Sierra Club Shoots Itself In The Foot

/

Once again a liberal activist judge has succumbed to a far-left climate extremist group. On Tuesday DC Circuit Chief Judge Srinivasan, along with Circuit Judges Childs and Garcia sent parts of a previously granted permit from the Federal Energy Regulatory Commission (FERC) back for review.

NextDecade’s (NEXT) Rio Grande LNG export terminal was one of the victims, although FERC was the respondent in the case. Today, obtaining any number of permits from a regulator is only the beginning of the approval process. Those permits then have to withstand legal challenges from judicial terrorists whose objective is to block infrastructure projects by increasing their cost and uncertainty of completion.

We’re invested in NextDecade because we believe providing cheap US natural gas to developing countries around the world, allowing them to grow their energy consumption with less reliance on coal, will continue to be profitable. The Sierra Club and their weird partners wrongly believe that India and other Asian countries will use more solar and wind if they can’t buy US Liquefied Natural Gas (LNG). This is not supported by the facts.

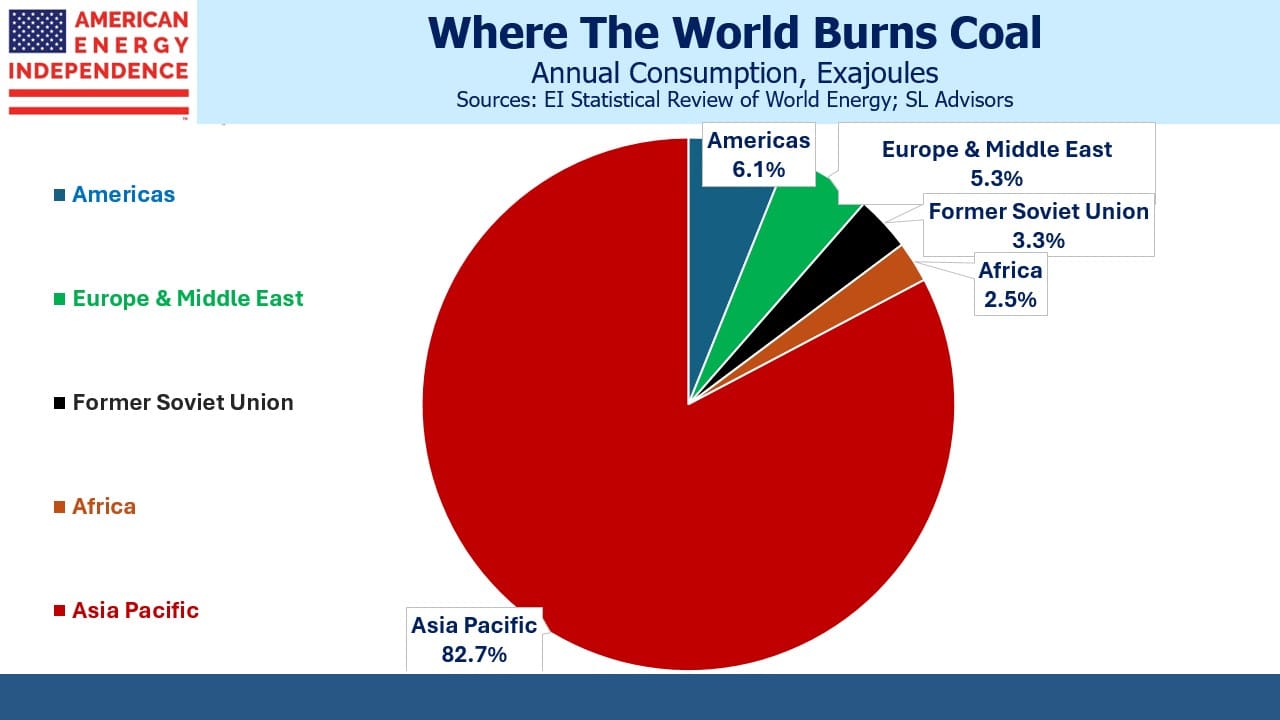

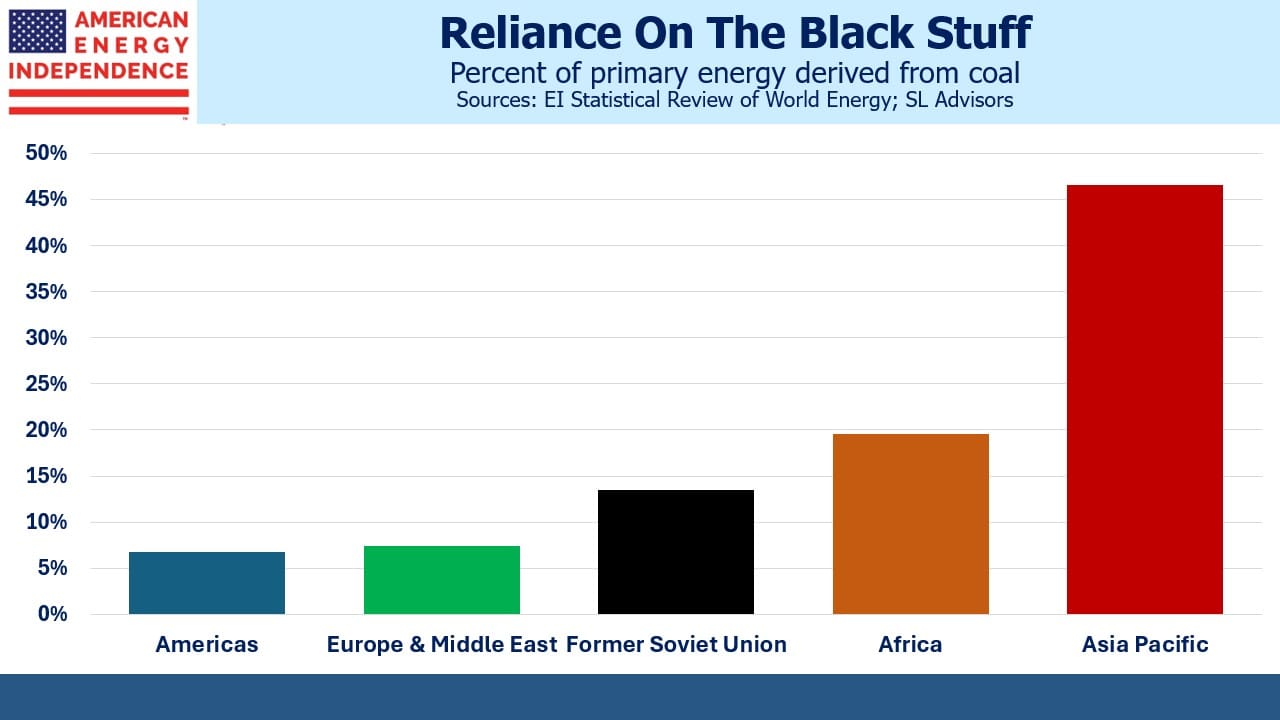

Coal is the single biggest source of primary energy for the Asia Pacific region. 83% of the world’s coal is consumed there, of which China is 56%. It provides 47% of that region’s primary energy and 54% of China’s. Coal generates on average 2X the greenhouse gas emissions as natural gas per unit of power generation and also generates harmful local pollution.

If you care about climate change, you want to reduce global coal consumption.

The Sierra Club is not pursuing policies to reduce emissions. As well as opposing natural gas to displace coal they are against nuclear. They’re obstructive to the real work and are nothing more than a bunch of virtue signaling loony leftists. They are weird.

It’s unclear how this will play out. On the same day as the court ruling which affects Trains 1-3, NEXT filed an 8-K with the SEC disclosing an agreement with Bechtel to build Train 4. The company hasn’t yet responded to the court ruling other than to say construction continues on the first phase.

NEXT has some big customers lined up to buy its LNG, including Shell and Exxon Mobil. TotalEnergies is a strategic partner, with a stake in NEXT and an agreement to buy its LNG. The ruling requires FERC to issue a revised Environmental Impact Statement (EIS), in part because the environmental justice rights of some nearby residents are at risk of being compromised. Specifically, the court found that they, “…may experience significant visual impacts, as well as significant cumulative visual impacts.”

The Rio Grande LNG terminal is being built alongside the ship channel in Brownsville, TX, so it’s this view that will be impacted. I don’t know what else you’d expect to see along the Brownsville Ship Channel other than energy infrastructure. It seems to me like buying a house near an airport and then complaining about the noise.

There’s no indication from FERC how quickly they will respond to the ruling and how long a new EIS will take.

Large holders of NEXT include York Capital Management, Blackrock and even Marc Lasry (co-founder of Avenue Capital, a distressed debt firm). Lasry is a well-known Democrat party fundraiser and has often drawn criticism from the weirdos at the Sierra Club for his investments. It’s an example of how fringe they are.

On Friday Ukrainian troops captured a key gas transit point supplying Europe as part of their incursion into Russian territory. Ukraine released a video of their troops at Gazprom’s Sudzha gas measuring station. US LNG provided vital supplies to Europe following Russia’s invasion of Ukraine. They still rely somewhat on Russia, some of which passes through Sudzha. European energy officials will have been made acutely aware of how tenuous that remaining supply is. America can be a reliable source.

Between the LNG buyers and investors there are some deep pockets who want to see the Rio Grande project through. We think that’s the most likely outcome, although the election adds some uncertainty.

New energy projects are less likely, which raises the value of existing energy infrastructure. Democrats have unwittingly been good for energy investors by discouraging investment in new supply. A President Harris probably wouldn’t be a supporter of new LNG, although she might note that swing state Pennsylvania will likely provide its throughput.

Under Kamala Harris, pipeline companies would have even less reason to boost capex, which will in turn drive up free cashflow.

Alan Armstrong, Williams CEO, has commented that they see less competition than in the past for new business. Energy Transfer and Cheniere each raised full year EBITDA guidance again when they reported earnings last week. Sierra Club policies will further strengthen their dominant market positions.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!