Chesapeake and Southwestern Are Betting On Higher US NatGas

/

Chesapeake (CHK) and Southwestern (SWN) are the latest energy companies to be contemplating a merger. Chesapeake was founded by Aubrey McLendon, whose belief in higher natural gas prices combined with his ample risk appetite led the company into financial difficulties during a period of low prices. In 2016 he was indicted by a federal grand jury on charges of conspiring “to rig bids on oil and natural gas leases”. The following day McLendon died alone in a fiery car crash. Chesapeake ultimately filed for bankruptcy in 2020 and emerged with reduced debt the following year.

The US natural gas story is about growing LNG exports. By combining, CHK and SWN would be America’s biggest natgas producer.

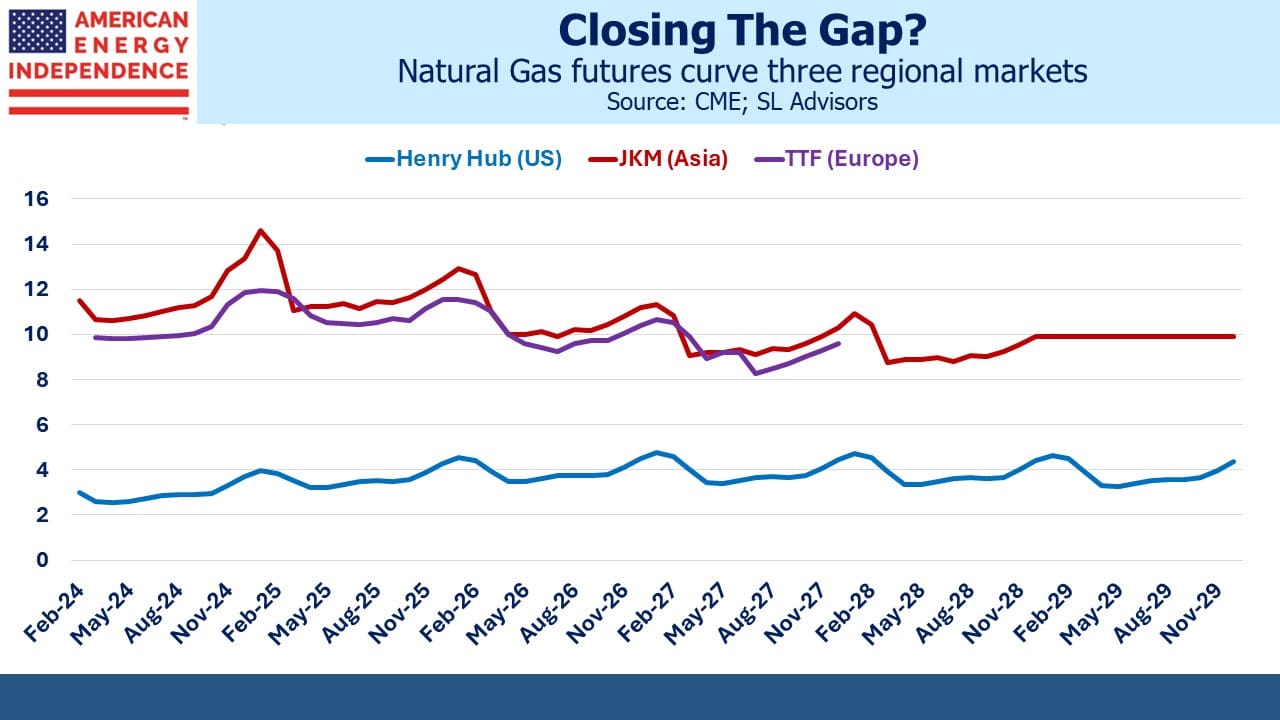

The opportunity can be seen in the futures curves for three regional benchmarks. Because natural gas is difficult and expensive to transport across the ocean, huge price discrepancies can persist for years until liquefaction and regassification infrastructure can be built in the appropriate places to allow for increased trade.

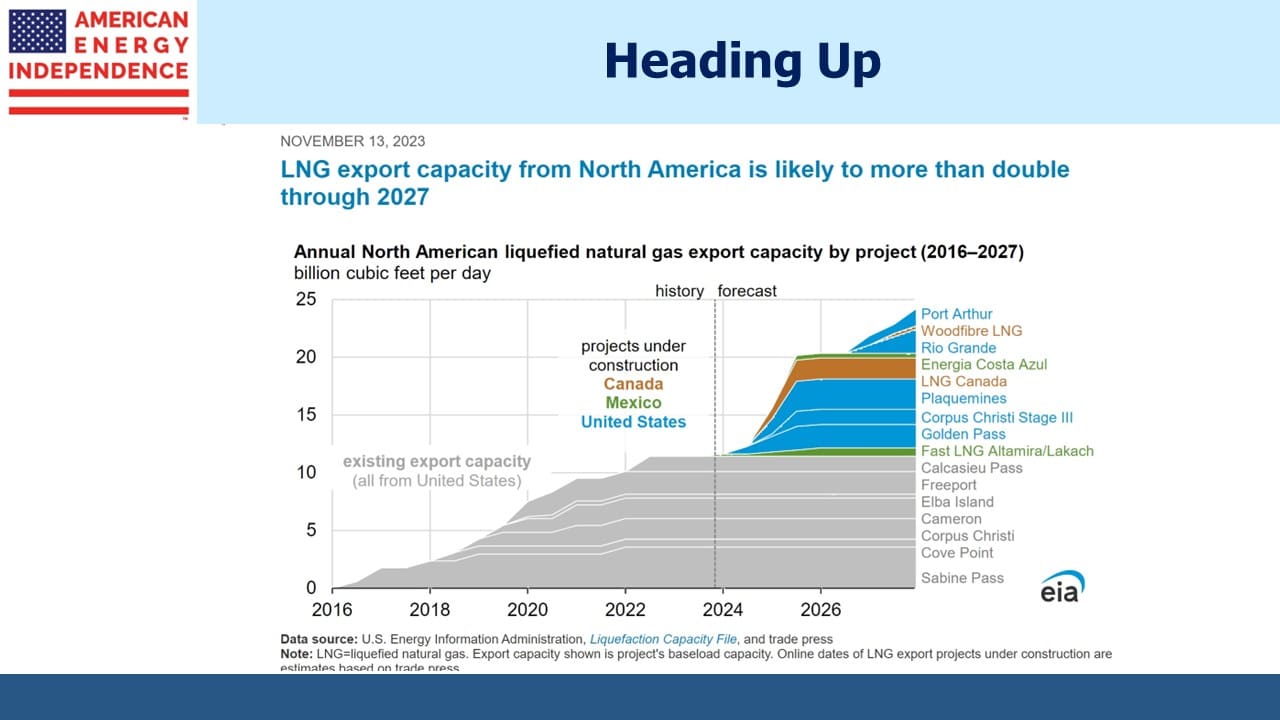

US natgas is very cheap, at under $3 per Million BTUs (MMBTUs). 13 Billion Cubic Feet per Day (BCF/D) is our export capacity, because that’s how much can be chilled and loaded onto specialized LNG tankers. But the discrepancy is so wide that it’s driving the construction of additional capacity.

The US Energy Information Administration (EIA) expects North American LNG export capacity to double by 2027. Given the several years construction takes, this is more than simply an economic forecast. Many projects have already reached Final Investment Decision (FID), meaning financing is lined up and they will be built. By adding in probable projects to those that have already reached FID, Wells Fargo sees 17 BCF/D of new US capacity by 2027 and 24 BCF/D by 2030, for 38 BCF/D of total US export capacity.

Perhaps the most tangible and certainly the most spectacular ESG disaster is Germany’s now shredded belief that they could rely on Russian gas while they transitioned to windpower. The WSJ quoted Bill Ackman thus: “Well-intentioned movements like ESG can have catastrophic consequences for the world. Europe’s loss of energy independence was a contributing factor in Putin having the confidence to invade Ukraine.”

The bet that a CHK/SWN tie-up is making is that the price differential between US natgas and other regional benchmarks will narrow. Asia has represented around 70% of global LNG trade in recent years. But Europe is becoming a bigger player, thanks to a misguided reliance on Russian gas and overly optimistic assumptions on renewables. European and Asian prices are $10-15 per MMBTUs higher than US, It costs around $2 per MMBTU to ship LNG from the US to Asia. Add in a $3 fee charged for liquefaction, and that still leaves a substantial price difference to support increased global trade.

The long term price curves for natgas futures suggest that increasing US LNG exports won’t be that impactful. This seems wrong. If US exports reach 25% or more of domestic production by 2030, as seems likely, domestic prices will rise. The market is not pricing in any narrowing of the differentials between the Asian/European benchmarks which are where the buyers are, and the US which is bringing more availability online.

Some may doubt Europe’s long term appetite for natural gas. It is the region most committed to reducing CO2 emissions, although much of their recent success on this has come from ruinously high energy prices forcing industrial output lower. German companies are relocating manufacturing out of Europe, including to the US.

But European energy companies aren’t behaving as if global LNG gas demand will disappear. Shell recently signed a twenty year contract to buy Canadian-sourced LNG from a new export facility in British Columbia. The Ksi Lisims project isn’t expected to be operational until 2030. And while Asia is geographically the obvious destination for these exports, if the European premium sustains it won’t be hard for Shell to redirect their purchased LNG to other buyers.

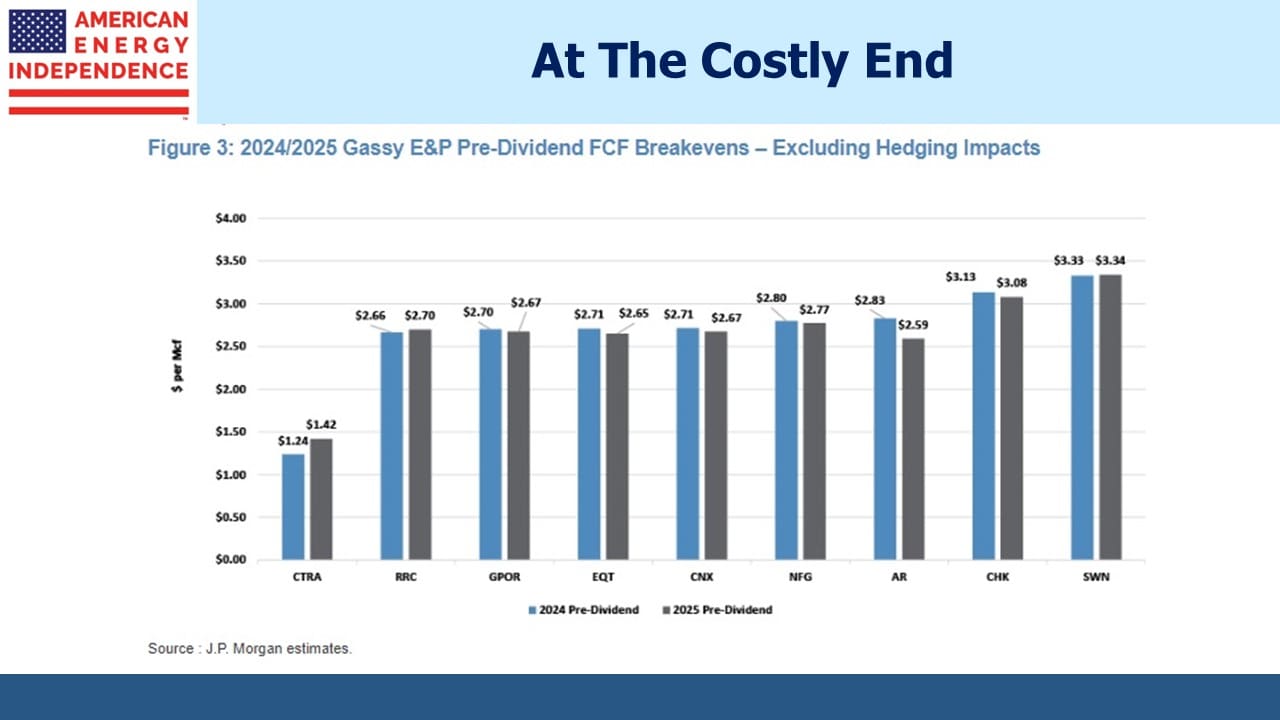

CHK and SWN are motivated by the likely upward pressure on US natgas prices growing LNG exports will cause. They’re probably also aware that as relatively high-cost producers, they are vulnerable to some more efficiently run competitors.

The bet on higher natgas prices looks like a sound one. If completed, the CHK/SWN merger will represent a pureplay bet on growing US LNG exports, something that’s also good for the midstream energy infrastructure companies that make it possible.

Join us for a webinar today, Wednesday January 10 at 4pm eastern. Click here to register.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

The KGS/CCLP merger is probably the most exciting in the space.