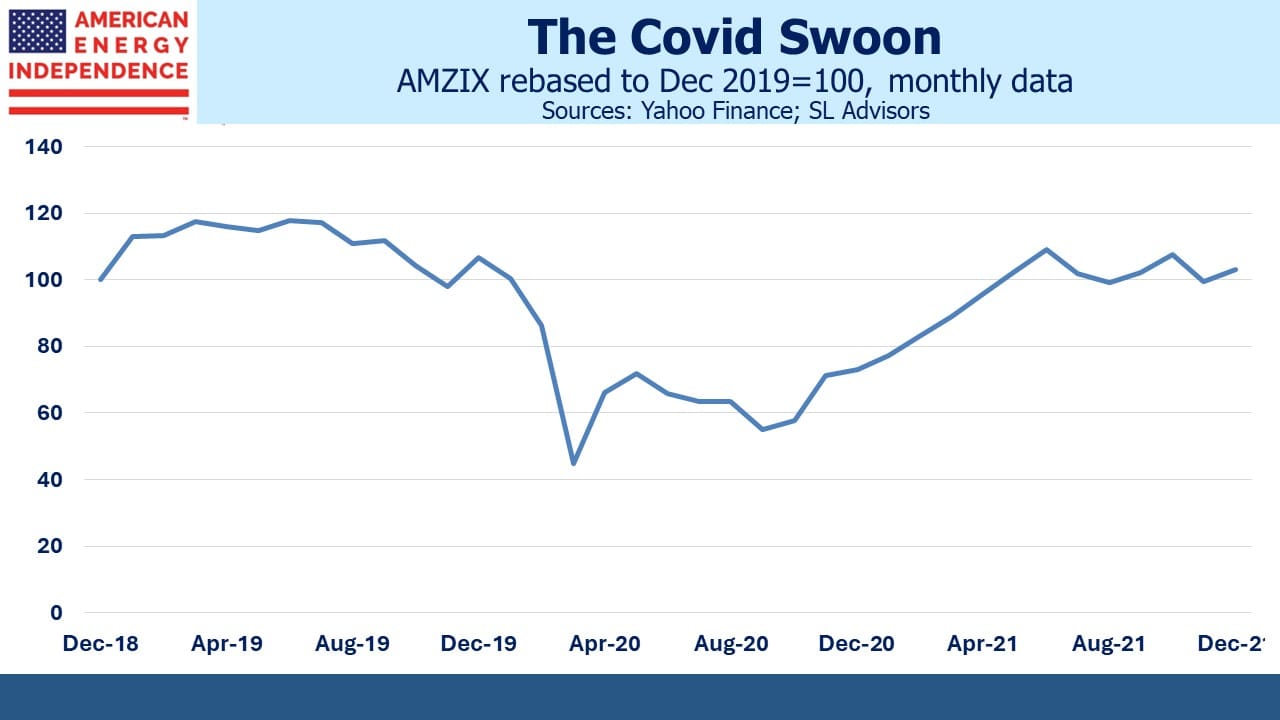

The Covid pandemic distorted the pattern somewhat. In March 2020 the AMZIX collapsed, closing the month –48%. It was a miserable time to be invested in the sector. The following month’s rebound was +48%, although that still left the index –34% YTD. Some excessively leveraged operators were partly to blame (see MLP Closed End Funds – Masters Of Value Destruction).

These two months dominate the average March and April returns, rendering the other months seemingly inconsequential.

Five years ago it looked as if the seasonal pattern was weakening (see MLPs Lose That Christmas Spirit) but in hindsight we were just looking back on a period of poor performance during which almost every month was flat or down.

Seasonals are now back in vogue. Sell-side research routinely mentions the January effect. Morgan Stanley noted that year-end, “historically has pointed to positive performance capture in late December through January.” A strategy of going long at the end of November for two months has an average return of +2.9%, roughly a third of the annual return. Morgan Stanley found that since 1996 MLPs have “posted a positive total return from December 15 through the substantive balance of January,” constituting 41% of the total return during that time.

It has been possible to earn much of the sector’s return with comparatively short holding periods arranged around year’s end.

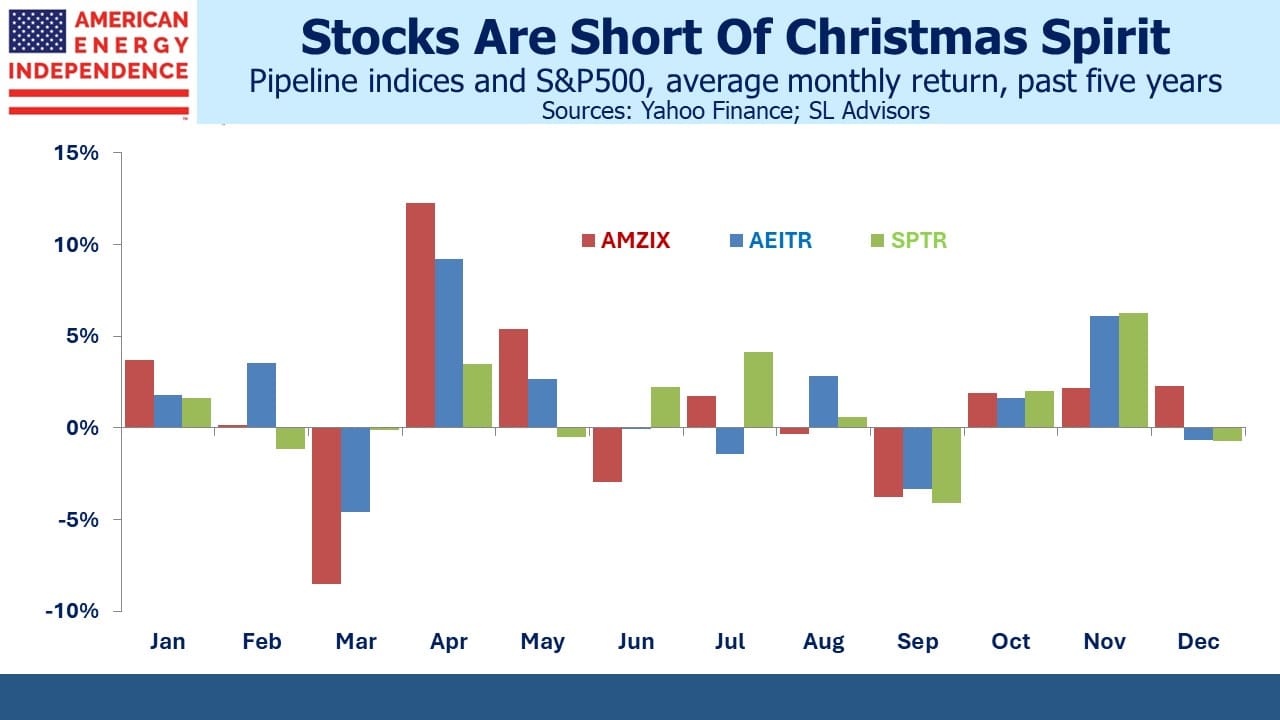

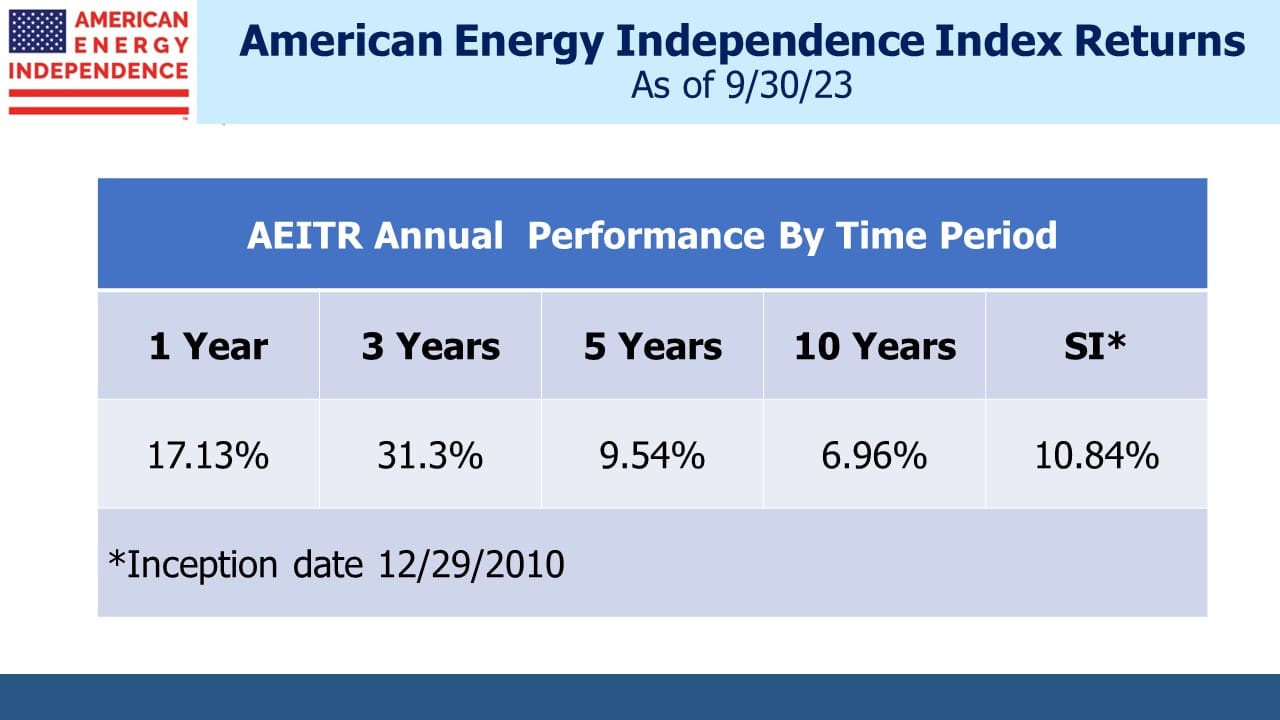

The effect is less pronounced for the American Energy Independence Index (AEITR), probably because it limits MLPs to 20% so as to be investable in a fund without being taxed as a corporation. Institutions are much less likely to be driven by the calendar, not least because their investment returns are mostly not taxed. The S&P500 exhibits no meaningful seasonal pattern.

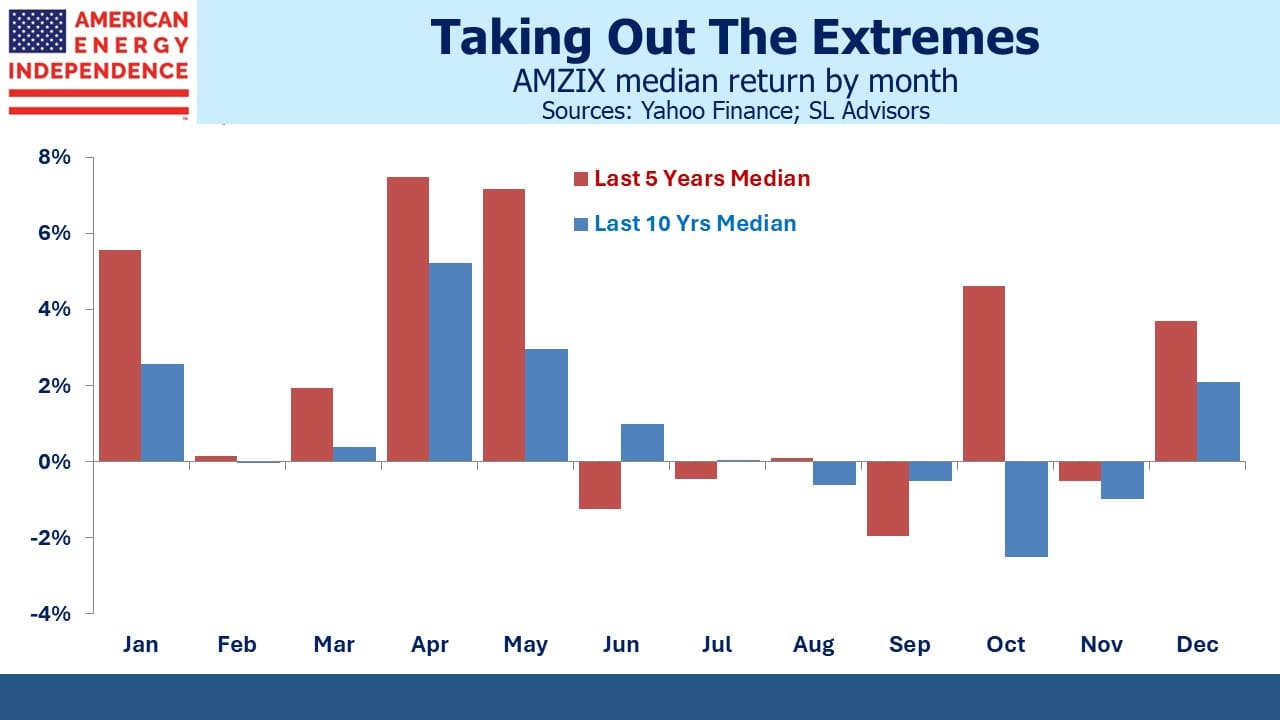

Less appreciated is the quarterly pattern around payouts. MLP investors love their distributions, which are generally paid in the first month of the quarter. Because of the distortion caused by Covid in 2020, it’s helpful to look at median returns rather than average. Over the past five and ten years this quarterly pattern is generally visible. For the past decade January was positive seven times and April eight. Oddly, July doesn’t show any seasonality.

Even with the median return, April still stands out as an appealing month. Perhaps a few investors annoyed at the delayed tax filing often caused by K1s decide to sell just as soon as they receive their April distribution. This was even true during the 2013-18 period when no other seasonal pattern was visible. I’ve personally found April to be the most interesting time to make seasonal trades in this sector.

Few MLP investors will find trading their positions appealing. The point of MLPs is to enjoy those tax deferred distributions for as long as possible, putting off indefinitely the recapture of taxes generated by a sale. These holders wouldn’t be interested in the possibility of a quick buck at the risk of an accelerated tax obligation.

In the spirit of open-mindedness and in spite of its numerous shortcomings routinely described on this blog, I can suggest AMLP as a temporary trading vehicle for this purpose. Since it is 100% MLPs it reflects the same seasonal pattern as its index, AMZI. In the past I have found it preferable to use options on AMLP rather than buying or selling the ETF directly. I already have plenty of exposure to the sector, so concluded that for a trade seeking to pick up a few per cent it’s imprudent to add any more long exposure.

In Sunday’s blog I incorrectly said Vettafi, who publishes AMZI, had dropped the 12.5% position limits in their quarterly rebalancing and allowed Energy Transfer to remain at 19.5%, a level it reached both through appreciation and the acquisition of Crestwood. It turns out they were just slow to update their website. TMX Group announced their acquisition of Vettafi last week. Perhaps they were distracted.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!