Spinning Off Value

A couple of weeks ago South Bow Corporation (SOBO) began trading on Nasdaq. It’s a spin-off from TC Energy (TRP) which decided to split its liquids business off from its core natural gas pipeline activities. SOBO operates the Keystone pipeline that moves crude oil from Hardisty in Alberta south via Cushing, OK to Houston and Port Arthur, TX. They spent years trying to add the Keystone XL before incoming President Biden withdrew the permit, upon which TRP gave up. TRP’s $15BN lawsuit was dismissed in July by a tribunal.

TRP runs natural gas pipelines and storage facilities in Canada, the US and Mexico, along with solar and wind power assets.

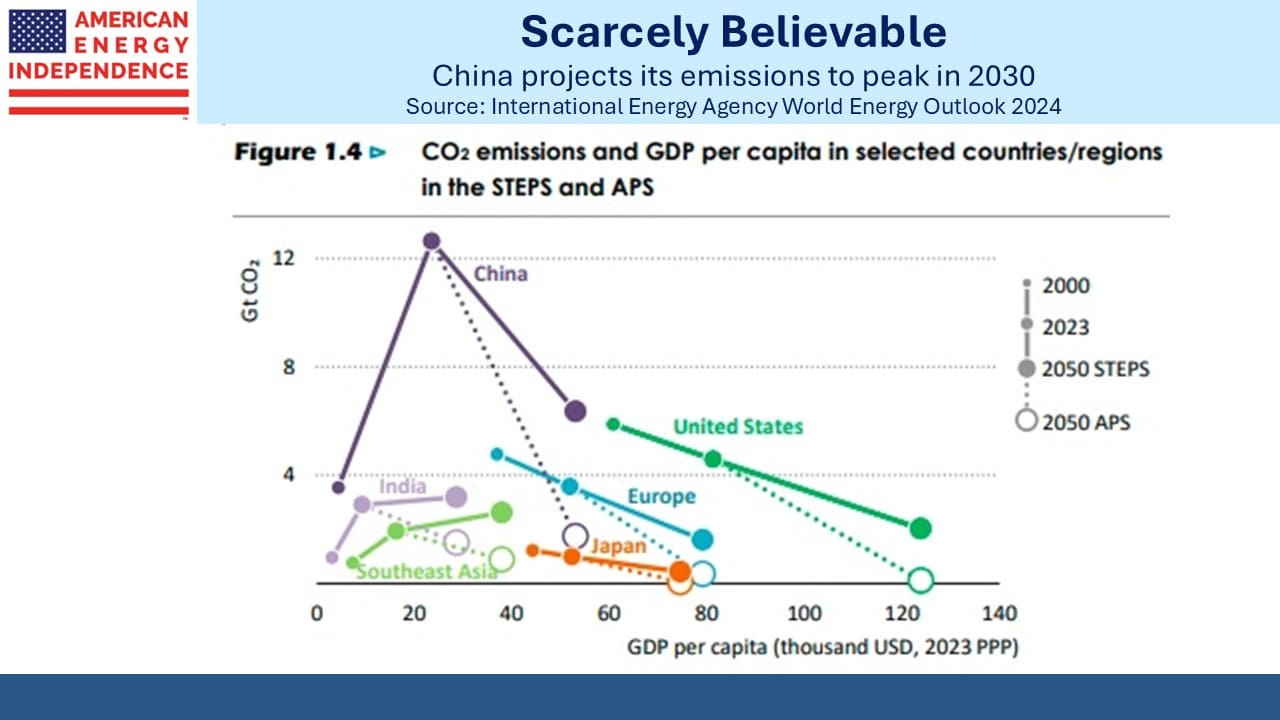

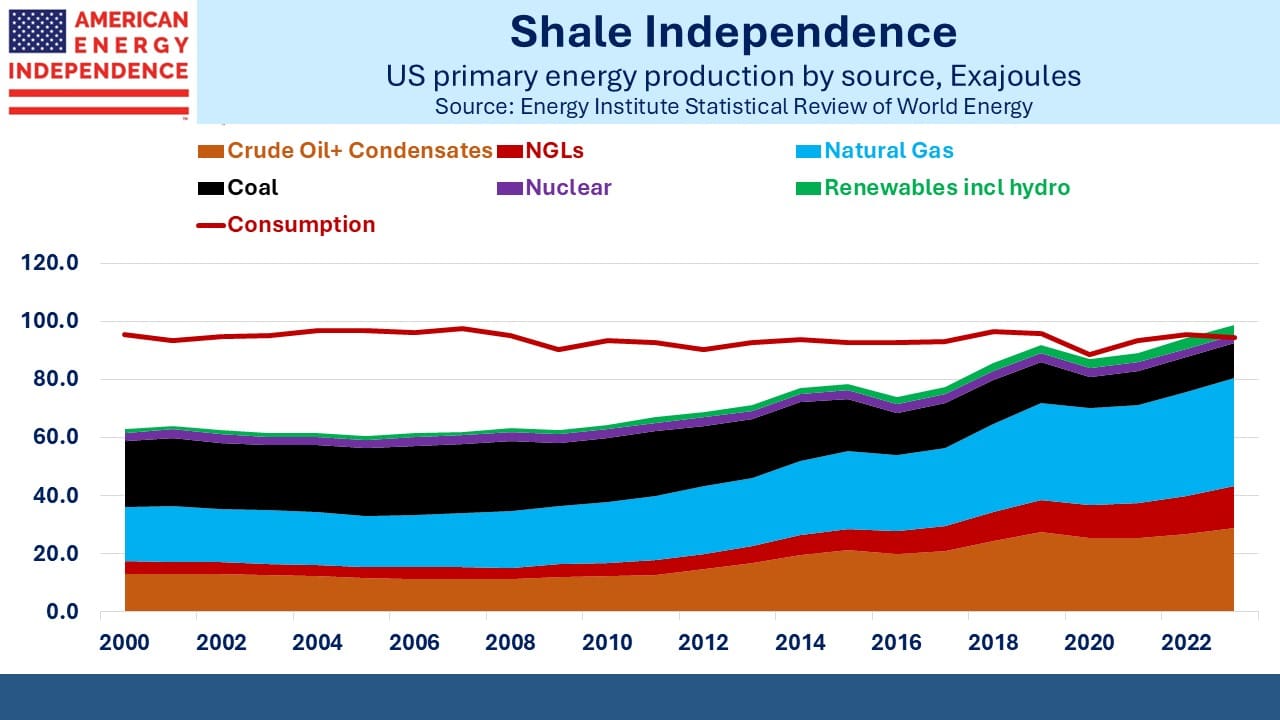

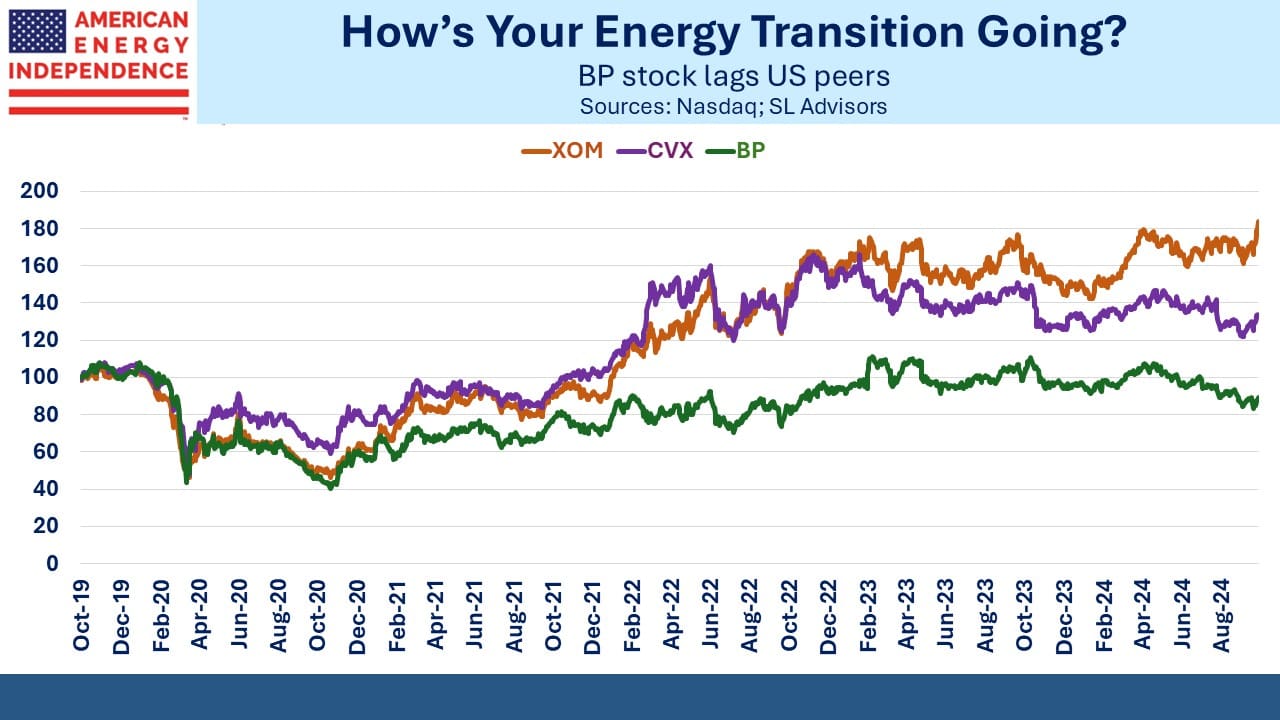

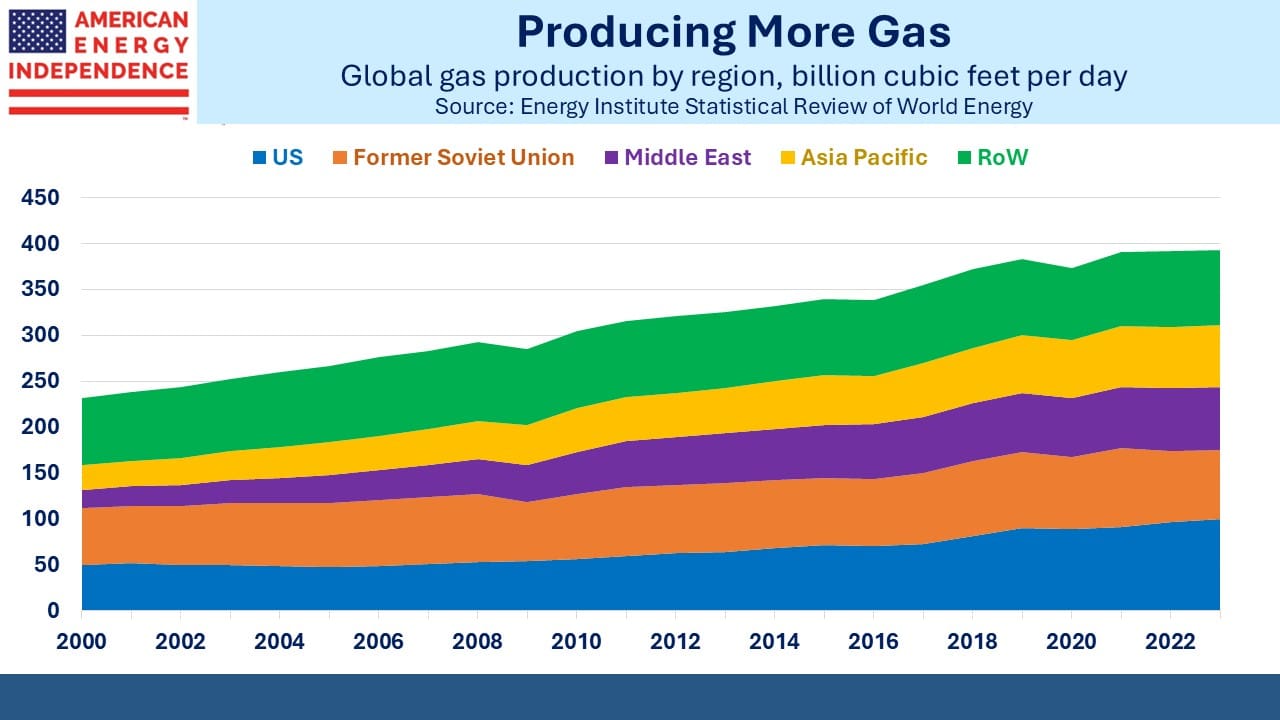

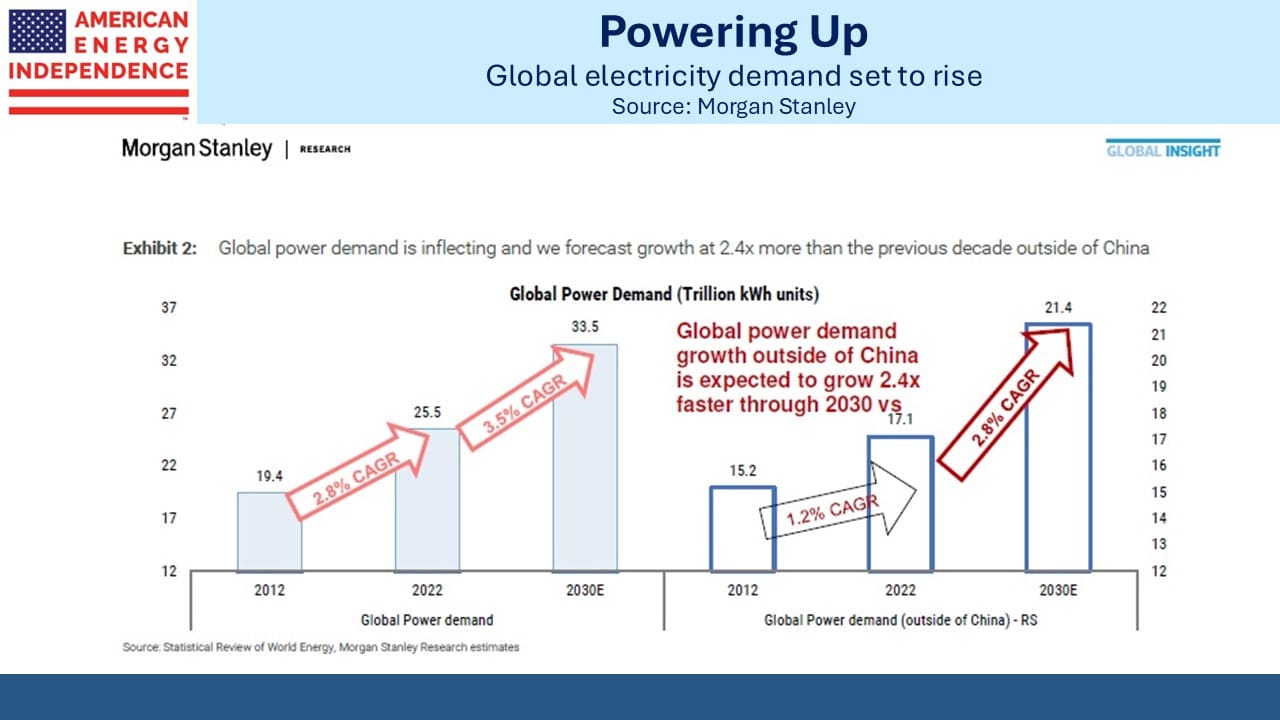

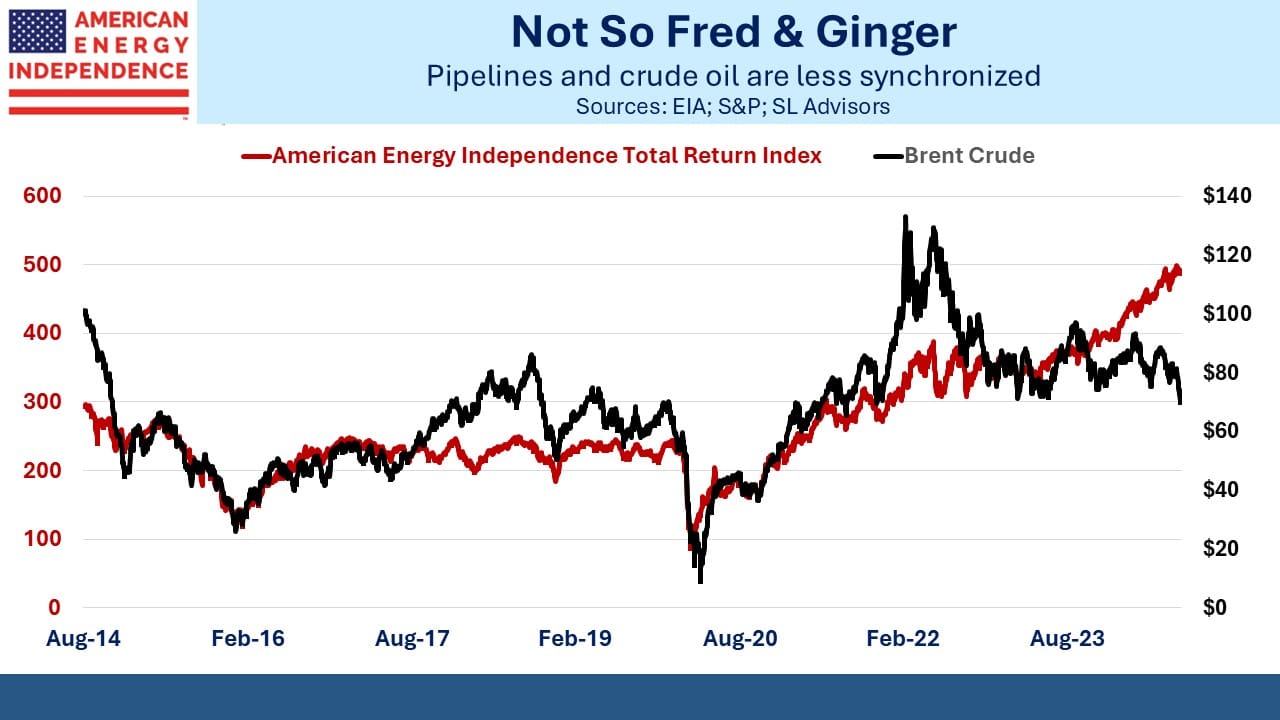

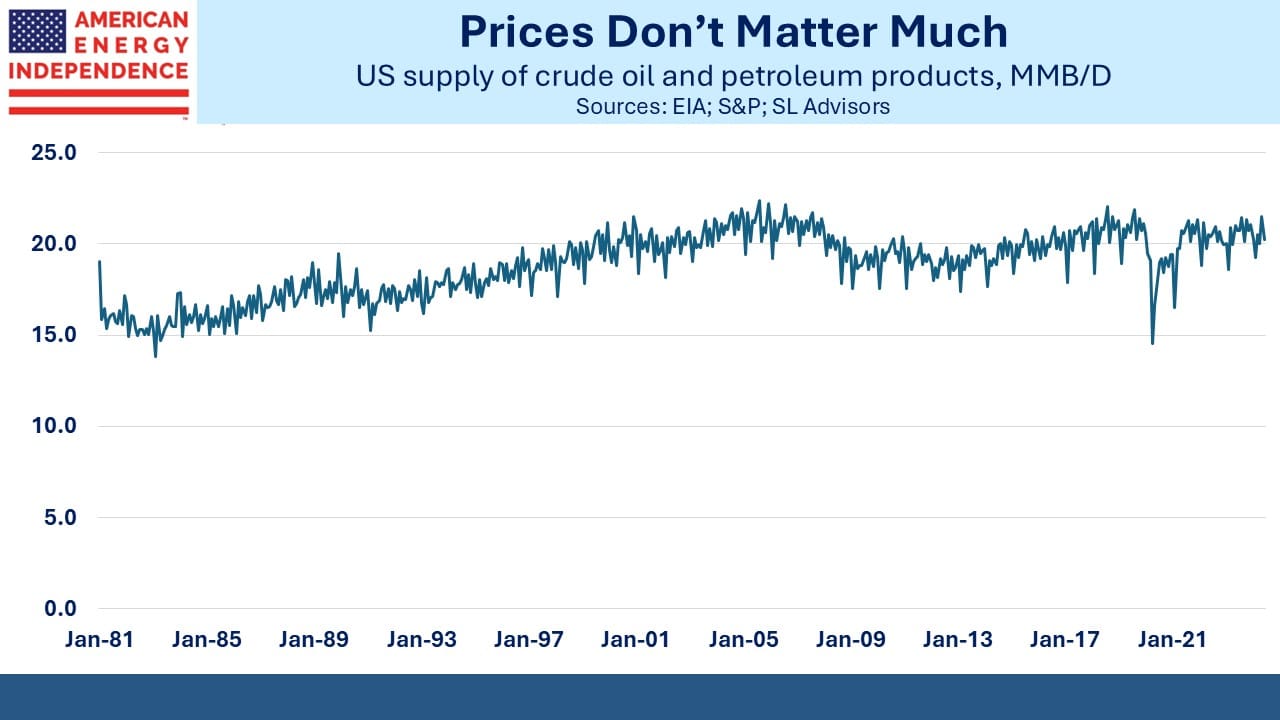

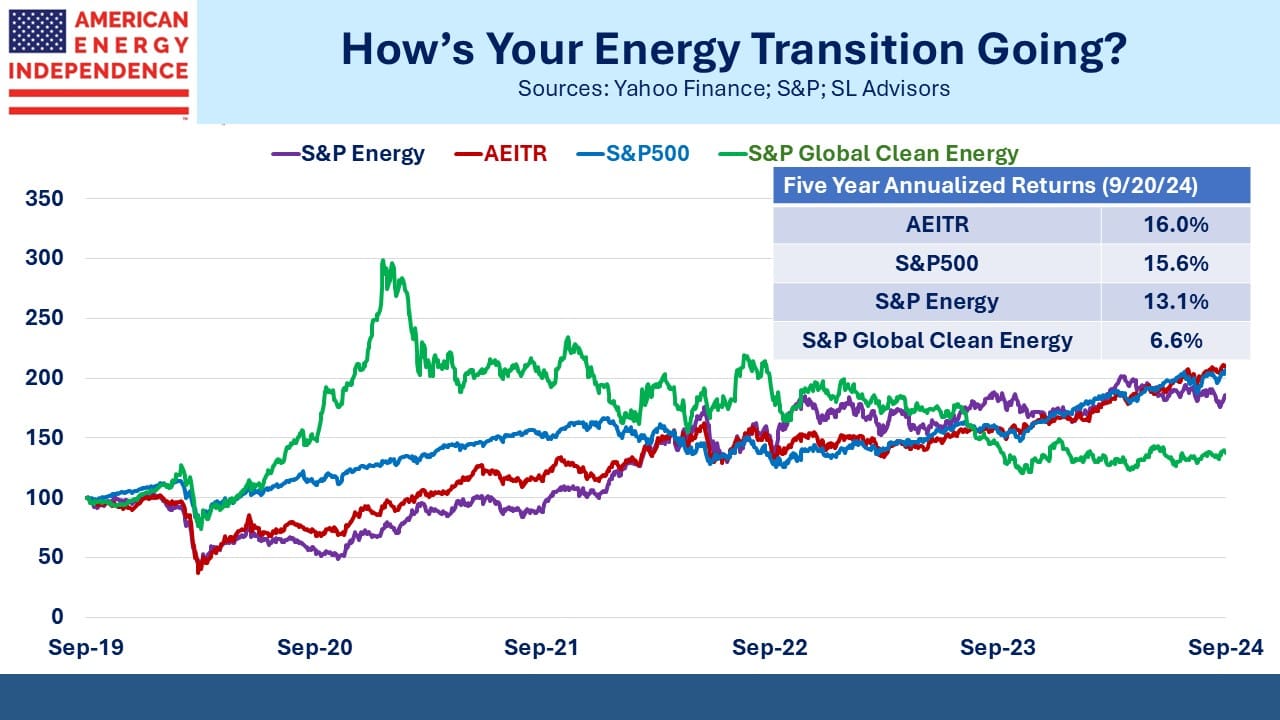

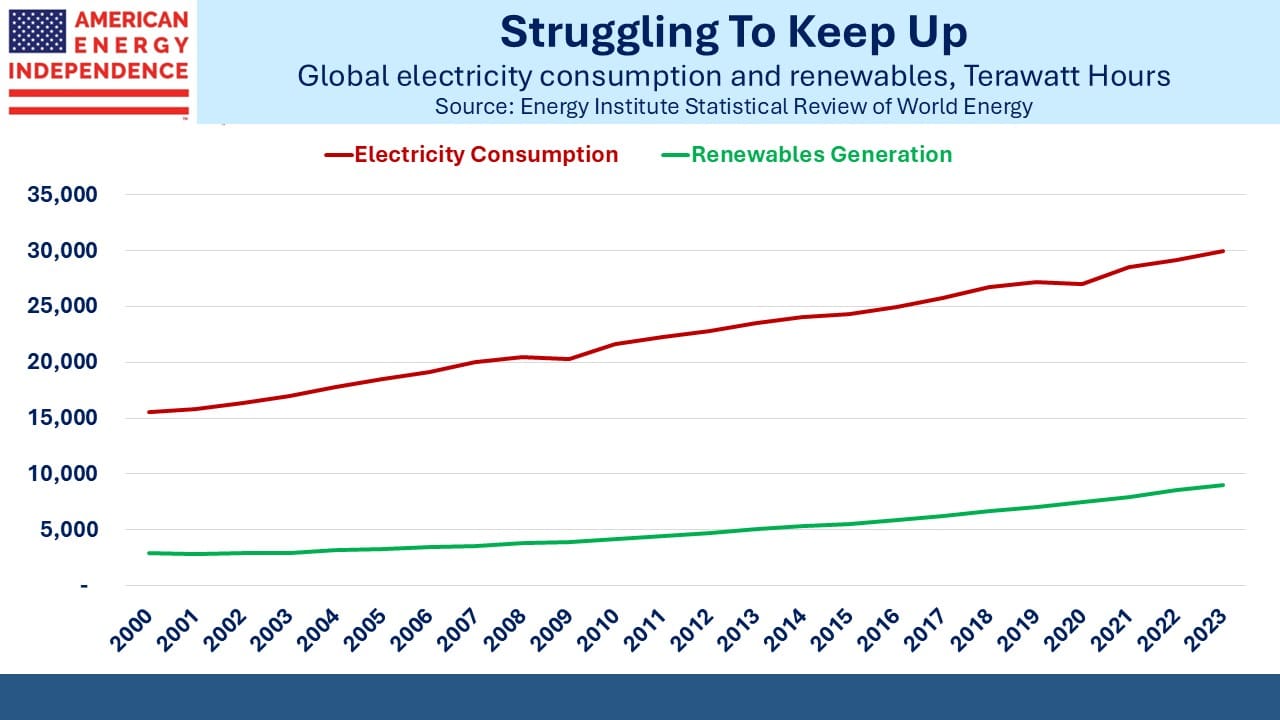

The logic of the spinout was that although liquids represented around a tenth of TRP’s value, this was holding down the company’s stock price. Long term oil forecasts routinely contemplate peak oil demand on rising EV penetration. Natural gas forecasts tend to envisage continued growth as economies electrify. Data center demand has added to the positive gas outlook.

It helped that SOBO was launched with a dividend of its own while TRP’s remained unchanged. This meant the combined entities are paying out an additional $400MM annually to TRP investors who retained their new SOBO shares. Some sold, in spite of the new stock’s initial 9.2% dividend yield, which fell to 8% as it rallied.

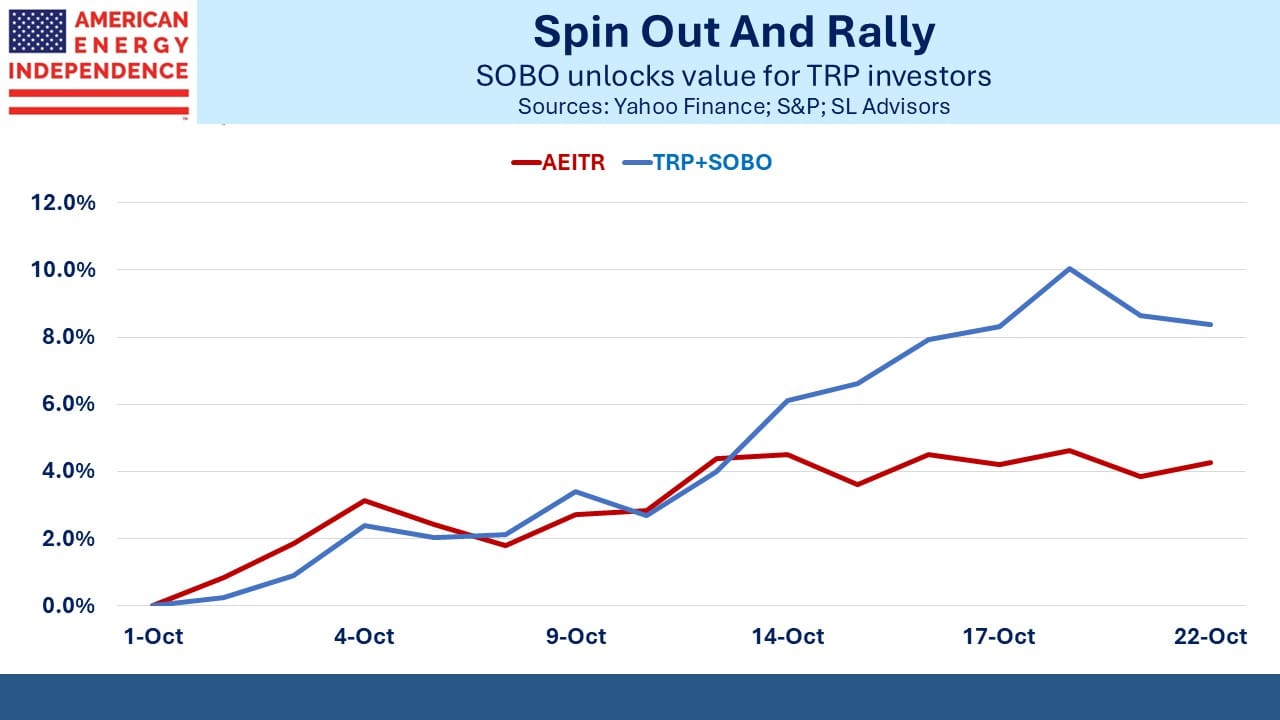

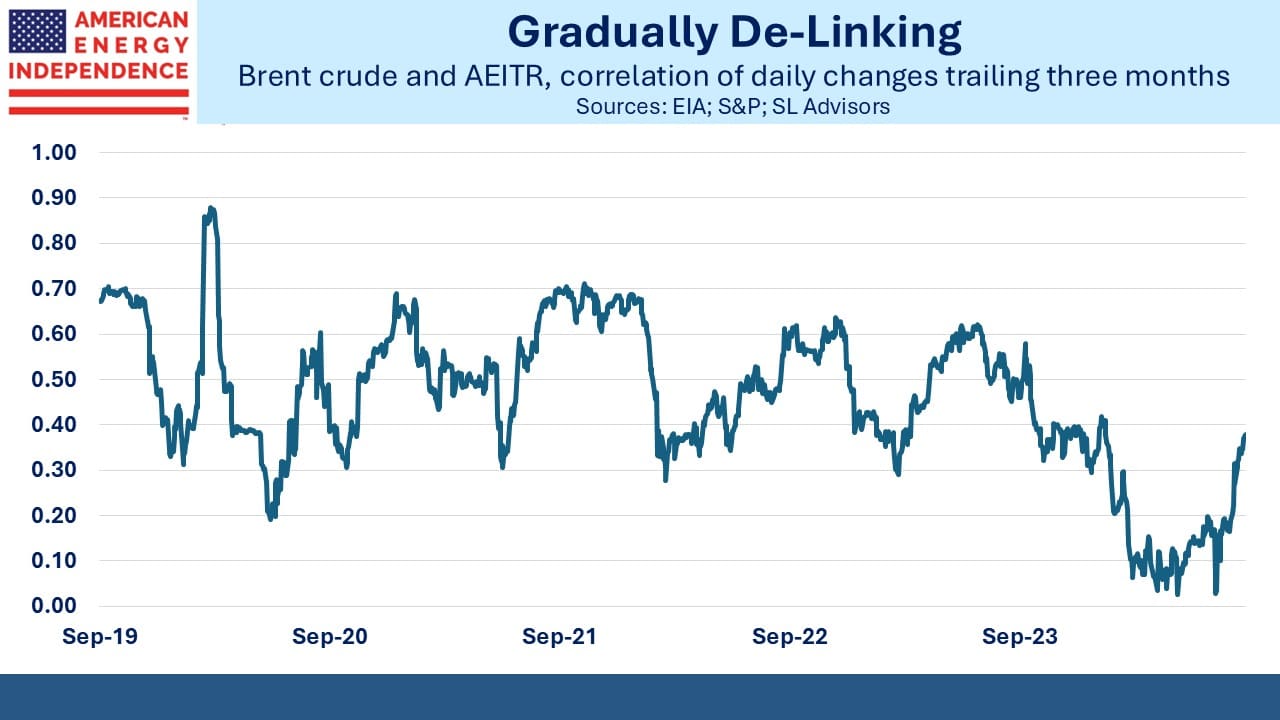

Since the SOBO business was spun out, the combined entity has rallied by over 8%, 4% more than the sector as defined by the American Energy Independence Index. The increase in TRP+SOBO market cap in excess of the AEIT’s rally is $2BN, the amount of value unlocked by the spin-out.

The 9.2% dividend yield at which SOBO began trading reflected the antipathy some TRP investors felt towards the liquids business. They owned TRP for the gas pipelines and were happy to dump their exposure to oil with its headwinds from transportation policy and EVs.

Other investors who had previously avoided TRP because of its liquids business found the now pure-play natural gas opportunity appealing.

It shows that the oil business was dragging down TRP’s overall value. Separating the liquids business allowed investors to self-segregate more precisely, reflecting their biases. Whatever synergies existed between oil and gas pipelines clearly weren’t that valuable.

For years Kinder Morgan (KMI) has operated an Enhanced Oil Recovery (EOR) unit with unclear benefits to the rest of its mainly natural gas pipeline business. EOR works by pumping CO2 into mature wells to raise the pressure and release more oil. We’ve long called for them to spin it out (see Kinder Morgan’s Slick Numeracy from 2020) because the unit adds oil price exposure into what is otherwise mostly a volume business.

The Inflation Reduction Act boosted the appeal of CO2 pipelines that could support Carbon Capture and Sequestration (CCS). Tax credits run as high as $185 per metric tonne for CCS that draws CO2 out of the air around us.

KMI operates one of the longest CO2 pipeline networks in the US. CCS in support of EOR also draws tax credits but the segment has shrunk to 8% of KMI’s business from 17% a decade ago. Its continued presence in KMI’s portfolio of business makes little sense. They are principally a natural gas and refined products pipeline company. The EOR business comes with commodity price volatility since lower crude decreases demand for EOR services.

When different business lines receive varying market valuations and offer limited synergies under the same corporate ownership, it can make sense to separate them to attract pure-play investors.

KMI’s earnings last week were slightly below expectations, with most segments including EOR lagging forecasts. Natural gas pipelines was the exception, beating expectations. Added capacity to the Gulf Coast Express gas pipeline should come online in 2026, alleviating the oversupply of natural gas in west Texas relative to its transportation options. The company sees up to 25 Billion Cubic Feet per Day of growth opportunities over the next five years to support growing domestic manufacturing and Mexican gas exports.

Perhaps after seeing the success of TRP’s spin-off they’ll consider something similar. Over the years KMI has delivered among the lowest returns on invested capital according to research by Wells Fargo. An EOR spin-out might unlock some value for shareholders.

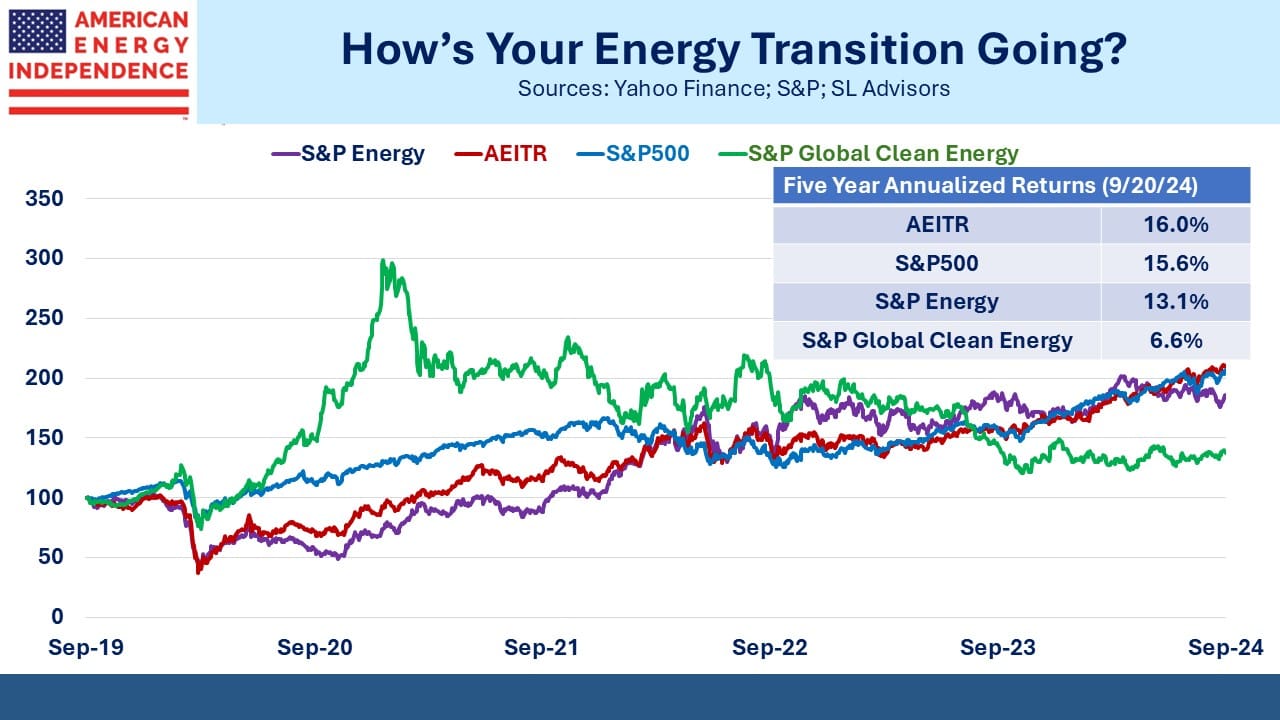

A couple of years ago we showed that the ARK Innovation ETF (ARKK) run by Cathie Wood had destroyed investor capital due to unfortunate timing by many of its investors (see ARKK’s Investors Have In Aggregate Lost Money). A recent article added Chinese ETFs to this ignominious crowd.

They would have done better with pipelines.

My travels continued in New Orleans where I had good discussions about prospects in the energy sector with current and future investors.

Finally, The Economist ran a terrific section on the US economy titled The Envy of the World. If you have any doubts about why this country provides a high standard of living for more people than anywhere else, read this unashamedly upbeat analysis of what makes this great country great, from a UK-based publication with a global view. The average person in our poorest state, Mississippi, makes more than the average person in the UK, Germany or Canada.

The Economist’s positivity is intoxicating.

We have two have funds that seek to profit from this environment:

Energy Mutual Fund Energy ETF