Deciding When To Sell

/

Investors sometimes ask us what induces us to sell a security. It’s usually because relative valuation has made one stock more attractive than another. Williams Companies (WMB) is an example. The company holds a unique position in natural gas pipelines with its Transco network running along the eastern US. They have a heavily fee-based business, regularly meet or beat earnings expectations and have paid a dividend for half a century. They handle roughly a third of US natural gas.

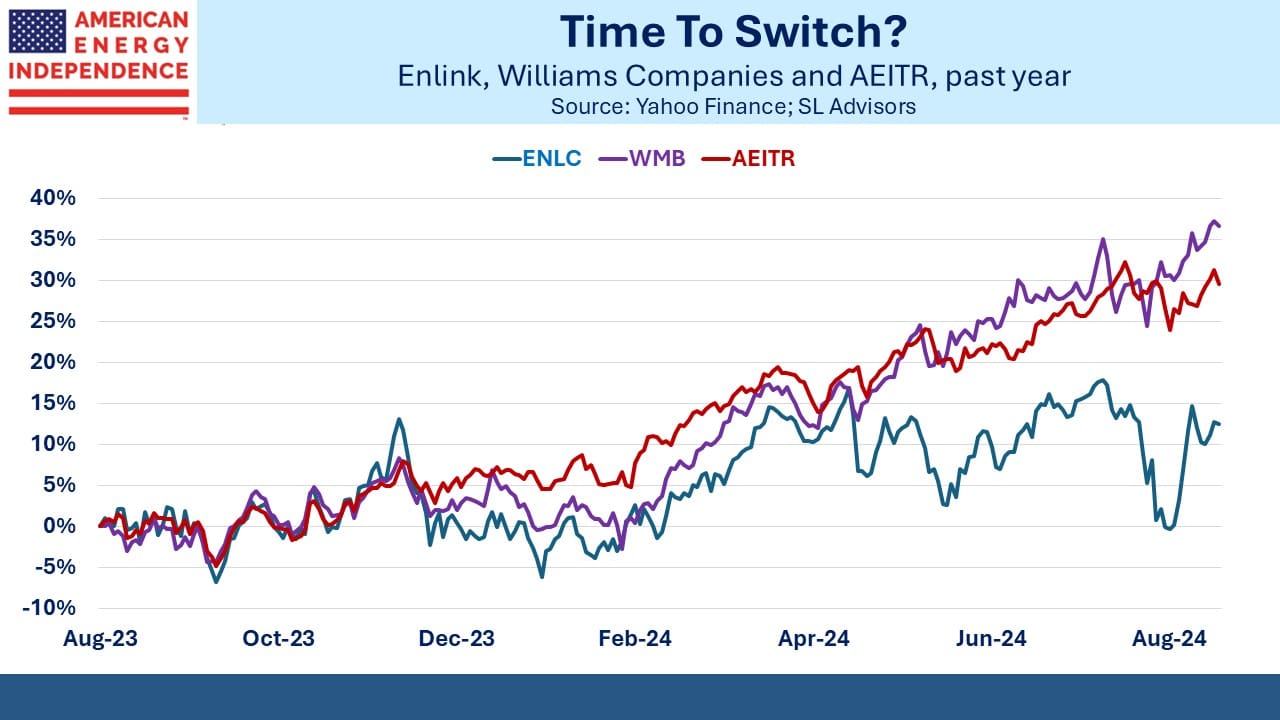

However, their 2024 Distributable Cash Flow (DCF) yield is below 8%, the lowest of any of their peers. Over the past year they’ve returned 37%, roughly 7% ahead of the American Energy Independence Index (AEITR). WMB is a stable company, in our opinion richly priced.

So we’ve cut our position back and purchased more Enlink Midstream (ENLC). They’re not perfect substitutes – ENLC’s $6BN market cap is much smaller than WMB’s $55BN. But we like their exposure to natural gas and NGLs in Texas and Louisiana. Their leverage is a comfortable 3.3X Debt:EBITDA giving them an investment grade rating.

Over the past five years ENLC has repurchased 10% of their stock. They have an interesting opportunity in Carbon Capture and Sequestration (CCS) since they serve many industrial companies throughout Louisiana’s industrial corridor. Their existing pipeline network allows them the opportunity to send CO2 generated by their customers back to the geological formations from where the natural gas was extracted.

There’s an elegant symmetry in taking carbon atoms originally sourced as CH4 (natural gas, methane) being returned home as CO2. Federal CCS tax credits under the misnamed Inflation Reduction Act help.

A further appeal is ENLC’s 15% DCF yield, among the highest in the sector and with potential upside from repricing of NGL contracts (see Long Term Energy Investors Are Happy).

ENLC has trailed the AEITR index with a 12% one year return. We concluded the valuation difference between WMB and ENLC was sufficient to switch some capital.

Sometimes less is more when it comes to regulatory approvals. Following a court ruling that partially suspended NextDecade’s (NEXT) permit for their LNG export facility (see Sierra Club Shoots Itself In The Foot) their stock fell sharply. Investors reassessed the odds of completing the Rio Grande terminal, even though construction continued after the ruling.

The Federal Energy Regulatory Commission (FERC) now has to revise their previously completed Environmental Impact Statement (EIS). NEXT was planning to include a CCS capability at Rio Grande. Now in an ironic twist, NEXT has withdrawn its CCS application from FERC, because they believe this will simplify regaining the permits they already had to build the LNG terminal.

The stock staged a modest recovery but will likely return to its pre-ruling levels only once the permit issue is resolved.

Climate extremists have been effective at constraining capex which in turn has helped drive up midstream free cash flow. But they’re opening themselves up to financial exposure along the way. Greenpeace was active in opposing Energy Transfer’s Dakota Access pipeline project, which substantially raised its cost.

Kelcy Warren’s company isn’t known for avoiding conflict. So they’re suing Greenpeace for $300 million, a sum the environmental group has said represents an existential threat. This is the group whose protesters illegally board ships and oil rigs to promote their dystopian views. They oppose natural gas, the biggest source of reduced CO2 emissions in the US.

If ET does prevail in court and a life-ending settlement is imposed on Greenpeace, they won’t be missed.

In another triumph for common sense, New Zealand is tempering its reliance on renewables (see New Zealand to push through law to reverse ban on oil and gas exploration). Electricity prices recently spiked to some of the highest among developed economies.

New Zealand’s previous center-left government imposed regulatory hurdles on LNG imports, something the current center-right government also wants to reverse.

Energy Minister Simeon Brown lamented that, “The lakes are low, the sun hasn’t been shining, the wind hasn’t been blowing, and we have an inadequate supply of natural gas to meet demand.” In other words, intermittent power supply that depends on co-operative weather has been, well, intermittent.

The climate extremists who speak loudest on policy promised New Zealand cheap, carbon-free energy. New Zealanders have received the opposite, with coal use for power generation increasing to meet the shortfall. New Zealanders each generate on average around 6 metric tonnes of CO2 annually, less than Germany which styles itself a leader on climate change.

Once the permit issue for NEXT is cleared up, they might have a new customer for their LNG.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Simon, Congratulations! You were early and right on ENLC. Stock closed up 9.42% today (08/29) after other commentators spoke favorably about the company.