Midstream Is About Volumes

/

Midstream companies are generally unaffected by the current round of daily tariff updates. Their stock prices may gyrate with the rest of the market, but nobody is revising guidance. It’s worth remembering that these are toll businesses, focused on volumes not commodity prices.

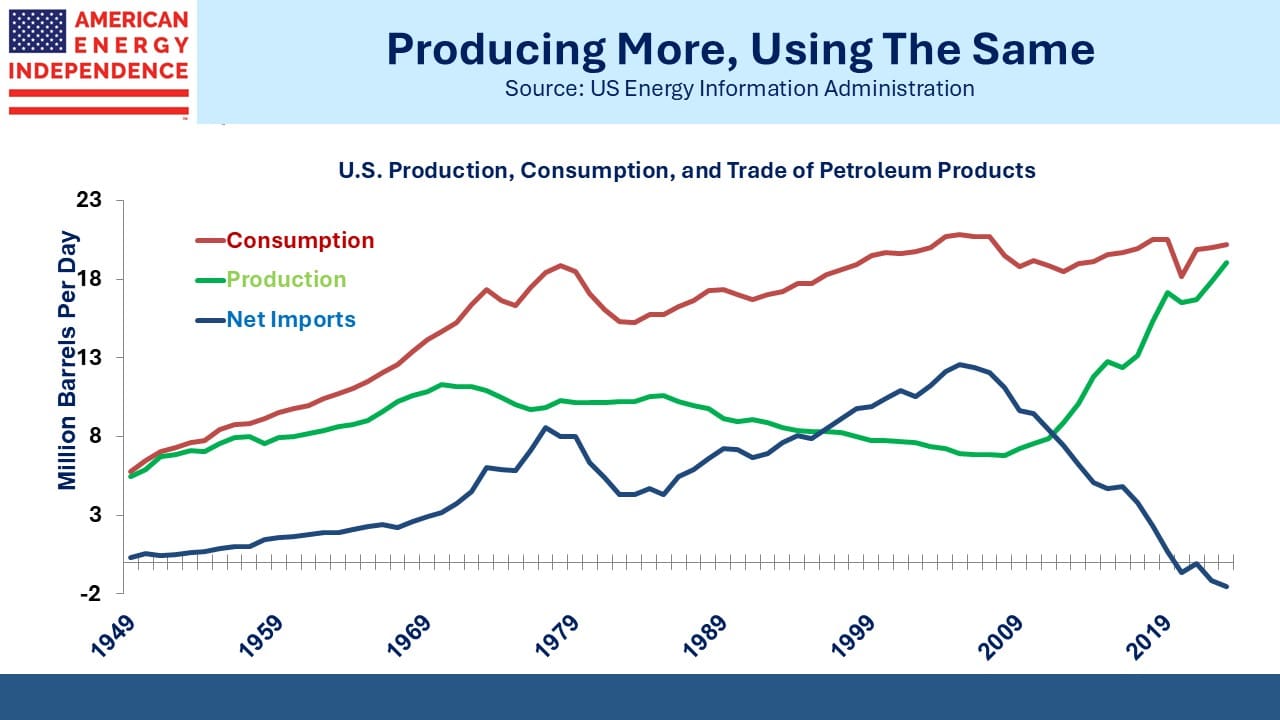

Consumption of petroleum products is remarkably stable. It’s been between 20 and 21 Million Barrels per Day (MMB/D) for the past two decades other than falling to 19 MMB/D in 2020 due to the pandemic. This remarkable stability is the result of improved energy efficiencies offsetting growth in GDP and population.

Changes in the supply/demand balance of oil are routinely absorbed by price changes. The value of what’s moving through pipelines sometimes fluctuates widely, but as the consumption chart shows, the quantity hardly budges. This is why midstream infrastructure is such an attractive sector for investors.

It’s behind the robust outlook for dividend growth. Wells Fargo increased their forecast to a sector-wide 5% increase this year. When investors ask me about long term return prospects, the 4-5% dividend yield combined with long-term dividend growth and buybacks each of 2-3% adds up to 9-10% in total. Recent sell-side forecasts suggest that cash returned to shareholders may run somewhat higher than this over the next few years.

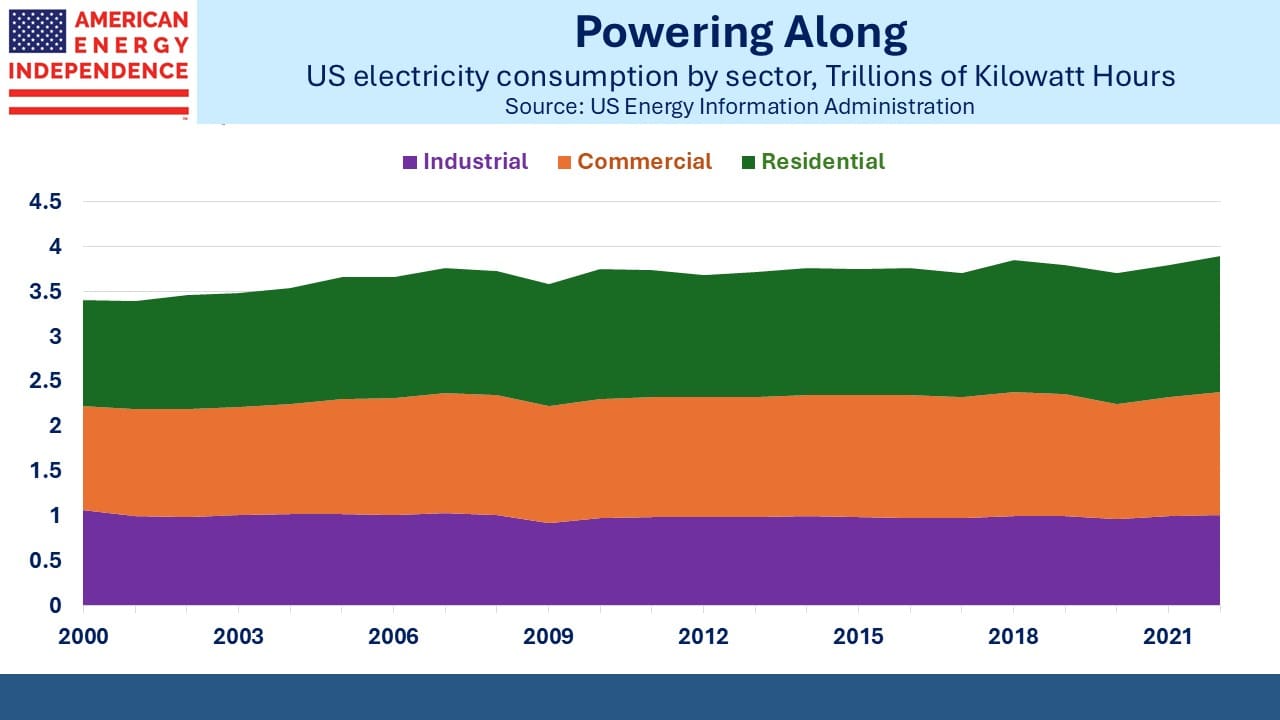

Electricity consumption follows a similarly stable pattern to crude oil, at just under 4 trillion kilowatt hours annually. It’s barely moved for over twenty years, although it will move sharply higher over the next few years because of data center demand. As with petroleum products, energy efficiency has neutralized growth in the past.

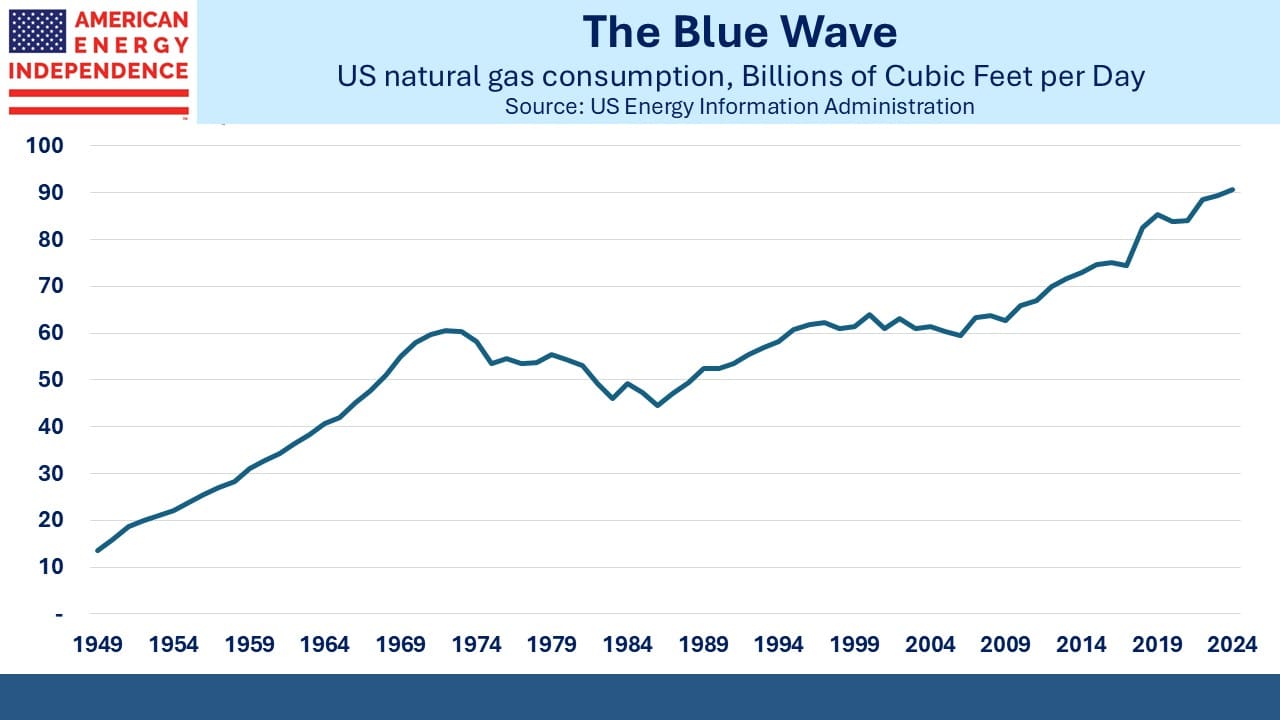

Natural gas consumption has been rising since the late 1980s. The shale revolution enabled coal to gas switching for power generation. Climate extremists agitate to keep gas in the ground, but without it US CO2 emissions would be higher. That wretched little girl Greta is fortunately sinking into oblivion while switching her attention to support Palestinian terrorists.

The 90 Billion Cubic Feet per Day (BCF/D) of natural gas consumption doesn’t include exports. We produced just over $103 BCF/D last year, with the excess going to our trade partners.

Consumption is going to continue higher because of the need from data centers for reliable power and increased LNG exports. If there’s any sensitivity to prolonged tariffs, it might be here. Signs of weaker growth have not yet curbed the capex plans of hyperscalers to invest in AI. But presumably if downward revisions to growth become meaningful data center construction may moderate somewhat.

LNG exports are for the most part underpinned by long term purchase agreements, which are often required to obtain financing to build the liquefaction terminals. The world wants more energy and the rate at which the US adds LNG export capacity will determine the volumes we send to our trade partners.

I must confess that the FT headline US backtracks on Canada-Mexico tariffs in latest sharp shift on trade left me confused – were we backtracking on softening the tariffs to include all USMCA-compliant goods, or backtracking on the hard line? In this case it was the latter, but the tariff trip is starting to feel as if there’s no strategy and a new twist on import taxes is possible every morning based on one guy’s opinion.

Check the date and time on each tariff story before considering its impact.

Venture Global (VG) has been a challenging stock for sell side analysts. On Thursday they missed expectations on Adjusted EBITDA with $688MM, but the range of forecasts was from $900MM to $2,851MM. Full year EBITDA guidance of $7.1BN disappointed the market, which was looking for $6.2-11.4BN.

JPMorgan lowered their price target from $25 to $16 and Wells Fargo stuck with $18.

Modelling VG is not yet a task of precision.

Having been uninvolved as the stock sank 60% below its $25 IPO price, we thought the EV/EBITDA multiple of 8X was a reasonable discount to best-in-class Cheniere at 11X, and made a modest investment. VG will continue to be a volatile stock.

The tit-for-tat tariffs with Canada have exposed weaknesses in New York’s energy strategy. They have shunned independence in favor of relying on exports of hydropower from Ontario, whose premier Doug Ford responded in Trumpian style by saying, “We will not hesitate to shut off their power as well.”

By next year New York City plans to rely on Canadian imports of hydro, nuclear and solar power for as much as a fifth of its electricity. This is assuming the Champlain-Hudson high voltage transmission line goes into service by then. New York’s Independent System Operator has warned of a power shortfall to the Big Apple by 2033, and by next year if Champlain-Hudson isn’t operating.

If the lights flicker in New York because of their left-wing energy policies, the White House won’t be too bothered.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!