White House Adopts An Energy Policy Where Everyone Loses

/

With his moratorium on new LNG export terminals, aging President Joe Biden and his advisers have stumbled on a way to upset both ends of the political spectrum. Domestic energy businesses want to export more, cheap US natural gas to foreign buyers. Following Russia’s invasion of Ukraine two years ago the US pledged to replace the natural gas no longer flowing through Nordstream to western Europe.

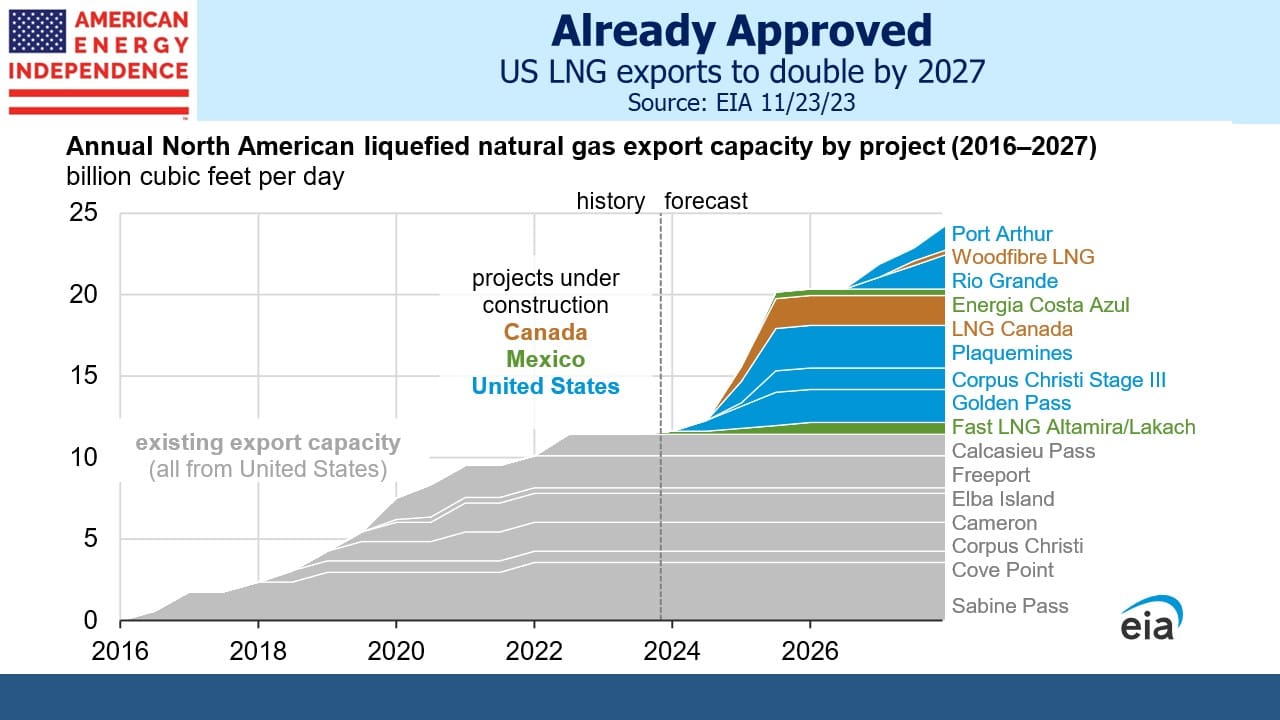

Many new LNG export terminals are at various stages of development. Planning and construction take several years. Now that the Department of Energy has been directed to examine the climate impact of each new facility awaiting approval, that will impose additional delays even assuming they’re approved. Venture Global’s Calcasieu Pass 2, or CP2, is the immediate casualty. This $10BN project is slated to export over 2.5 Billion Cubic Feet per Day (BCF/D), raising exports by 20%.

But enough projects have already been approved and begun construction that we’re still on track for a doubling of US LNG exports to around 24 BCF/D by 2027.

The White House has turned to Alex Haraus, a 25-year-old Colorado social media influencer, in an effort to excite young people enough to re-elect a doddering octogenarian. Like too many climate extremists, Haraus combines well-intentioned enthusiasm with poor recommendations.

His social media profile caught the attention of White House adviser John Podesta, and a Zoom meeting followed, which evidently impacted the new policy. Haraus and his TikTok followers believe that building LNG terminals assures long term trade in natural gas. Haraus presumably believes the world needs to run on solar and wind.

It’s a shame that youthful enthusiasm to curb Greenhouse Gas emissions (GHGs) isn’t directed towards practical solutions. LNG buyers are largely Asian. The International Energy Agency reports that China, India and other south-east Asian countries consume 75% of the world’s coal. They noted that last year’s 5% demand growth in China was driven by increased electricity consumption. This is partly because of the growth in EVs, often lauded by policymakers as evidence of China’s commitment to reduce GHGs. Yes, China’s EVs run on coal.

Coal-to-gas switching is how GHGs have fallen in the US and is our best chance to achieve similar success in emerging Asia. Haraus and his band of idealistic young supporters are pushing policies whose results won’t match their aspirations.

To cite just one example, Pakistan last year decided to quadruple coal-based power generation because of high LNG prices. Perhaps shocking to the Haraus TikTok crowd, Pakistan did not immediately turn to solar and wind.

Coal is cheap and easy to use. Its consumption keeps hitting new records as emerging economies consume more energy.

China and Russia are planning the Power of Siberia 2 gas pipeline to redirect supplies no longer going to Europe. Slow negotiations over the final terms have delayed construction, but it will eventually be built. This will reduce China’s need for coal, and thereby its GHGs.

Emerging economies would like to use more natural gas. We should encourage them.

So far the White House has upset energy companies around the world who are planning for more US LNG exports. Foreign business groups have expressed concern over America’s inconsistent posture on providing energy security. Japan’s government said they’re worried about the possibility of delays at facilities that haven’t yet gained approval. The White House has implemented a policy that will set back climate ambitions in the hopes of gaining youthful, idealistic votes in November.

Wall Street analysts regard it as a temporary delay that will be reversed after the election. That’s why there’s been little impact on stocks that might otherwise be affected. Cash flows from Energy Transfer’s proposed Lake Charles terminal were not reflected in the stock price. JPMorgan thinks further delays would reduce near term capex, a positive.

Similarly, delays to Cheniere’s planned addition of Trains 8 and 9 at their Corpus Christi Midscale facility could also boost near term free cash flow. Both Wells Fargo and Morgan Stanley expect the moratorium on new approvals to be lifted after the election regardless of who wins. Trump has already said he’d do so immediately.

This means that Alex Haraus and his idealistic TikTok followers are being played. Investors are betting that Biden will reverse himself if he wins the election. So by December the moratorium on LNG approvals will have upset just about everyone possible, from the energy sector and its customers to the climate extremists whose election support was rented. And it won’t have helped reduce GHGs, because of the widespread reliance on coal among Asian LNG importing countries.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Biden is too old and Haraus is too young for their jobs.

Major news outlets have declared Biden’s LNG decision to be a “victory” for climate activists. The stupidity is truly breathtaking.