Renewable Energy Doesn’t Mean Clean

/

A wood-burning fireplace on a cold day is a welcoming sight. The crackle and smell of combusting organic matter has provided a place for humans to bond for millennia. Coal replaced wood as the developed world’s chief source of energy in the 19th century. Because of this some feel a misplaced sentimental attachment to burning firewood. Environmental extremists pursue policies intended to return living standards to pre-1850, before the onset of the industrial revolution with its increase in anthropogenic (ie human-generated) CO2. So it’s not surprising that they’d favor that era’s main energy source.

Coal displaced wood for fuel because it was more efficient. Coal is more energy dense, so generates more BTUs by weight. The ratio depends on the type of coal and wood being compared, but 2X is a fair approximation.

Wood also generates lots of fine particulate matter. That fireplace is cozy, but it’s also a toxic environment. The US Environmental Protection Agency warns of the dangers presented by wood smoke, especially indoors. It’s a big source of pollution and respiratory problems across Africa and in other developing nations where wood is commonly used for cooking and heat. The UN has initiatives aimed at reducing the pollution and CO2 emissions from poor families using wood.

There is plenty of evidence that burning wood is bad for the planet. Left-leaning outlets such as NPR and the UK’s Guardian have been critical.

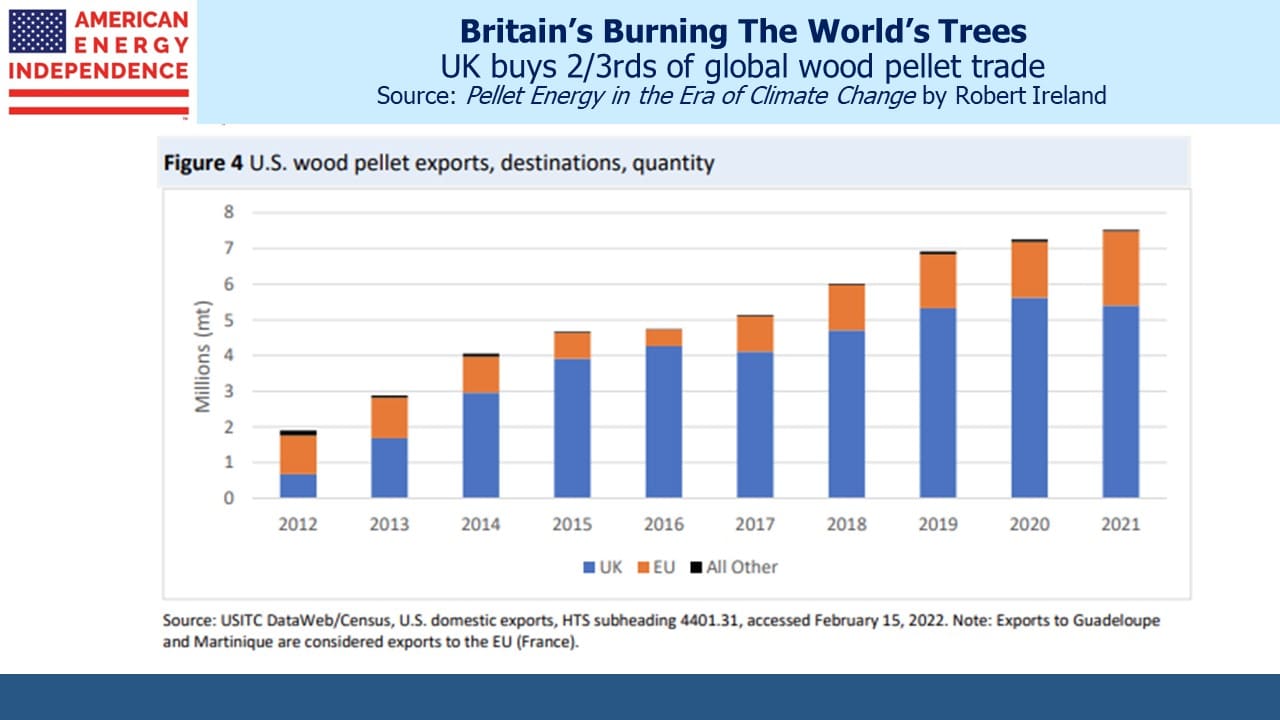

Nonetheless, the world is burning more wood to generate power, especially in the UK and EU. Fuzzy math in accounting for the CO2 generated from using wood pellets to produce electricity classifies it as clean energy. This means their CO2 emissions aren’t counted. The US is the largest exporter of wood pellets, often sourced from forests in the south east. Canada is #3. The UK is by far the largest importer.

The companies that produce and consume wood pellets seem to be exploiting a hole in the EU’s climate change policies (known as RED II).

Wood pellet producer Enviva argues that wood pellets are produced from fallen branches that would otherwise sit on the forest floor and decay, or that only trees cut down for “thinning” a forest are used. But drone footage and Enviva’s public filings show that they’re using freshly cut trees.

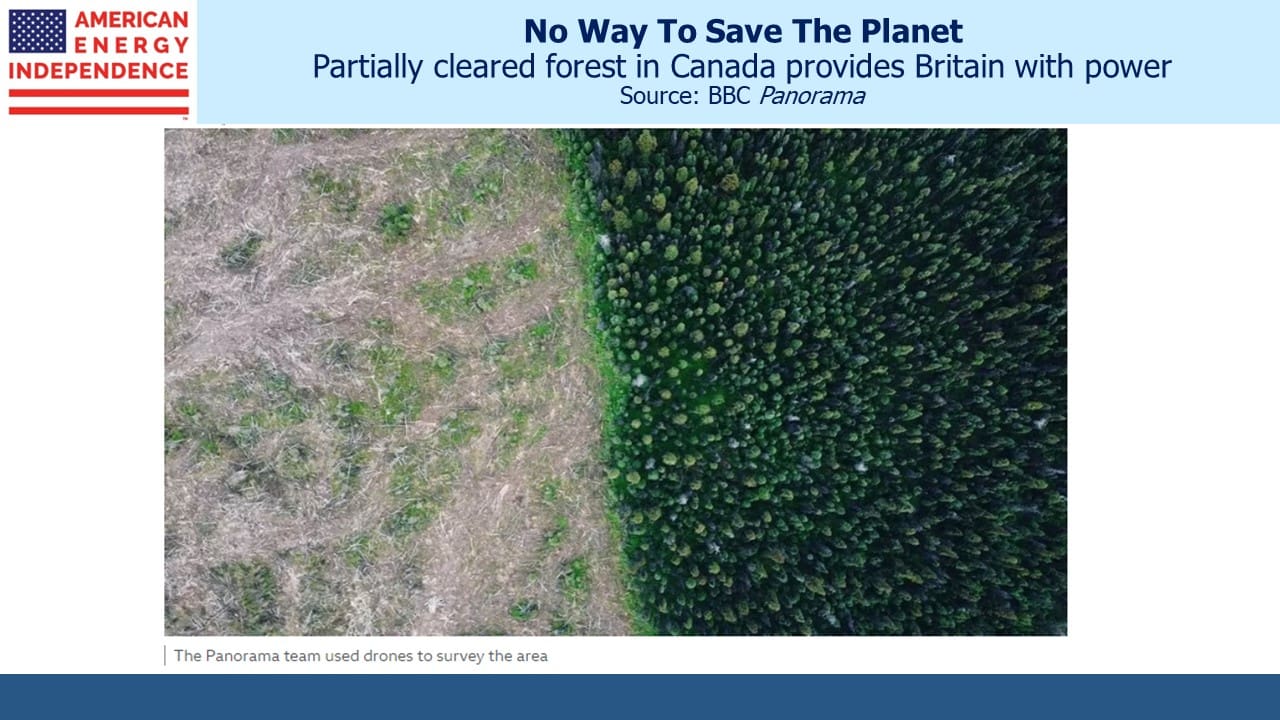

Drax runs the UK’s biggest power station, and thanks to £6BN of UK taxpayer subsidies converted a coal burning power plant to run on wood pellets that provide 12% of the UK’s “renewable” electricity. A BBC documentary found that Canadian forest was being cleared and used for wood pellets.

Trees are nature’s way of absorbing CO2 – research shows that global CO2 levels fluctuate with the seasons. A felled tree stops absorbing CO2, and burning it releases the CO2 it held. Apologists argue that by replanting new trees in the same forest they’ll suck those emissions back in. But researchers at the Massachusetts Institute of Technology have concluded that not only does wood burn dirtier than coal, it takes at least 44 years for replanted trees to absorb the carbon released from burning the ones they replaced.

It seems so obvious that chopping down trees to produce electricity is a dumb idea. Because trees grow back again wood pellets are classified as renewable. That doesn’t mean they’re clean. But since the EU and UK have legal requirements to lower emissions, they’re resorting to slick accounting because solar and wind aren’t going to do it.

It’s too early to say whether the Inflation Reduction Act’s subsidies for biofuels (the catchall within which wood pellets sit) will encourage the same perverse policies the UK has pursued here in the US.

Sometimes it seems as if the lunatics are running the asylum.

My thanks to good friend Mike Shinnick of Naples, FL for bringing this topic to my attention.

Kinder Morgan (KMI) reported earnings last week. They were ho-hum. The quarterly dividend was raised by 2% to $0.2825. A decade ago then-CEO Rich Kinder reacted angrily to criticism from Kevin Kaiser, then at Hedgeye. But within a couple of years they slashed the dividend from $0.51 to $0.125. KMI has an attractive 6% yield because they have a long and mediocre record of capital allocation, which is why the dividend is only slowly recovering.

However, in the press release current CEO Steve Kean, who will soon step aside for CFO Kim Dang, commented on the continued failure of Congress to deal with reforming infrastructure permitting. Kean added that the difficulty in building pipelines in America, “…increases the value of our existing natural gas pipeline systems, which results in a favorable recontracting environment.”

The continued delay in completion of the Mountain Valley Pipeline is frustrating Senator Joe Manchin and is the best example of what’s broken. However, the environmental extremists whose court challenges are the cause are unwittingly increasing the value of existing infrastructure. This is another reason why it’s a good time to be a pipeline investor.

Climate extremists aren’t always deep thinkers in the policies they pursue, but they’re not all bad. If you meet one, give them a hug and offer a drive to their next protest.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

The discussion of wood was fascinating and depressing. How are idiots so influential?