Bond Rally Helped Equity Valuations

/

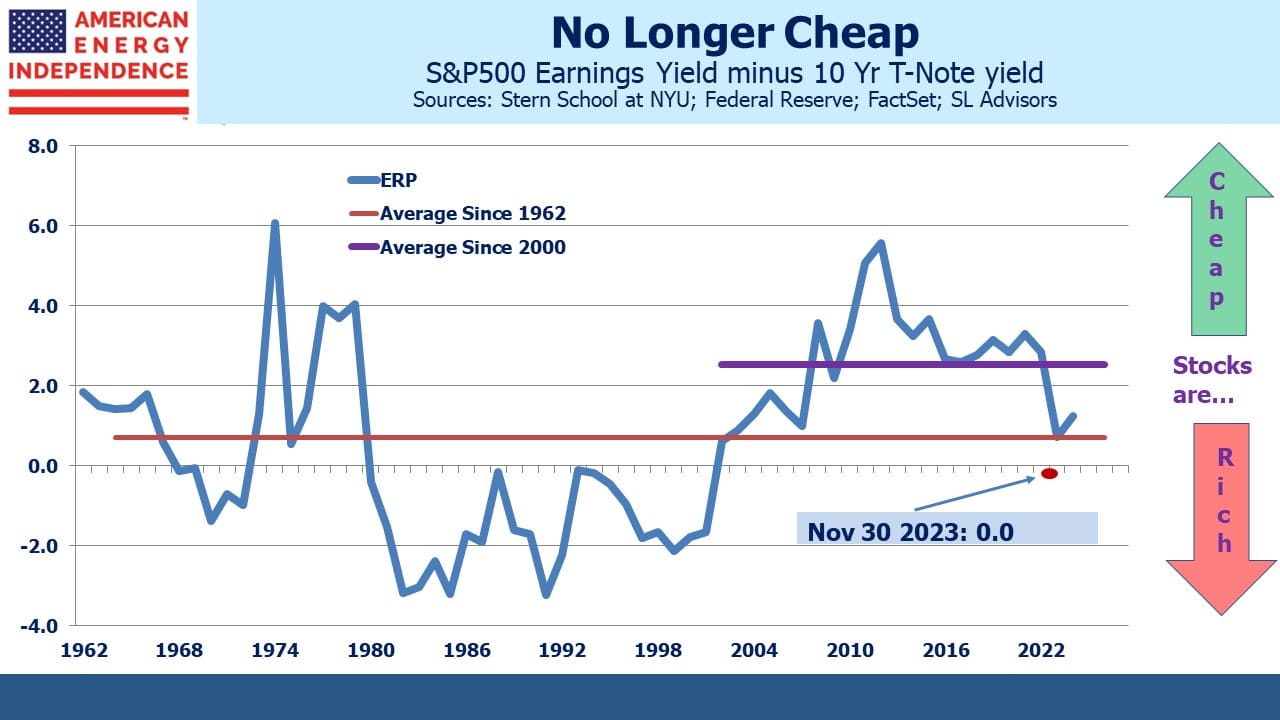

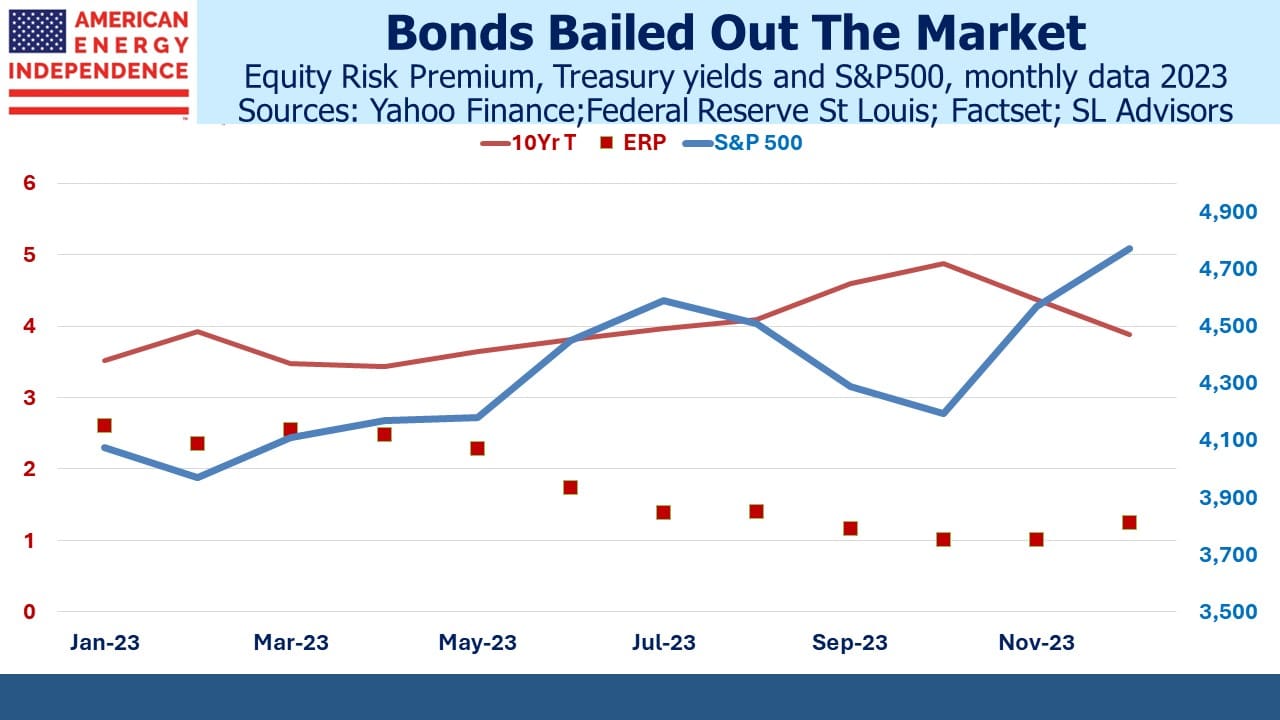

It can fairly be said that the bond market boosted stocks in the last couple of months of the year. Equities have lost their cheapness in recent years, ever since the Fed belatedly became concerned about inflation. TINA became unfashionable as interest rates returned to unfamiliar, reasonable levels.

Compared with bonds, stocks are as expensive as they’ve been for at least two decades. October was the worst point of the year for relative valuation. The Equity Risk Premium (ERP), defined here as the yield spread between S&P500 earnings and the ten year treasury, touched 1.0 as long term rates briefly reached 5%. The subsequent bond rally was helped in December by the FOMC’s Summary of Economic Projections (SEP) indicating rate cuts in 2024. The fall move in bond yields was so strong that the relative pricing of stocks still isn’t as poor as it was two months ago, even after an almost 16% rise in the S&P500.

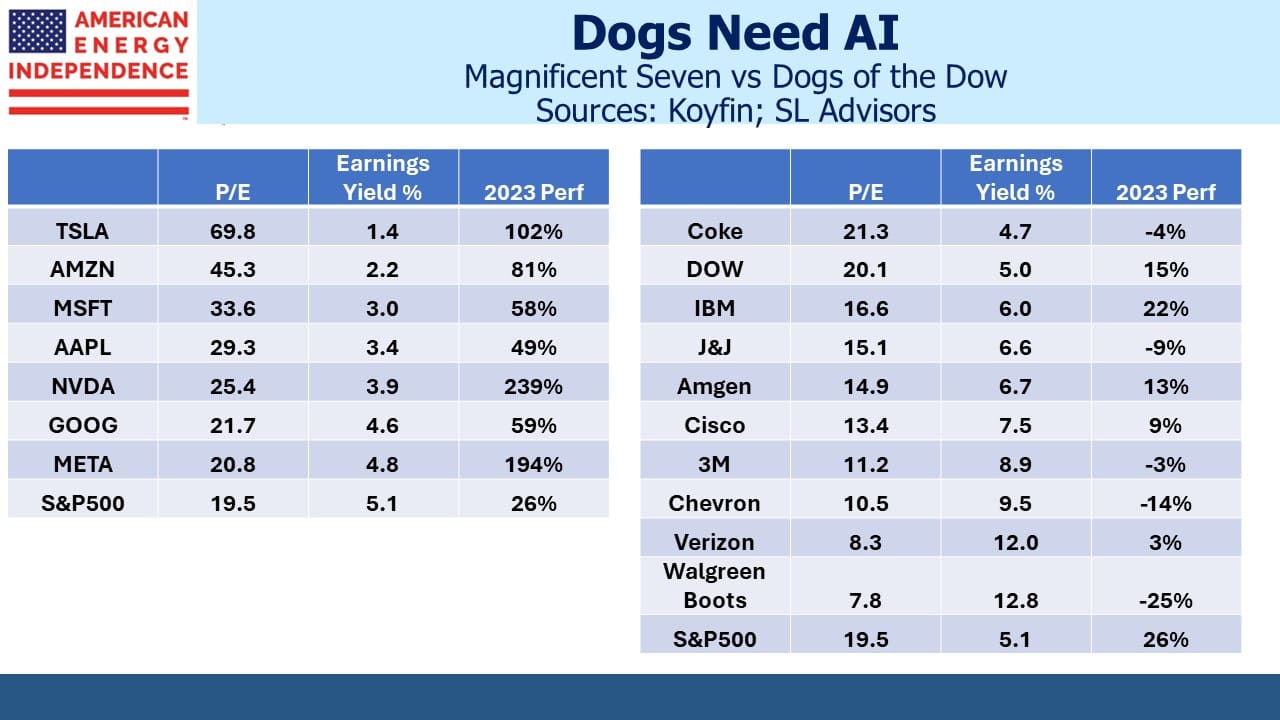

The problem with considering the market’s ERP is that performance has been dominated by the “Magnificent Seven”*. Five of them sport an earnings yield nowhere close to the market. Tesla in particular looks ruinously priced. This blog maintains a spirited dialogue with fervently happy Tesla owners (watch EVs are NOT cheap) whenever we fail to embrace the charms of waiting 20-30 minutes to recharge.

Uber leases Teslas to some of their drivers, and I’ve only heard one complain about having to stop at a charging station in the middle of each workday. Elon Musk has built a devoted following, and a short trip to penury awaits those who short Tesla. The last short squeeze ended in 2020 when Tesla finally took pity on the shorts, providing more supply with a secondary offering following a tripling in price. It spent most of last year near the top of most shorted names. Bernstein is recommending a short sale. but I think Tesla’s best avoided from both sides.

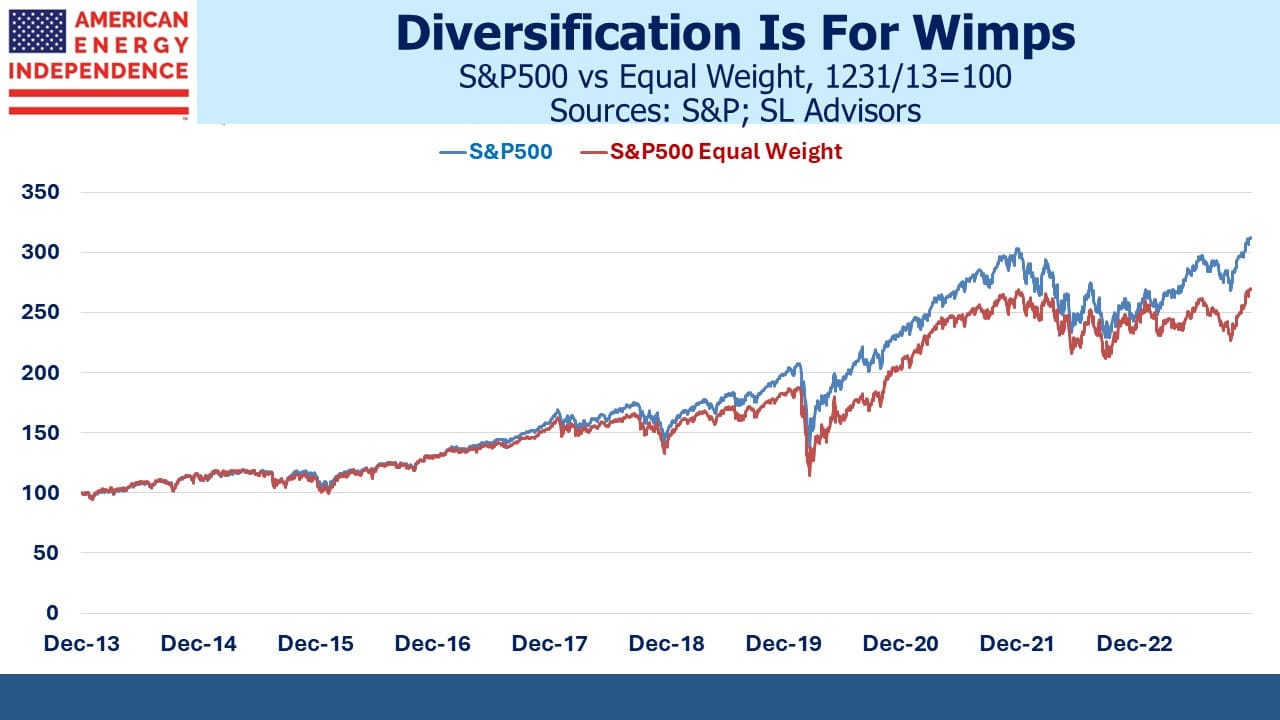

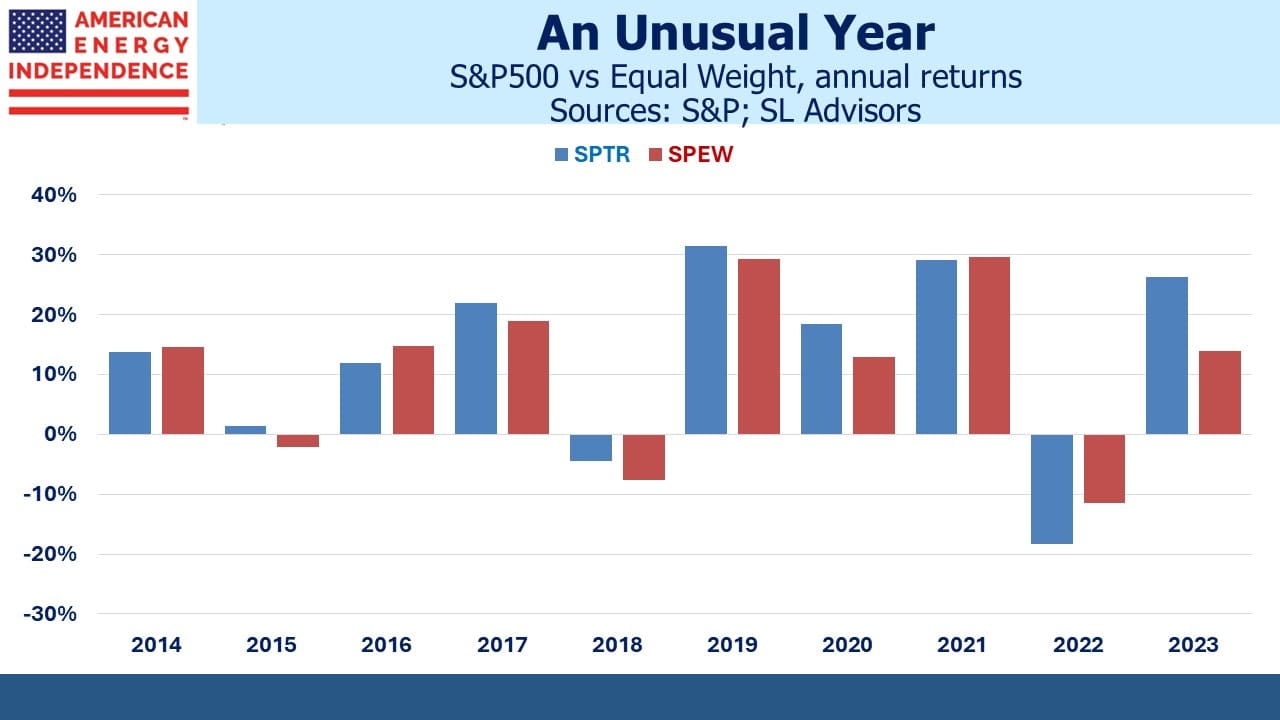

The domination by the Magnificent Seven is evident in the contrasting results of the S&P500 with its equal weight cousin. From 2013-2022, the annual returns of the market cap weighted version beat equal weight by an average of 0.7%. Last year was 12.4%. It was less about stock picking than how much AI you had in your portfolio.

The “Dogs of the Dow”, popularly defined at the ten stocks in the DJIA with the highest dividend yield, all lagged the S&P500 last year. Historically, their purchase has rewarded investors over the following year.

It does seem to be a moment of extreme valuations. Without the Magnificent Seven, the ERP would be closer to its long term average.

After examining the market from these various angles, 5.25% three month treasury bills seem pretty reasonable. The market is telling you the yield won’t last, but you never know. Jay Powell downplayed the inference from the December SEP that they’ll be cutting rates in the first half of this year. If you’re ambivalent on adding to equity exposure, even if rates fall this year and rolling over treasury bills averages, say, 4.5%, that hardly looks like a disaster.

Energy infrastructure continues to offer compelling cash returns. Enbridge (ENB) yields 7.6% and has increased its payout for 29 straight years. It still looks a compelling pairs trade versus a short SPY (noted in Fiscal Policy Moves Center Stage in early October). And January should see seasonal buying pressure in MLPs (see The MLP Yuletide Spirit). AMLP is the simplest way to play that – although this deeply flawed ETF is regularly criticized on this blog, it does have its uses as a short-term trading vehicle.

On December 26, also known as Boxing Day to Brits (email me if you want to know more), the Vogtle nuclear power plant in Georgia finally began commercial operations. It’s the first new nuclear reactor in the US since the Tennessee Valley Authority’s Watts Bar 2 was commissioned in 2016. France relies heavily on nuclear for power, and China is leading the world in new construction, as for many things. Spain confirmed they’re phasing out nuclear power by 2035.

It’s not credible to be concerned about global warming but also be anti-nuclear, the world’s safest form of power generation. If your only solution is to run everything on weather-dependent solar and wind, you’re promoting an enormous leap backwards for humanity rather than trying to solve the problem.

*Amazon, Apple, Google, Meta, Microsoft, Nvidia and Tesla

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!