The Energetic Outlook For Energy

/

Goldman Sachs released a report last week forecasting that Brent crude will slip into “the low $50s” by late next year. It currently trades at around $66 per barrel, down $8 from its year-end level end and $11 over the past year.

The Energy Information Administration (EIA), in their most recent Short Term Energy Outlook (STEO) goes even further. They expect Brent to average $51 next year, $16 below their forecast for this year’s average. This suggests that it will spend some time in the $40s.

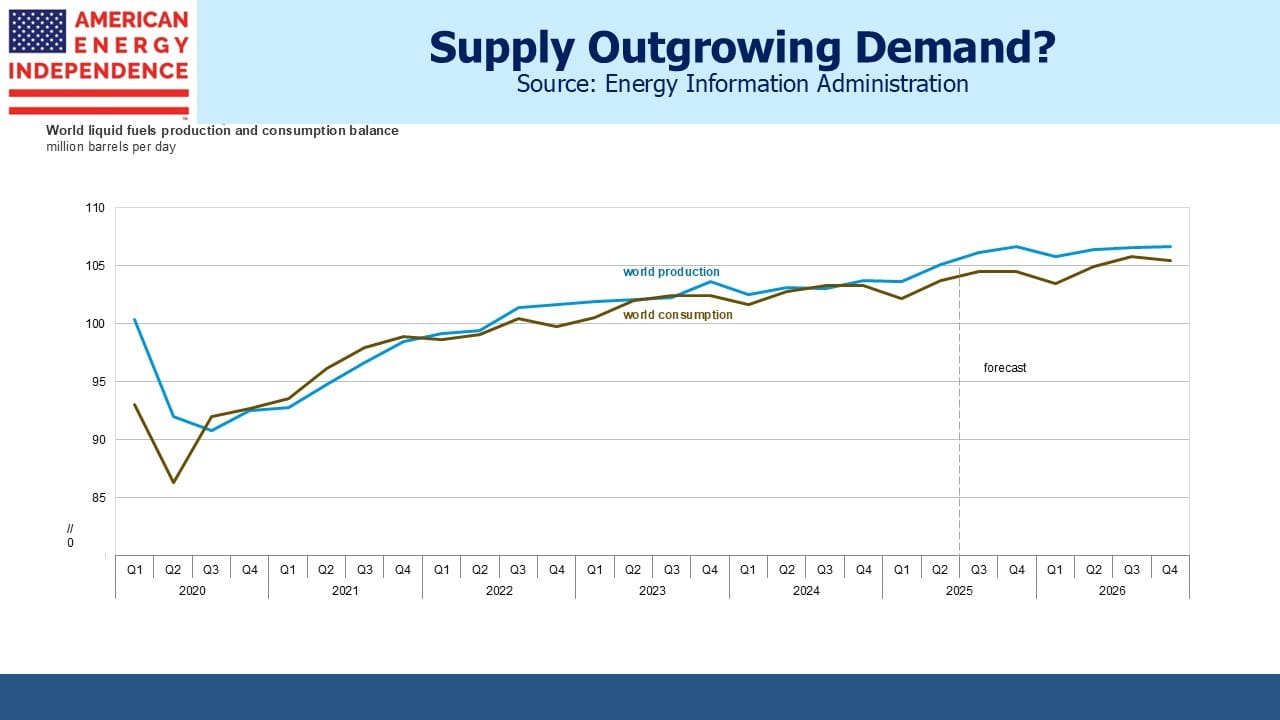

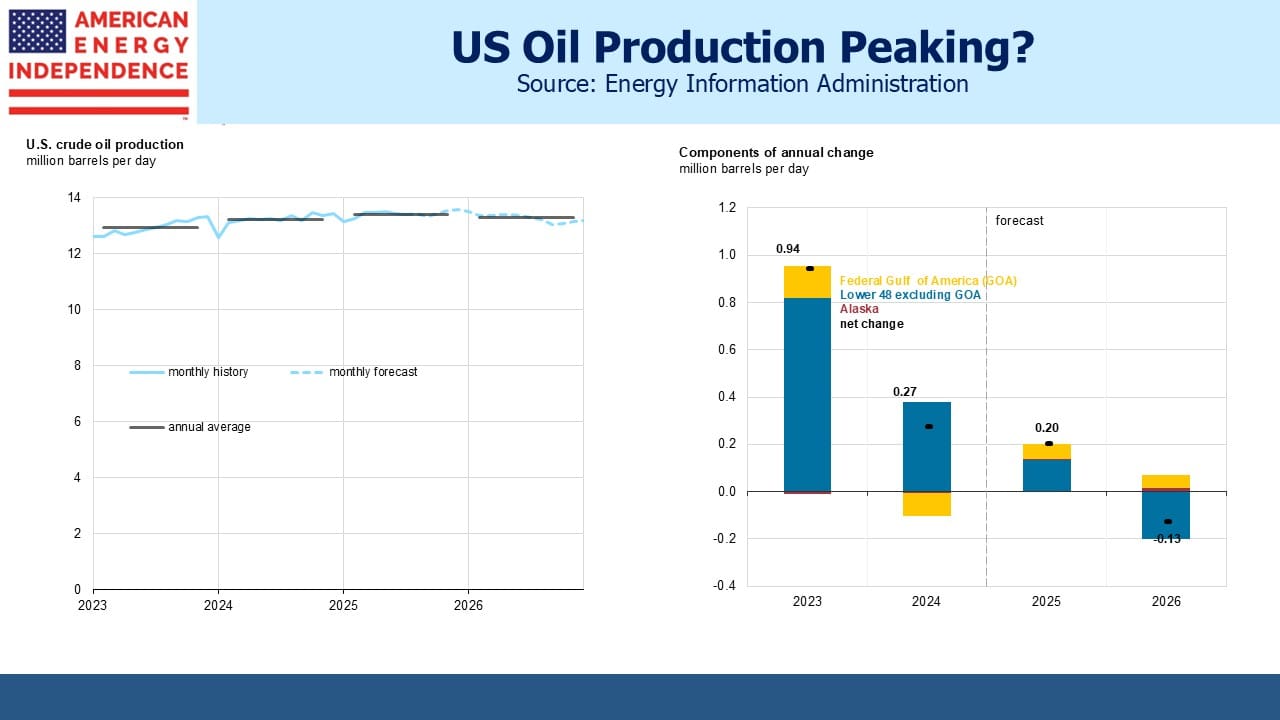

The reason is that supply is growing faster than demand. The EIA expects global inventories to swell by 2 Million Barrels per day (MMB/D) by the end of this year, up by 0.8 MMB/D from their previous forecast a month earlier. They do expect an impact on US production, which they see peaking at 13.4 MMB/D this year before slipping to 13.3 MMB/D next year. In good news for drivers, they see gasoline prices down 20 cents per gallon in 2026.

Over the near term, OPEC+ supply of liquids is forecast to be +1 MMB/D compared with 1H25, with non-OPEC supply led by the US, Brazil, Norway, Canada, and Guyana up by a similar amount.

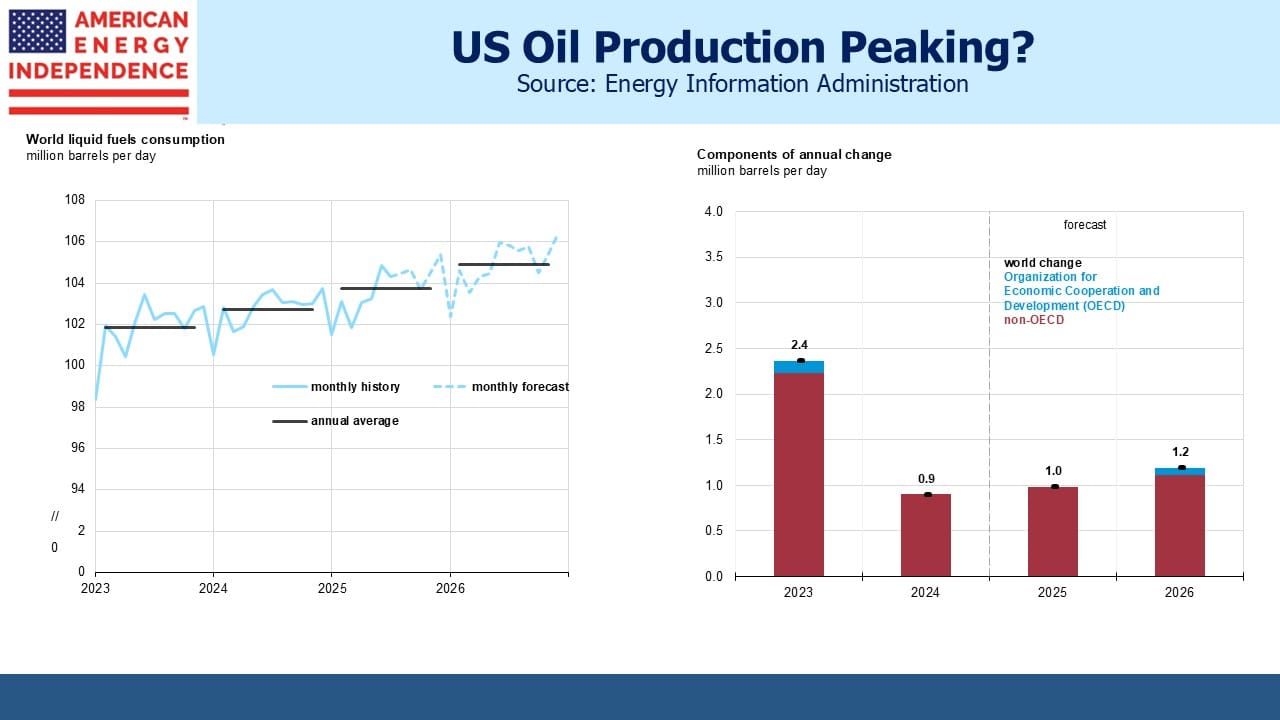

Global demand is growing, just not by as much. The EIA expects consumption of petroleum and other liquids to reach almost 105 MMB/D next year. Growth is all in non-OECD countries. Interestingly, Indian consumption is expected to grow more than China’s, even though the latter uses 3X as much.

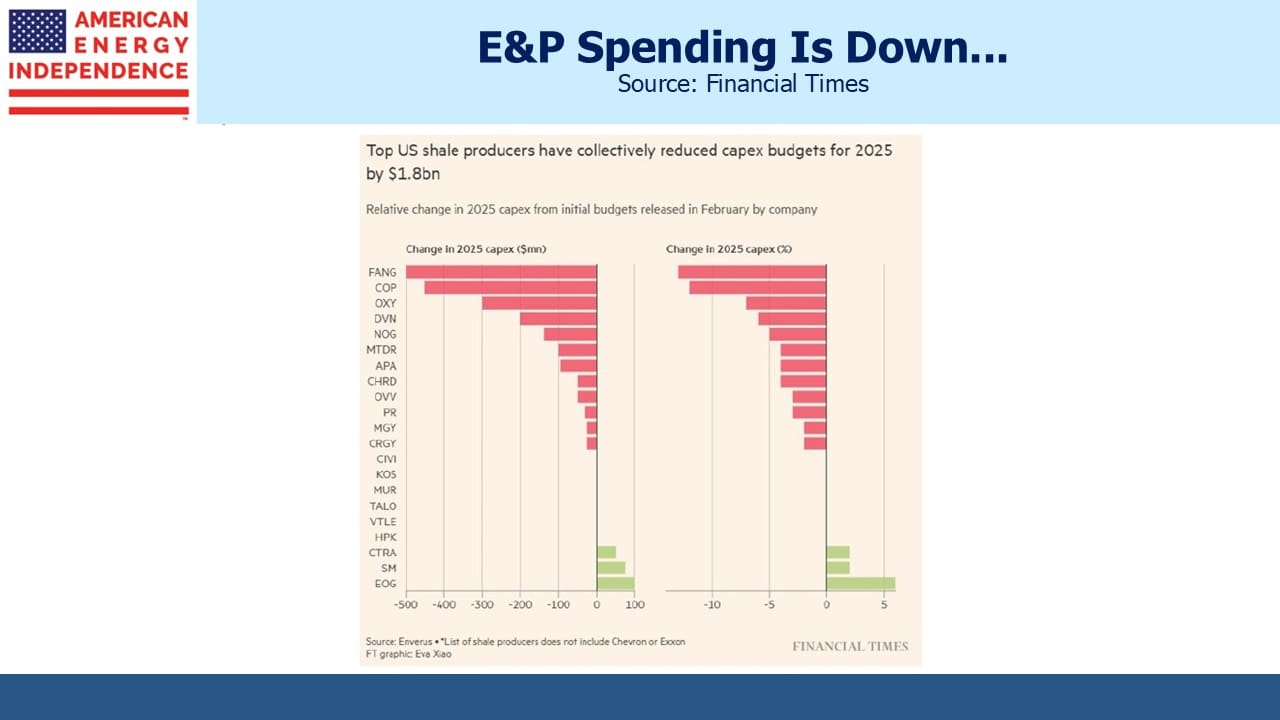

The EIA’s crude oil forecast is aggressive. If crude trades into the $40s next year, I would think US shale production will fall more sharply than the EIA suggests. Crude futures are priced around $15 above the EIA’s forecast for next year. If E&P companies think the EIA is correct, it should already be affecting today’s planned production. Upstream capex is falling but doesn’t reflect that type of price plunge.

It also seems likely that oil that cheap will stimulate demand. Consumption in China and India will probably grow faster. And surely OPEC+ would reinstitute their supply cuts in the face of such a glut.

Although the EIA forecast incorporates some supply response from producers, it’s mild and seems incongruent with their price forecast.

The White House wants more output and lower prices. They should be pleased with the EIA’s STEO. A conspiracy theorist might wonder if the analysts producing such work are at least subliminally aware that projecting high prices might draw the administration’s ire.

Perhaps that’s also the case at Goldman Sachs. President Trump recently called on CEO David Solomon to fire the bank’s top economist over his bearish and so far, wrong call related to tariffs. I doubt the EIA would project crude prices $15 above the futures curve. Who wants to be part of the news cycle and pilloried on Truth Social?

The EIA is supposed to be immune to political influence. In my experience they’ve made plenty of wrong forecasts, including for years being overly pessimistic about US crude output. But they always looked independent. Today, I’m willing to bet that their oil forecast is wrong, but less sure that it’s issued oblivious to any potential presidential feedback.

We’ll never know. Independent thinking is important.

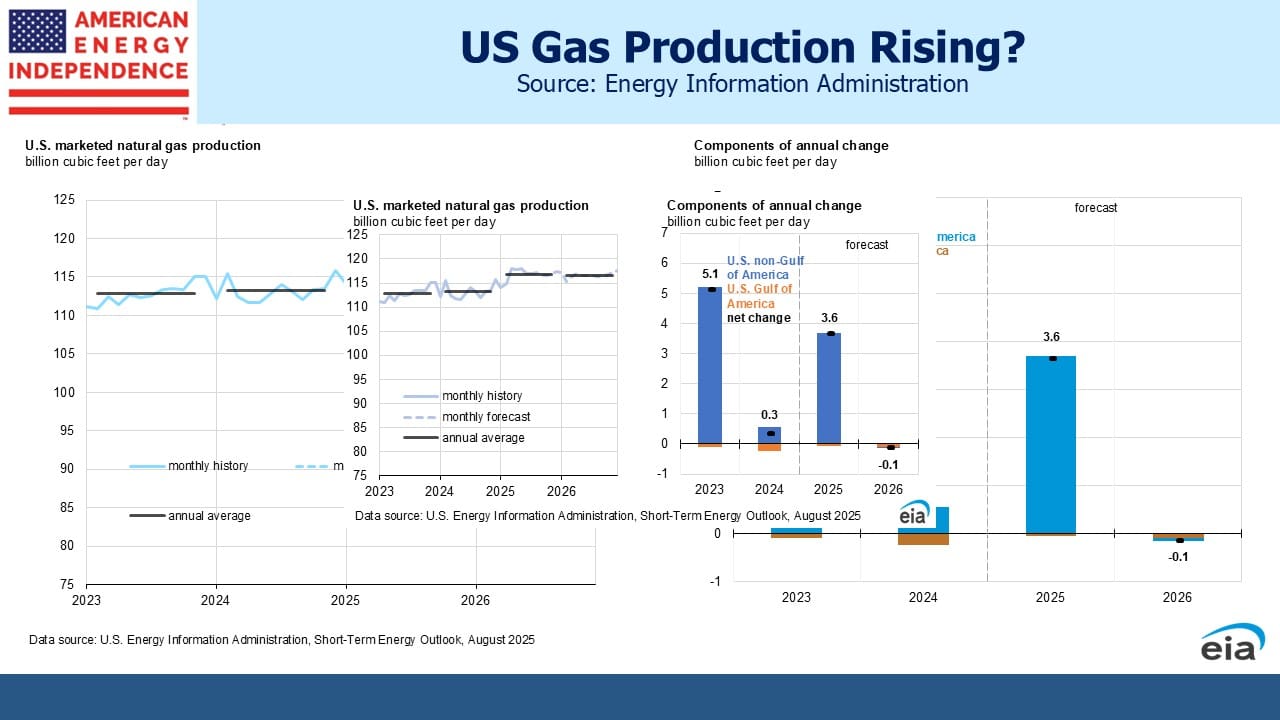

The EIA’s natural gas outlook is more constructive. They expect production of around 117 Billion Cubic Feet per Day (BCF/D) next year including natural gas liquids, flat with 2025 but +3% on last year. Wells in the Permian basin in west Texas tend to become gassier over time, so falling crude production there is expected to trim associated gas output. However, growth in both the Haynesville in Texas and the Appalachia region in the north east will offset.

The EIA expects the natural gas price benchmark to move above $5 per Million BTUs (MMBTUs) by the end of next year, compared with under $3 per MMBTU at present. Gas demand for data centers and for growing LNG exports are the twin drivers.

Capex on data centers by companies such as Microsoft, Google, Amazon, and Meta is around $340BN this year. An interesting comparison is with US corporate tax revenue, which was $530BN last year and around 11% of total Federal revenue. It’s hard to overstate the size, and they’ll need natural gas power plants for electricity.

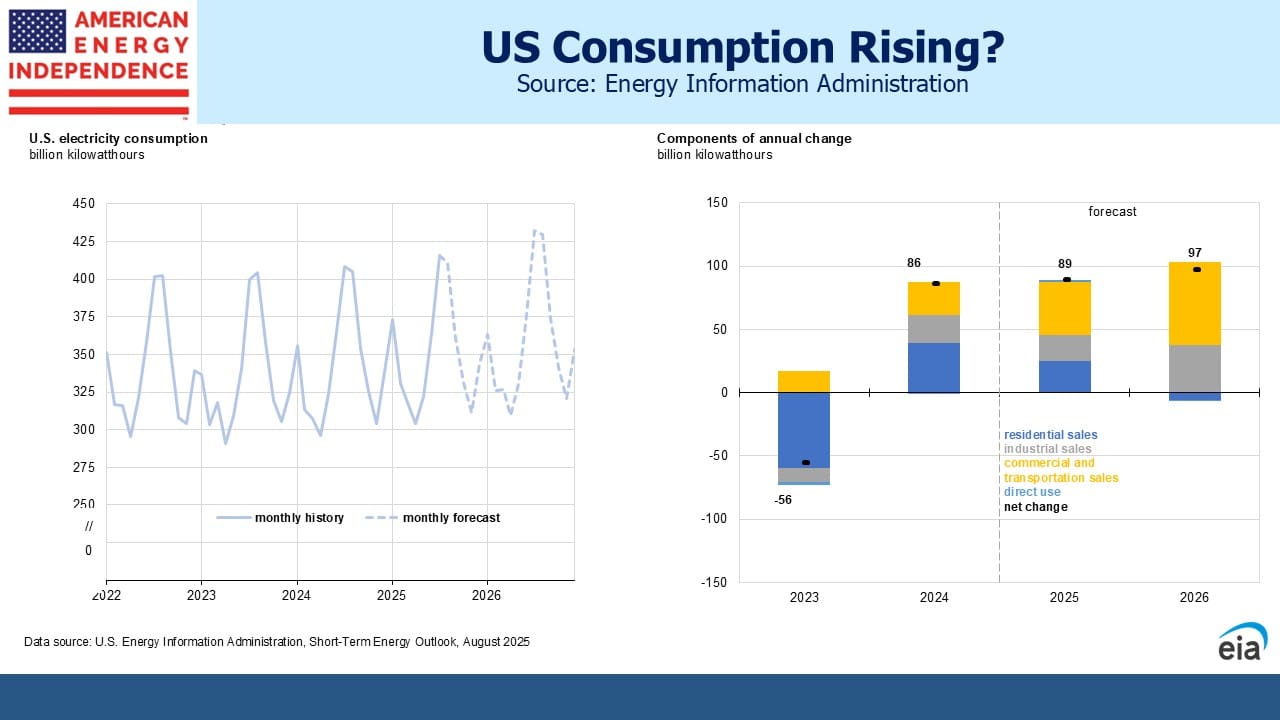

US electricity consumption is at the start of steady annual increases following decades of almost no growth. The EIA expects +2.2% this year and +2.3% next year. We expect natural gas to be the most important source of supply for this additional power generation.

We think the EIA is getting it right with its gas and power forecasts, but on the price of oil looks overly influenced by the White House. But in almost any scenario, energy consumption is going up.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!