Midstream’s Goldilocks Phase

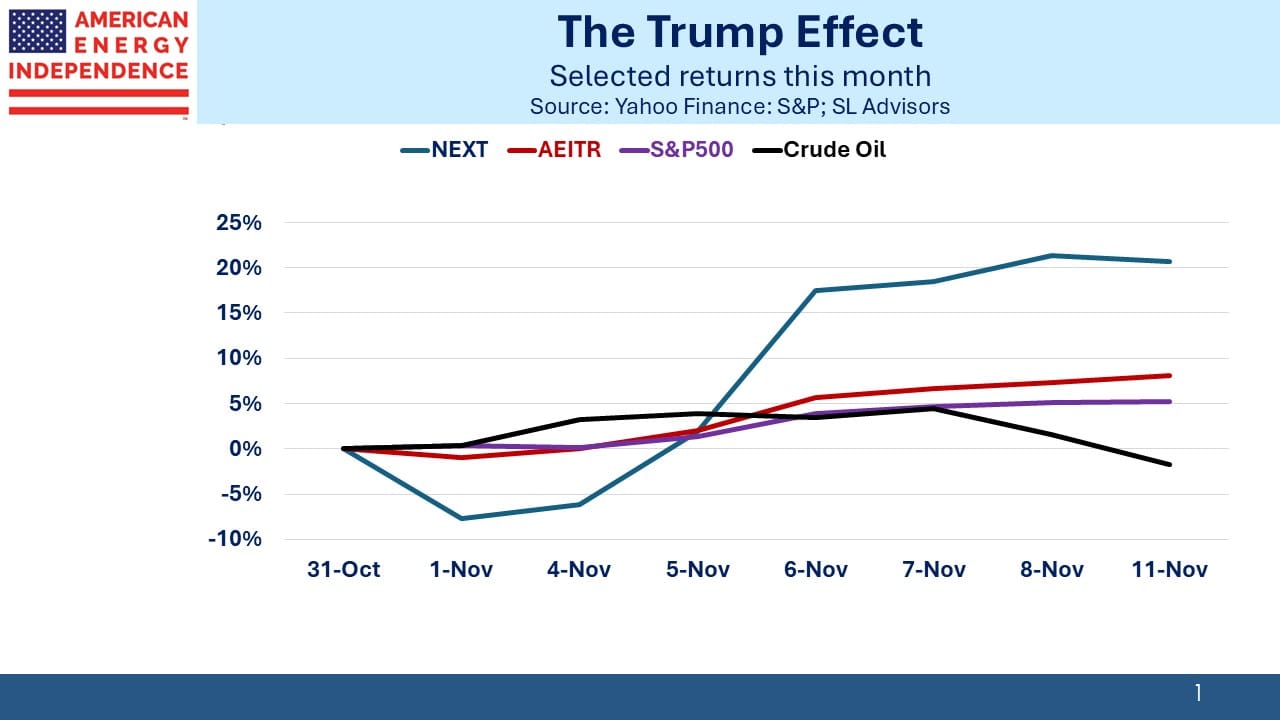

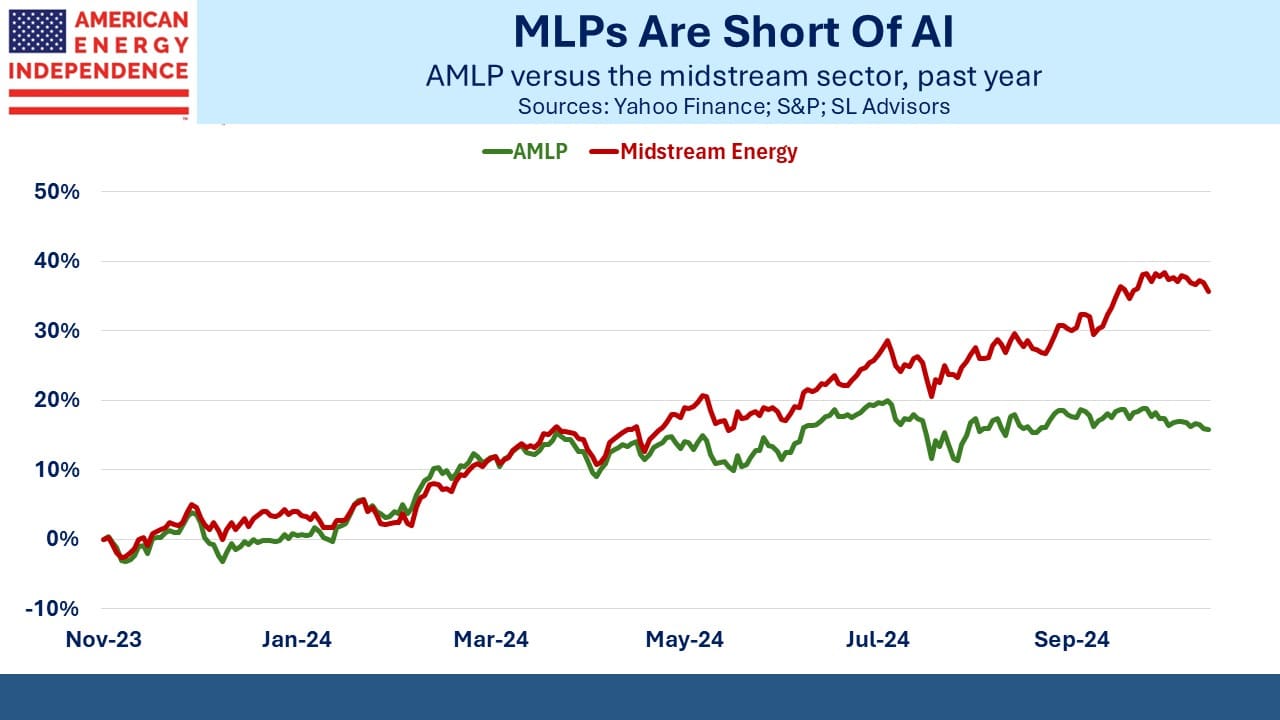

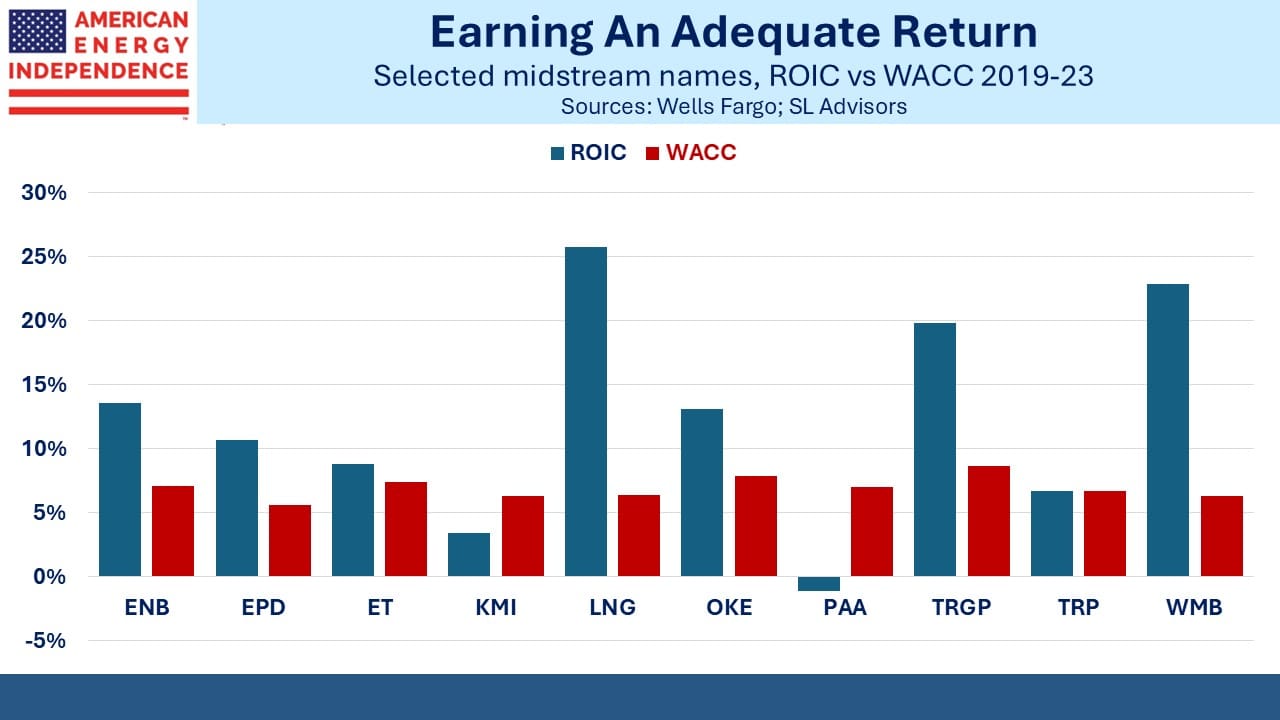

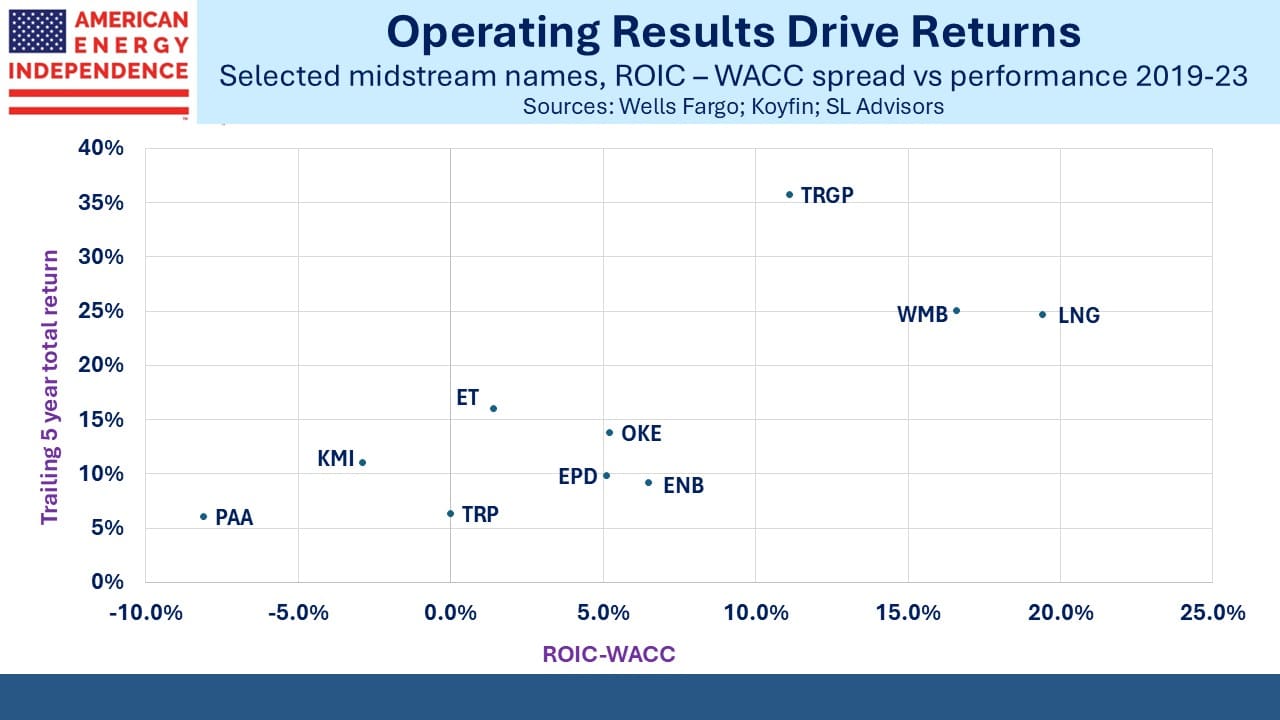

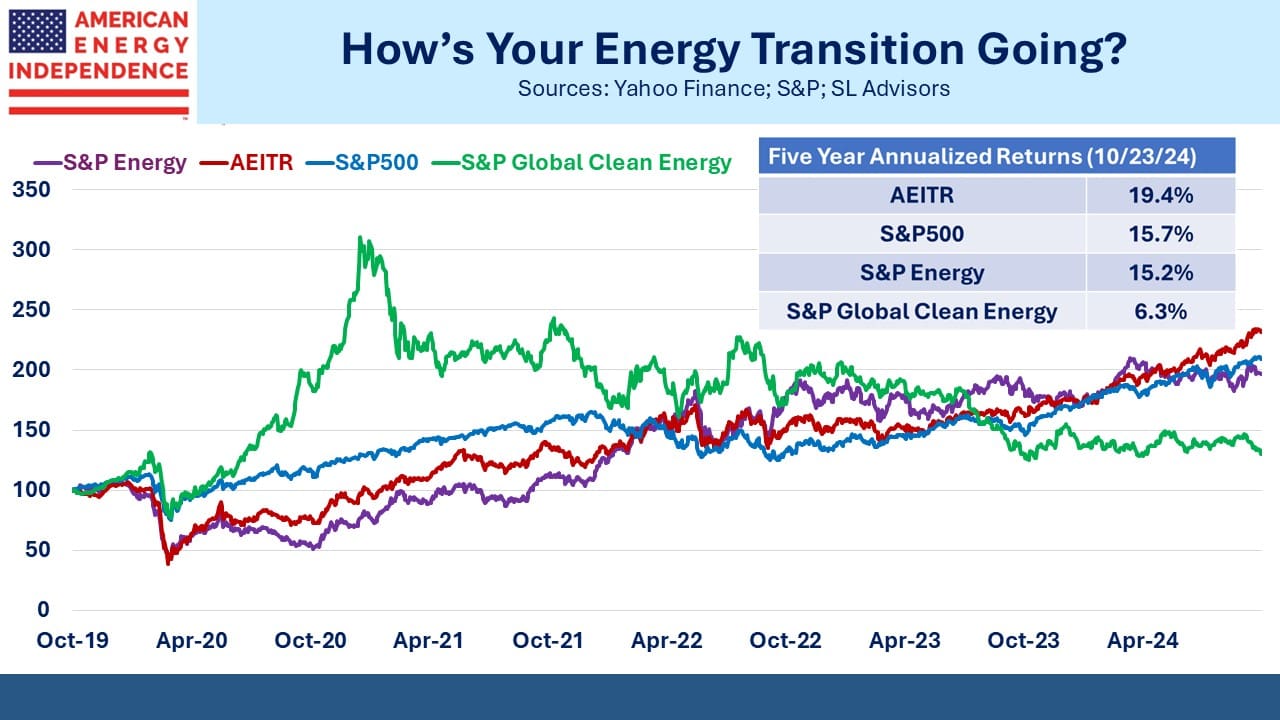

The word of the week is re-rating. Both Wells Fargo and Morgan Stanley have suggested that, notwithstanding this year’s 50%+ return in midstream energy infrastructure, further upside is possible. They posit that a re-rating of the sector would not be unreasonable given the strong fundamentals.

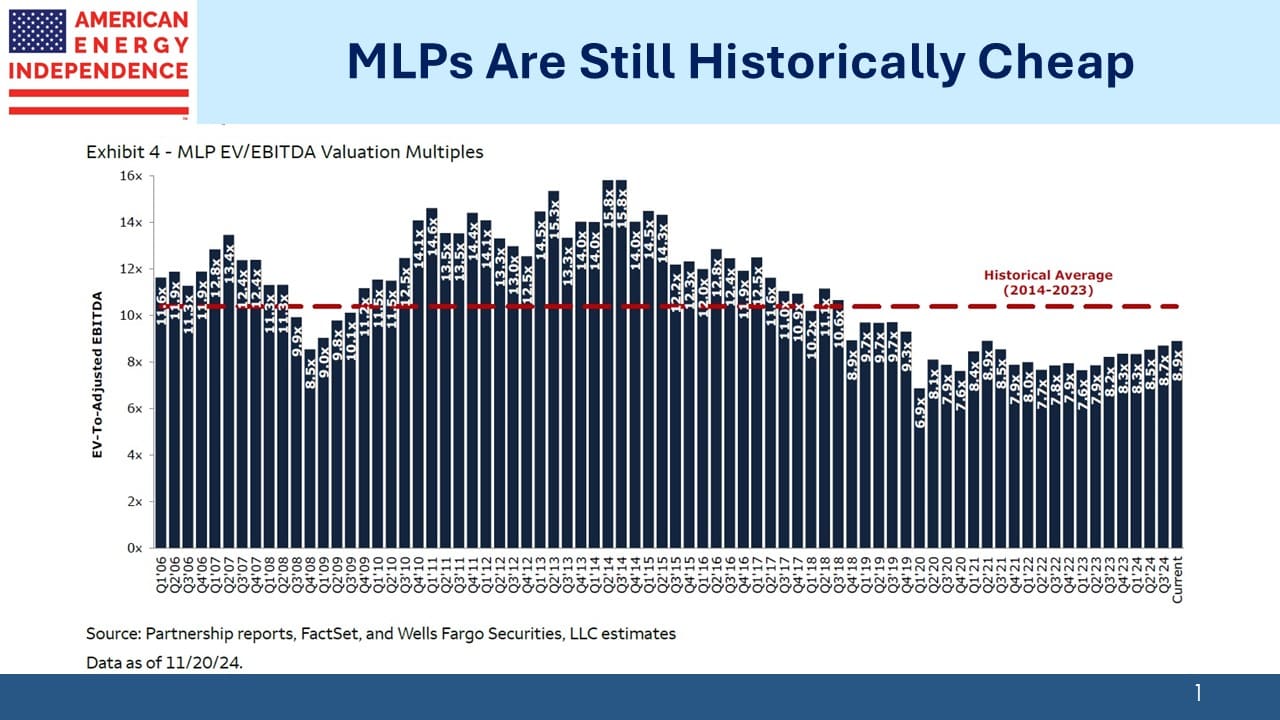

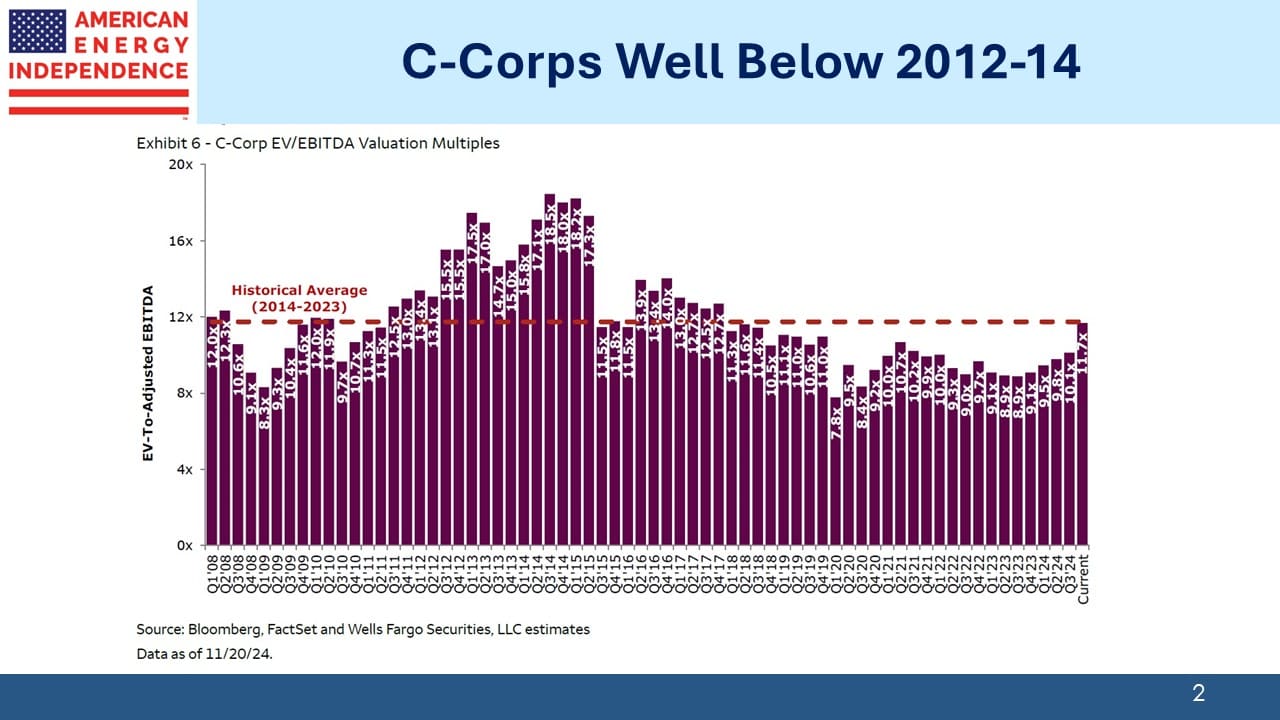

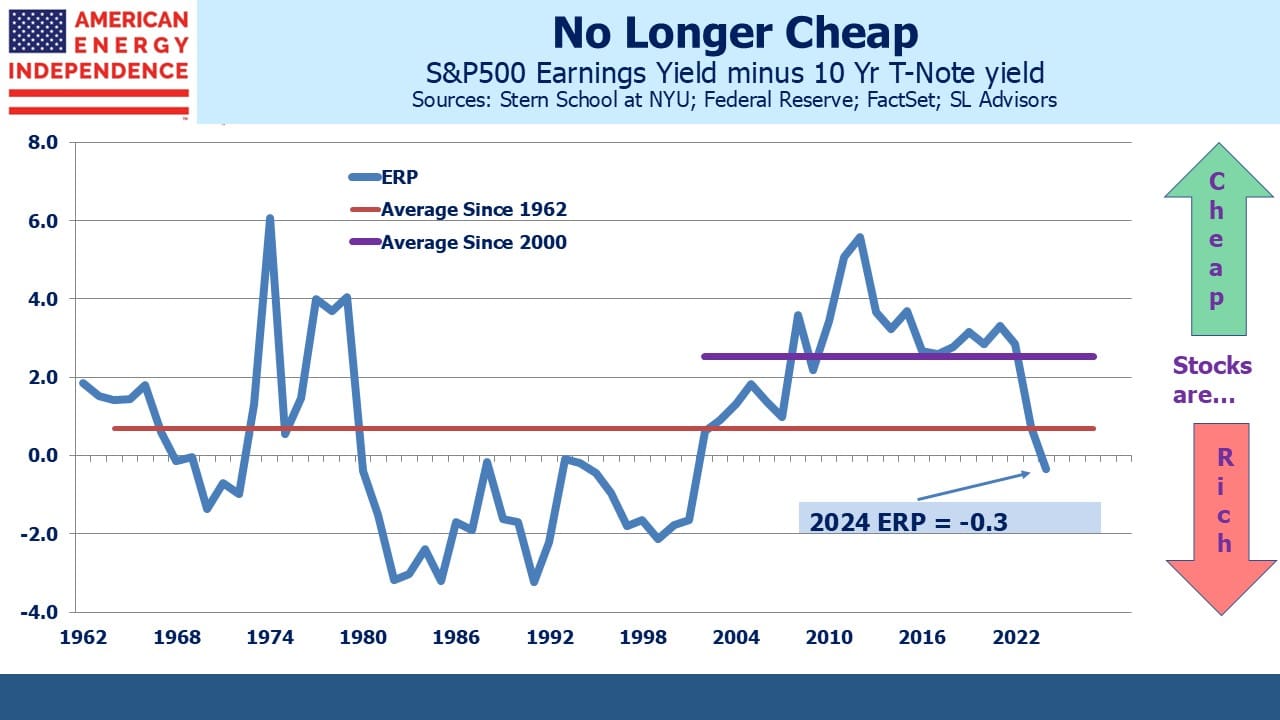

Enterprise Value/EBITDA (EV/EBITDA) is a widely used valuation metric, although my partner Henry correctly points out that this is less useful when leverage varies throughout a sector. By this measure though, MLPs remain below their ten-year average while c-corps, representing roughly two thirds of the investible universe, are at their ten-year average.

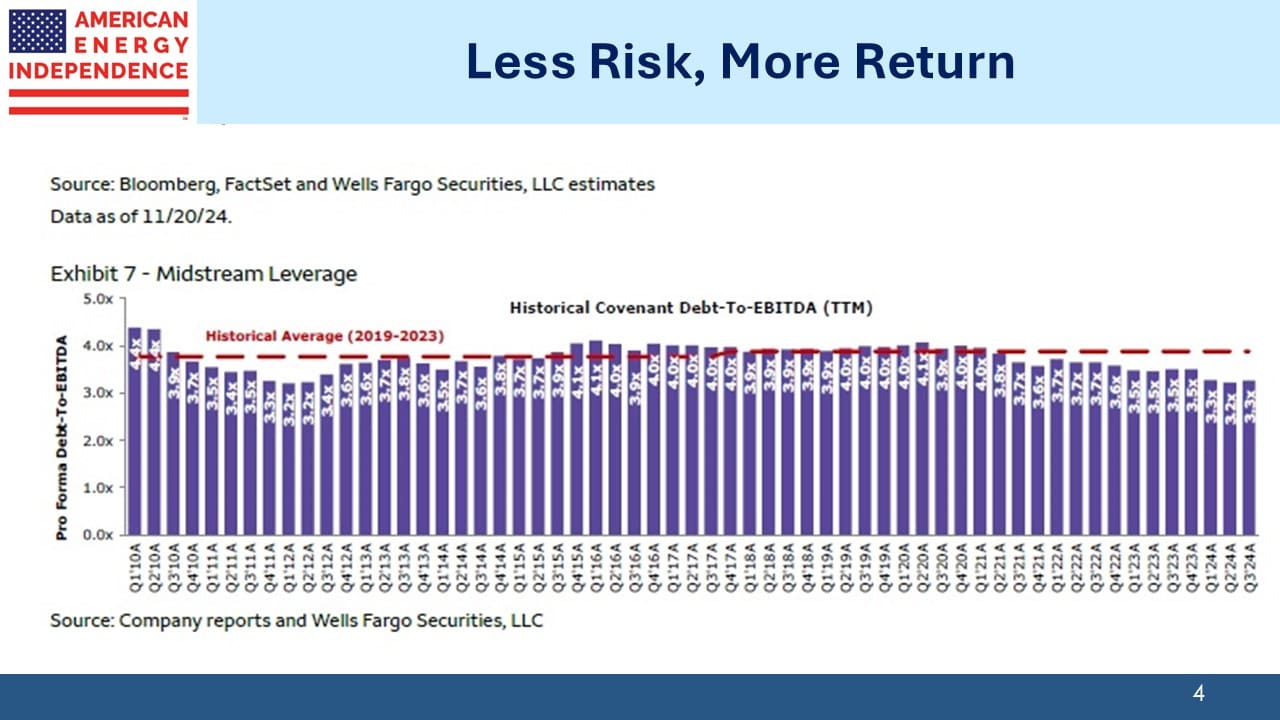

Reasons why fair value might exceed the average include the sharp increase in gas demand for data centers and the secular drop in leverage, which is 3.0-3.5X (Debt:EBITDA) versus 4.0X and higher a decade ago.

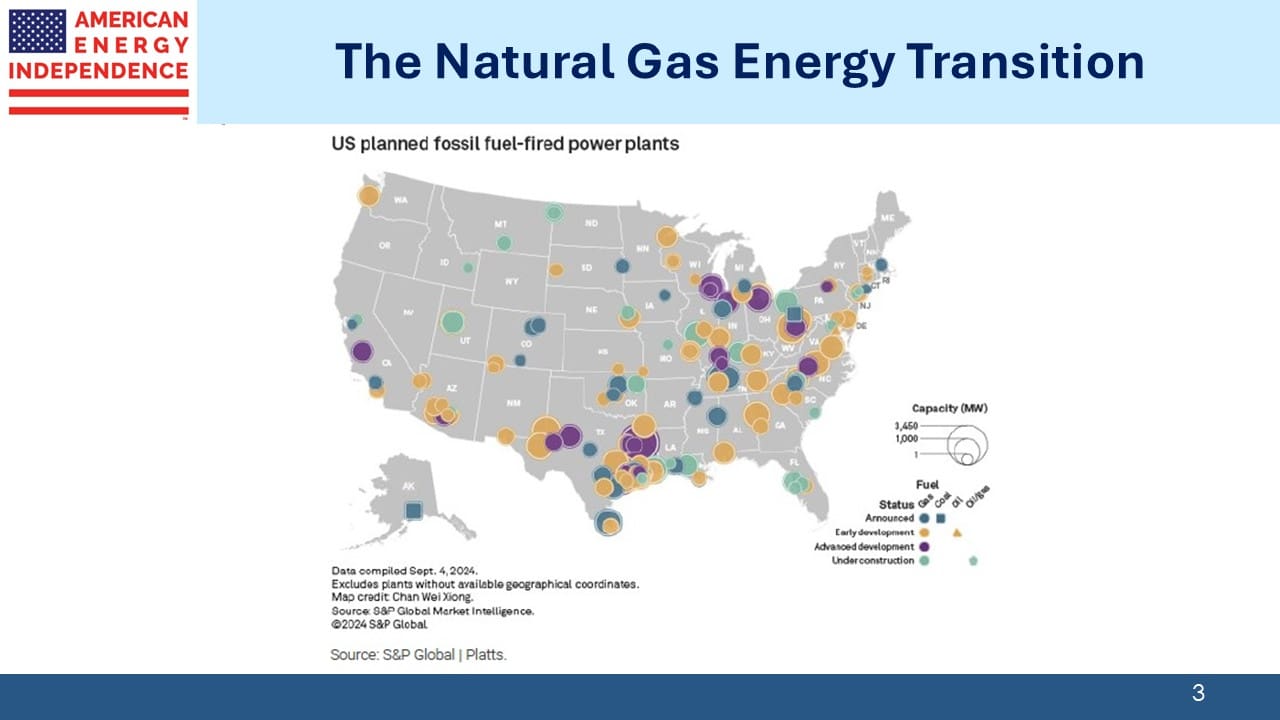

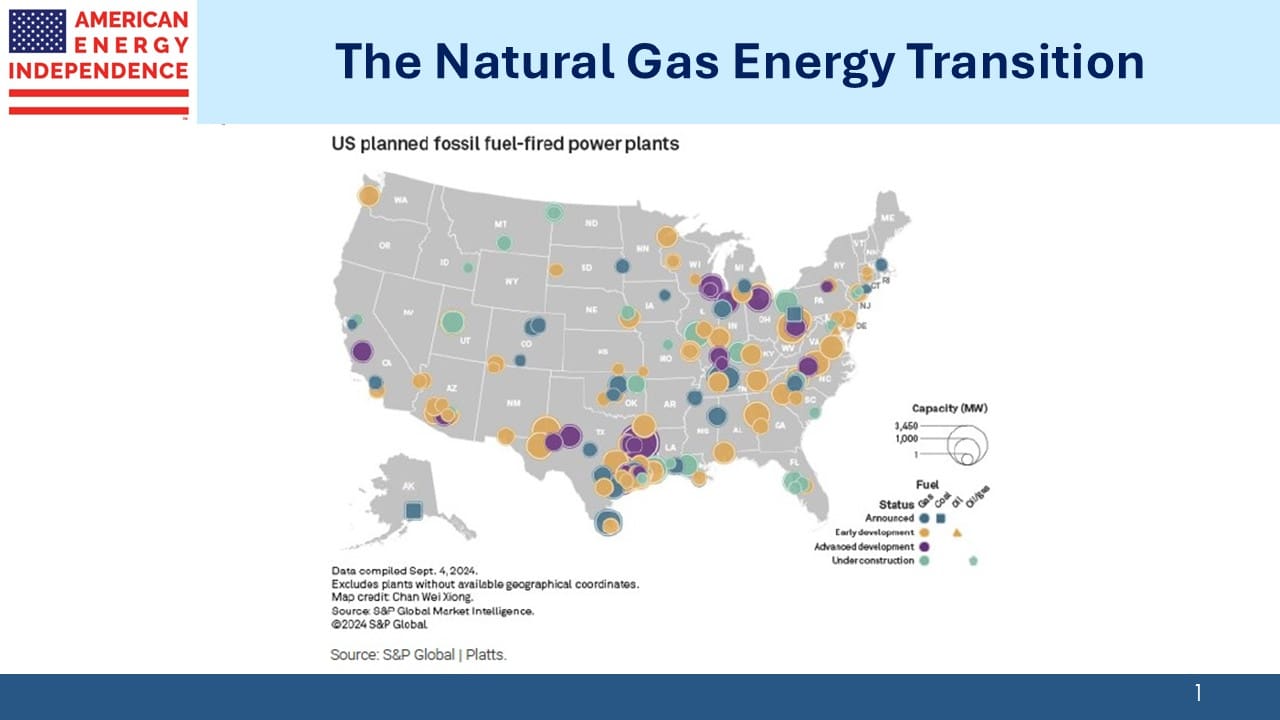

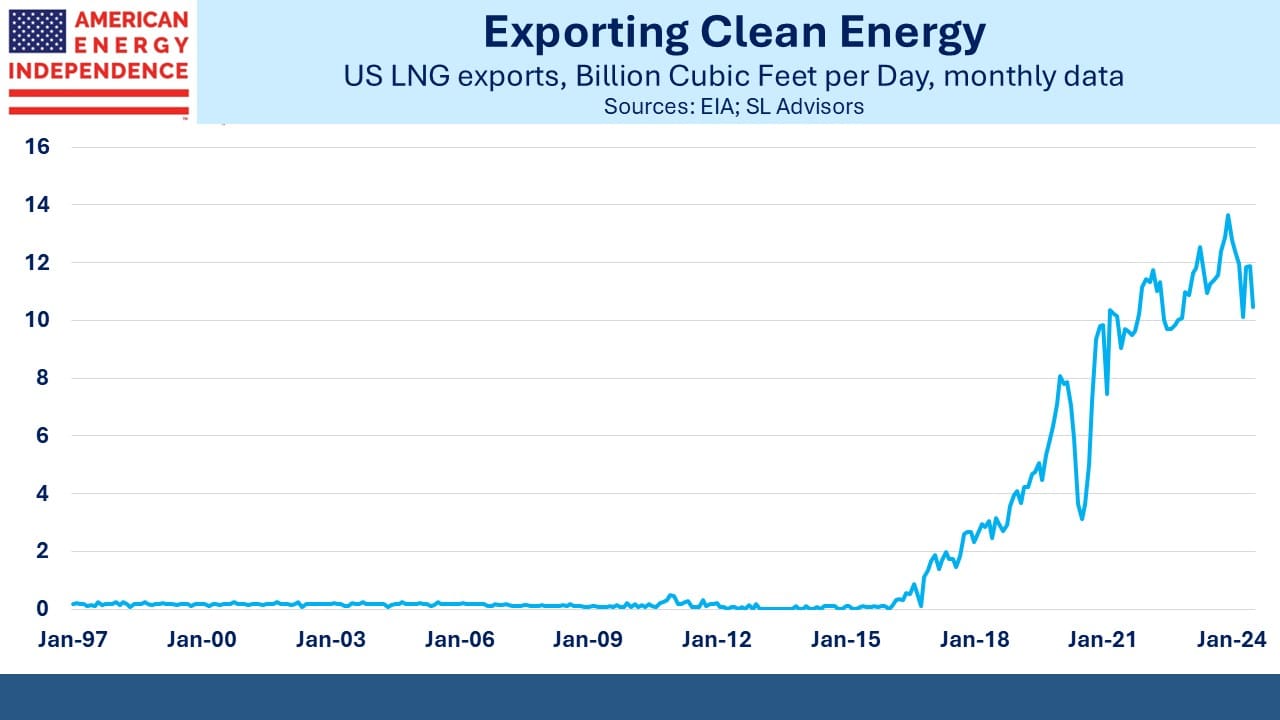

The increase in natural gas demand is real. 148 new power plants are under construction or have been announced as of September, up from 133 in April.

Entergy is building two new gas-fired power plants in Richland Parish, LA for a $5BN Meta data center in nearby Holly Ridge, LA. According to Morgan Stanley, Meta has, “expressed a need for the project to be completed quickly.”

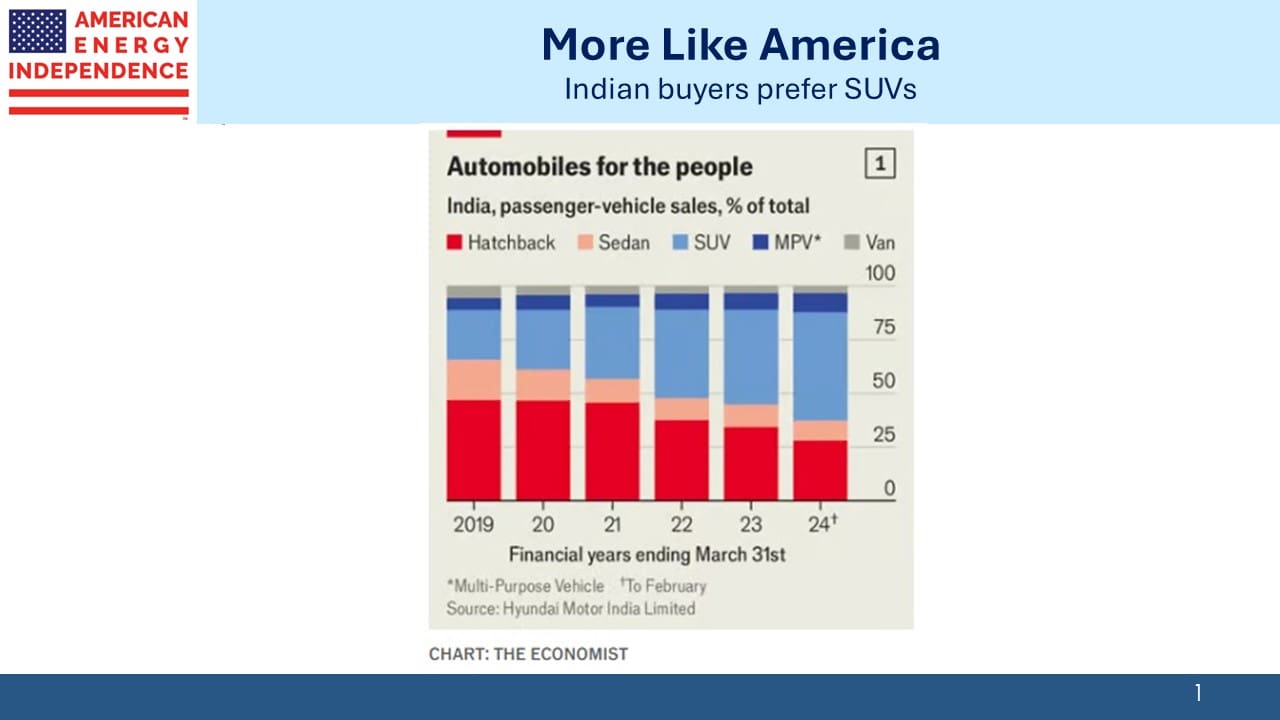

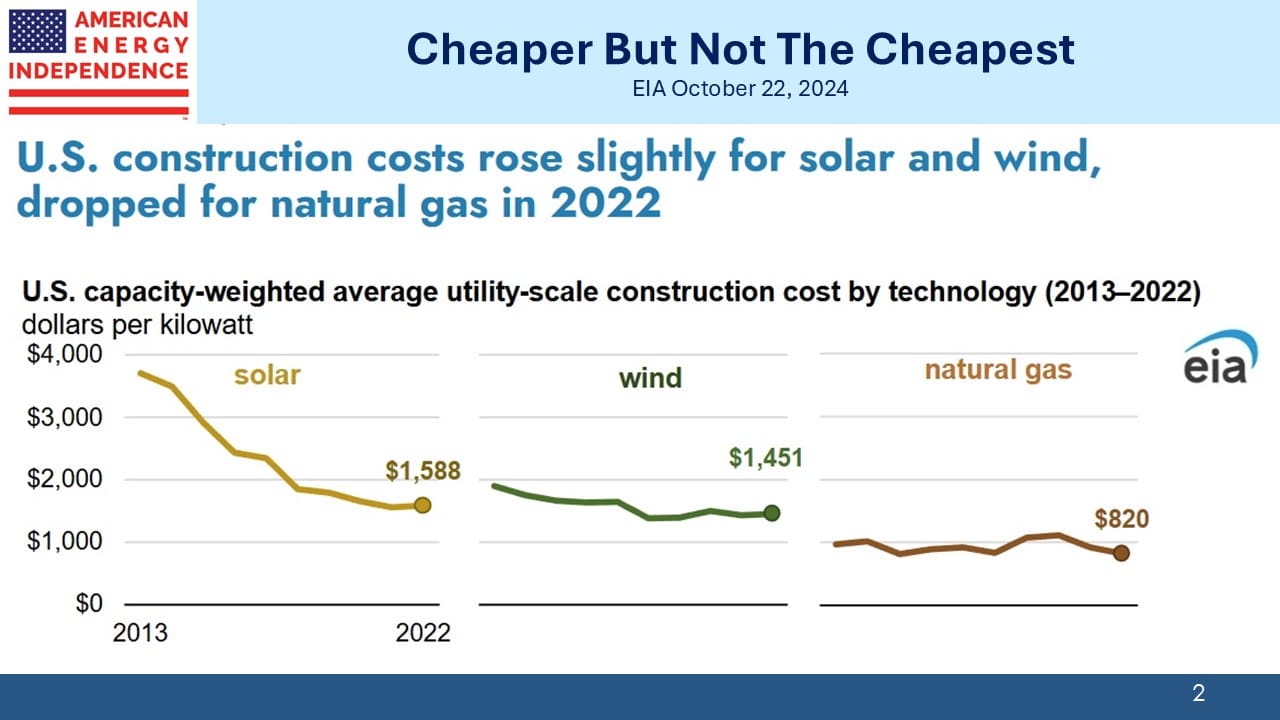

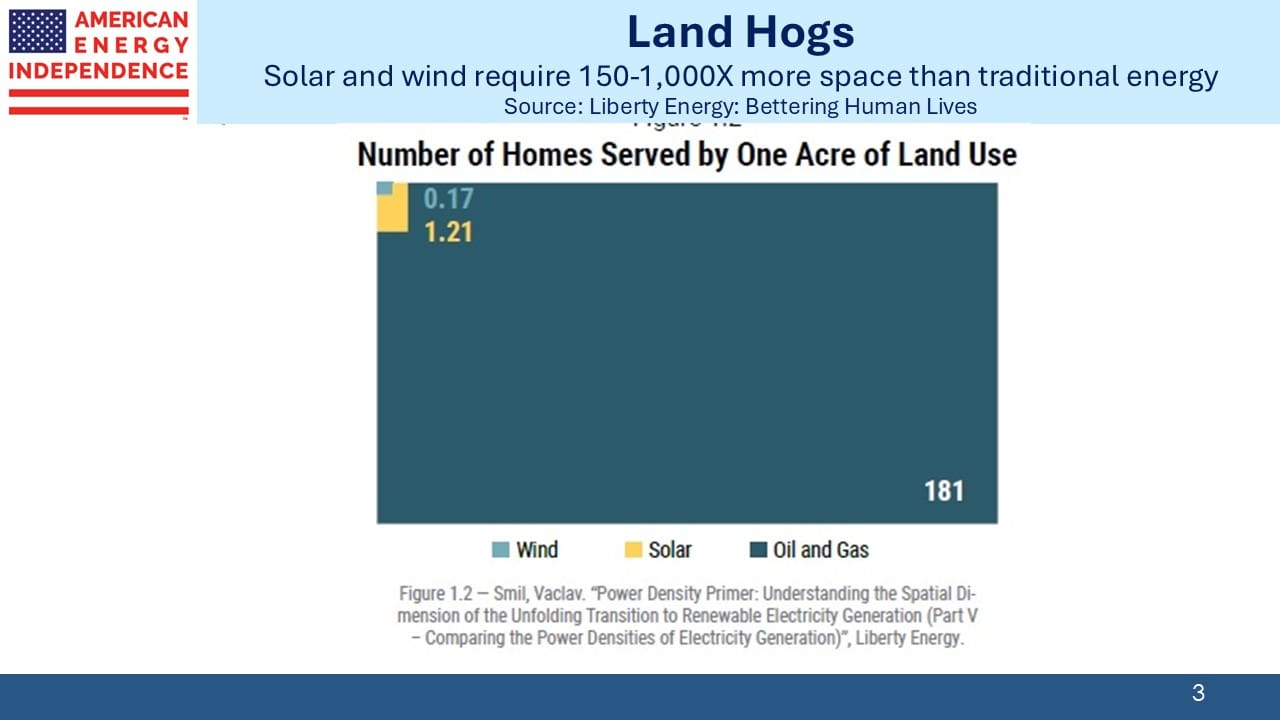

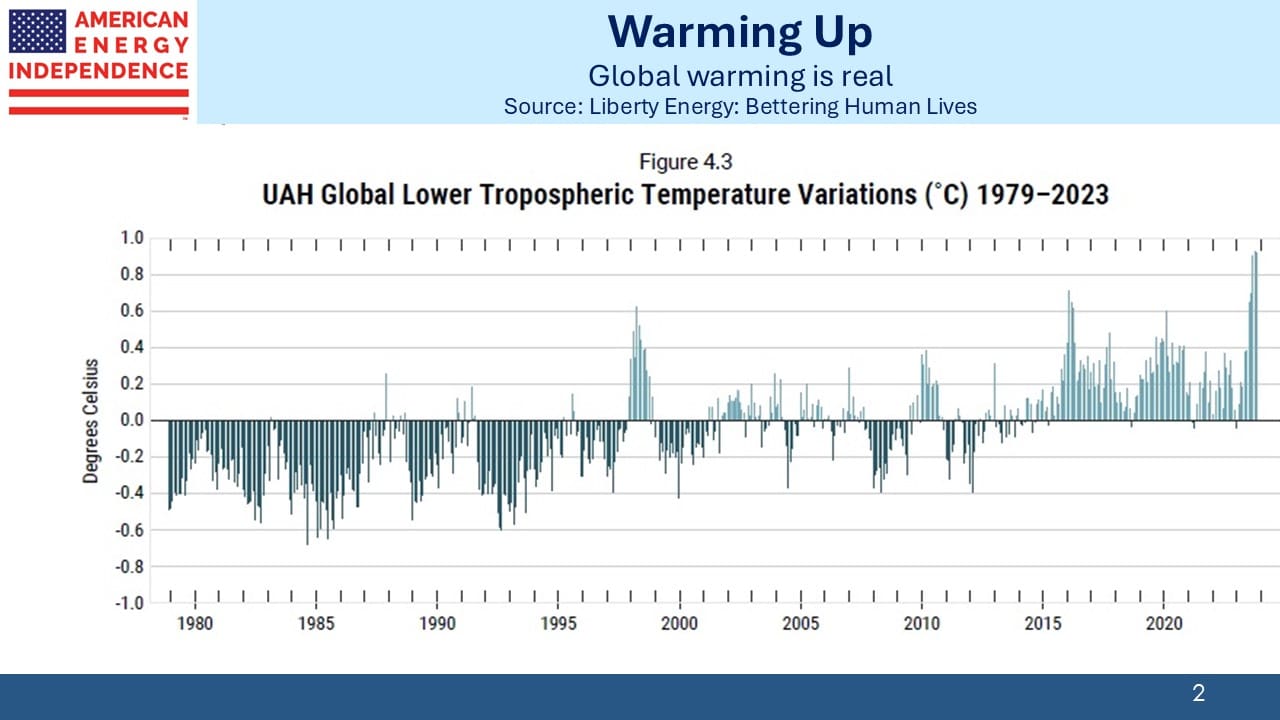

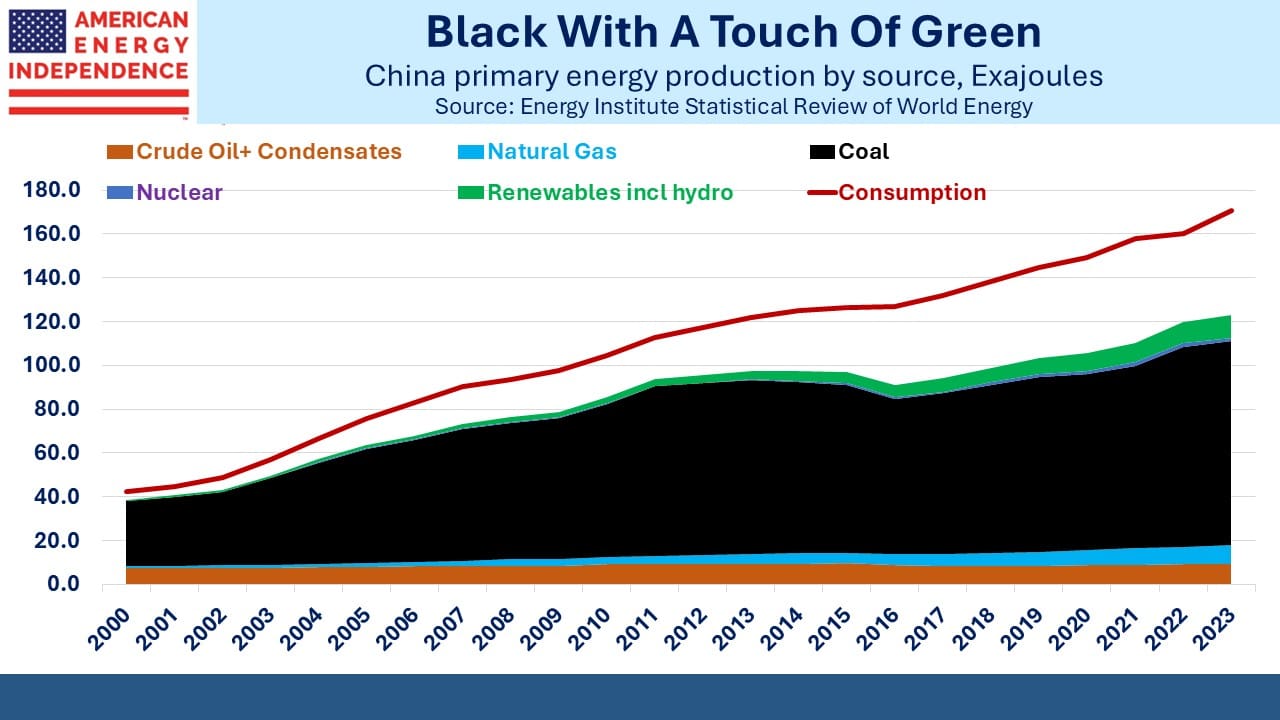

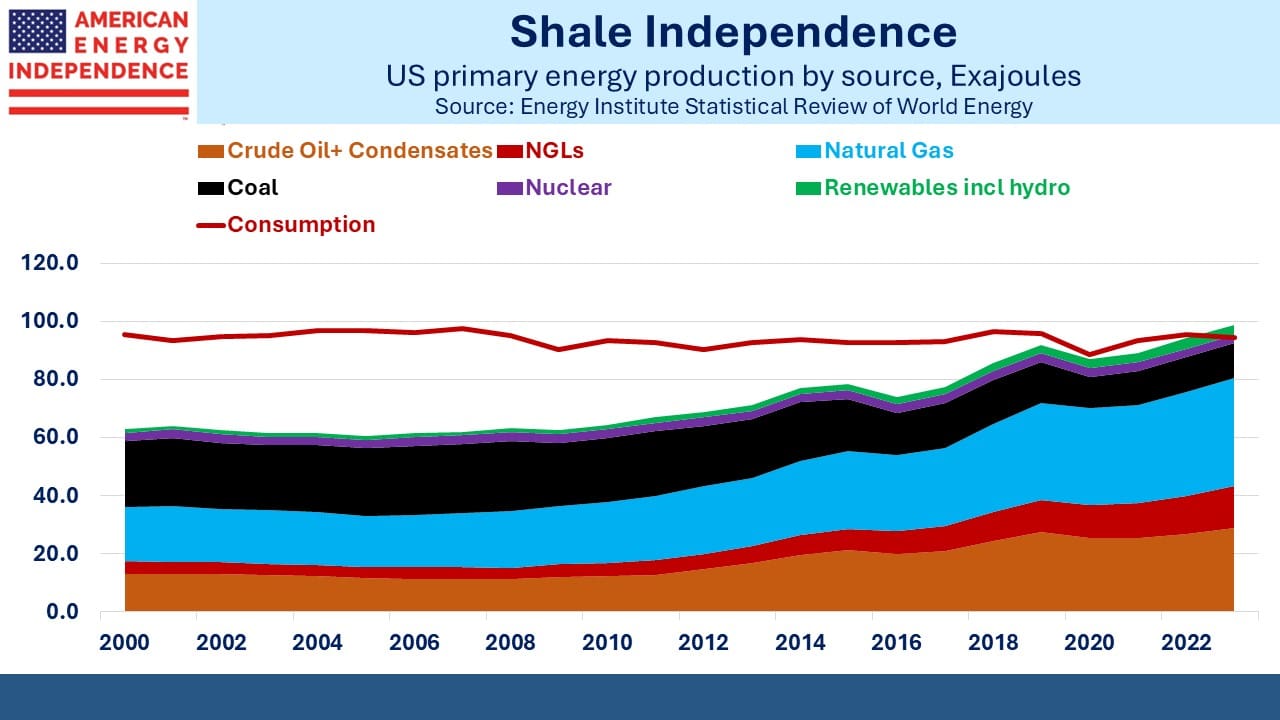

America’s tech giants need more electricity. Nuclear can meet some of this but restarting old reactors takes years. Solar and wind, the choice of climate extremists, are weather-dependent. Natural gas, which already provides 40% of our power, is the best solution. You can still read poorly informed commentators stating that renewables are now cheaper than hydrocarbons. They’re not. The choices data centers are making clearly show that natural gas is the preferred option.

Midstream companies have also been de-risking their balance sheets. After peaking at 4.1X during the pandemic, leverage has been steadily falling. Reduced capex has helped. Few want to embark on a new greenfield pipeline project anymore. Leverage recently reached 3.2X.

Climate extremists have learned how to weaponize the court system so that interminable delays make completion uncertain and IRR less attractive. Investors like us have come to appreciate the consequent boost to free cashflows even if it’s an unintended result of efforts by the Sierra Club and their motley crew.

Hug a climate extremist and drive them to their next protest.

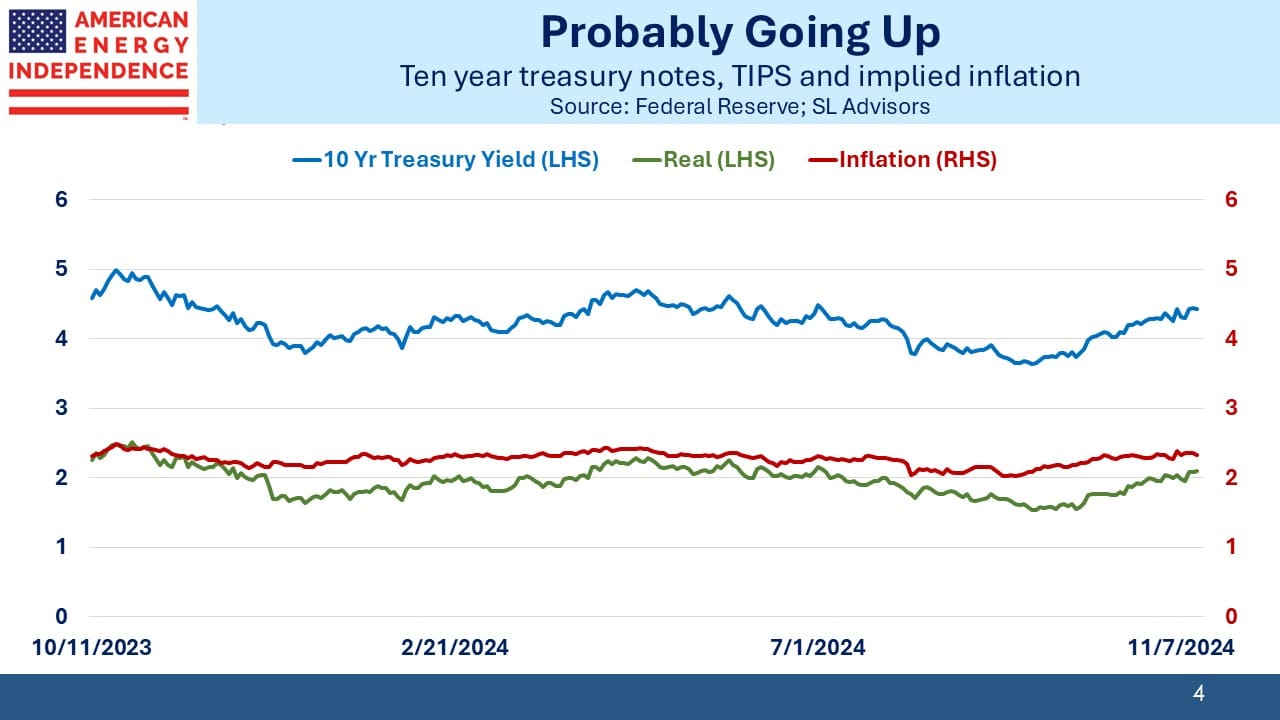

Some have expressed concern that the incoming administration’s energy mantra “drill baby, drill” will lead to a repeat of the poor investment performance under Trump’s first term. But there’s little evidence that another bout of over-production will depress oil prices, and sanctions on Iran will likely remove at least one million barrels per day from global markets. US natural gas prices are held down by associated gas production from Permian basin oil wells in west Texas and New Mexico. It’s unlikely any E&P company will “drill baby, drill” with reckless abandon for more gas.

Several people have asked us whether the construction of the Keystone XL pipeline will be restarted. A story on Politico said Trump was planning to reissue the permit as part of a raft of energy-related executive orders on his first day in office.

Keystone XL was an expansion of the existing Keystone pipeline intended to solve Canada’s perennial challenge of getting crude oil from Alberta to overseas markets. Because it crosses the border, the US State Department was required to issue a permit.

Back in 2010 a limited permit was granted under Obama with numerous conditions attached. By 2012 with increased sensitivity to climate opposition, Obama canceled it. Trump reinstated the permit upon taking office in 2017, and Biden duly rescinded it four years later. Canada’s TC Energy sued the Federal government for $15BN in damages once they finally threw in the towel.

Given this history, one might think there would be little appetite to start again, especially since construction takes longer than a single presidential term. TC Energy is now principally a natural gas pipeline company, having spun off its liquids business in the form of South Bow. And the Canadian federal government completed TransMountain Express at considerable taxpayer expense after buying it from Kinder Morgan (KMI). An ongoing dispute between Alberta and British Columbia led KMI to conclude that they had no place in the middle of an inter-provincial squabble.

Completed substantially over budget, TMX now moves crude oil to the pacific coast for shipment to export markets. So Canada’s need to find egress for its crude oil is not as acute as several years ago. Our betting is that the reissued Keystone XL permit will provide a welcome change of regulatory intent but won’t lead to any construction.

We just might be in a Goldilocks period for midstream, with the desire to build, baby build due to positive fundamentals tempered by continued financial discipline. Under such circumstances, re-rating doesn’t seem unreasonable.

We have two have funds that seek to profit from this environment:

Energy Mutual Fund Energy ETF