A Look Back At Energy Transfer

Energy Transfer (ET) is the pipeline company most often directly owned by the financial advisors we talk to. It seems perennially cheap, and that’s in part due to their controversial history of at times treating themselves better than their other unitholders. They’ve provided plenty of material for this blogger to note how management always seems to get the best deal.

When the GP-MLP structure prevailed, Energy Transfer Equity (ETE) controlled several MLPs. Investors in all of them suffered distribution cuts, except ETE which was coincidentally the preferred vehicle of then-CEO Kelcy Warren and other senior executives (see Energy Transfer: Cutting Your Payout, Not Mine). They did eventually cut their distribution in late 2020 under pressure from rating agencies but have since fully restored it plus some.

Eight years ago Energy Transfer was engaged in an ill-fated pursuit of Williams Companies (WMB). After reaching an agreement and concerned about the increased leverage embedded in the deal from the cash portion, Kelcy Warren had second thoughts. They issued a special class of convertible preferred securities just to ET insiders which diluted the value of the deal so it fell apart. An adverse tax opinion helped (see Will Energy Transfer Act with Integrity?). WMB sued and finally won $495MM in damages last year.

With the deal canceled, many expected the offending convertible preferreds to be canceled, since their purpose had been served (see Is Energy Transfer Quietly Fleecing its Investors?). Their terms allowed owners to reinvest dividends at the original issue price, an attractive feature that further diluted the rest of the shareholders.

A class action lawsuit followed. A client of ours was even asked to testify. It seemed obvious that the offending securities would be canceled by order of a Delaware judge. But the company prevailed by arguing that their issuance had preserved the distribution on the common equity for everyone else. The court victory didn’t mean they’d acted fairly. ET’s stock has long been weighed down by fears that management will put their own interests ahead of unitholders again.

The company never avoids a fight. Their construction of the Mariner East pipeline in Pennsylvania resulted in numerous regulatory infractions. ET eventually pleaded “no contest” to environmental and other charges, which under state law presumes they’re guilty.

In 2016 protesters tried to block completion of ET’s Dakota Access pipeline, needed to transport crude oil to Illinois. This was a case of opponents trying to overturn already approved permits, an all-too-common problem that is impeding many types of new infrastructure. Critics accused the company of taking a bare-knuckle approach to resolving the conflict. North Dakota is suing the Federal government for the $38MM cost of policing the protesters and subsequent clean up.

WMB wants to build a natural gas pipeline that will cross an existing one owned by ET in Louisiana, and the company has refused permission. Many think it’s simply an effort to impede competition. ET has cited safety concerns. WMB said last week they expect to prevail in court.

You get the picture. ET doesn’t back away from a fight. When the stock was languishing below $10, I wondered if they’d engineer a management buyout at some modest premium, capturing substantial value themselves from a too-cheap stock price their own actions had created. Were we incurring the downside risk but with only limited upside, like a put option?

At one time this curbed our enthusiasm for the stock.

I’d have bet they tried to take the company private, but even back then at ~$30BN equity value plus debt it would have been challenging to line up sufficient capital.

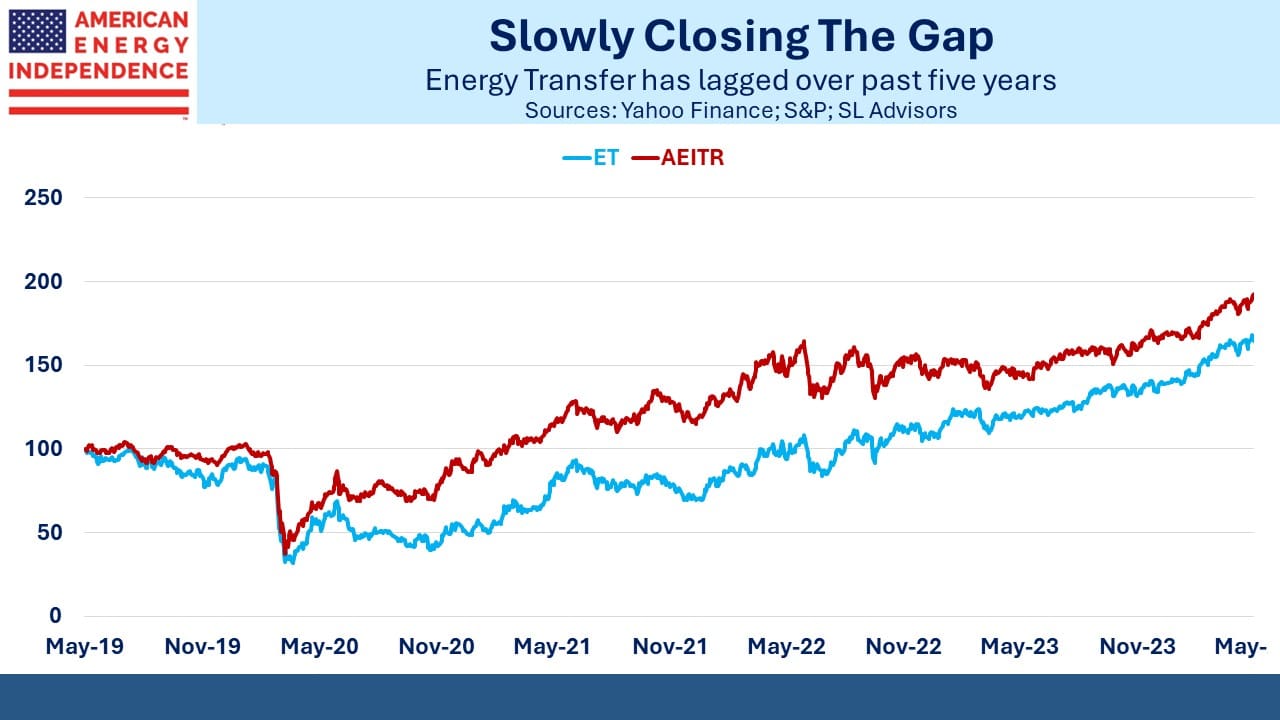

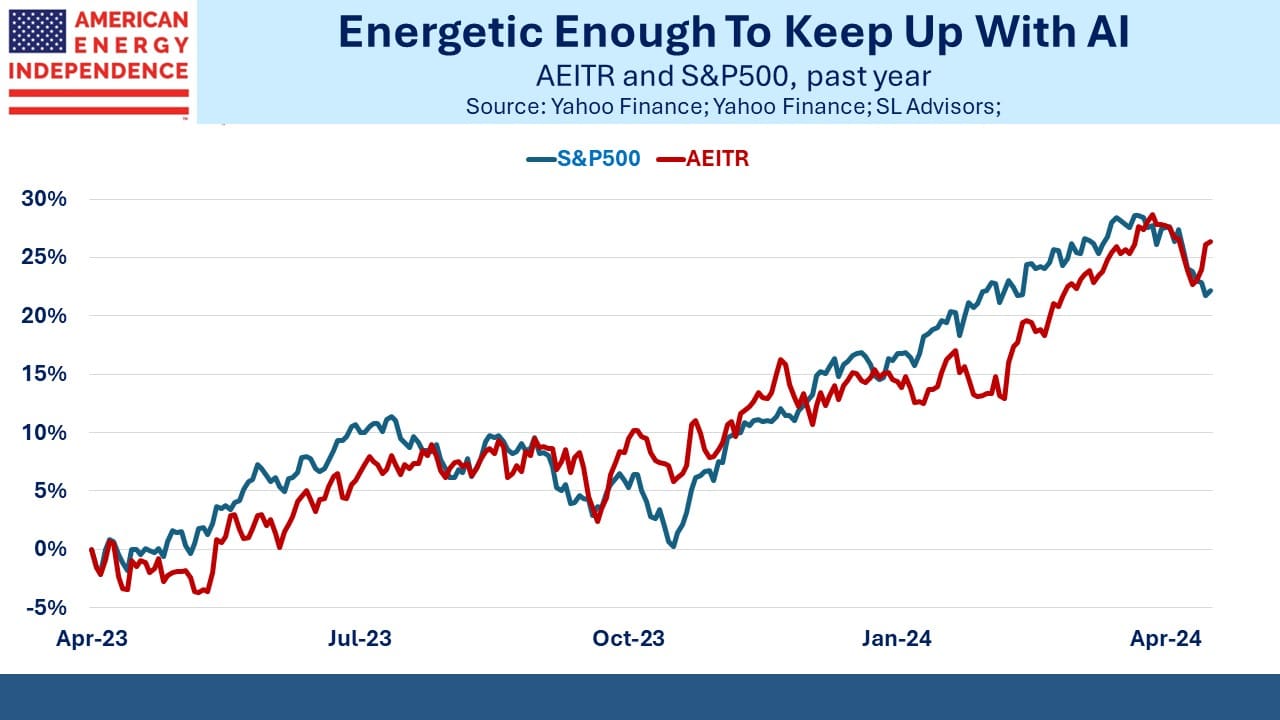

Kelcy Warren stepped back from the CEO role in 2021 but is still Chairman. Mackie McCrae and Tom Long now split the CEO-role. The management team knows how to run their business, and the stock has responded accordingly. Over the past year it’s returned 42%. 1Q24 EBITDA beat expectations by 5%. They raised FY 2024 guidance by $0.5BN and increased their dividend, both by around 3%. The self-dealing reputation earned by convertible preferreds is a receding sour memory, but they retain their “in your face” posture.

ET still looks cheap to us. They’re guiding to $15BN of EBITDA this year with a market cap of $53BN.

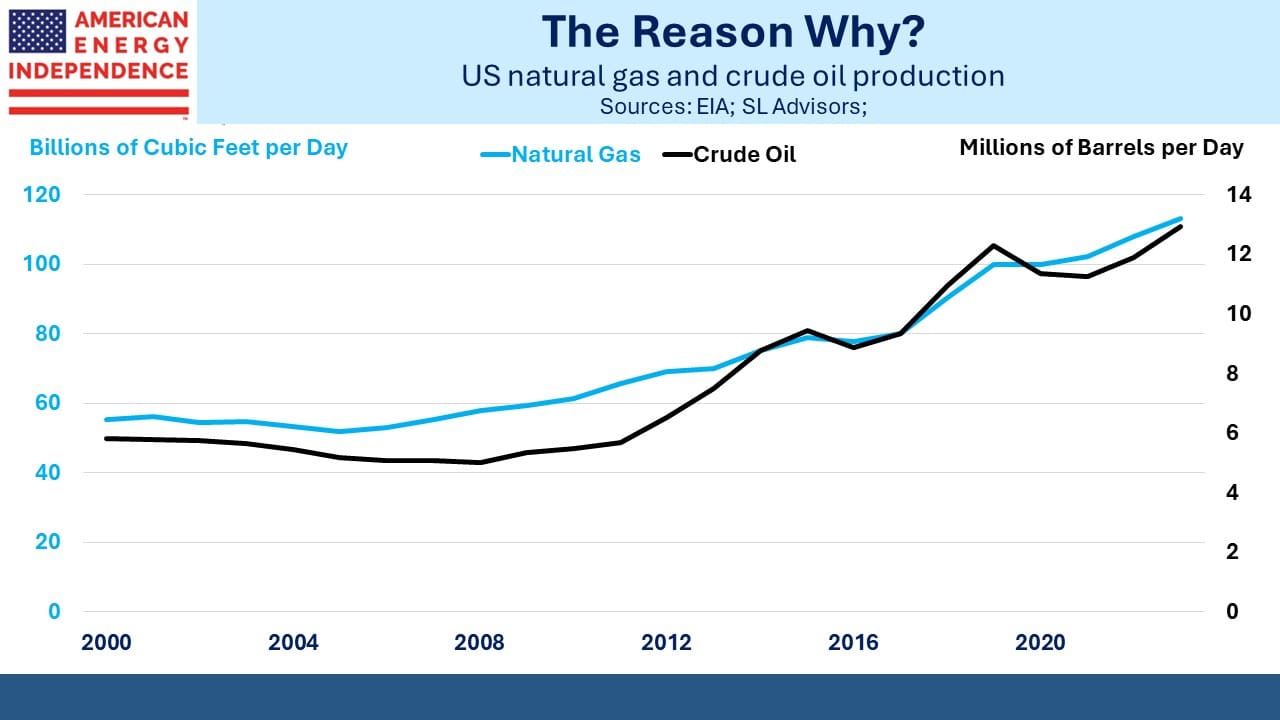

Earnings for our portfolio companies were largely at or ahead of expectations. Data centers to support AI growth figured prominently in subsequent conference calls. With another 12 Billion Cubic Feet per Day (BCF/D) over the next six years for LNG and increased consumption of natural gas for domestic power generation, Citibank thinks this could require 20 BCF/D or more of domestic production by 2030.

NextDecade stock was strong last week. We continue to think the market isn’t pricing in trains 4 and 5, which are already permitted and therefore not subject to the recent pause on new LNG permits. We are hearing reports that Administration bureaucrats are finding other ways to frustrate new LNG exports. It’s bad energy policy and prevents Asian buyers from reducing coal use. But it’s good for NEXT because they still have some remaining export capacity to contract out. We understand negotiations are progressing well, with a go-ahead decision on train 4 possible next quarter.

Lastly, the White House confirmed its ambivalent approach to the energy transition by increasing tariffs on Chinese EVs. Achieving the widespread adoption Biden says he wants will require cheaper EVs, because recharging is inconvenient. Progressives must realize that he’s not genuinely concerned about climate change, just the political posturing it requires.

We have three have funds that seek to profit from this environment:

Energy Mutual Fund Energy ETF Real Assets Fund