Emerging Markets Never Do

/

Allocating to emerging markets is a Wall Street construct designed to confuse investors and justify periodic reallocations to higher fee products that obscure measures of relative performance. Some financial advisors will be outraged at this statement. So let me quickly move to the evidence.

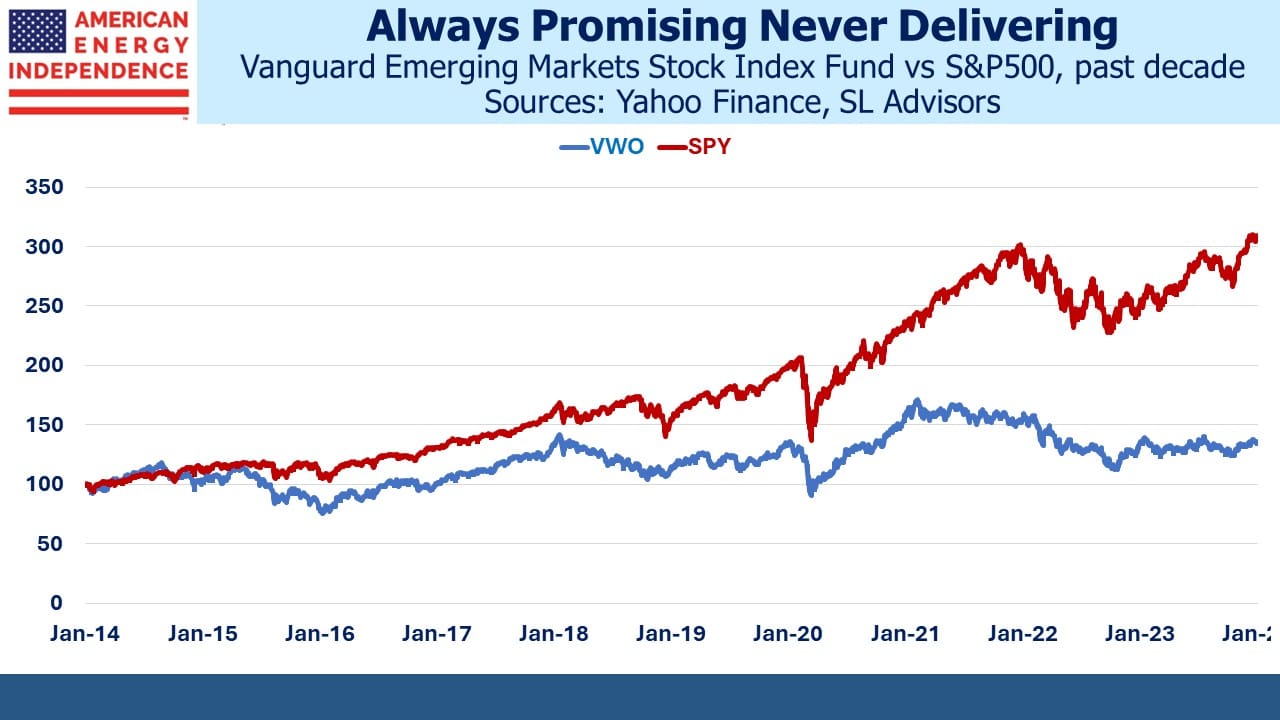

Start with the Vanguard Emerging Markets Stock Index Fund, the biggest ETF in the sector. Over the past decade it has returned 3% pa versus the S&P500’s 12%. Emerging Markets (EM) hasn’t just had a poor couple of years. It’s had a lousy decade.

This shouldn’t be surprising. Nobody ever emerges from an EM index. For my entire 44 year career in finance, the EM composition has barely changed. “Emerging” is a marketing gimmick that suggests upward progress. But in reality, these countries are all destined to have living standards below the OECD (ie developed countries) indefinitely.

Nobody ever emerges.

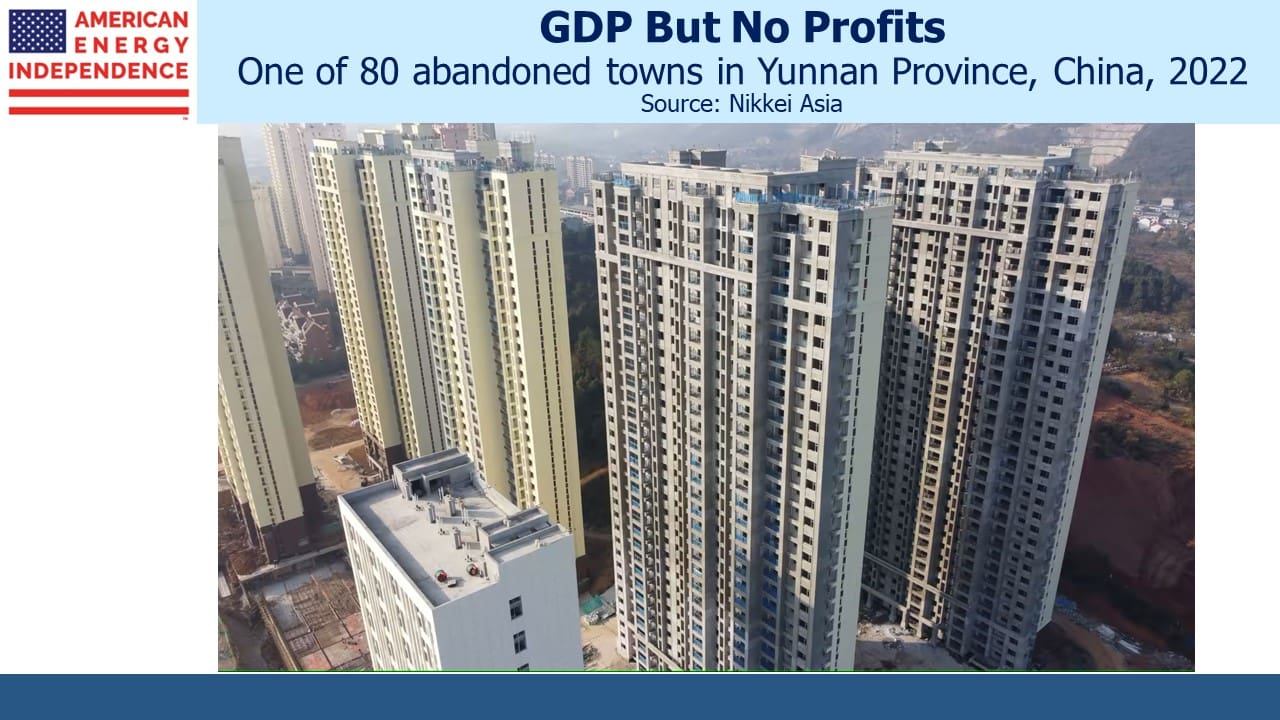

EM proponents will argue that their higher GDP growth means better equity returns. But GDP and corporate profits are different. An uncompleted apartment building generates GDP but is clearly not generating any profits to equity owners if its units can’t be rented. China’s many zombie cities are an example. Building out infrastructure creates immediate GDP, but only helps equity investors if it improves an economy’s productivity.

Many countries exhibit a poor transmission mechanism from GDP growth to equity returns.

Then there’s disclosure standards and property rights. EM countries typically don’t meet western standards on these two issues. The EM investor adopting the tenuous argument that GDP growth = corporate profits next has to consider that the companies she’s invested in are less than transparent in their accounting. Or that local government officials may misappropriate parts of the businesses she owns through dubious legal maneuvers. Outside of western liberal democracies, it’s rare to find countries with a history of respect for individual rights, for the impartial application of contract law and with strong investor protections in place.

Returning to China – can you really trust the government to protect the interests of foreign investors?

The case for an EM allocation isn’t supported by historic returns. But the financial advisor who recommends EM exposure for a client benefits from the complexity this introduces into performance evaluation. Only the most financially sophisticated will have the tools to establish whether EM added any value. And because EM is rarely a buy and hold strategy, a second timing decision on when to exit also looms. EM is the refuge of the financial advisor obfuscating results with complexity.

All but a handful of the S&P500 does business in EM. Their presence can be used to justify an investment – if Coke is making money in Brazil, why aren’t you? But Coke is so much better equipped to navigate local laws, ownership rights and taxes while still complying with US GAAP standards. And Coke is better situated to calibrate their EM exposure among the countries where they perceive the best opportunities.

If you apply the same logic to another 475 or so members of the S&P500, an investment in the biggest US companies comes with an EM exposure through the filter of US standards and sized according to the collective capital allocation wisdom of hundreds of executive teams and boards of directors.

There’s no reason for the retail investor to make an EM allocation. If your financial advisor recommends it, share the dismal decade displayed above, reject the complexity that benefits him not you and tell him you’re happy with the EM exposure your S&P500 investment provides.

On a different topic, China’s National Energy Administration recently reported, “Based on the overall promotion of oil and gas supply security and green development, oil and gas development enterprises have accelerated the pace of integration and development with new energy on the basis of effectively stabilizing oil and gas and improving the ability to independently guarantee oil and gas resources,” (translated from Chinese by Google).

Don’t be confused by China and renewables. Energy security explains the dual focus on clean energy and coal, because they help reduce China’s reliance on imported oil and gas. Coal provides over 60% of China’s power and is 70% of its emissions. They’re adding new coal plants at more than one a month. Security, not climate change, drives their policies. Why else would a country boost electric vehicle sales powered with the worst of fossil fuels if not for energy security?

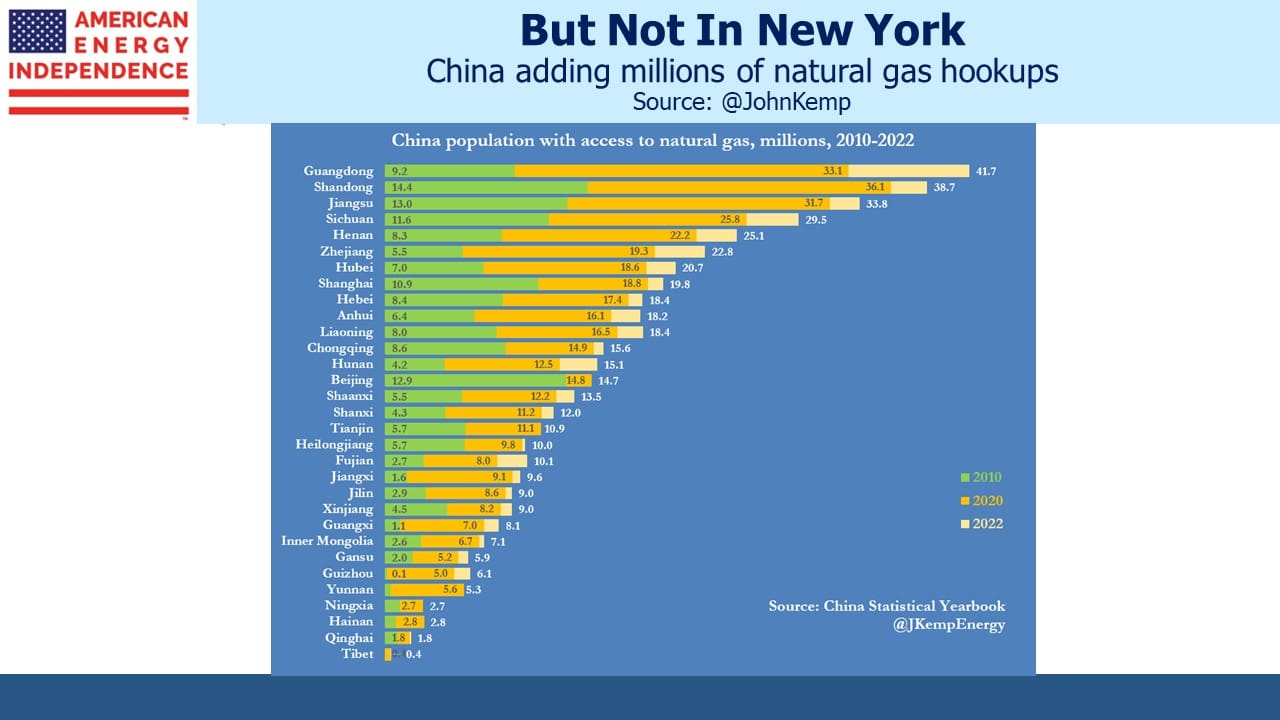

Chinese consumers are being connected to natural gas supply across the country. Many provinces have tripled or more the local population able to use natural gas. In 2022, 15 million new customers were added. This contrasts with New York state which is impeding the ability of new customers to access natural gas.

Do New Yorkers know that China is extending natural gas access while their government does the opposite? Have they bought in to the liberal proposition that we’ll reduce emissions while others grow them? Or are they simply unaware, accepting constrained access to reliable energy in the naive belief that all the world’s emitters are aligned in their efforts to achieve a common goal?

Next time you encounter a New York Democrat voter (and there are many), ask them.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

The analysis of allegedly Emerging Markets seems to also apply in the US to Democrat controlled states.