Britain’s Energy Transition

/

I spent two weeks recently touring southern England with my wife. It’s 42 years since I moved to the US, and I appreciate my old country more now than as a teenager itching to escape to the new world. We did some sightseeing and saw old friends. As we traveled around, the British approach to the energy transition was never far from my mind.

Despite voting for Brexit, which was a populist, right wing decision, Britain is a politically liberal country like much of Europe. Reducing greenhouse gas emissions to limit global warming is not a contentious issue. The Conservatives, who were in power from 2010 until an ignominious electoral drubbing in July, passed a “Net Zero” law in 2019 mandating zero emissions by 2050.

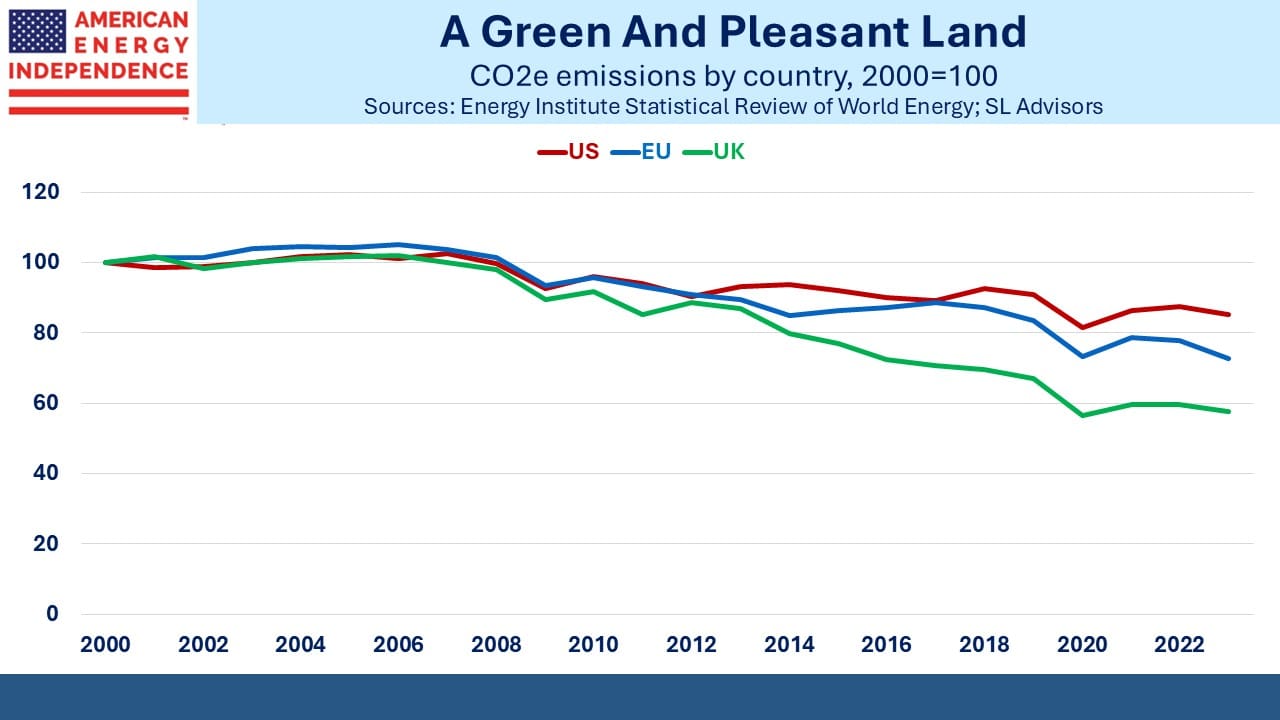

The UK has been surprisingly successful in heading towards this goal. Emissions are down 44% from their 2006 peak, meaningfully ahead of the EU whose equivalent reduction is 31%. Germany may be the self-styled leader of the “energiewende” but Britain has been quietly getting it done.

In 1900 coal provided 95% of Britain’s electricity. As recently as 2012 it was still 40%. The last coal-burning power plant will be decommissioned by the end of this year. They’re also planning to add more nuclear.

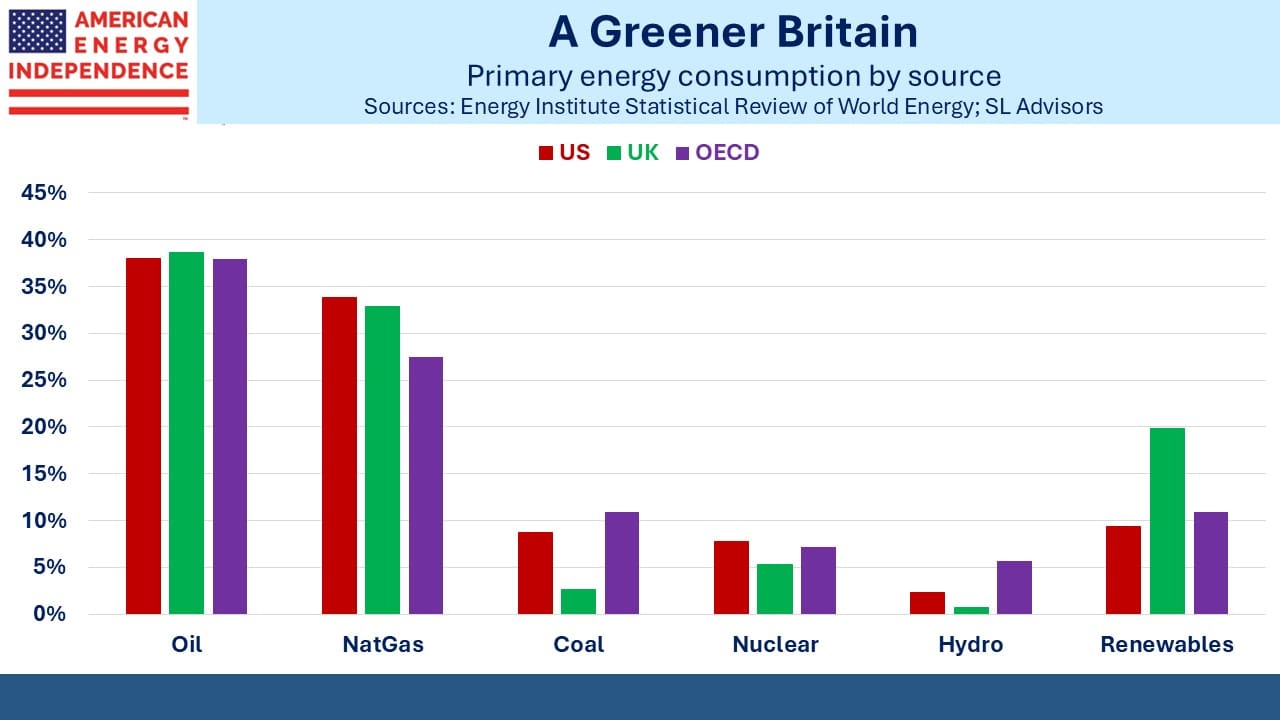

Renewables provide 20% of the UK’s primary energy, substantially ahead of the US (9%) and the OECD (11%). Last year wind provided 29% of their electricity, just behind natural gas at 32%. What the National Grid calls “zero carbon energy” (mis-named since manufacturing wind turbines relies on traditional energy) regularly produces most of their electricity and was 51% last year.

The North Sea is a reliably windy place, and offshore wind turbines are far less controversial than in the US. We saw them from numerous spots while traveling along the south coast. Windpower suffers from cost and intermittency, but the view of turbines miles out to sea doesn’t strike this blogger as particularly offensive.

US windpower is overwhelmingly onshore. Offshore has been plagued with cost over-runs and cancelations. Coastal residents complain about the view, and a 300-foot fiberglass blade recently shattered near Martha’s Vineyard, with jagged pieces washing up on the beach. Voters along the New Jersey shore, politically red in a very blue state, are outraged at plans for offshore wind (see Windpower Faces A Tempest).

In the UK you’re never far from a wind turbine.

Energy costs more in Britain. Electricity is around $0.40 per kilowatt hour, more than 2X the US. People commonly shut the lights off when leaving a room. One hotel we stayed at required your room key inserted in a slot for the lights to stay on, preventing guests from going out and leaving the lights on.

Gasoline (petrol to Brits) costs around twice as much as the US because of higher taxes. But the cars are smaller and the roads narrower. Even though I learned to drive there, it was over 40 years ago. Driving through the English countryside, it felt like small cars were zipping around impossibly narrow lanes. But our 800 miles of driving cost £100 ($133), just under $0.17 per mile and similar to the average for US drivers.

British drivers grumble about the cost of petrol (and the traffic) but unlike the US it’s not a political issue. Everyone knows the British government has no influence over oil prices.

Americans drive more miles per year than most countries, which is why gasoline prices get people so worked up. Moreover, Britain’s more extensive public transport system generally gets you around faster than in the US. Taking a painfully slow NJ Transit train into New York compares unfavorably with the faster commuter trains servicing London.

In Britain, it’s household heating bills that earn the public’s ire.

Natural gas is widely used, and Russia’s invasion of Ukraine boosted winter heating bills. For a couple of years households were protected from the full impact of higher gas prices, through government caps, but that costly program has ended. During our trip the new Labor government’s plan to cancel pensioners’ annual heating rebate was a leading news story.

Britain has a good energy transition story to tell. But how do people feel about making a considerable effort while developing economies led by China overwhelm their efforts? Most haven’t given it much thought, and those that have shrug and say it’s important to “do your bit.”

Young people care more. My nephew, who’s a data scientist, even considers the energy required of a data center in constructing the form of AI queries he submits.

Unquestioning fealty to green energy is common among liberals. If climate change is such an existential threat, why don’t their governments make it a priority in dealings with China? I think it’s because the politics of climate change aren’t driven by solving the problem, but rather by imposing costly and inconvenient local measures that appear effective but are globally irrelevant.

Britain is ahead of its peers in reducing emissions, but the worldwide effect is inconsequential. The 44% reduction they’ve achieved since 2006 is only 0.6% of the total. For reference, the UK is around 3% of global GDP.

Climate extremists are driving policy in the UK as elsewhere and are missing the big picture. At its worst it’s wokeness trying to impose guilt on everyone simply for being here, on Planet Earth, living.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!