Climate Extremists Lack Serious Solutions

/

To be an energy investor is to consider the energy transition on a daily basis. You don’t even have to be certain that man-made global warming is happening. Simply accepting that it may be possible should still induce a prudent world into managing this risk. Climate is complicated, and certainty that increasing CO2 emissions will cause irreparable damage is as implausible as certainty that they won’t.

We won’t hit the UN Zero by 50 target, meaning eliminating CO2 emissions in 26 years, because it’s not taken seriously enough. That may sound odd. All you ever read is articles hailing the growth in solar and wind along with their plummeting cost. But even in the US, renewables provide just 3.5% of our primary energy output, up from 2.7% a decade ago.

Perusing data from The Energy Institute’s 2024 Statistical Review of World Energy reveals how far we are from tackling the problem.

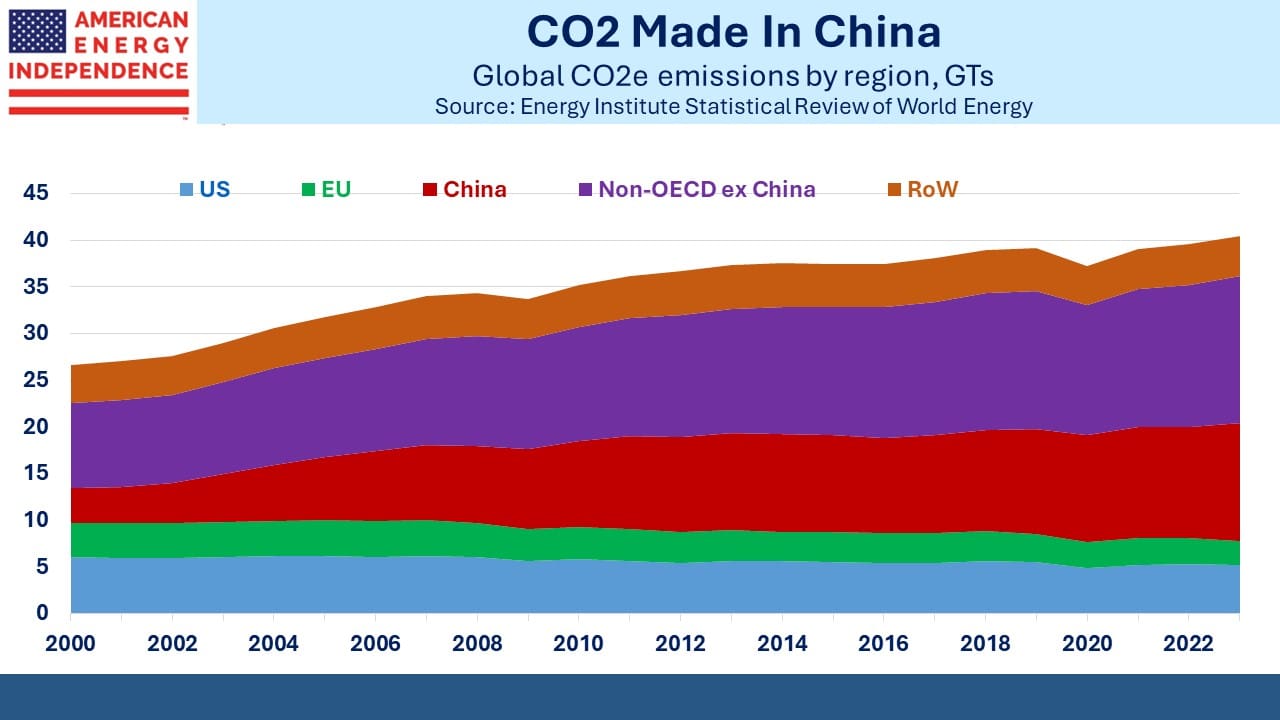

The first thing to understand is that global CO2 emissions will be determined by China, not the US or the EU. China’s 12.6 Gigatons (GTs, billions of metric tonnes) of CO2 equivalent (i.e. including methane) have increased by a factor of 3.4X this century. They are 31% of the total, up from 14% in 2000. Over this time the US and EU have each lopped around 1 GT off their emissions.

Non-OECD ex-China (ie the rest of the developing world) has gone from 9 GTs to almost 16 GTs. The data shows that concern about emissions rises with incomes. Everyone wants a western standard of living, which requires more energy. This is the inexorable force driving consumption of coal, oil and natural gas.

The success the US has enjoyed in reducing emissions has come from swapping coal for natural gas in power generation. It seems obvious to extend this benefit elsewhere through increased US exports of cheap Liquefied Natural Gas (LNG). But climate policy is driven by the marginal, most fringe views. Climate extremists have made it their misguided mission to impede US gas production at every step (see Sierra Club Shoots Itself In The Foot). These are the people most likely to prioritize climate change in casting their vote. Therefore, their policy recommendations hold outsized influence over public policy.

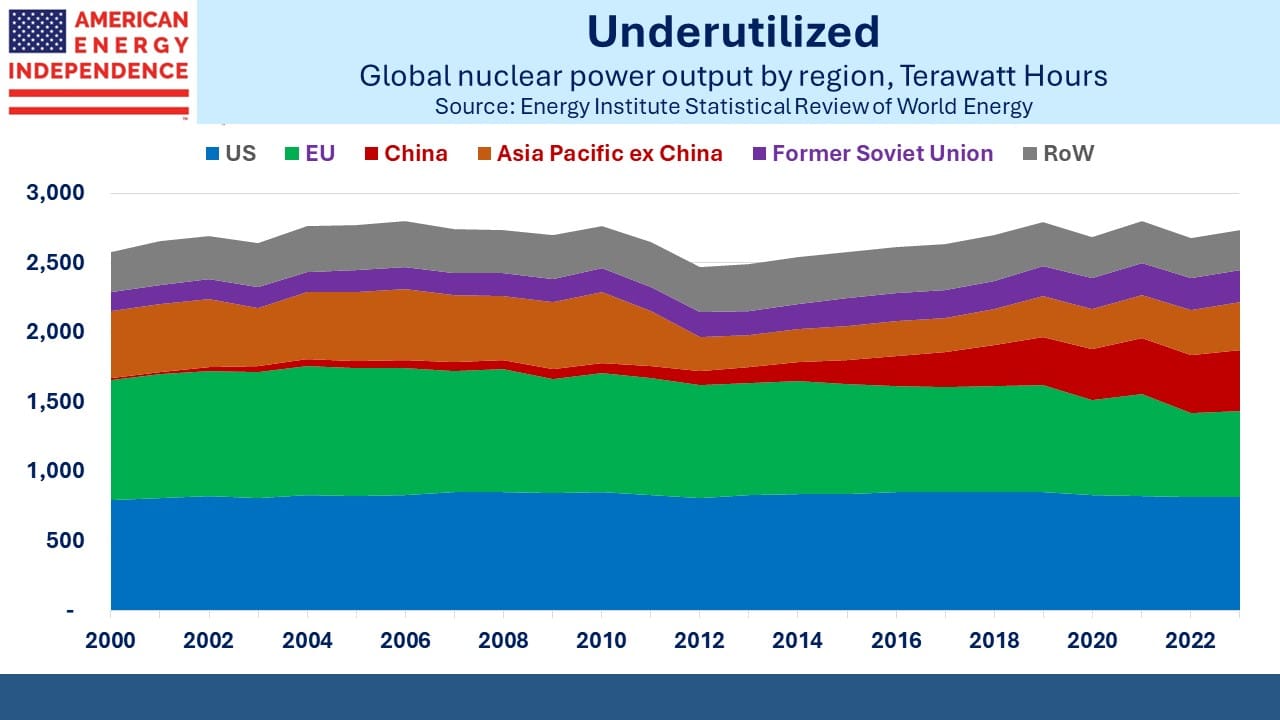

As a result, China’s coal consumption grows unchecked. Their substantial investments in solar and wind capacity are hailed as evidence that their policies are aligned with ours, but emissions keep growing. Climate extremists are so convinced that renewables can ultimately provide all our energy that they ignore the facts. They remain implacably opposed to nuclear power, even though it has the lowest fatality rate per unit of power generated of any source of energy. The Sierra Club believes that, “every dollar spent on nuclear is one less dollar spent on truly safe, affordable and renewable energy sources.”

Nuclear power output has barely risen this century. China is the one exception. The rest of Asia responded to Japan’s Fukushima disaster by shutting down nuclear. Germany followed suit. France remains a notable exception, deriving 65% of its electricity from nuclear power. The rest of the world is at 8%.

The US Navy has 72 nuclear-powered submarines, 10 aircraft carriers and one research vessel. They have never had a safety incident. Maybe they should run our nuclear program. Every form of energy production includes risks. Climate extremists who thought hard about the issue would use their outsized political influence to improve the process by which US nuclear reactors are approved in the private sector.

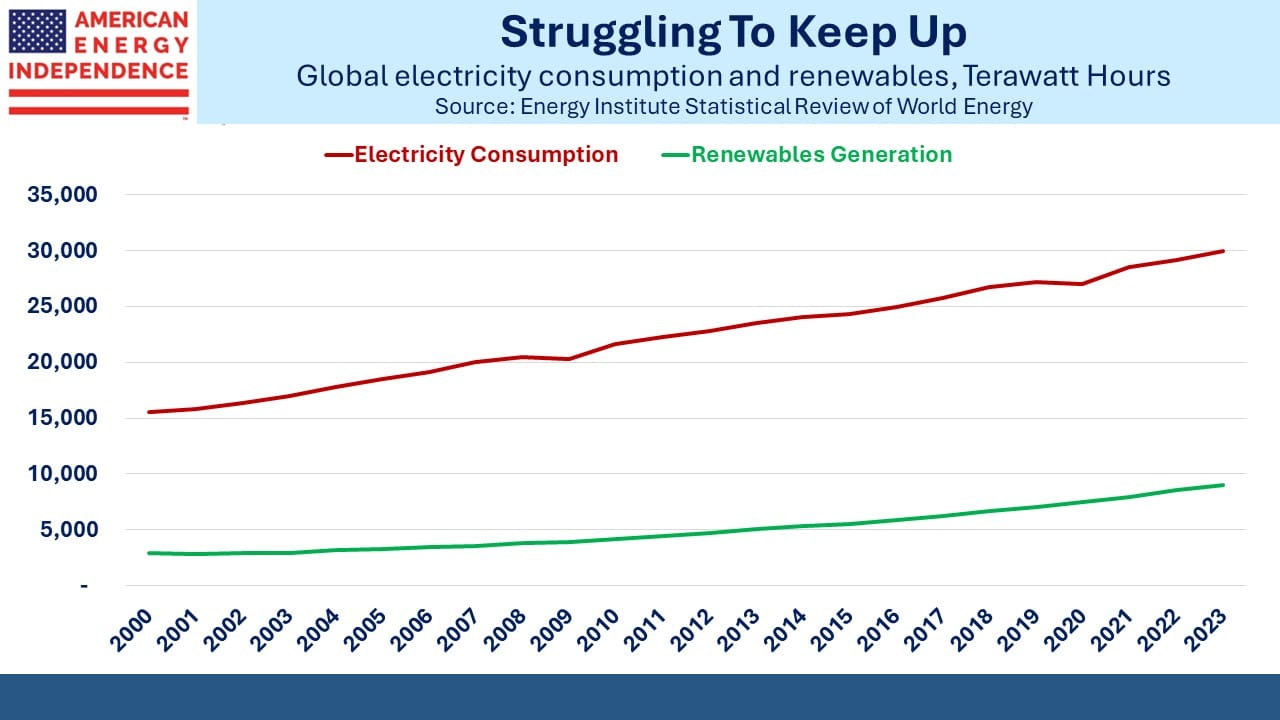

The futility of the solar/wind obsession can be seen in the chart comparing renewables generation with overall electricity. Global power consumption has grown at a 2.9% annual rate, and renewables at 5.1%. The analyst who tortures the data until it confesses what he wants interprets this as positive.

But another way to look at it is that global power demand has grown by 14,360 Terawatt Hours (TwH) and renewables by 6,124 (TwH). For all the media enthusiasm about weather-dependent energy, its growth has met less than half of the increase in global power demand so far this century.

This is why natural gas remains a great long-term bet. Policymakers may conclude that effecting a global coal-to-gas switch is a vital part of the solution. Or we may continue as we are. Both outcomes will see increased natural gas consumption.

I have this fanciful vision of the Sierra Club one day apologizing to the world for such narrow solutions while rising sea levels lap around their HQ (headline: Sierra Club Flooded). They are based in Oakland, CA, a mere 43’ above the Bay Area water, which seems imprudent given their prognostications. Or perhaps they don’t think it’s that serious, just like their policy solutions.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

would the Sierra club embracing LNG exports likely lead to US actually increasing exports of LNG to china?