Help With Timing Regional Conflicts

/

Dimitri Alperovitch co-founded CrowdStrike, the cybersecurity firm whose faulty software update on the Windows operating system last year led to worldwide IT failures. Alperovitch was no longer with the company, having left four years earlier to launch a nonprofit called the Silverado Policy Accelerator.

In April 2024 he published World on the Brink: How America Can Beat China in the Race for the Twenty-First Century, a thoughtful book on how the US should approach China.

World on the Brink opens with a hypothetical 2028 scenario in which China attacks Taiwan. This resonated with me more than anything else. The rest of the book chronicles the history of the west’s engagement with China, from Nixon’s visit in 1972 through the strategic ambiguity with which subsequent US presidents have spoken publicly about Taiwan.

Jimmy Carter said, “The Government of the United States of America acknowledges the Chinese position that there is one China and Taiwan is part of China.” Note that we didn’t agree with their position, simply acknowledged it. Joe Biden, when asked in 2022 if the US would defend Taiwan in one of his more lucid exchanges with a reporter, said, “Yes, if in fact there was an unprecedented attack.”

The book goes on to present thoughtful recommendations for US policymakers.

America’s long, ambiguous support for Taiwan has always struck me as not clearly in our national interest. We have a history of favoring democracies over dictatorships, but Taiwan has always complicated relations with China.

It’s like our decades-long military presence in Europe to protect them from Russia. This has passed its expiry date. US defense spending has enabled Europe’s generous government funded healthcare and a ruinously exorbitant pursuit of decarbonization, neither of which would have been possible without American troops stationed in Germany. That’s now changing.

It’s easy to see that this administration’s worldview will assess Taiwan as not worth fighting over.

In 2027 Chinese Premier Xi Jinping will probably be re-elected as leader of the Chinese Communist Party (CCP). At the age of 75, he’ll be in his third decade in power and the oldest leader since Deng Xiaoping. It’ll likely be his last term in office. While US presidents have issued carefully vague statements on defending Taiwan, Xi routinely asserts that reunification of the island with mainland China is inevitable. For the CCP, it’s only a matter of when.

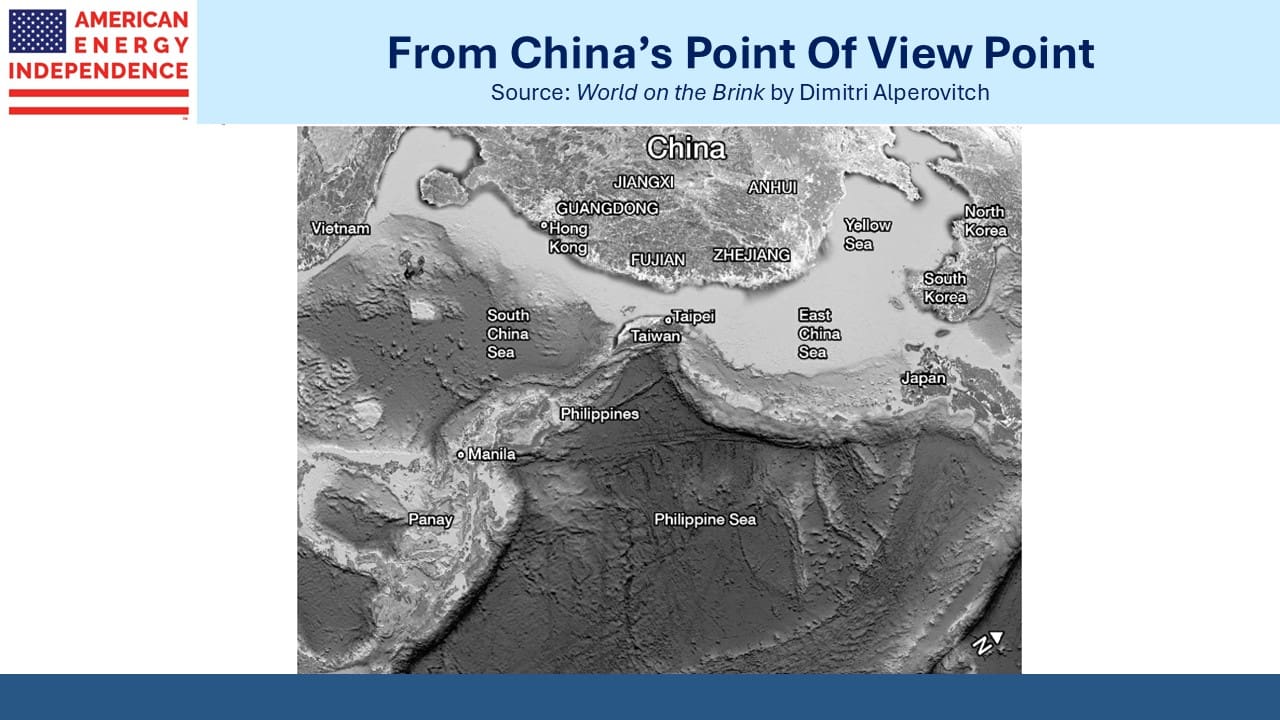

To westerners, Taiwan looks like an island off the east coast of China. But tilt the map on its side as World on the Brink does and it blocks the gap between the Philippine and Japanese archipelagos. A hostile power could limit the access of China’s blue water navy to the deep waters of the Pacific.

Alperovitch argues that late 2028, with the US presidential election leading to a domestic focus and perhaps even a contentious transition, might be Xi’s best and last opportunity.

It’s a compelling scenario. One can imagine the “If not now, when?” argument as Xi considers whether to seal his legacy with a final crowning achievement.

Most of us have no influence over US geopolitical strategy, but as investors we need to think about the potential for a major conflict like this one. Alperovitch explains why it might be closer than we think.

US foreign policy has suddenly become transactional rather than strategic. Article V of the North Atlantic Treaty which governs NATO says “…will assist the Party or Parties so attacked by taking … such action as it deems necessary.” The treaty itself leaves room for maneuver, and who doubts that any US military action will be preceded by a negotiation.

It’s not clear that Russian tanks invading Poland would be met with US boots on the ground. Taiwan has no more assurance. They look a lot like Ukraine – vulnerable to the regional superpower without their security being in the US national interest.

In the Middle East, Iran continues to develop its nuclear weapons capability. Deeply buried and dispersed, eliminating their growing missile launch capability represents a complex military challenge beyond Israel’s capability. Their only chance to take out this developing threat requires US support. Will they ever have a better opportunity than during the next four years, with a US administration that is unabashedly pro-Israel?

If not within the next three and half years, then when?

World on the Brink made me think differently about the odds of conflict over Taiwan. I now assess it as more likely than not. My partner Henry pointed out the Israel/Iran analysis and believes a US-aided attack on nuclear launch sites is virtually certain during the Trump presidency.

We don’t make a living from geopolitical prognostications. We’re not changing our investment posture. It does seem that global defense spending is on an upward path as the world adapts to America’s strategic shift.

We think domestic energy infrastructure is among the best investments you could choose at any time. Over the next four years, even more so.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Excellent commentary. Thank you for the book recommendation.