AI, Trump And The Yield Curve

The other day I listened to an interview with the CEO of Anthropic, Dario Amodei, on an Economist magazine podcast. Anthropic is in AI safety and research. They write large language models for sectors including healthcare and financial services. Many people think AI will create such fundamental change that it will eliminate jobs across large swathes of the economy.

Anthropic takes their role in this type of creative disruption seriously. They even have a Philosopher-in-residence, Amanda Askell, whose job it is to think about such things. Preparing for this new world, she says that employment should not be the only way we measure our worth.

Worrying publicly about the mass unemployment the success of your company will cause may be a smart way to excite investors about your business prospects. It may also be the height of hubris at a market peak, depending on your perspective.

That AI offers enormous promise is undeniable. Healthcare stands ready for a revolution in diagnostics as AI models assimilate hundreds of millions of case histories, test results, x-rays and outcomes to encompass the medical sector’s collective experience. There can be no greater benefit to humanity than enabling longer, healthier lives.

Will such revolutionary change slash healthcare employment? Many think it will. I’m not convinced. I doubt patients will accept a diagnosis from a computer, other than perhaps for conditions that can be treated today at an urgent care center. I see AI as increasing the tools available to health care professionals. Your doctor will interpret results from a model, or perhaps multiple models. The returns to education will increase.

I don’t think AI will replace financial advisors. People are not going to trust their health or their money to an algorithm, even while the management of both will increasingly rely on professionals using these tools.

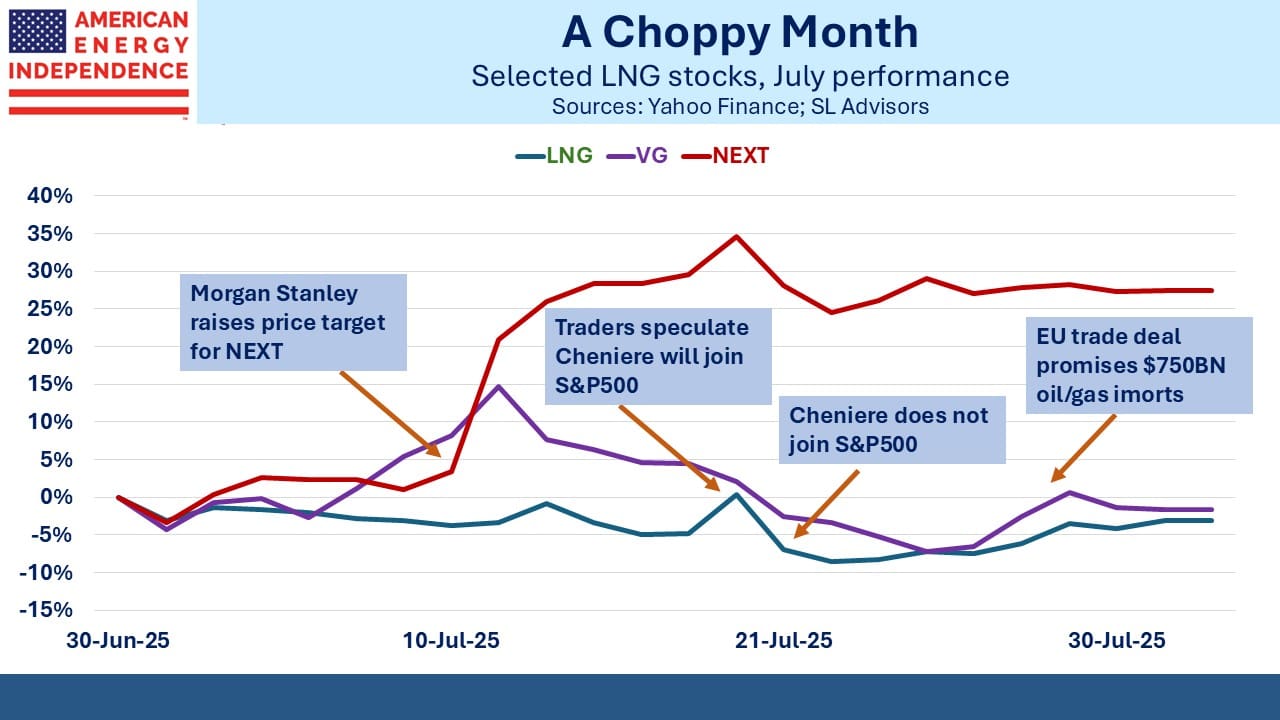

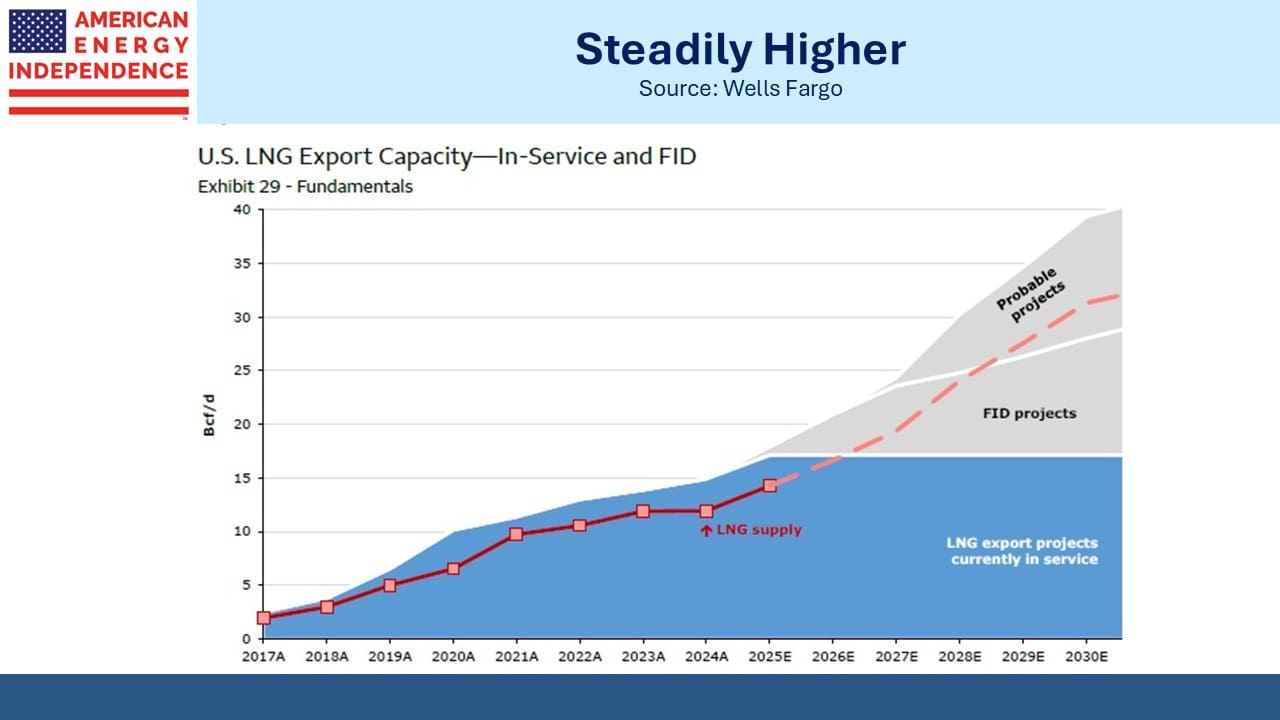

Would an AI financial advisor have overweighted AI stocks? Or LNG exposure? Any credible portfolio construction must be designed for at least one business cycle of 5-10 years. With 100-150 years of historical market data, there just aren’t enough non-overlapping time segments to train a model.

Legal risk seems a prosaic impediment to the AI revolution. Humans make mistakes all the time. When doctors or financial advisors deliver unacceptable outcomes, they get sued, but the consequences are limited to the individuals involved. These are idiosyncratic risks. If an AI model replaced a whole class of professionals, it would introduce systemic risk.

Flawed diagnostics or improper portfolio construction could impact thousands of people simultaneously. Class action lawsuits would follow, targeting the deep pockets of the software companies who built the model. Plaintiffs might even use AI to identify patterns of damaging medical care or investing.

If this seems implausible, note that Tesla just suffered a Florida jury award of $243 million for an accident in 2019 involving their autonomous driving software. Last year over 39,000 Americans died in auto accidents, overwhelmingly due to human error. People drive recklessly and make mistakes all the time.

Autonomous vehicles could cut this dramatically. Society accepts 39,000 deaths because each was caused by the idiosyncratic risk of different individuals. If Tesla’s AutoPilot cut this by 99%, lawsuits from families of the 390 remaining fatalities would bankrupt the company, even though thousands of lives had been saved. Without legal reform, the move from idiosyncratic to systemic risk will create exposures to corporations that in America’s litigious society will be ruinously expensive.

The standard of competence of an AI model needs to approach flawlessness, exceeding the average human professional by orders of magnitude.

I love how Google search results using AI are so improved and relevant. In the 1980s and 90s when I was trading interest rates, I often put on a yield curve trade in the late summer to exploit a seasonal tendency for it to flatten in the fall. I asked Google if this pattern still exists and learned it does. Old Google would have hunted for relevant websites that didn’t properly address the question. Or I would have downloaded years of historic data and spent hours building a spreadsheet to answer the question myself.

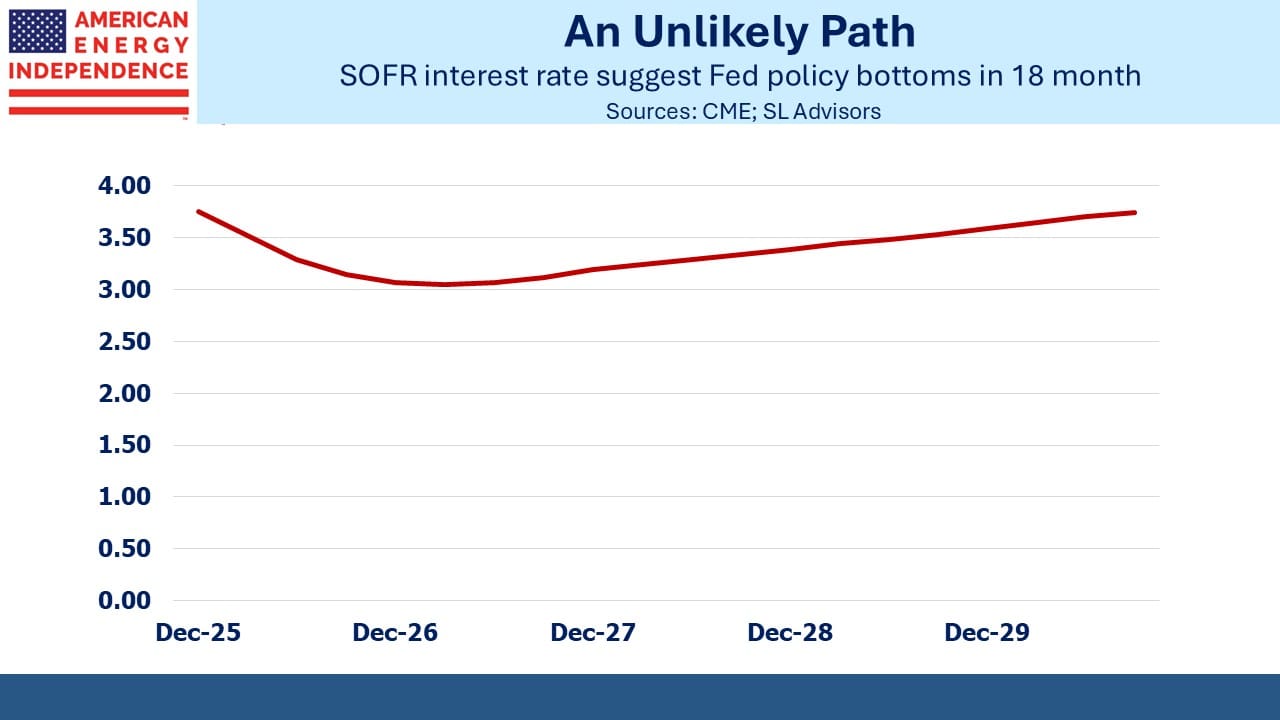

December ‘26 SOFR futures yield less than December ‘27 SOFR futures, suggesting rates will come down next year and then move up the year before the election. I think it’s more likely that rates in two years will be lower than next year.

Trump’s continued bashing of the Fed is counterproductive in the near term. Any rate reduction needs to be unambiguously supported by the data to avoid the appearance of lost independence. They’ll move slowly.

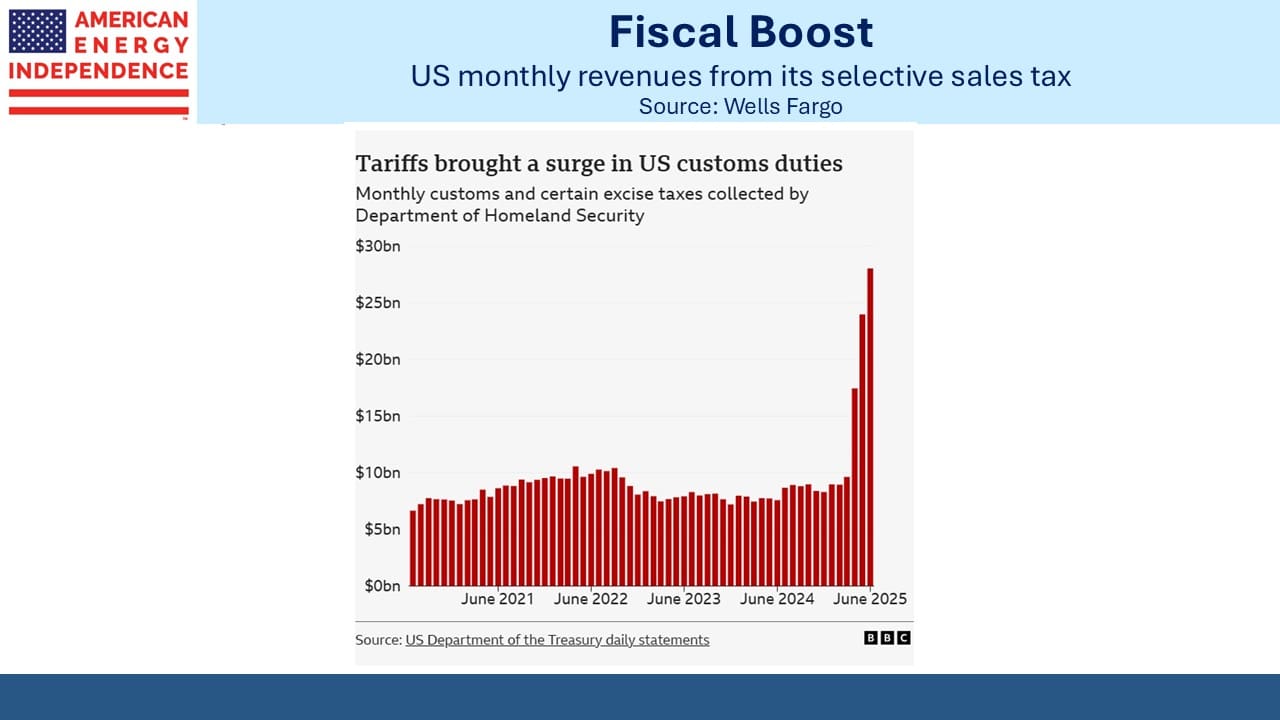

But over time Trump will probably bully the FOMC into partial submission. Tariffs and immigration policy may by then be hurting growth. Complaints that tight monetary policy is keeping US interest expense intolerably high, because we owe so much, will be more widespread.

I think the short Dec ‘26/long Dec ‘27 spread trade is worth doing.

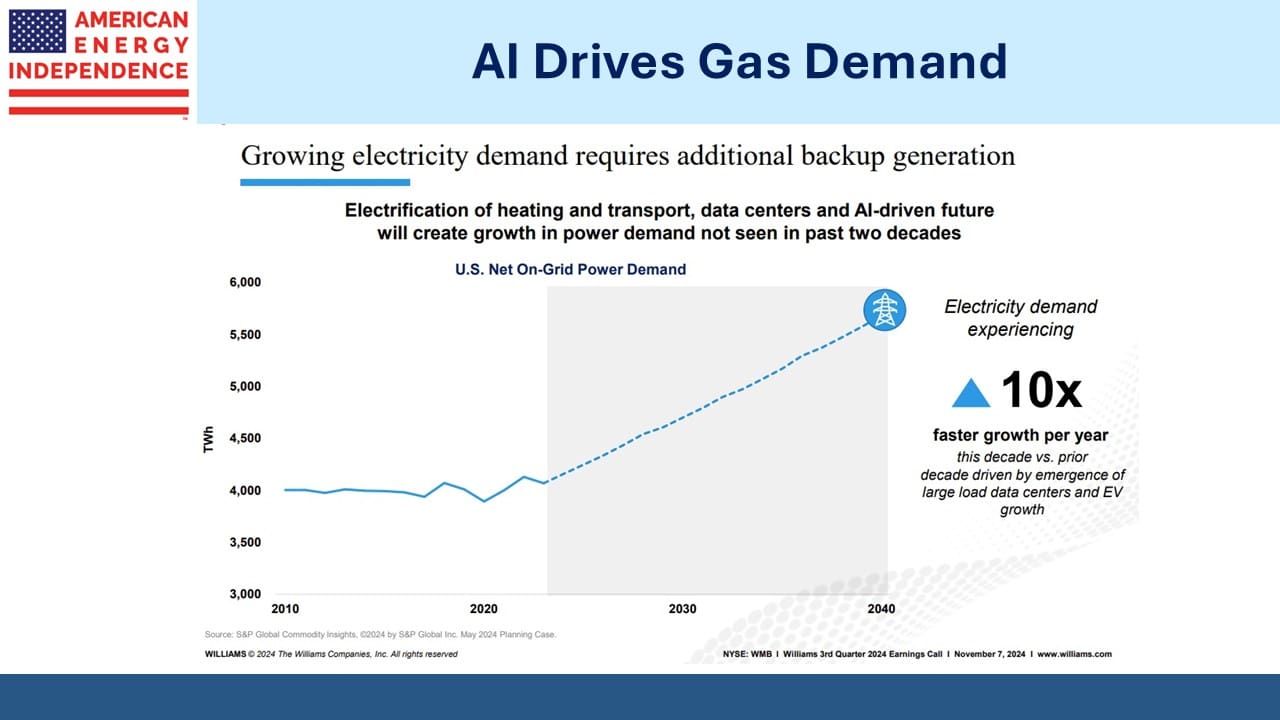

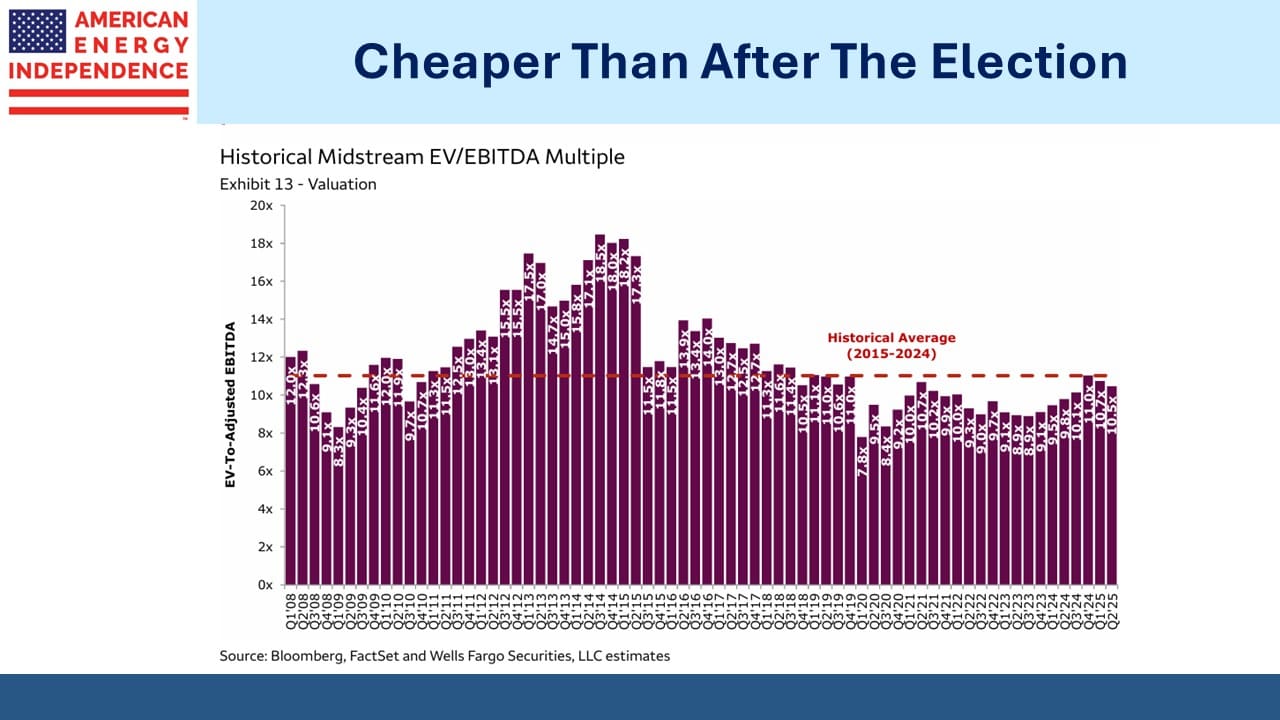

If you’re concerned about monetary policy taking more risk with inflation, as President Trump would like, you should own real assets. We think midstream energy infrastructure, with price hikes often linked by regulation to PPI, offers good protection in such a scenario.

We have two have funds that seek to profit from this environment:

Energy Mutual Fund Energy ETF