Debt Monetization And Pipelines

/

I just finished reading Andrew Ross Sorkin’s new book 1929, which relies on a lot of previously unpublished material to tell the story of the Great Crash through some of the protagonists. For those who enjoy economic history or even a good story, this will not disappoint.

Benjamin Strong ran the Federal Reserve until his untimely death in 1928, and some historians think the collapse of the stock market’s speculative bubble might have been better handled had Strong been around.

During the 2008-09 Great Financial Crisis (GFC) we benefited from insightful financial leadership from Hank Paulson at Treasury, Tim Geitner at the New York Fed and then Fed chair Ben Bernanke, as Ross Sorkin chronicled in Too Big To Fail.

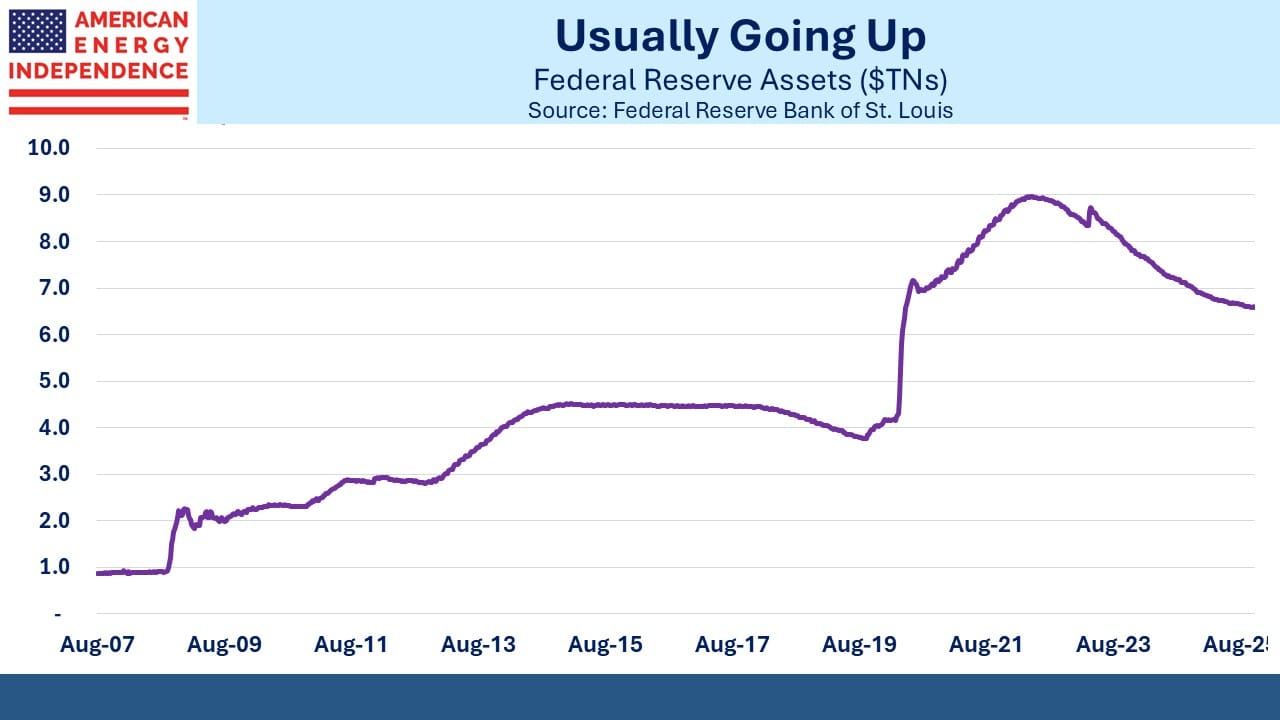

Bernanke used the Fed’s balance sheet to great effect, initiating Quantitative Easing (QE) under which the Fed bought far more treasury securities than it needed to conduct monetary policy, with the goal of forcing long term rates down. Many thought this would be inflationary, but QE turned out to be a vital tool to compensate for a near-paralyzed financial system.

QE should have been a one-off measure, reversed via Quantitative Tightening (QT). But somehow the time has never been quite right for the Fed to exit the long term bond market.

It took the Fed until 2017 to start to unwind the original QE, and that was soon derailed by the pandemic, which took their balance sheet to $9TN by April 2022. It was then allowed to decline until last week when Chair Jay Powell announced an end to QT. He said, “At a certain point, you’ll want . . . reserves to start gradually growing to keep up with the size of the banking system and the size of the economy,”

The Fed’s current holdings are six times bigger than in 2008 while the economy is twice as big.

A permanent holding in excess of what’s needed for monetary policy is simply debt monetization. On this basis, the Fed has monetized at least $4TN of our $36TN outstanding and plans to do more. It is a monetary narcotic, a habit we can’t kick.

The next financial crisis will take it higher still. All the political pressure is aimed at keeping rates low and risking price stability. 3% inflation remains more likely than 2%. Midstream energy infrastructure with its PPI-linked contracts offers some protection in our opinion.

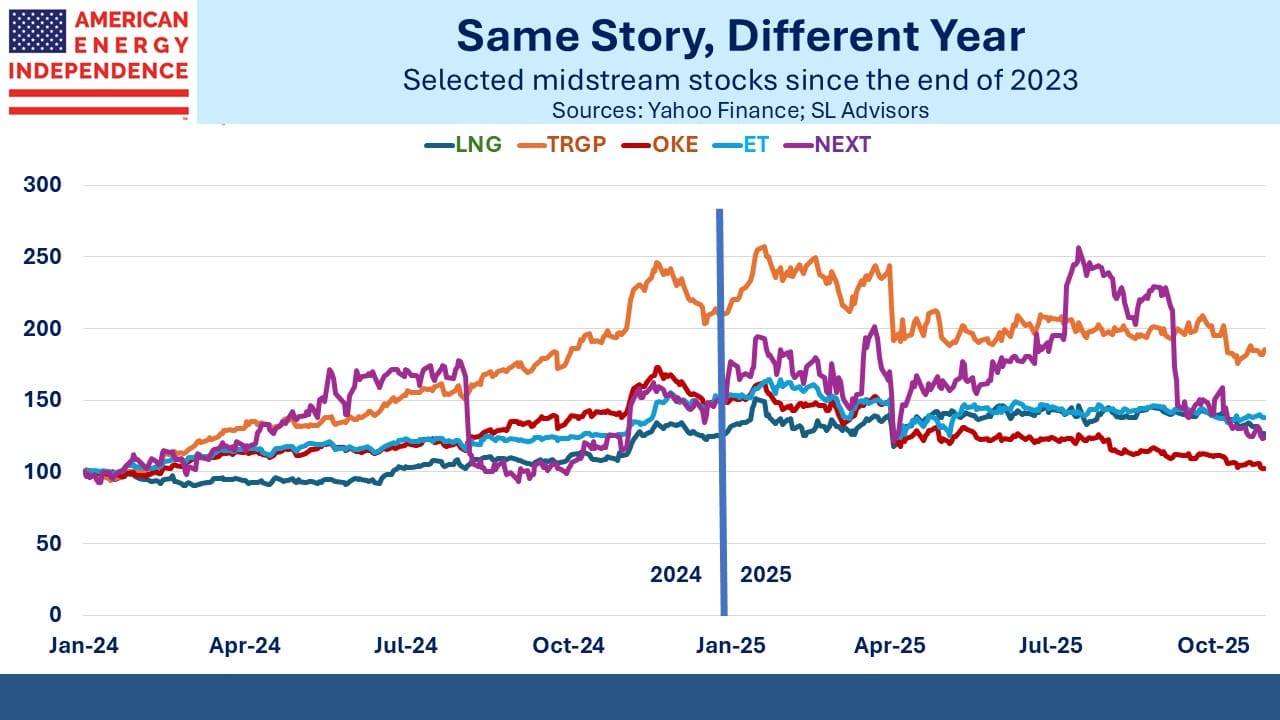

Midstream energy has been a passive bystander to the AI-fueled excitement of the S&P500.

If they were private companies not subject to constant revaluation, as investors we’d feel the macro outlook remains positive and operating performance has been good.

But we’re burdened with a public opinion of that view on a continuous basis, and this year’s mood does not match last year’s. Oil-linked names such as Oneok (OKE) have sagged with oil prices, even though domestic crude oil production reached a record 13.8 million barrels per day in August – we’ll have more recent data once the Federal government re-opens. Exxon and Chevron both increased output in 3Q25.

OKE’s 2024/2025 YTD performance is +48%/-31% respectively.

Targa Resources has built a vertically integrated business for hydrocarbons that allows multiple opportunities to touch a molecule. Its 2024/25 performance is +111%/-12%.

Energy Transfer (ET), perennially cheap in part because it’s an MLP but well positioned to profit from the build out of data centers in Texas, is +53%/-10%.

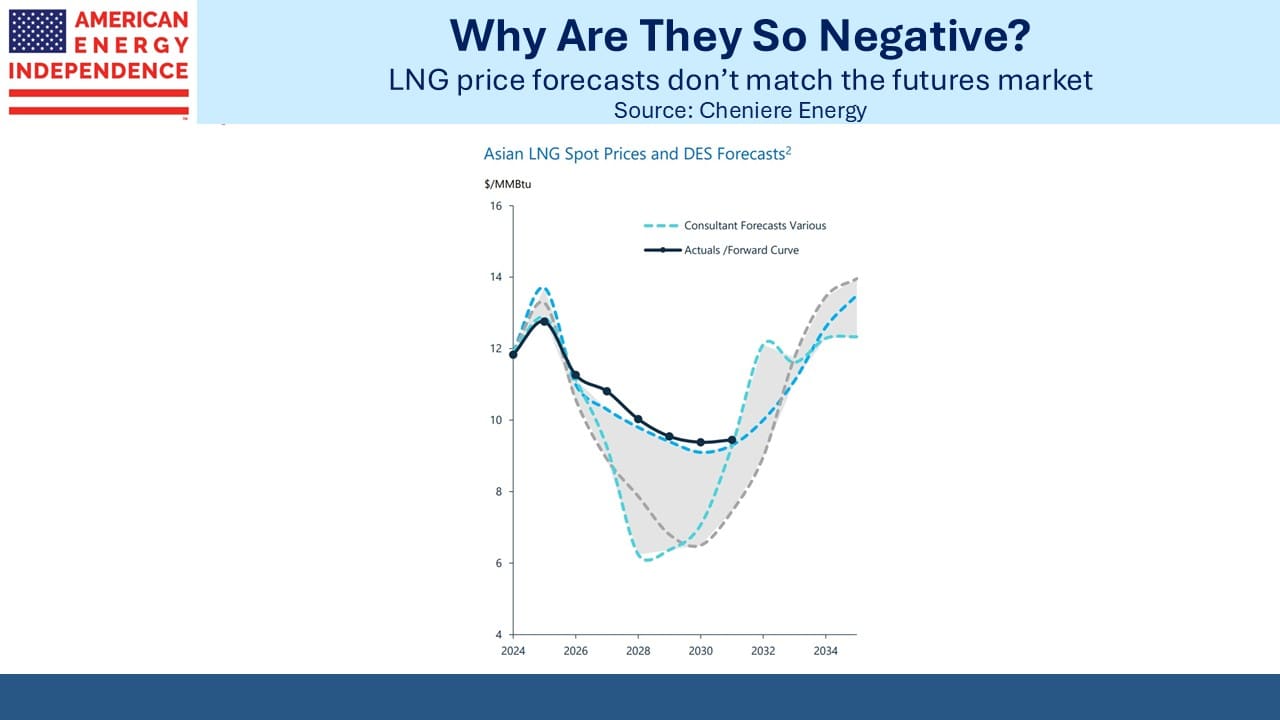

Cheniere Energy (LNG), our leading exporter of natural gas, continues to expand its capacity under budget and ahead of schedule. Many analysts are warning that global LNG export capacity will flood the market, depressing prices and volumes. Oddly though, the futures market is more sanguine than the more dire forecasts weighing on the sector.

Moreover, Cheniere operates with 95% of its capacity pre-sold through 2035, giving it unparalleled cash flow visibility. In 3Q they repurchased $1BN of stock. Its performance is +28%/-1%.

NextDecade (NEXT) reached final investment decision on Trains 4 and 5 with much better economics than on the first three and has plans for further expansion. Its story improved. Its performance is +54%/-25%.

Maybe these stocks and others outran their positive fundamentals last year. Their outlook and operating performance have only improved. Or perhaps it’s a growth year, and AI exposure is where investors want to be.

In any event, long term investors in the sector, which very much includes your blogger, are enjoying 5% yields with growth, strong balance sheets and inflation-linked pricing power on pipeline fees. Our president is a fan of energy exports and easy money. Pipelines offer the opportunity to compensate for fiscal profligacy. It’s the place to be.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!