ARKK’s Investors Have In Aggregate Lost Money

Last Thursday Jim Cramer described the performance of the ARK Innovation ETF (ARKK) run by Cathie Wood as “attrocious”. This caught my attention – Cramer, whether you love him or not, doesn’t often criticize other asset managers.

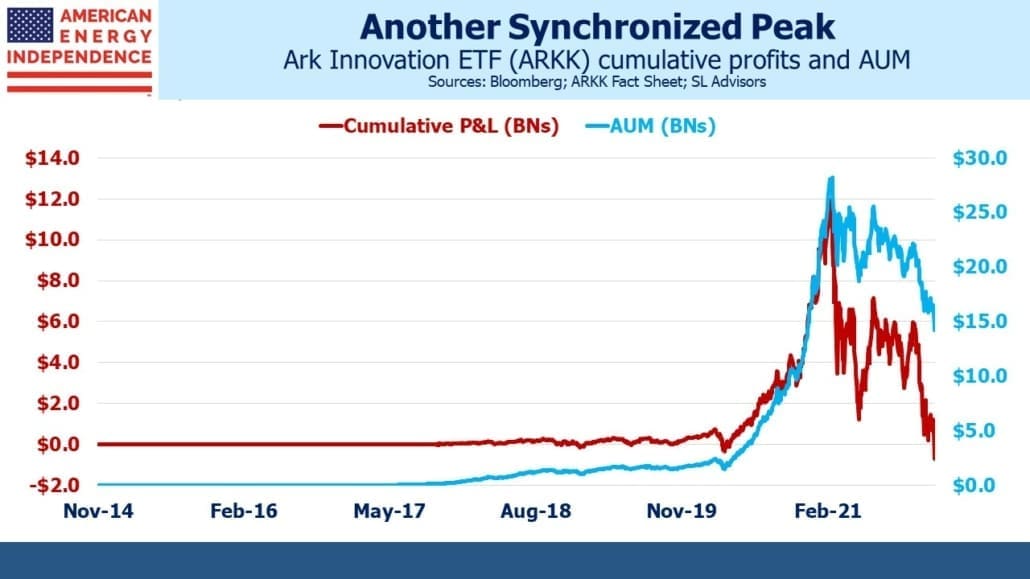

It turns out that the demise of ARKK highlights what happens too frequently in finance. To wit, because inflows to ARKK followed strong performance, as is usually the case, it turns out that the cumulative P&L on ARKK is negative. It peaked last February at just under $12BN and has been in steep decline ever since. At the beginning of this year it crossed into negative territory. The average dollar invested in ARKK has lost money.

I employed this type of analysis when I wrote The Hedge Fund Mirage a decade ago. The high returns hedge funds generated in the 1990s weren’t enjoyed by many, because Assets Under Management (AUM) was small. There just weren’t that many clients.

Flows followed performance, and by the 2008 financial crisis the hedge fund industry was big enough that in one year it lost all the earlier profits ever generated for investors. This inspired the book’s opening sentence: “If all the money that’s ever been invested in hedge funds had been put in treasury bills instead, the results would have been twice as good.”

This indictment of the hedge fund industry was justified because in its early days “absolute returns” were promised – a positive return over a market cycle. Investors were also led to believe funds would close to new capital once the manager determined deploying it would dilute returns. More common was for the most successful wealthy hedge fund managers to return ALL the capital so they could focus on their own money.

Marketing has moved on since then because absolute returns were unachievable. Good relative returns was tried but also dropped as empirical evidence found this wanting. They later settled on uncorrelated returns, and have succeeded with undiscerning investors ever since.

Even though ARKK has now joined hedge funds in generating net losses for investors, it would seem unfair to be quite as critical of PM Cathie Wood. ARKK clearly doesn’t hedge, and every manager believes their fund will generate positive returns. It’s easy to forgive circumstances beyond the manager’s control – your blogger has run an energy mutual fund and ETF for many years. It hasn’t always seemed the place to be, which is partly why performance has been so strong lately.

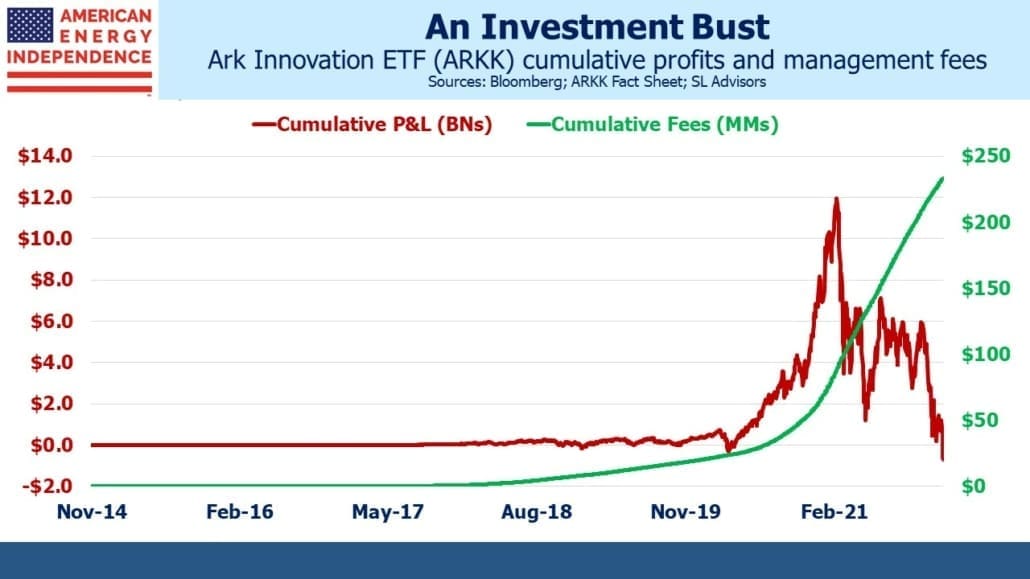

It is nonetheless sobering to compare the cumulative P&L of ARKK with the management fees earned, which we estimate at around $230 million since its 2014 launch and still piling up at around $300K per day. Clearly an investment in Ark Investment Management, LLC, the advisor to ARKK, was a much better choice than ARKK itself, just as being a hedge fund manager has been far better than being a client.

Fund managers can resolve this misalignment of interests between them and their investors by investing alongside their clients. Fluctuations in the value of my personal holdings of pipeline stocks exceed by a wide margin the returns from asset management, which is how it should be.

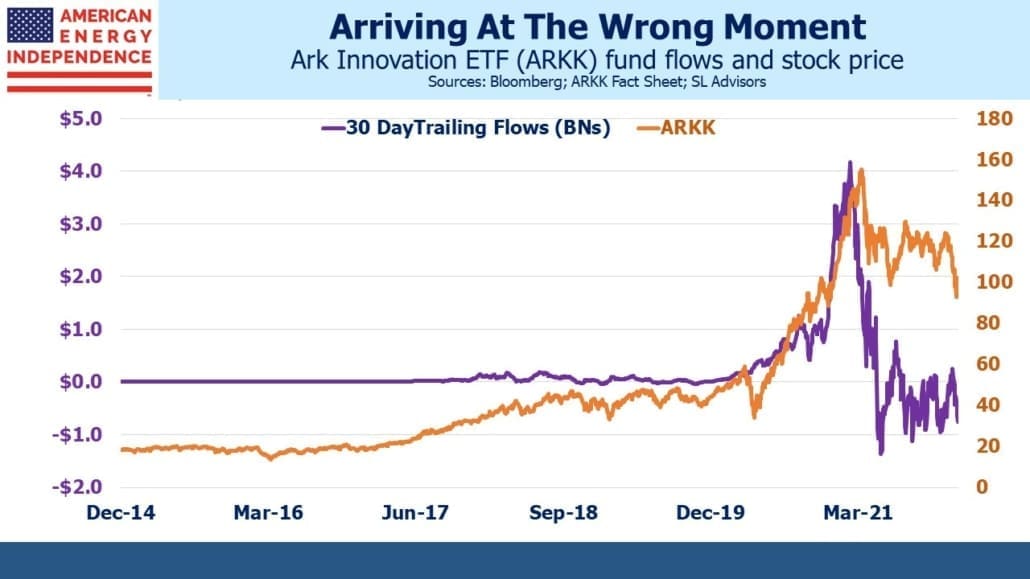

Even though the contrast between the fortunes of Ark Investment Management, LLC and ARKK is due in large part to inflows chasing performance, it’s still visually striking. A large segment of the investing public needs confirmation from others before committing their own capital.

While copying others is usually a sound approach in the purchase of most things (cars, consumer goods etc.) financial markets don’t work that way. History regularly provides examples of the folly in following the crowd. But it repeats. The timing of ARKK’s biggest inflows coincided with its peak – the moment of maximum misplaced confidence.

Morningstar doesn’t help. Even now, with a lifetime negative P&L, ARKK has four stars and is the #1 ranked fund over five years. Morningstar’s rankings are all based on quantitative data, presumably to eliminate any analyst judgment. But you might think that the trajectory of ARKK’s cumulative profits would be worth considering. It’s hard to identify much useful for investors here, although Morningstar rankings do drive fund flows which generally benefits managers.

ARKK has still handily outperformed the energy sector over the past five years. Pipelines have not drawn innovation-seeking buyers, instead appealing to more pedestrian tastes. The opposite trajectories of ARKK and energy have persisted during the boom in commodity proces and global energy crisis.

Although there’s no pleasure in seeing ARKK’s fall from grace, the shift from growth to value has benefited midstream energy infrastructure. Pipelines are also a long way from experiencing the type of manic buying that punctuated the peak in ARKK’s share price, which seems like another good reason to consider the sector.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

I’d like to thank SL for his very insightful statement from his quote in Jason Zweig’s recent article that in ..following past performance, “You can only buy future performance- which is likely to be hindered by a tidal wave of new money. The subtlety of the use of the word ‘hindered’ also shows a great sense of humor, since he might have replaced that word with ‘crushed’!

Great Regards to you.