The Case For Real Assets

/

I began investing in midstream energy infrastructure almost two decades ago. When SL Advisors was founded in 2009 it was one of our core strategies. Over the years it’s become our principal focus. Infrastructure possesses enduring qualities for the long-term investor, and energy is just one segment of what’s often referred to as real assets.

Although we focus on energy infrastructure, real assets are much broader than that. They can be structured as REITs. They can be involved in transportation, mining, aerospace and defense. They can be involved in water management and distribution, logistics and the petrochemical industry. Utilities operate infrastructure dedicated to power generation, storage and distribution.

Key attributes of infrastructure include long-lived assets that: provide inflation protection; possess barriers to entry either for regulatory reasons or because of synergies/economies of scale with other assets; generate attractive yields with visible long-term cash flow; and have a low correlation with the equity market.

Maintaining the purchasing power of savings is the goal of all long-term investors other than the foreign central banks and other institutions who hold trillions in US government bonds. Real assets that can raise prices either on commercial terms or because their regulatory framework ensures a minimum return on invested capital can be an effective way to achieve that goal. Oil and gas pipelines often operate under a system of tariffs managed by the Federal Energy Regulatory Commission. Utilities typically have their rates approved by a local regulator. Marine ports and airports often have a scarcity value, in that the alternatives available to shippers and airlines are less convenient or more expensive.

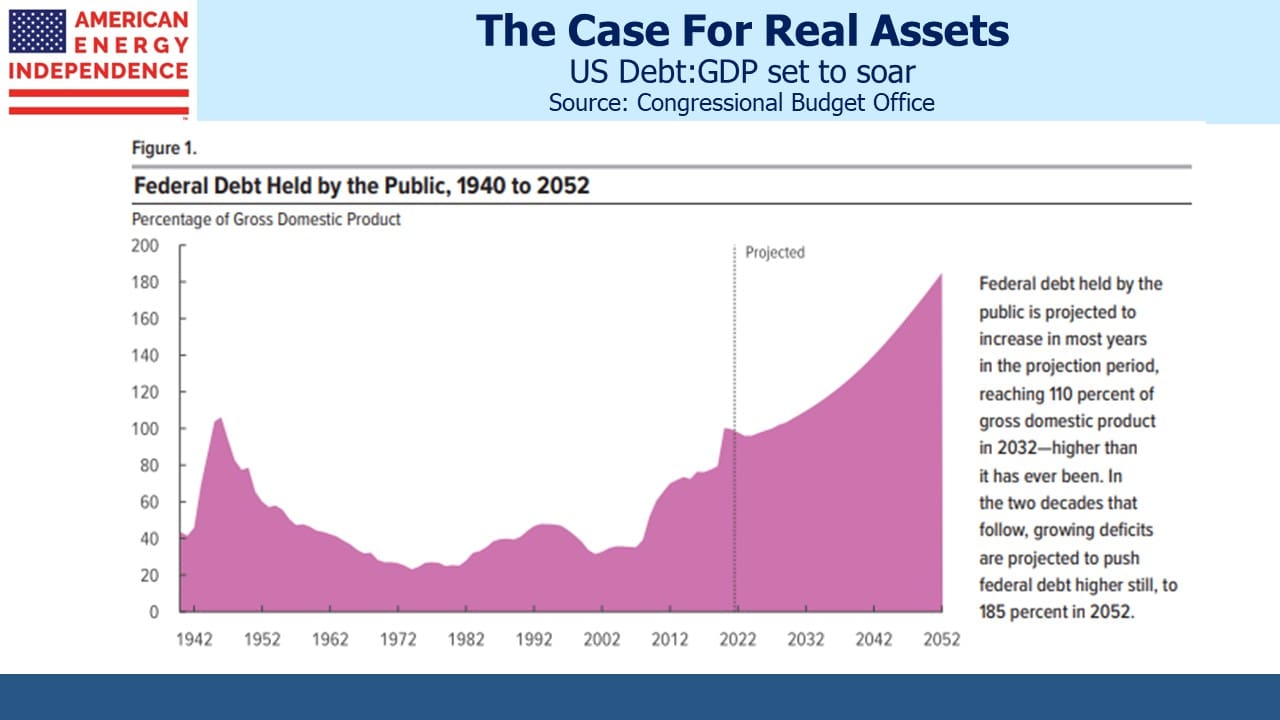

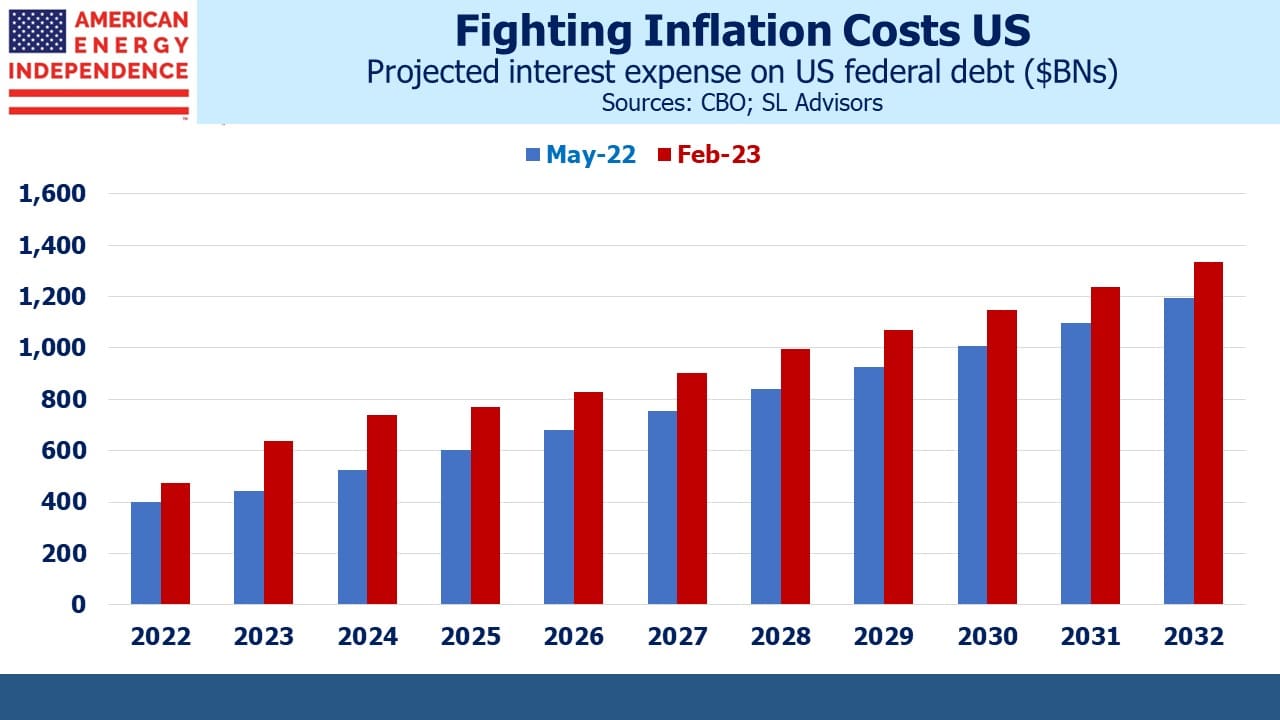

The US fiscal path is well known to be dire and unsustainable. The higher inflation of recent years looks to have dissipated quickly, but the Fed’s sharp increase in short term rates nonetheless raised the cost of financing our debt. Between May 2022 and February 2023, the point at which the Congressional Budget Office forecasts Federal interest expense will exceed $1TN was brought forward by two years, from 2030 to 2028. Higher inflation may turn out to have been transitory this time around, even if Fed chair Jay Powell conceded it wasn’t during its early ascent. But tight monetary policy does hurt our fiscal outlook more than in the past.

This makes it more likely that monetary policy will eventually accommodate our spiraling Debt:GDP by allowing higher inflation and negative real interest rates, increasingly common until the last couple of years. For centuries, monetary debasement has been the refuge of fiscal profligacy.

Infrastructure assets often have barriers to entry. Transco, the natural gas pipeline network owned by Williams Companies that runs through America’s eastern states from Texas to New York is an example. Since its origination in the 1950s, towns and highways have developed that make the construction of a competitor pipeline economically unfeasible. Railroads possess similar features. Where real assets are regulated, it means their stable profits are visible but not excessive, reducing the potential benefits for a competitor.

Established pipelines, railroads and other logistics assets create synergistic connections to other infrastructure, making their replication harder. And scale usually works to the advantage of the incumbent.

Predictable, recurring cashflows allow companies holding real assets to pay a substantial portion of their profits in dividends, which often results in attractive yields. This can be true for REITs, pipelines and many other assets. Just be cautious of utilities with their growing obligation to fund energy transition assets, since this is pressuring their cashflows (see To Lose On The Energy Transition Buy Utilities).

The S&P500 was dominated by the “Magnificent Seven*” last year. JPMorgan calculates that since early 2022 free cash flow growth of the S&P493 (ie excluding the seven) has been flat. Profit margins for the seven high flyers are 2X the other 493.

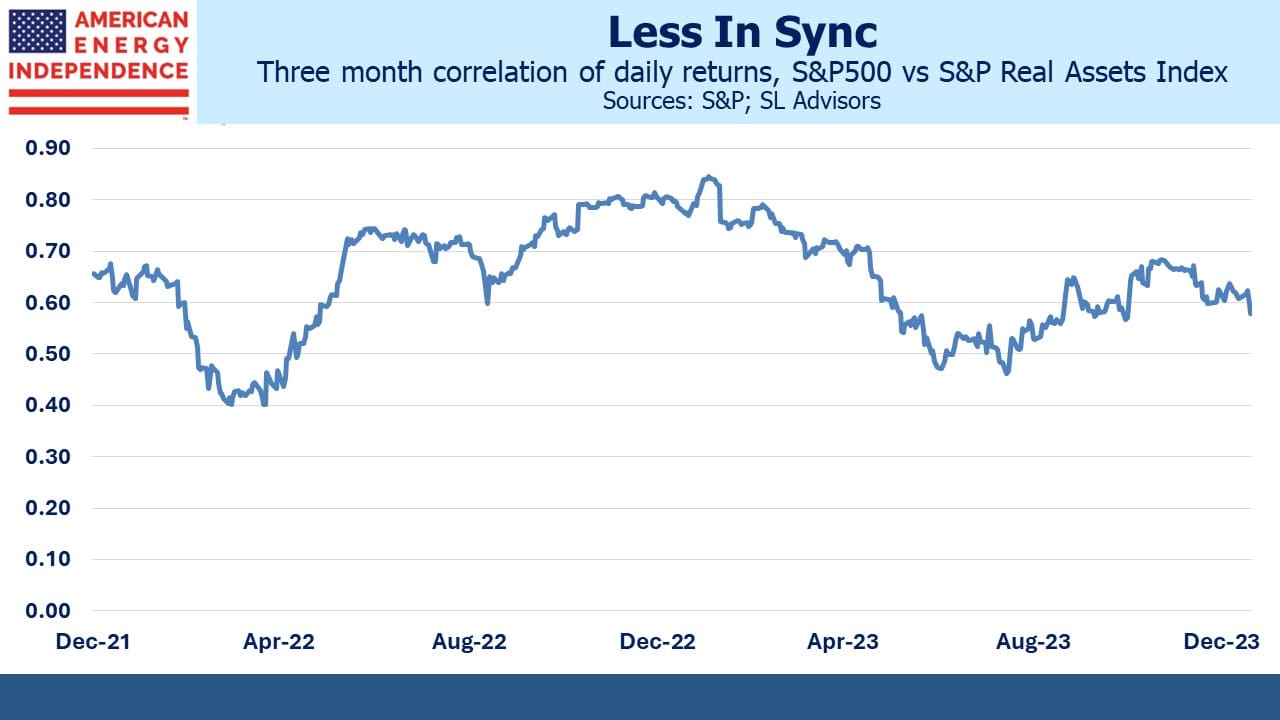

Owning the Magnificent Seven in 2023 was a great call. But they have caused the market to be less correlated with real assets, and when the inevitable reversal happens that low correlation will be welcomed by those who have retained some portfolio diversification.

The dominance of the Seven has led to the market being more “tech-centric”. Because real assets provide good earnings visibility, their valuations tend to be more grounded. They’re less likely to soar on hyped up expectations or plunge on deep pessimism.

Inflation protection, barriers to entry, attractive yields and a low market correlation are all reasons for investors to consider an allocation to real assets.

*Alphabet (GOOG), Amazon (AMZN), Apple (AAPL) Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA)

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

The CBO projects total Fed debt held by public by 2033 to be $46.7T…. call it $50T. US debt rolls over about every 4 years, so that’s a lot of refunding. Who’s going to buy it other than the Fed? Personally, I can’t see how we cannot be at $2T a year in interest payments with [by then] an $8T Fed budget, 25% of which is to pay interest (2/8).

By 2033 Social Security will be busted, China and Europe will be in deep demographic decline, and today’s socialist youngsters will be in charge, many of whom will be illegal immigrants with all the skills they bring to the table. America will be much older, suggesting the productive Boomers of recent prosperity will be either dead or sucking the economy dry, while the tiny Zoomers will have to support them with their degrees in lesbian dance theory.

Who knows what wars we’ll be in.

The only favorable thing on the horizon will be A.I., but that will be a double edged sword, perhaps enslaving us in conjunctions with CBDCs.

Still, I think your hard asset strategy is the way to go. I especially like MLPs.

Another “Key attribute of infrastructure” is the role of its depreciation in reducing or even eliminating taxable income at the enterprise level.