Quantifying The Gas Arb

In The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution, author Greg Zuckerman explains how today’s traders spend most of their time doing research. At Renaissance, the hedge fund Zuckerman chronicles, and other quantitative funds, traders spend much of their time looking for market anomalies that are likely to repeat and aren’t just the accidental result of noise. The trading that takes place is done by algorithms executing trades for a given strategy. The trader monitors the activity and looks for new opportunities.

This is very different than the trading I did over thirty years ago. Fast reactions and rapid mental numeracy were what separated the great traders from the average. We often hired MBAs. Some years ago, I visited the trading floor for Jane Street, a big market maker in ETFs, and learned that their hires are typically computer science majors.

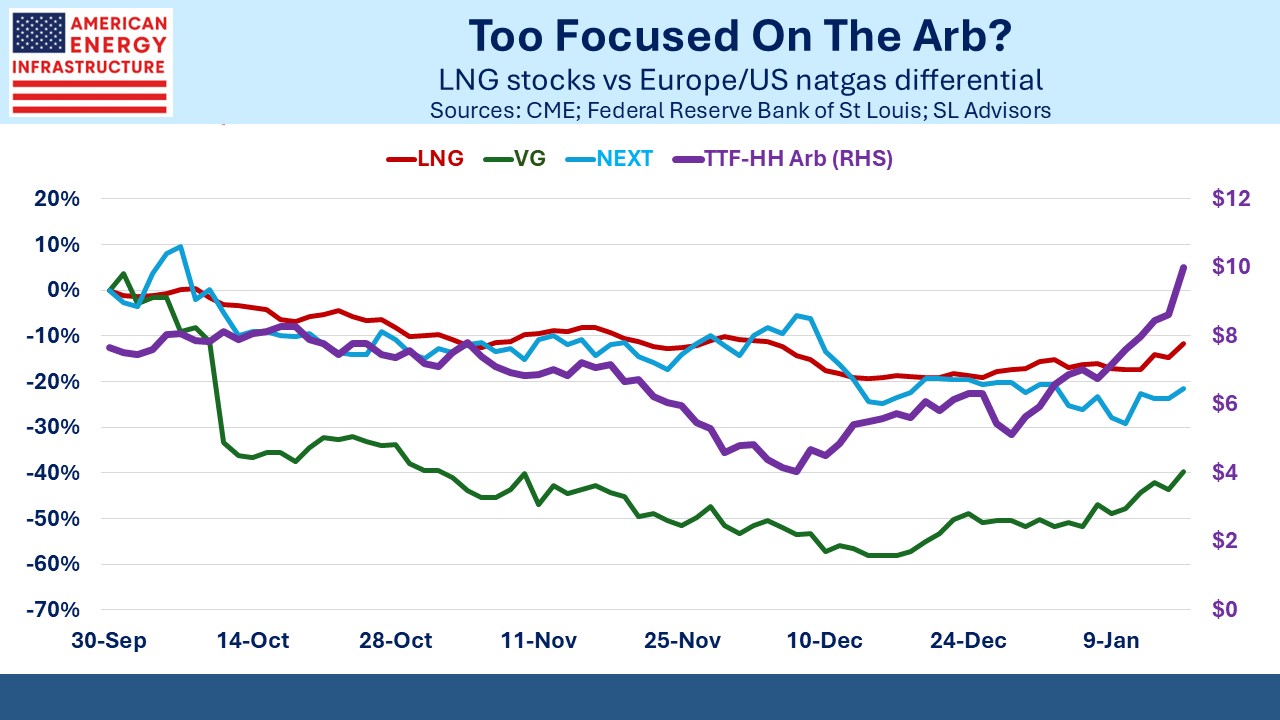

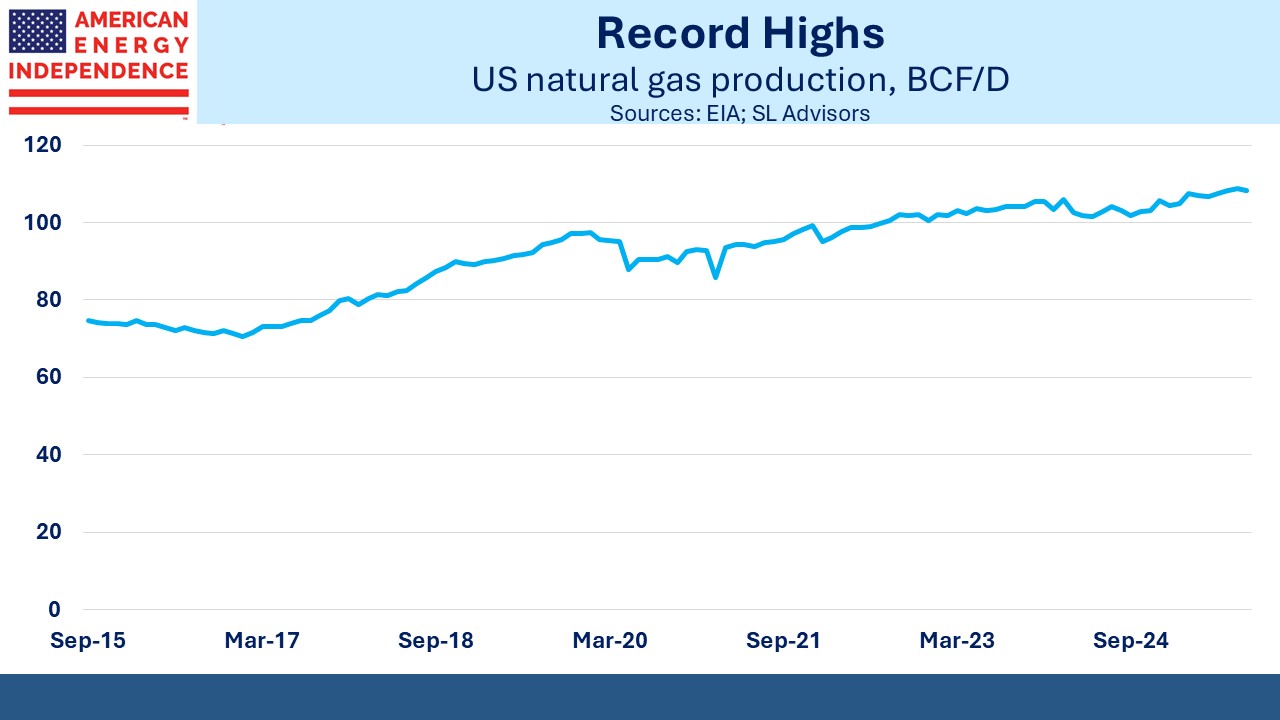

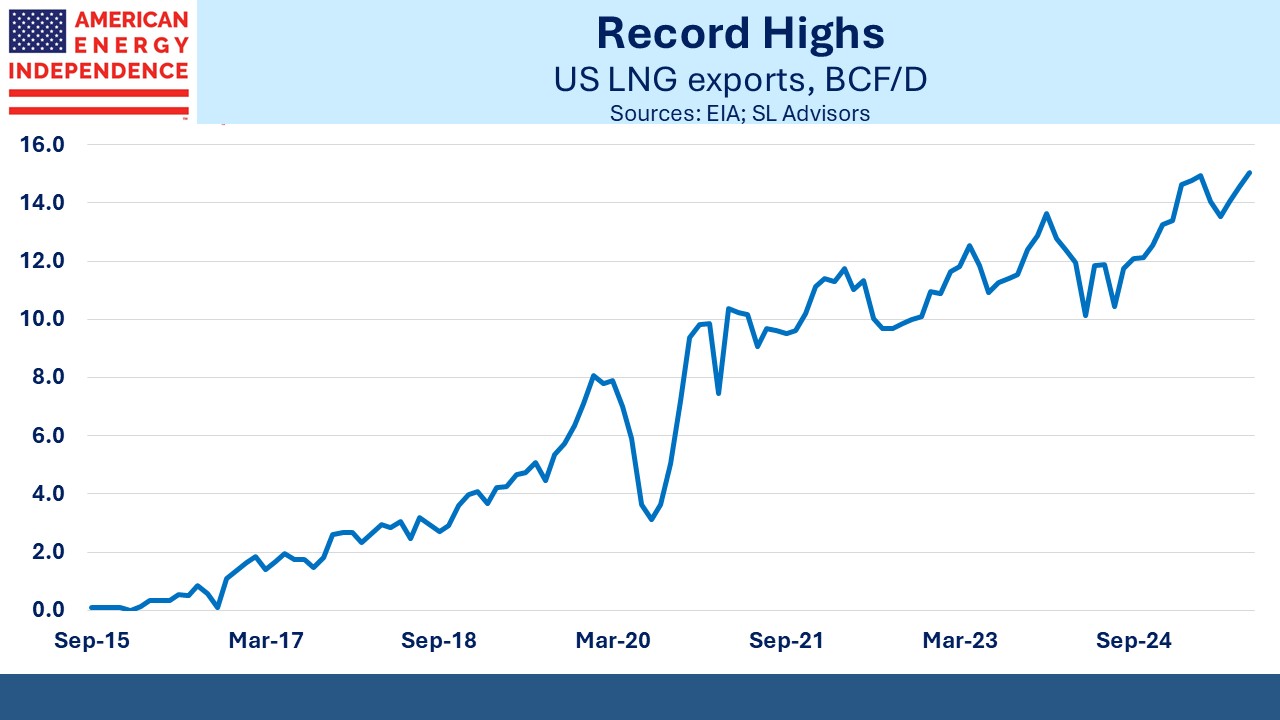

Over the past couple of months, we’ve noticed a relationship between the Europe/US natural gas spread and the prices of LNG stocks. I don’t know if quant hedge funds are trading this. We’re not, but their prices seem to be connected.

Specifically, we looked at the difference between the TTF Dutch benchmark for natural gas and the US Henry Hub, converted to US$ per Million BTUs (MMBTUs). It costs around $2-4 per MMBTUs to liquefy US gas and ship it to Europe, whereas the TTF/HH spread is usually more than that. The wider the spread, the bigger the profit opportunity.

Generally, LNG is liquefied under long term Sale Purchase Agreements (SPAs). Cheniere (NYSE: LNG) has locked in 90% of its estimated cashflows through 2035 with SPAs. Venture Global (VG) famously exploited a sharp widening of this spread following Russia’s invasion of Ukraine in 2022 (see Nothing Ventured, Nothing Gained) They netted $BNs and wound up being taken to arbitration by aggrieved counterparties claiming breach of contract. They won against Shell in August but then lost to BP in October (see Gassy Isn’t Happy), which led to a repricing of their stock to reflect worse than losing all the remaining cases.

LNG terminals retain some uncontracted liquefaction capacity to allow for maintenance or other downtime. A wider TTF/HH arb is directionally good for them, but these are facilities with a useful life measured in decades so changes in the arb shouldn’t have much effect on, say, thirty years of discounted cashflows.

Nonetheless, Cheniere, VG and NextDecade (NEXT) all dropped by 20% or more as the spread narrowed during 4Q25. The Henry Hub benchmark traded up from $3 to $5 per MMBTUs on colder US weather. Meanwhile the TTF benchmark slumped from €31 to €27 per Megawatt Hour ($11.25 to $9.25 per MMBTUs) on ample supplies and mild weather.

This slashed the TTF/HH arb in half, from over $8 to $4.

VG probably has more exposure than Cheniere and moved more. But it still seems excessive. And they need never lose money on the arb. If it drops to an unprofitable level they would simply stop doing any new spot transactions.

Even more bizarre was the reaction of NEXT, since they’re at least a year away from shipping any LNG at all. They’re not generating any cash, so the spot arb is irrelevant. But perhaps the computer scientists at quant funds are trading a basket of LNG stocks, and since there aren’t many to choose from, NEXT is added for diversification.

In any event, the arb has been widening in recent days, which seems to have acted as a catalyst on these stocks. On Friday morning it spiked to $10, which should benefit VG and to a lesser extent Cheniere via increased profit on spot market transactions. It’s also worth noting that Qatar, from which the US recently removed some air base personnel as a precaution in case we attack Iran, is the world’s second biggest exporter of LNG.

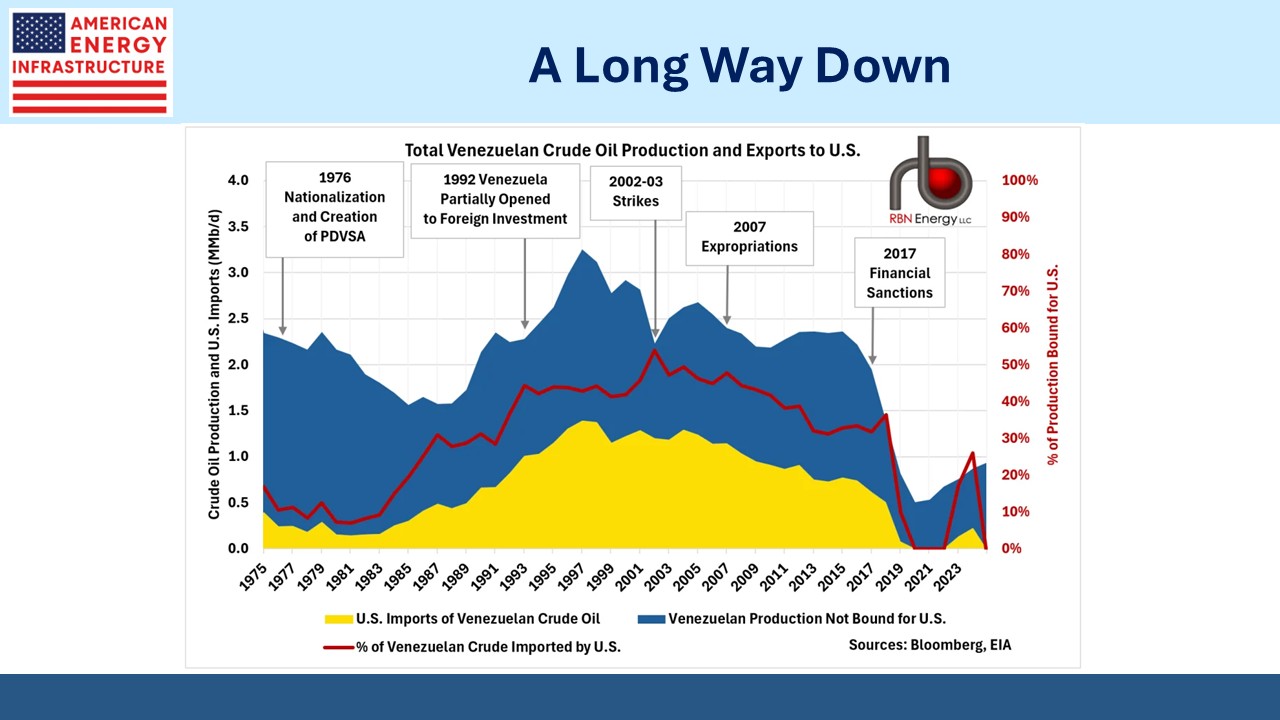

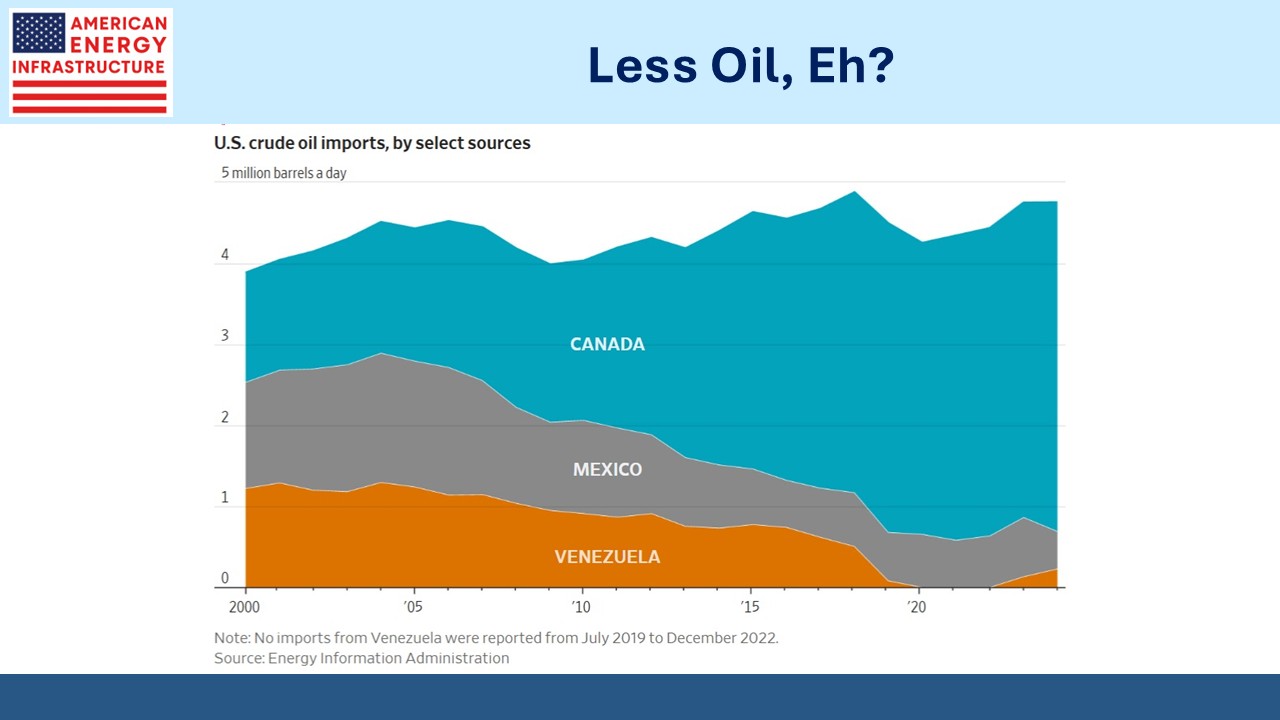

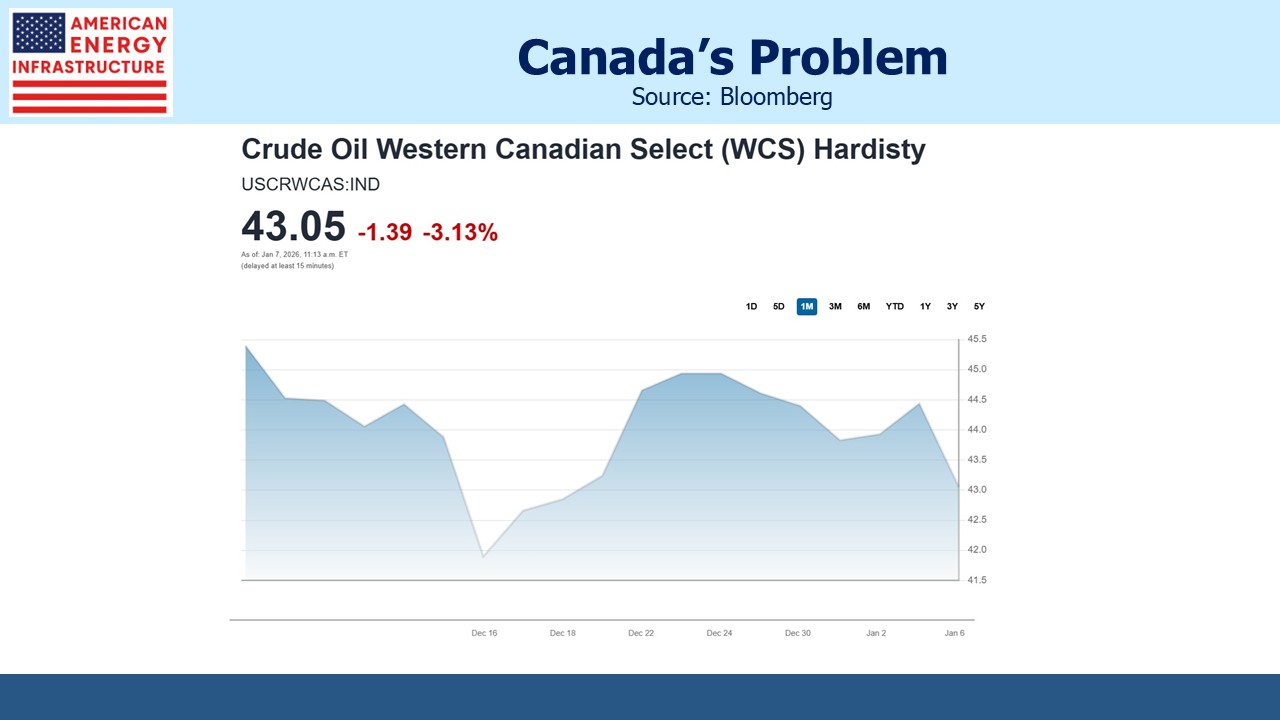

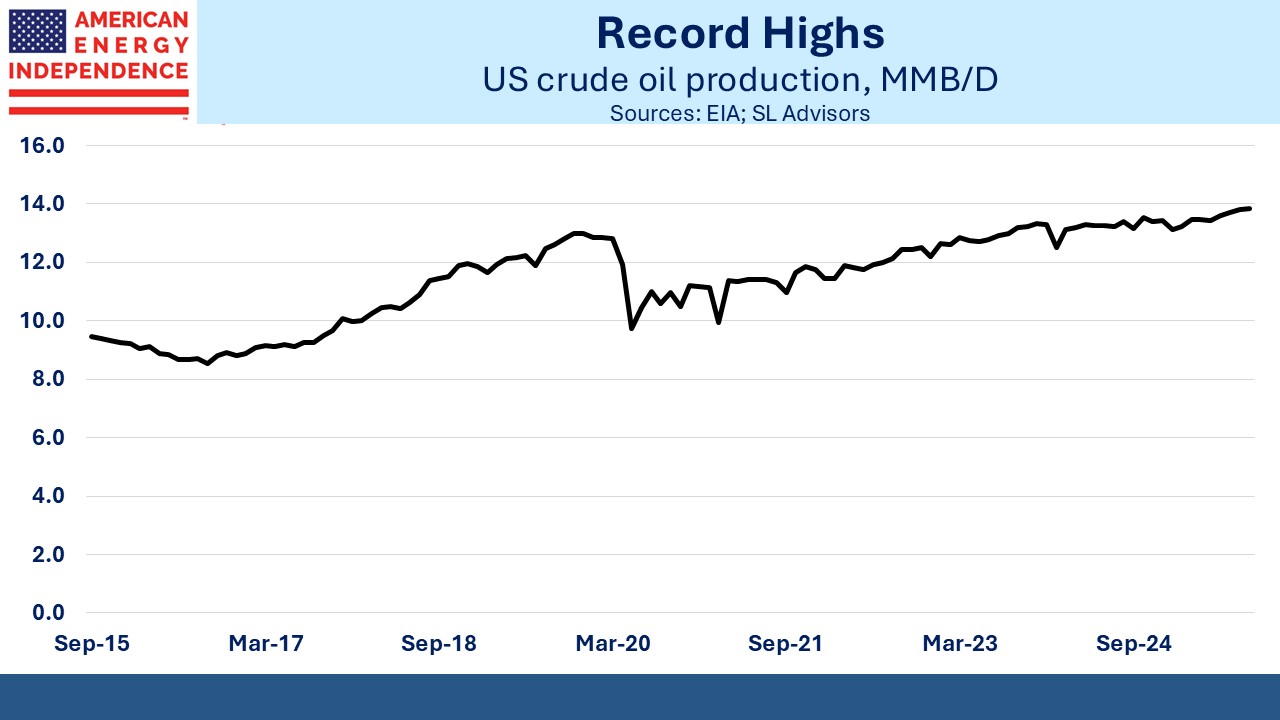

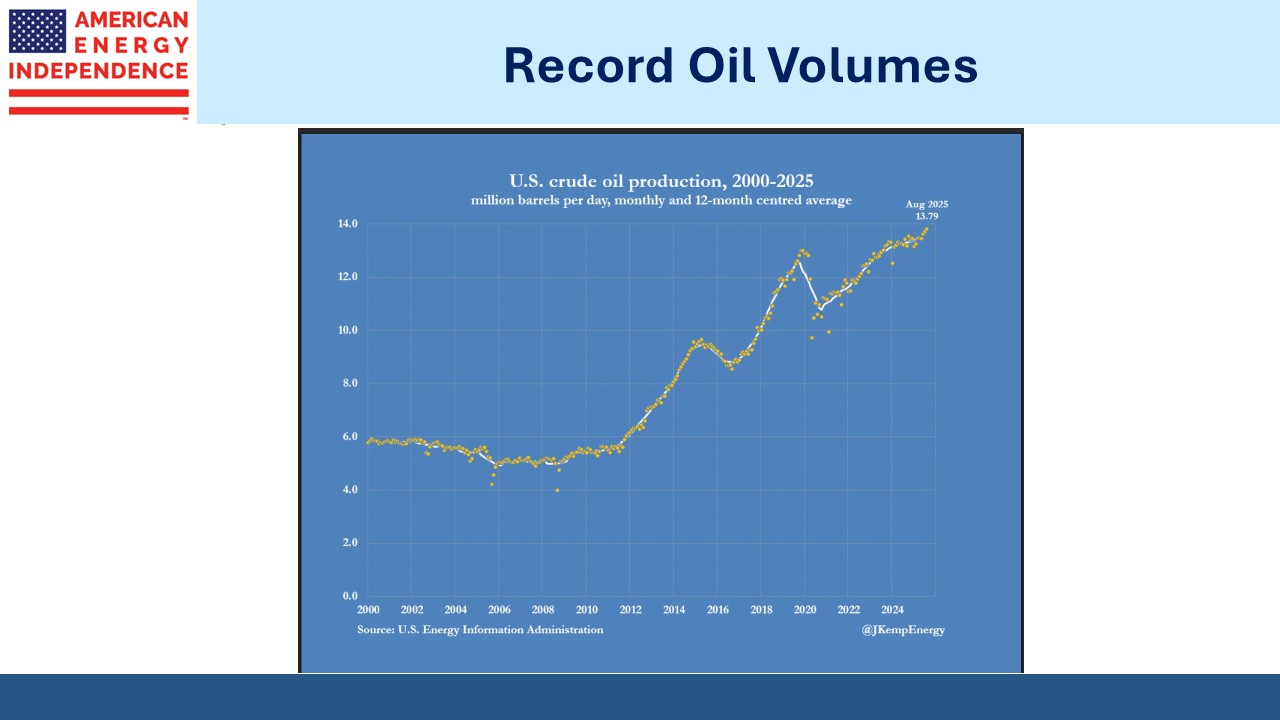

Elsewhere in energy, the oil glut is not a secret and Jeff Currie (formerly head of Commodities Research at Goldman Sachs but now at Carlyle) argues that the geopolitical risks have risen markedly following the capture of Venezuela’s Maduro. China may start seizing oil tankers in the South China Sea which are typically “dark fleet” vessels. We don’t make oil bets, but Currie’s views are worth considering.

Last week was the CFA Naples Annual Forecast Dinner. SL Advisors was a sponsor, and I was happy to bring Bradley Golden and Thomas Vulgaris, both from Pacer Advisors, along with long-time friends and investors David Pasi and Michael Shinnick. David Rubenstein, co-founder of Carlyle, was the speaker and his star power drew record attendance.

We have two have funds that seek to profit from this environment: