Year-End Roundup

/

Heading into year’s end, a number of interesting stories caught my attention. Energy Transfer (ET) rarely avoids conflict and is embroiled in a dispute with three pipeline developers in Louisiana who sought crossings over Gulf Run Pipeline, owned by ET. Momentum Midstream, one of the developers with a $1.6BN project, accused ET of unfair trade practices. ET has also sought temporary restraining orders against Williams Companies and DT Midstream.

Pipelines routinely have to cross over or under each other as they crisscross the country. Momentum argues that without competition, ET could control up to 80% of the pipeline capacity supplying LNG exports in Louisiana. ET argued that the crossings sought were numerous, threatened pipeline safety and disregard ET’s exclusive ownership over certain stretches of land.

A court ruling is awaited. ET’s well-earned bare-knuckle approach to business hasn’t hurt the stock, +27% this year.

Morgan Stanley continues to report attention around the Alerian MLP Infrastructure Index (AMZI), which AMLP tracks (albeit not very well). The shrinking pool of MLPs is causing AMZI to be more concentrated and even to move beyond midstream infrastructure by incorporating USA Compression Partners, LP. At their recent rebalancing, AMZI publisher Vettafi retained the 12% position cap. Morgan Stanley continues to warn that AMZI might eventually relax its 12% cap or, more radically, AMLP might adopt a RIC-compliant index which would limit its MLP holdings to 25% (versus 100% now).

Such changes could create turmoil in MLP names. But Vettafi could also do nothing, reasoning that if investors didn’t like the fund’s current structure they wouldn’t own it.

Kinder Morgan’s (KMI) prescient sale of the TransMountain (TMX) pipeline project to Canada’s federal government in 2018 (see Canada’s Failing Energy Strategy) looks better every month. Facing unexpectedly hard rock, TMX recently asked the regulator for permission to drill a smaller-diameter pipe through a 1.4 mile section. The regulator turned them down, causing TMX to warn of a further two year delay if they are forced to proceed with the wider diameter. Canadian Natural, the country’s biggest oil producer, has urged the regulator to give its approval. Meanwhile the Trudeau administration approved another C$2BN in loan guarantees for a project quickly exceeding triple the cost anticipated when KMI made its well-timed exit.

A drought in Panama has impeded ship traffic through the canal in recent weeks. This is because the locks rely on supplies of inland fresh water to operate. As a result, Chile and some Asian buyers have reduced their imports of US gasoline from the gulf coast, depressing prices. The alternative route around the tip of South America is more costly and slower. Interestingly though, an LNG executive recently told us that Panama sets the canal tarrif close to the break-even point for ships considering the alternative. For US LNG exports to Asia, this suggests that the long route takes longer but doesn’t cost that much more.

In Oklahoma, fans of David Grann’s Killers of the Flower Moon will have been fascinated to see the Osage Nation win a victory against a wind farm built by Italian energy company Enel. A decade-long legal fight was settled when U.S. Court of International Trade Judge Jennifer Choe-Groves ruled eighty wind turbines had been illegally built. They have to be removed. You can find a more complete telling of this unusual tale here.

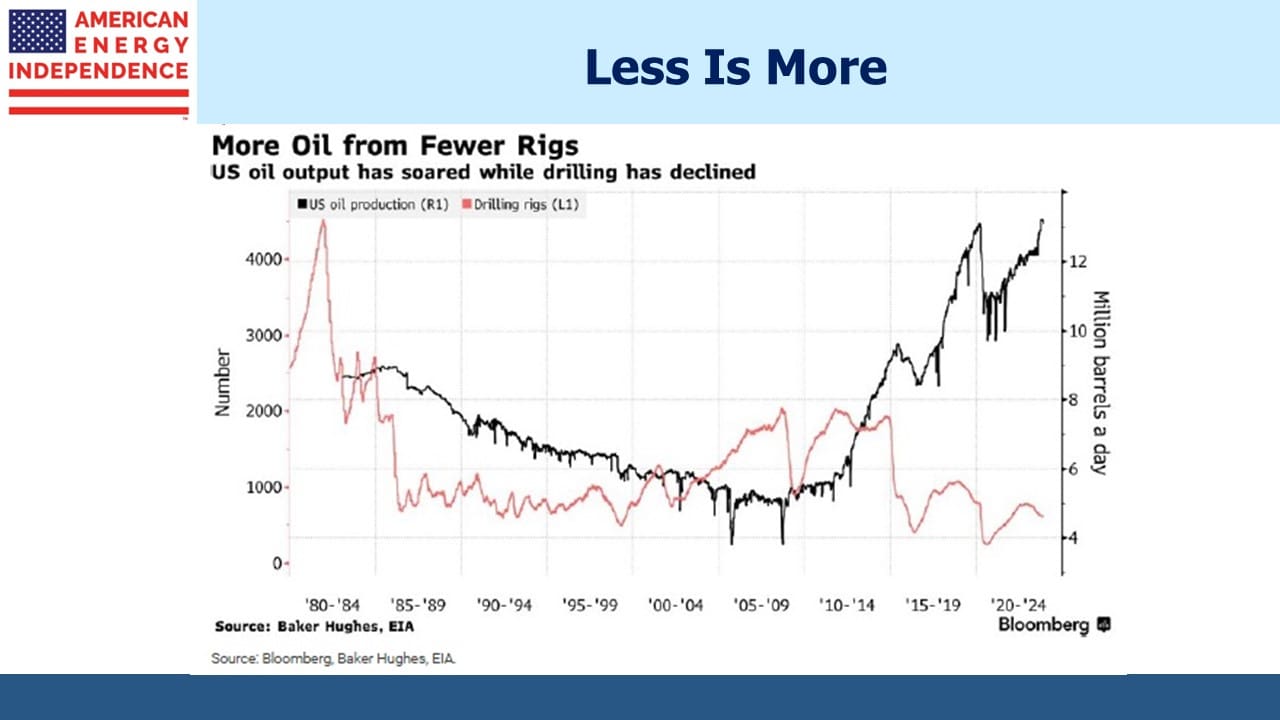

We know oil production has become more efficient over the years, but this chart of rigs versus production back to 1980 is a compelling visual. Few forecasters saw US oil production reaching a new high this year. But it did.

Finally, the slowdown in US EV sales continues to draw unwelcome news coverage. They’re still growing, but at a declining rate. EVs are also taking dealers about three weeks longer to sell than conventional cars. Sales tend to be concentrated in blue counties and states. Across the US EVs have an 8% market share, but in California it’s 24%. In Michigan it’s 3%.

The Administration wants to require that EVs represent 2/3rds of all automobile sales by 2032. Canada is planning to require all auto sales be zero emission by 2035.

The EPA estimates that the typical passenger car emits about 4.6 Metric Tonnes (MT) of CO2 per year. The Inflation Reduction Act values CO2 pulled out of the ambient air and permanently buried via Direct Air Capture (DAC) at up to $180 per MT in tax credits. This is enough to have encouraged Occidental to build the world’s biggest DAC plant and CEO Vicki Hollub is bullish on the technology.

It looks as if public policy is to force EV adoption by making conventional cars scarce. But if you’d prefer to own just one car, not two like most EV owners I know (a regular one for long journeys), a carbon tax based on 2X the DAC credit would impose a $1,656 annual cost on the owner of a gas-powered car. Some would willingly pay that for the convenience of easy refuelling and assurance that inadequate charging infrastructure wouldn’t force them to have their EV transported back home on a truck.

I would be one of those people willing to pay the $1,656 annually. It’s why a carbon tax would be better than the current method of subsidies, tax credits and regulation. It gives people a choice.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

A reasonable perception would include USAC’s operations and assets in midstream infrastructure.