An Uncontroversial MLP Merger

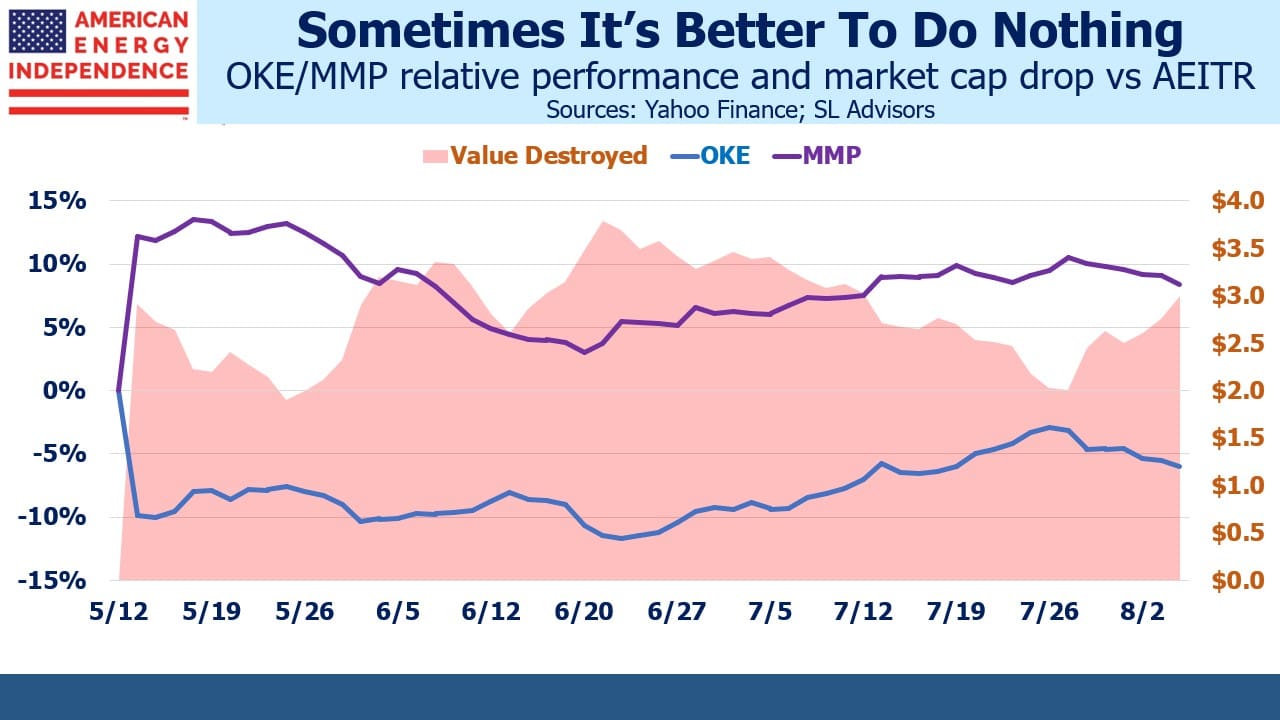

Energy Transfer’s (ET) acquisition of Crestwood (CEQP) highlights the shortcomings of the proposed merger of Oneok (OKE) with Magellan Midstream (MMP). Because ET and CEQP are both MLPs, combining the two entities doesn’t constitute a taxable event for unitholders. This contrasts with OKE/MMP where MMP unitholders will face the recapture of deferred income tax on prior distributions. The synergies in ET/CEQP are modest and achievable – likely understated given ET’s strong operating history. Projected OKE/MMP synergies were never very convincing because they handle different commodities.

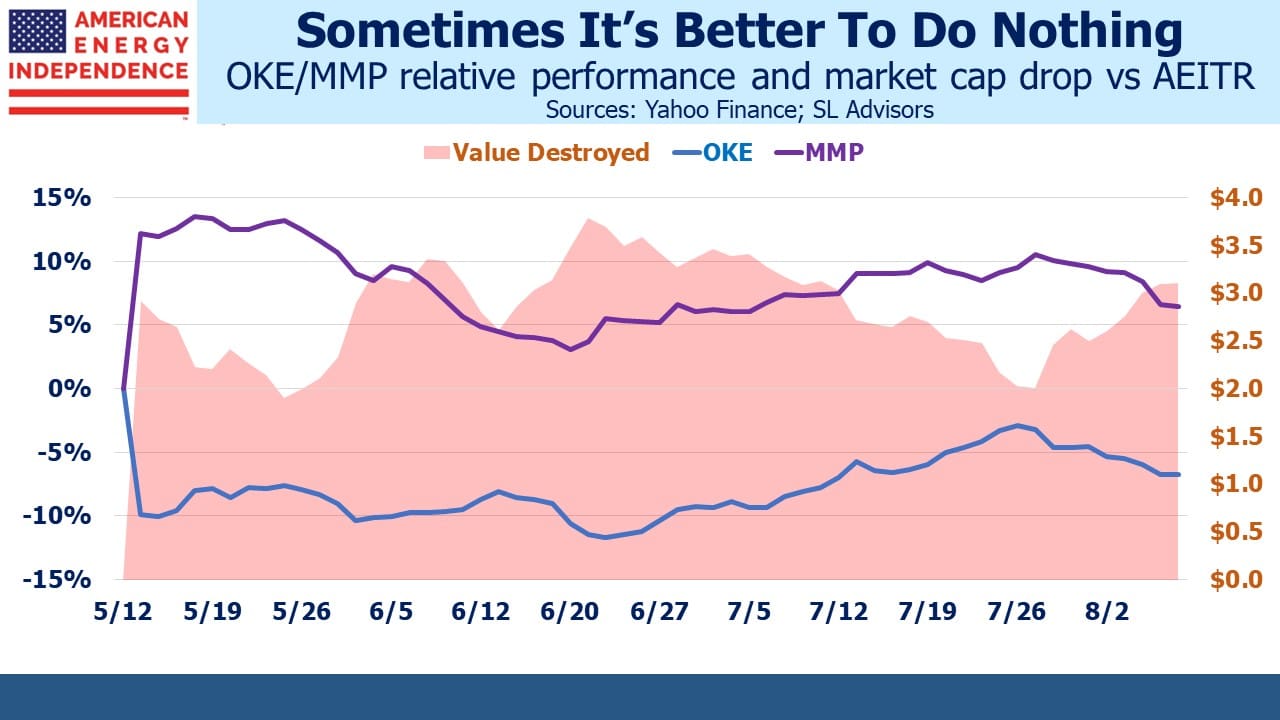

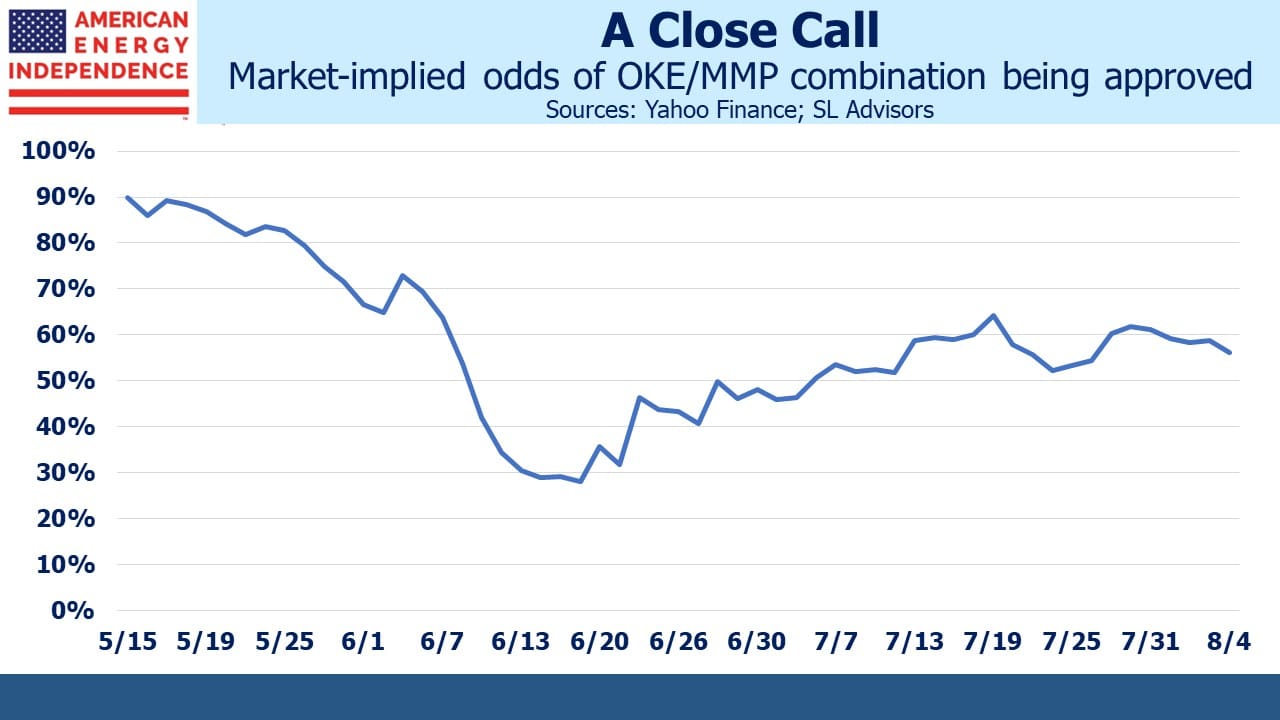

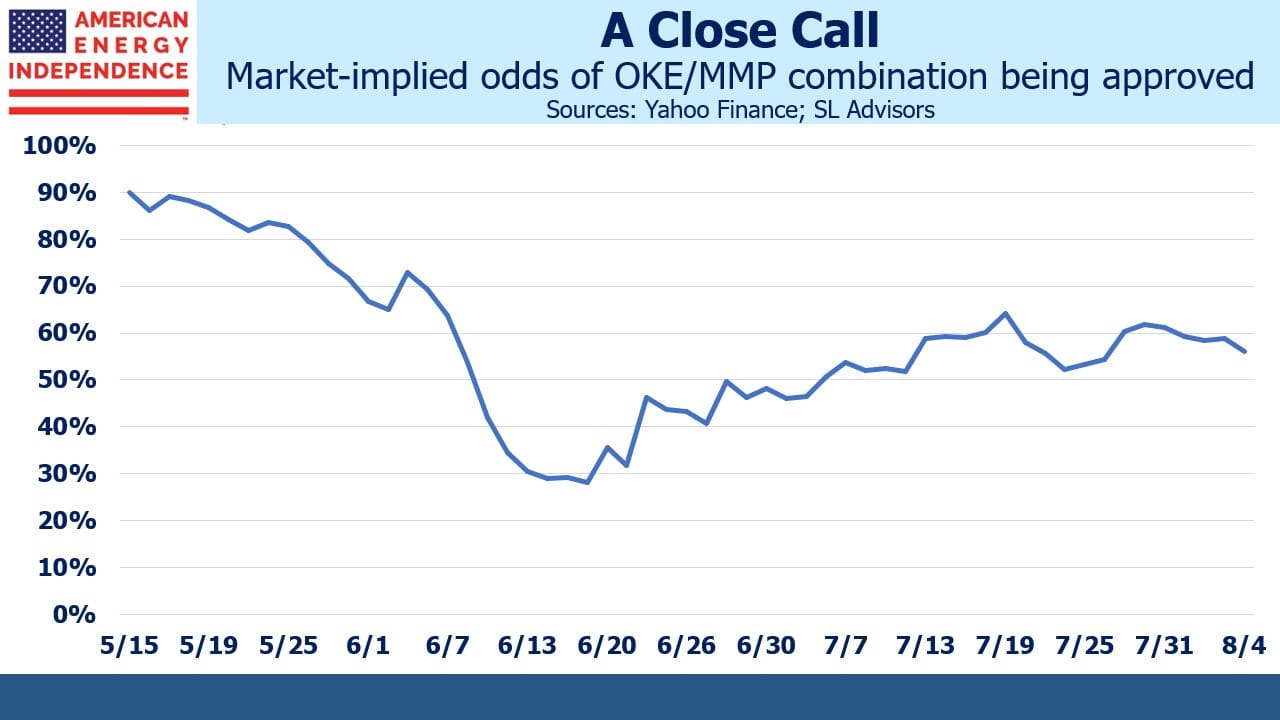

The market-derived odds of the OKE/MMP deal closing have risen recently, and it looks likely to receive shareholder approval although not ours. We calculate the odds at close to 80%, sharply higher over the past couple of weeks. Both management teams have clearly been actively making the case to institutional investors. MMP investors and their financial advisors should be ready for an unwelcome 2023 tax bill.

As we noted last week (see AMLP Fails Its Investors Again), the Alerian MLP ETF (AMLP) will suffer another loss of its rapidly depleting constituents when MMP ceases to exist as a stand-alone entity. ET’s acquisition of CEQP will remove yet another, reducing the total to twelve.

MMP is 12.44% of AMLP’s portfolio and CEQP another 5.24%. They’ll have to reallocate 17.68% of the portfolio, further concentrating their positions.

There are no good options for AMLP, but that doesn’t mean its advisor Alps won’t try something. Converting AMLP to a RIC-compliant fund by limiting MLPs to 25% of its portfolio would allow for more diversified holdings. However, this would signal to the market the sale by AMLP of three quarters of its portfolio, depressing the prices of the MLPs it owns and causing its holders great offense.

Existing investors in AMLP and any other non RIC compliant funds such as the Invesco Steelpath family are all exposed to any of their peer group funds making such a change. AMLP investors must assess the odds of Invesco moving first, and vice versa. It’s a percolating problem and at some point, a resolution will create an overhang of MLPs for sale. The smaller MLPs, favored by AMLP because there are so few to choose from, are especially vulnerable because their only other buyers are the K1 tolerant US taxable individuals that historically owned MLPs for the tax deferred distributions.

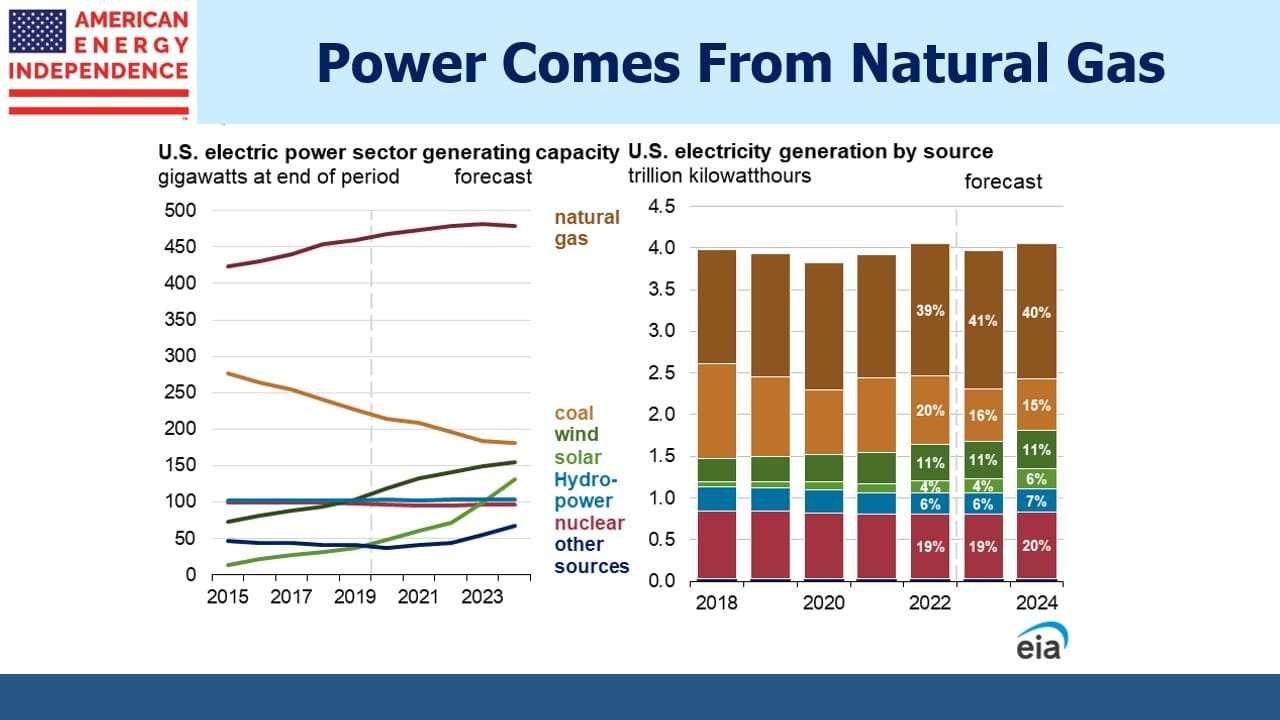

Last week the Energy Information Administration released data showing that US pipeline exports of natural gas to Mexico hit another record. Living standards in our southern neighbor are rising, which means energy consumption is too. This trend is clear across most of the developing world. Much of the world and especially poorer countries aspire to American lifestyles. Per capita energy consumption and GDP are closely linked. This is what’s driving growth in global energy consumption. Rich world OECD countries want lower emissions, and generally energy consumption isn’t rising among this group. In Germany it’s been falling, a consequence of their disastrous energy policies which are making it a less attractive location for any industry that needs reliable, reasonably priced energy.

Our southern neighbor exhibits many of these trends. Mexico’s population has more than tripled since 1960. The UN expects further population growth through 2050. More people with rising living standards mean more energy consumption. As with most countries, improving efficiency has kept consumption below these twin trends.

Mexico’s energy consumption grew at a 0.8% Compounded Annual Growth Rate (CAGR) over the past decade. This was behind Asia which averaged 2.6% but well ahead of Europe which saw –0.9%. At 0.6% the US stands out among G7 nations as the only one with growing energy consumption – cheap domestic natural gas has spurred investments in industry.

Mexican electricity generation is also growing, following a sharp drop in 2020 due to the pandemic. The CAGR for the past decade is 1.4%, a third of Asia (4.6%) but well ahead of the US at 0.5%.

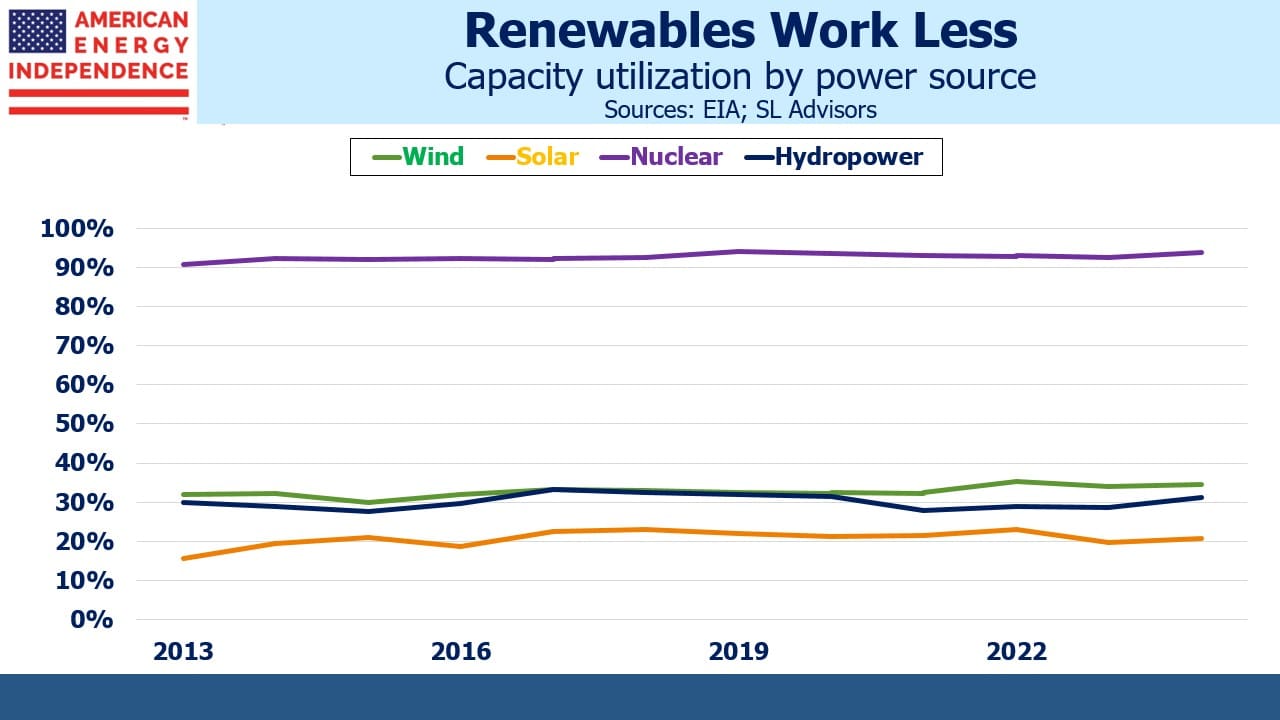

Good news for US natural gas exporters is that this remains Mexico’s biggest source of power generation at 56% last year. From 2020-22 solar and wind combined went from a 10.9% share to 11.7%. Renewables are gaining, but slowly.

US natural gas will increasingly supply global buyers as our LNG export capacity grows and consumers in developing countries enjoy rising living standards supported by increased energy consumption. The energy transition and efforts to reduce global greenhouse gas emissions will need to align with this reality.

We have three funds that seek to profit from this environment:

Energy Mutual Fund Energy ETF Real Assets Fund

![Slide1[1]](https://b3547620.smushcdn.com/3547620/wp-content/uploads/2023/08/Slide11-1.jpg?lossy=2&strip=1&webp=1)

![Slide2[1]](https://b3547620.smushcdn.com/3547620/wp-content/uploads/2023/08/Slide21-1.jpg?lossy=2&strip=1&webp=1)

![Slide3[1]](https://b3547620.smushcdn.com/3547620/wp-content/uploads/2023/08/Slide31.jpg?lossy=2&strip=1&webp=1)

![Slide4[1]](https://b3547620.smushcdn.com/3547620/wp-content/uploads/2023/08/Slide41.jpg?lossy=2&strip=1&webp=1)

![Slide5[1]](https://b3547620.smushcdn.com/3547620/wp-content/uploads/2023/08/Slide51.jpg?lossy=2&strip=1&webp=1)

![Slide6[1]](https://b3547620.smushcdn.com/3547620/wp-content/uploads/2023/08/Slide61.jpg?lossy=2&strip=1&webp=1)

![Slide1[1]](https://b3547620.smushcdn.com/3547620/wp-content/uploads/2023/08/Slide11.jpg?lossy=2&strip=1&webp=1)

![Slide2[1]](https://b3547620.smushcdn.com/3547620/wp-content/uploads/2023/08/Slide21.jpg?lossy=2&strip=1&webp=1)