Nothing Ventured, Nothing Gained

/

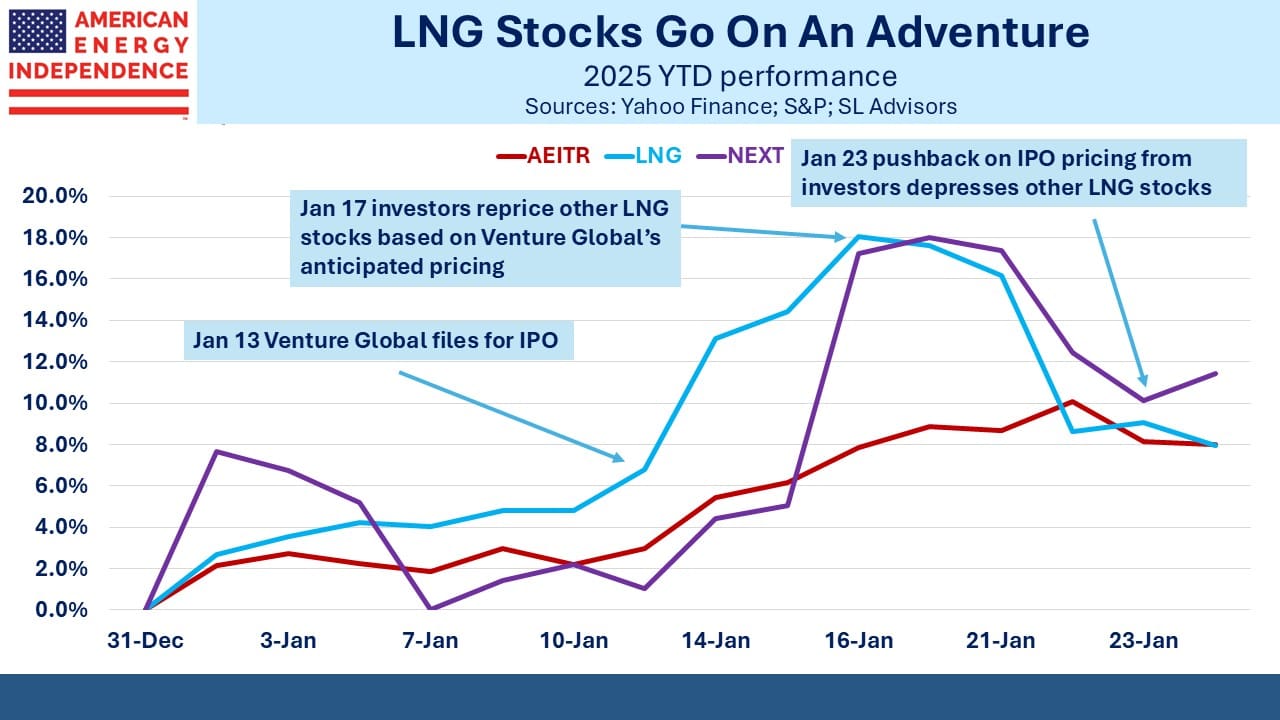

One source of recent volatility in midstream has come from a stock that wasn’t even listed – Venture Global (VG), the LNG exporter whose IPO priced on Thursday. The fundamentals could not be more positive. Trump has reversed the LNG export pause, wants US energy dominance and asked our trading partners to buy more American oil and gas. It’s hard to conceive of a better environment to launch an LNG IPO.

VG rather overplayed their hand though, originally seeking a valuation of over $100BN, double Cheniere’s (symbol: LNG) who handles half of all US LNG exports.

As investors contemplated VG’s proposed valuation, the effect was to highlight how cheap Cheniere is. Its stock duly rose, along with NextDecade (NEXT), a company we like that is building its first LNG export terminal.

Underwriters found quite a pushback from potential buyers on VG’s lofty pricing, and repeatedly lowered the target range. On Friday it priced at $25 – far below the mid 40s valuation underwriters had been suggesting a week earlier. Gains in other LNG stocks quickly evaporated. LNG and NEXT have gyrated without any actual trading in VG.

We still think the IPO price for VG is high – or more accurately, we think it highlights how cheap Cheniere is, at around 11X EBITDA vs 14X for VG. IPO buyers should still prefer these two stocks in our opinion.

VG also has a mixed reputation with its customers. While they have the same type of long-term sale-purchase agreements common to the industry, the spike in global natural gas prices following Russia’s invasion of Ukraine enabled them to delay commissioning of their Calcasieu Pass terminal. Although the facility was exporting LNG, VG said it wasn’t yet fully operational, and they were therefore not bound to supply gas under the long term contracts. Instead they sold supplies on the spot market, reaping $BNs of additional profit.

Shell, BP, Galp and Repsol initiated arbitration proceedings claiming that this gas should have been supplied to them. The plaintiffs claim VG improperly gained $3.5BN. This dispute is a risk factor in VG’s S1 filing with the SEC.

It seems that Shell and the other buyers are guilty of not negotiating a tight enough contract. VG offered attractive liquefaction pricing, and perhaps the buyers accepted more delivery risk as a result. VG also took an aggressive interpretation of their obligations, evidently surprising their customers. It looks like VG’s CEO Michael Sabel is cut from the same cloth as Energy Transfer’s chairman and former CEO Kelcy Warren. It’s great to be in business with him as long as you’re sure your interests are aligned (see from 2018: Energy Transfer: Cutting Your Payout, Not Mine).

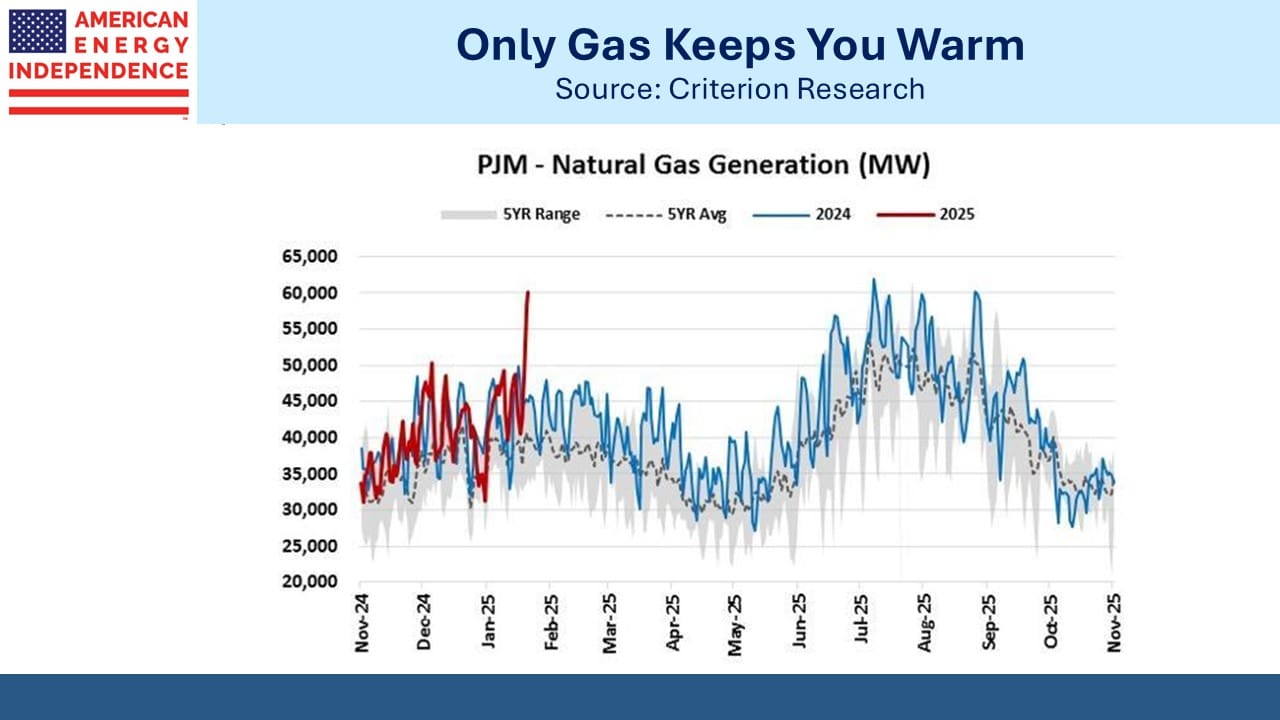

Last week in Naples, FL was miserably cold, a condition that drew little sympathy from family and friends enduring single digit morning temperatures in the northeast. The freezing weather once again showed the importance of reliable, dispatchable energy. The PJM grid, which extends from NJ to Illinois and Tennessee used record amounts of natural gas to generate the electricity customers needed to stay warm.

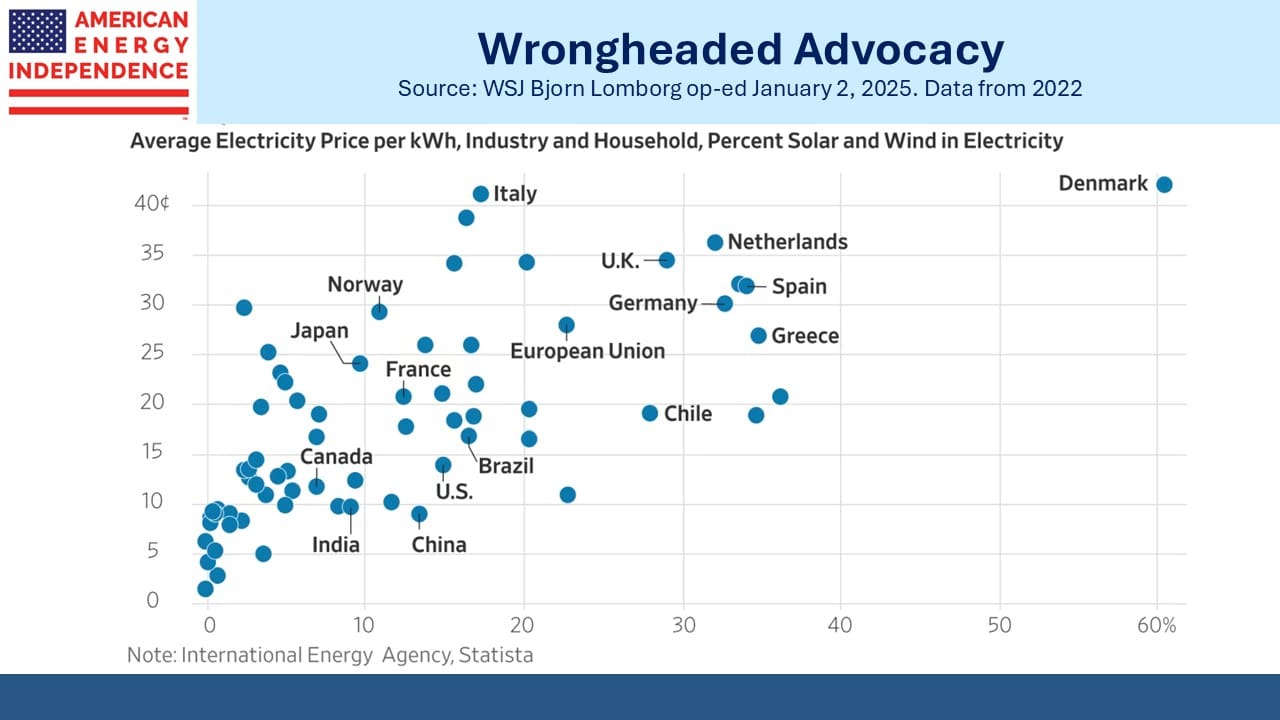

The claims of climate extremists that solar and wind are cheaper than traditional energy have been thoroughly discredited. Opportunistic power that’s only available when the weather co-operates requires natural gas back-up. This surplus capacity raises costs, as the chart from Bjorn Lomborg illustrates.

It’s fortunate that in the US progressives haven’t done any lasting damage with their policies, other than in a few liberal states such as California, Massachusetts and New York. Our friends on the Jersey shore are certainly happy that plans for offshore windpower appear to have stalled.

Some solar and wind can work as long as a grid doesn’t become too reliant on them. At low levels they can drift in and out of the supply mix. Dependence is costly.

It’s one of the reasons the FT wrote Davos hits ‘peak pessimism’ on Europe as US exuberance rises. Former climate czar John Kerry made time to fly there in his private jet to talk about climate change. The European energy policies that he no doubt admires prompted Christine Lagarde, president of the European Central Bank, to say it was “not pessimistic” to say that Europe was facing an “existential crisis”.

Lastly, the FT wrote something we’ve long noted – US stocks at most expensive relative to bonds since dotcom era. Valuation isn’t a good timing tool, and stocks have been relatively expensive for at least a year. But it’s worth noting, because midstream energy looks like the exception to us (see Pipelines Are Cheap; Stocks Are Not).

Last week’s post, The Energy Story’s Trifecta, makes the case and has generated a lot of positive feedback.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!