The Energy Story’s Trifecta

/

I was chatting with an investor the other day, and he remarked that there are three powerful legs to the midstream story. They are demand growth for natural gas; attractive valuation; the incoming administration’s support for traditional energy. He felt that there’s too little appreciation of the underlying support from these three elements.

Last year the market began to appreciate the likely impact of new data centers on natural gas demand growth. Renewables remain a footnote in terms of actual US power generation. Solar and wind produce 16% of our electricity while natural gas is 43%.

We’re enjoying the Natural Gas Energy Transition because growth in production is 8X that of renewables – over the past five years, ten years and for all of the 21st century.

S&P expects data centers to add between 3 Billion Cubic Feet per Day (BCF/D) and 6 BCF/D to gas demand by 2030.

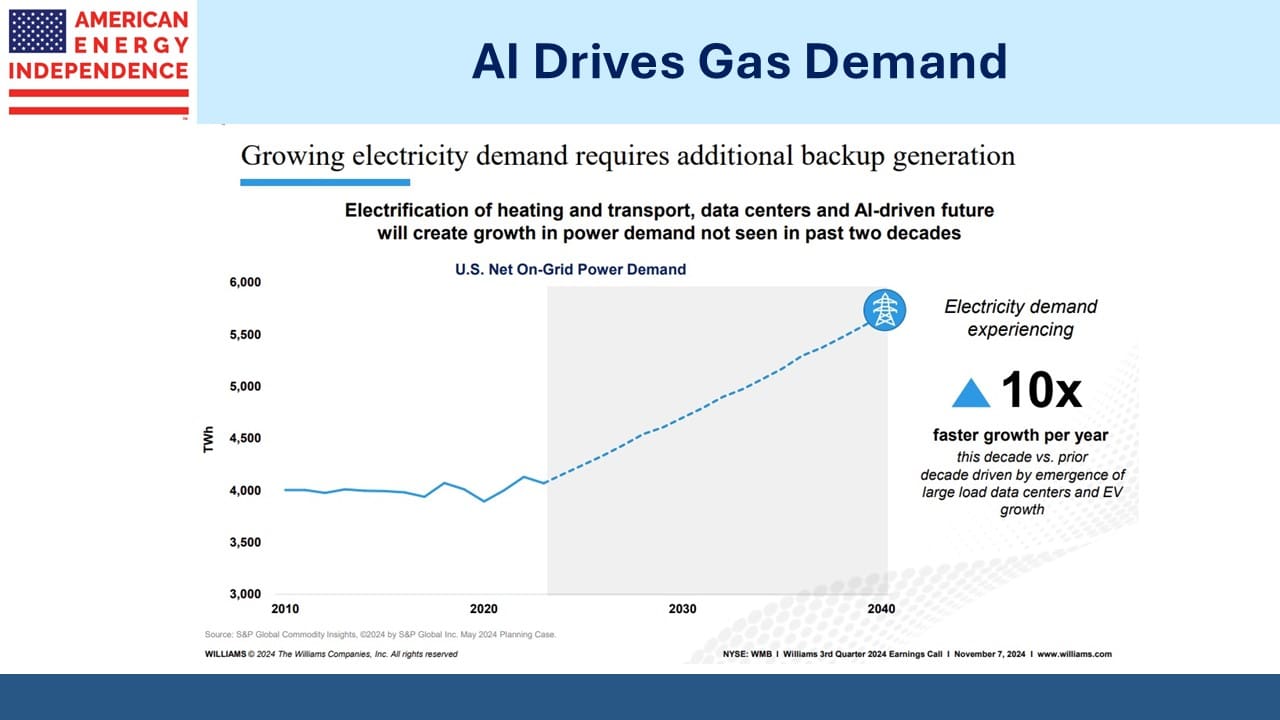

Williams Companies expects power demand to grow at 10X the pace of the past decade. Much of this will be supplied by natural gas, but even where intermittent energy plays a role it’ll require natural gas back-up because data centers don’t only run when the weather co-operates.

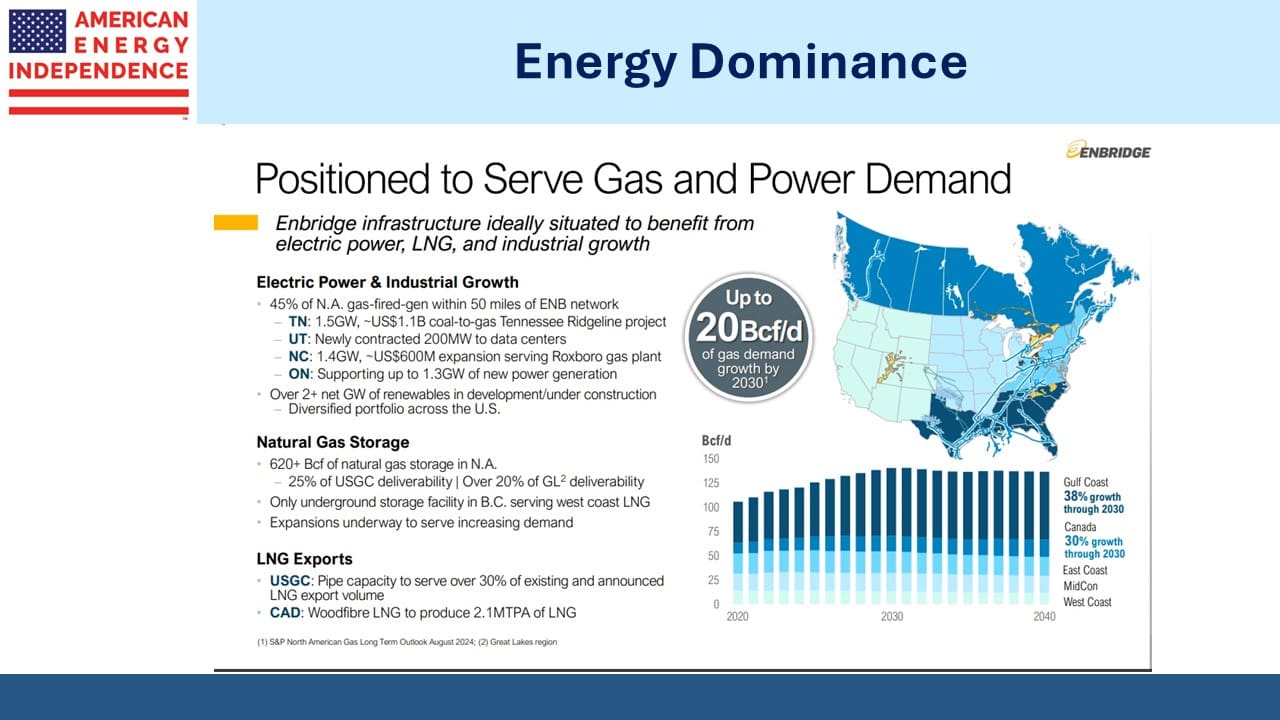

Kinder Morgan sees natural gas demand up 19% by the end of the decade (around 20 BCF/D). Increased LNG exports and pipeline sales to Mexico will add to industrial sector demand.

Canadian pipeline company Enbridge has a similar growth forecast for natural gas across North America.

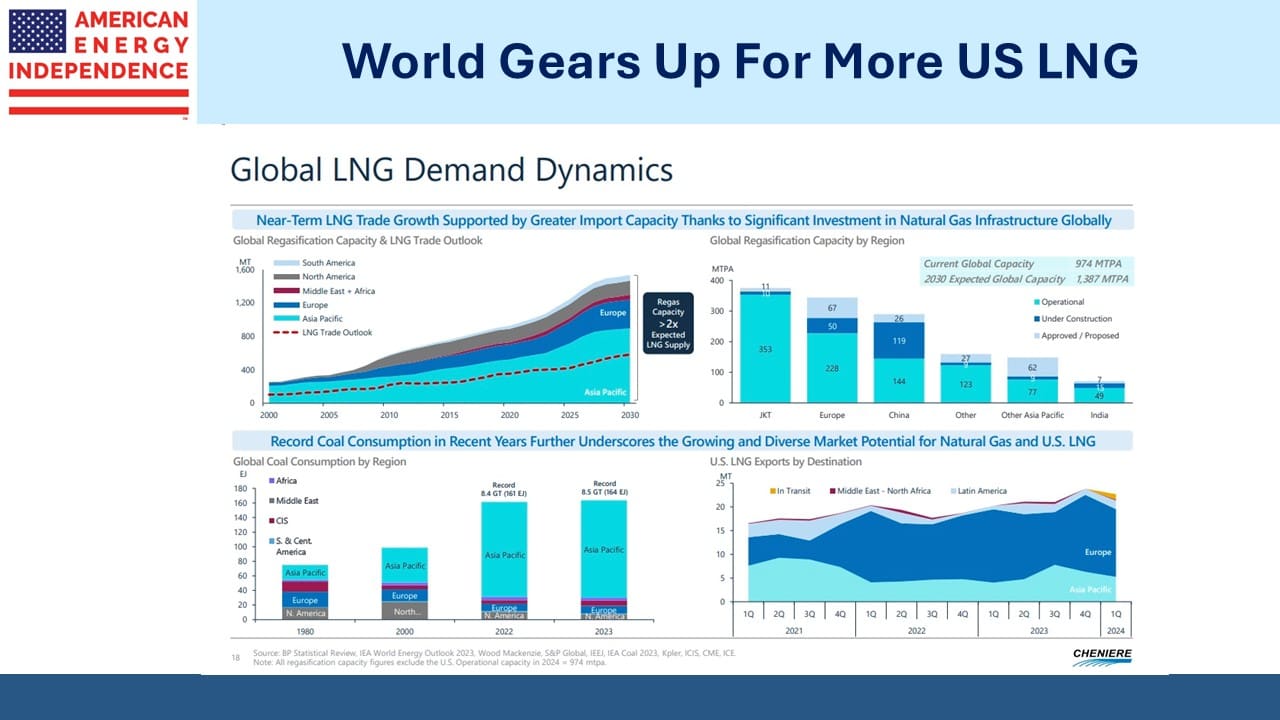

The demand for US LNG is supported by investments many importing countries have made in regassification facilities that allow them to convert gas from the near-liquid form in which it arrives by tanker back in to the gaseous form required by users.

Cheniere notes that global regassification capacity is 2X the expected supply of LNG, which shows that demand is likely to be more than equal to supply over the next several years.

The positive demand story would be unremarkable if it was reflected in high valuations for midstream stocks, but it’s not. The S&P500 trades at around 25X 2025 Factset EPS. Although valuation isn’t a good timing tool, this is historically not an attractive comparison with bonds.

By contrast, large cap pipeline stocks trade on average 10 turns cheaper at a P/E ratio under 15X (see Pipelines Are Cheap; Stocks Are Not).

Distributable cash flow yields, which represent free cash flow less maintenance capex, are over 11%, more than 3X the equivalent for the broader market.

As we often tell people, there’s no irrational exuberance present in this sector. Valuations and fund flows still exhibit excessive caution in our opinion.

Completing the trifecta, we have a new administration that is fully behind US oil and gas production. In his inauguration speech Trump even repeated “drill baby, drill.”

Chris Wright, the new Energy Secretary, brings a pragmatic and refreshing approach. He acknowledges climate change but rejects the dystopian view of progressives. He will be a strong advocate for US LNG exports which will help foreign buyers use less coal. The ludicrously partisan permit pause on new LNG export terminals will finally be lifted.

An improved regulatory environment will lower costs for E&P companies, but all signs are that increased output will need to be profitable.

US energy underpins America’s past decade of strong growth and rising living standards. As Germany has pursued its energy transformation (“Energiewende”), electricity prices have soared and manufacturing has slumped, all while global CO2 emissions have continued rising. It’s a pointless effort while China burns 55% of the world’s coal and plans to go higher.

Democrats and liberal politicians in other western countries have pursued ruinously expensive subsidies for renewables and electrification of transport while applauding China’s auto market where EVs now exceed a 50% market share. This is even though they run on coal which is their dominant source of electricity.

President Trump obviously won’t engage with China on climate change. But had he signed the Inflation Reduction Act with its $TNs of financial support for renewables, you know he would have confronted China over their emissions first.

Compelling fundamentals and attractive valuations co-exist in President Trump’s favorite sector. Energy investors got the election outcome they wanted. Some will recall that Trump’s first term in office coincided with poor returns as executives overspent and overproduced. Profits returned under Biden in spite of his leftward shift once in office.

We think Trump’s second term will be much better for energy investors than the first.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

The nonsensical permit pause on LNG export facilities has now been lifted.