ARK’s Cathie Wood: Getting Rich While Losing Money

/

Which is a more important measure of an investment manager’s skill – the return on the first dollar invested at inception, or the return on the average dollar?

Return since inception is widely used because it covers the longest period. If performance is reasonably consistent, both methods should tell the same story. That this is not the case is surprisingly common.

It was the motivation behind my 2011 book The Hedge Fund Mirage: The Illusion of Big Money and Why It’s Too Good to Be True in which I showed that the average hedge fund investor would have been better off owning treasury bills, even though the industry’s since inception return was good. Although hedge funds generated substantial profits, the 2 and 20 fee structure transferred most of those gains to managers.

The Hedge Fund Mirage received coverage in my favorite magazine, twice (see The Economist Once More Writes About The Hedge Fund Mirage). Since my writing aspires to be as good as theirs while inevitably falling short, I took this as the ultimate endorsement.

Several hedge fund managers told me they fully agreed with the revealed widespread mediocrity, while noting that it didn’t apply to their hedge fund. Hedge fund consultants, who make a living promoting them, were critical (see The Hedge Fund Lobbyists Fight Back). Thus was the gulf in IQ between the two groups confirmed.

The difference between the two measures of performance is explained by the fact that early hedge fund investors did well but weren’t that numerous. As new money flowed in and hedge funds went mainstream, profit opportunities became scarce under the weight of this additional capital. During the 2008 Great Financial Crisis I estimated hedge funds lost $500BN, wiping out all the profits they’d ever made. The promised delivery of absolute returns came up short.

It can be illuminating to apply this analysis elsewhere. Three years ago, I did this for a popular $15BN fund (see ARKK’s Investors Have In Aggregate Lost Money). Equity funds can lose money because of a weak market even if their stock picks are good, so some might say this is an unfair way to look at Cathie Wood’s ARK Innovation ETF (ARKK).

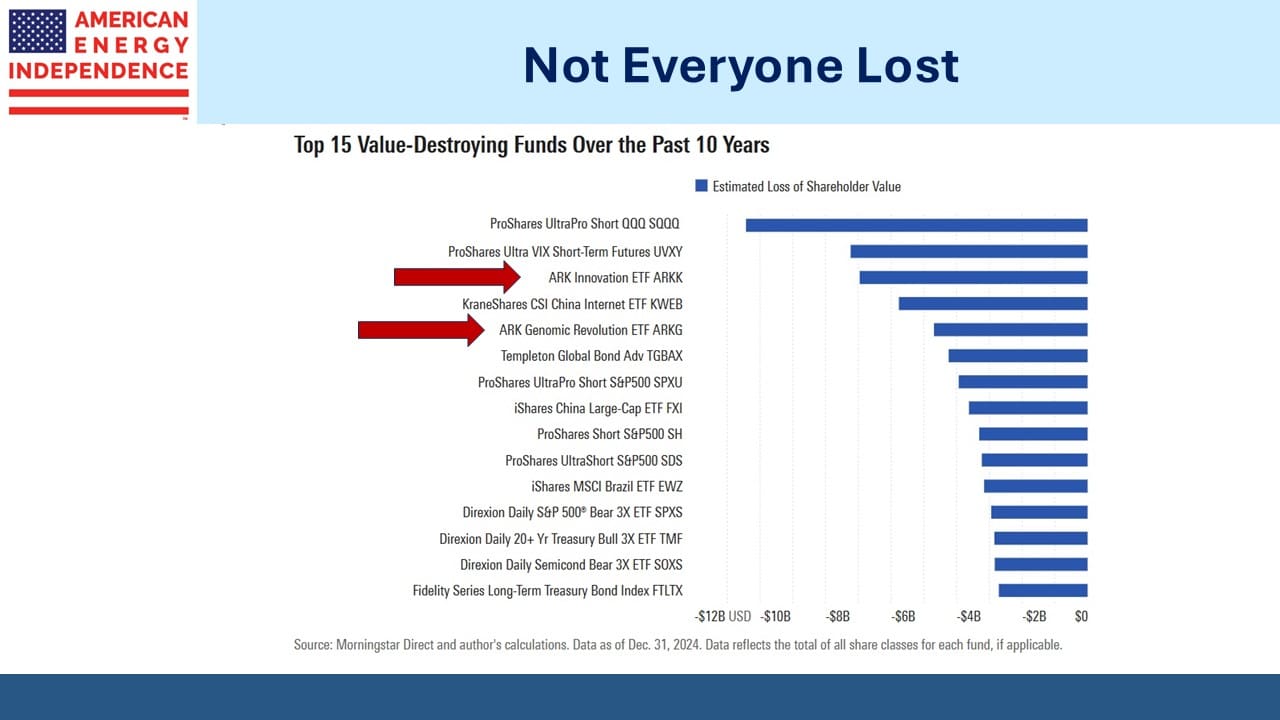

More recently, a team at Morningstar found that Cathie Wood’s firm ARK Invest tops the list of value-destroying fund families at $13.36BN over the past decade. The S&P500 returned 13.1% pa over the same period, a considerable tailwind. It seems Cathie Wood isn’t very good at picking stocks.

At this point a friend of mine who ran government bond trading at JPMorgan decades ago would helpfully say, “Simon, if you had her money, you’d burn yours.” Which is to say that the failure of her investors to avoid poor manager selection hasn’t impeded Ms Woods’ ability to become rich. Her net worth is estimated at over $250 million.

The fortunes of clients and their money manager have rarely diverged so spectacularly.

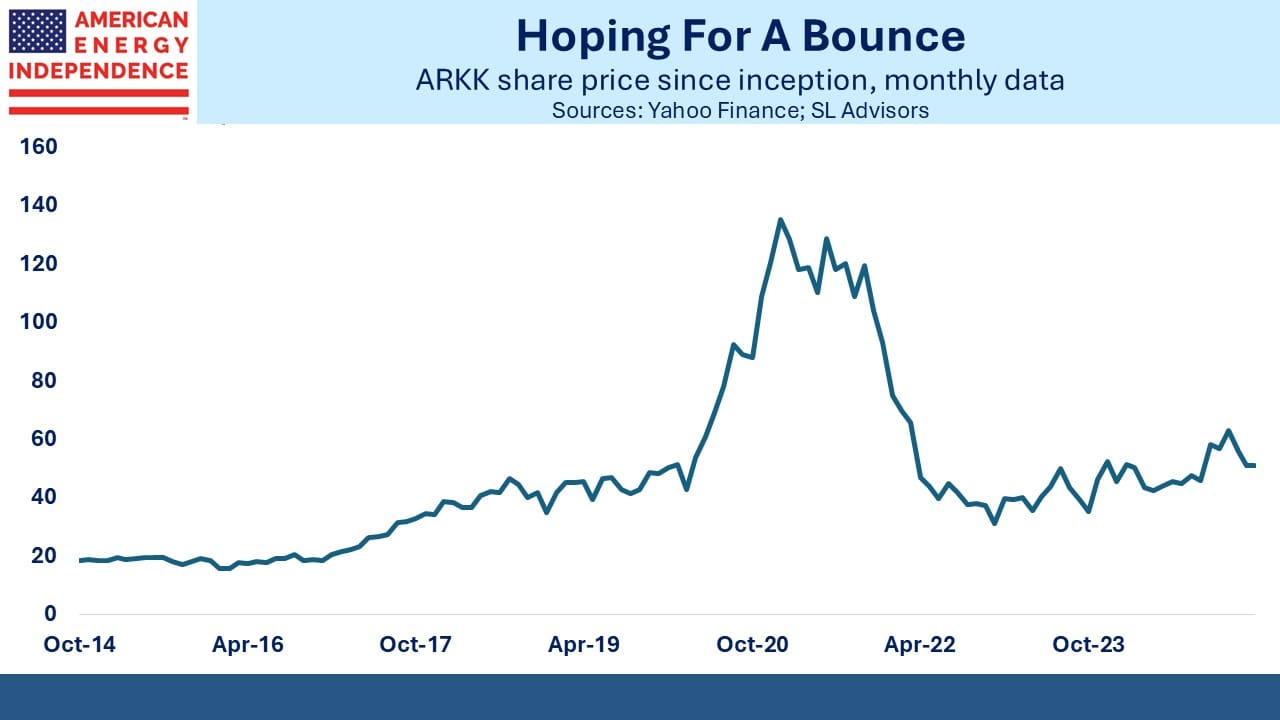

Inflows to the ARK Innovation ETF (ARKK) peaked in late 2020 following an annual performance of 152.8%. Since then, ARKK has lost over half its value.

Many of those 2020 investors are deeply underwater and are hanging on, waiting for a recovery. Inducing abject hope in your clients can be a powerful asset-retention strategy.

In other news, there are signs that opposition to reliable energy in New England might be softening. A recent conversation took place between NY governor Kathy Hochul and President Trump over the Constitution pipeline.

Intended to deliver natural gas from Pennsylvania to a hub near Albany for further distribution, Williams Companies finally threw in the towel in 2020 after four years of challenging the New York State Department of Environmental Conservation’s 2016 denial of a key water quality permit.

New York and its neighboring New England states have some of the country’s highest energy prices. This is because renewables are expensive, and they sometimes have to import liquefied natural gas. Democrats are worried that working class voters in poor Boston communities won’t prioritize climate change as highly as the college-educated progressives who drive policy.

Much needs to be agreed upon before the construction project can be resurrected. And WMB will worry that the pipeline won’t be fully utilized for its projected 30-40 year useful life if regional policy turns back against hydrocarbons.

But it was surprising that New York’s governor could have a productive conversation with Trump about any topic. Perhaps some pragmatism is intruding.

It also highlights the enduring appeal of natural gas. While US gasoline demand may have peaked in 2019 before the pandemic, natural gas consumption continues to grow along with exports. It’s why we often remind investors that the Natural Gas Transition is the only energy shift of any consequence in the US.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

would be great to write on the returns of PE? seems like there’s a bit of a mirage there too