The Coming Fight Over Powering AI

/

US natural gas and its related infrastructure isn’t the only beneficiary of the AI-driven boom in power demand. Utility stocks have been rising, as investors assess growing power demand will boost earnings. The S&P Utilities Index is several per cent ahead of the S&P500 this year.

Operators of data centers well understand the challenges they face in obtaining reliable electricity. This is coming at a bad time for grid operators, who are already struggling to incorporate renewable sources into their power mix. Weather-dependent solar and wind operate 20-35% of the time. This requires increased redundancy across a grid as they add more dispatchable power (mainly natural gas) to compensate for when it’s not sunny or windy.

Some data centers are lining up their own sources of electricity. One example is a campus owned by Amazon Web Services (AWS) in Pennsylvania that will buy power from Talen Energy’s Susquehanna nuclear facility. But the AWS data center will retain access to the grid, run by PJM, the regional transmission organization.

Electricity markets are complicated. Exelon and American Electric Power (AEP), who operate within PJM’s region, have filed a formal protest with the Federal Energy Regulatory Commission (FERC). They are challenging Susquehanna’s application for a non-conforming Interconnection Service Agreement (ISA).

It’s not possible to assess the merits of this protest from public documents. But the filing does offer insight into issues that are likely to become common areas of dispute among industrial customers, power providers and regulators.

The infrastructure that delivers electricity (ie power lines, transmission stations etc) represents a significant fixed cost that is shared across customers approximately according to how much electricity they use. Residential solar panels are already challenging this model – California no longer credits homes that send excess power back to the grid at the same price they pay, because the economics no longer work.

The Exelon/AEP protest suggests that Susquehanna is trying to connect to the grid without fully paying for its costs. It asks why the nuclear facility will synchronize its power with the grid while still claiming to be separate from it. Data centers need extremely stable power with minimal harmonic distortions, so perhaps there are technical reasons Susquehanna needs to be “synchronized” with the grid.

The protest goes on to note that another unit at the facility had an unplanned outage last year, but apparently “no load was dropped” suggesting that grid power made up the shortfall.

Exelon/AEP are telling FERC that Susquehanna wants to “…operate as a free rider, making use of, and receiving the benefits of, a transmission system paid for by transmission ratepayers while not sharing in the costs.”

Susquehanna retorts that the protest is stifling innovation. As the competition for reliable power intensifies, such disputes will become more common.

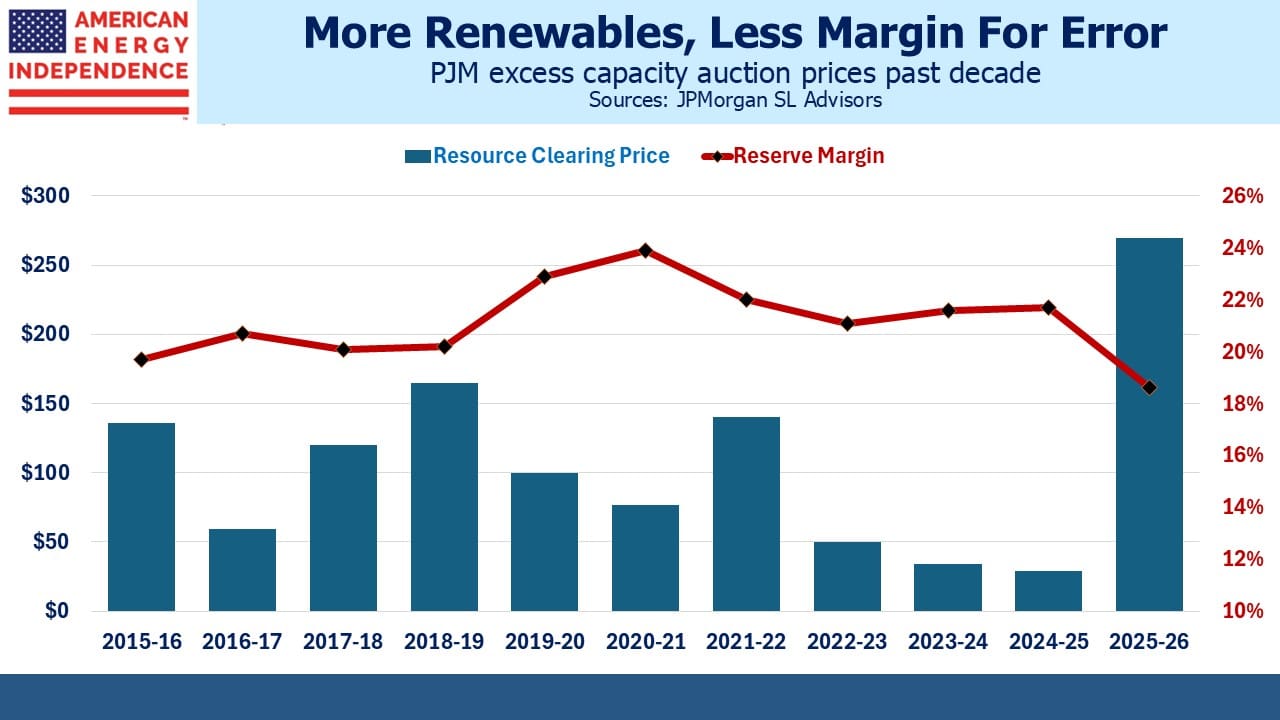

Meanwhile, PJM recently held an auction to provide their Regional Transmission Organization Reliability Requirement for the 2025-26 delivery year. Think of this as surge capacity to be available during a heatwave or when a substantial portion of its generating capacity is down. Unsurprisingly, solar and wind represented just 2% of the responses to the auction, since they produce power when they can, not necessarily when it’s needed. Natural gas was 48%.

PJM is estimating they’ll need 2% more surge capacity than in the prior year. The auction cleared at $269.92 per Megawatt-Day, more than 9X the prior year’s 28.92 figure. Moreover, their reserve margin shrank from 20.4% to 18.5%.

This is not good news for PJM customers. PJM attributed the price jump in part to the loss of 6.6 Gigawatts of generation capacity (mostly coal) that is retiring. Because it’s not being replaced at the same rate, there’s less power available.

The North American Electric Reliability Corporation has warned grids across the country that the energy transition as it’s currently being implemented is reducing reliability and increasing the risk of power cuts.

Solar and wind are especially useless at providing surge capacity because their operators can’t be certain how much they can produce. Natural gas was almost half because it’s “dispatchable”, meaning it can be delivered when needed. It’s another example of the inferior quality of solar and wind compared with traditional energy.

JPMorgan suggested that another reason for the price jump is that power providers are holding back, skipping the auction while they negotiate long term contracts with data centers.

The hunger for power to support AI is on a collision course with plans to decarbonize our electricity. Old forecasts of modest 1% annual demand growth driven by EVs is now turbo-charged to 5% or more. Globally, added renewables are unable to even meet the increase in primary energy consumption across developing countries. In the US the Exelon/AEP dispute with Susquehanna is only the first of many.

Energy investors will be learning more than they expected about the commercial intricacies of America’s electricity supply.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!