So Many Pessimists

/

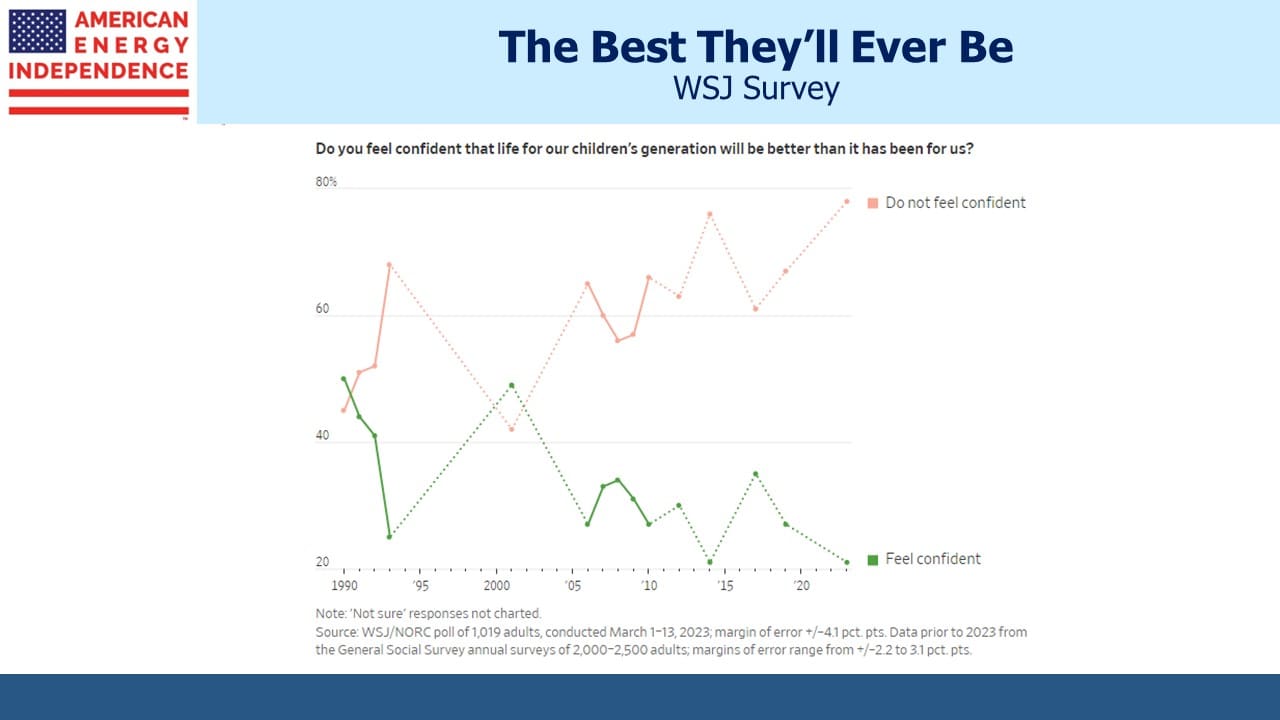

Why are people so negative? A recent WSJ article included results to the yes/no question: “Do you feel confident that life for our children’s generation will be better than it has been for us?”

78% of respondents said no. They think the next generation will be worse off. This is the most negative reading in over thirty years of the question being asked. America is a nation of positive, can-do people. I knew that when I moved here 41 years ago. In Britain, where I grew up, the response to challenges is often one of resignation. In America we get mad – like in the 1976 movie Network. “I’m as mad as hell, and I’m not going to take this anymore!”

By objective measures such as incomes and longevity the next generation has been doing better than prior ones for at least the past couple of centuries. To expect this to change is to bet against a well-established trend.

It’s possible to interpret the answers differently. The four fifths who think the next generation will be worse off than us may be so giddily happy with present circumstances that any further improvement is inconceivable. This is being negative in a positive way, and if true would reflect a warm, optimistic outlook.

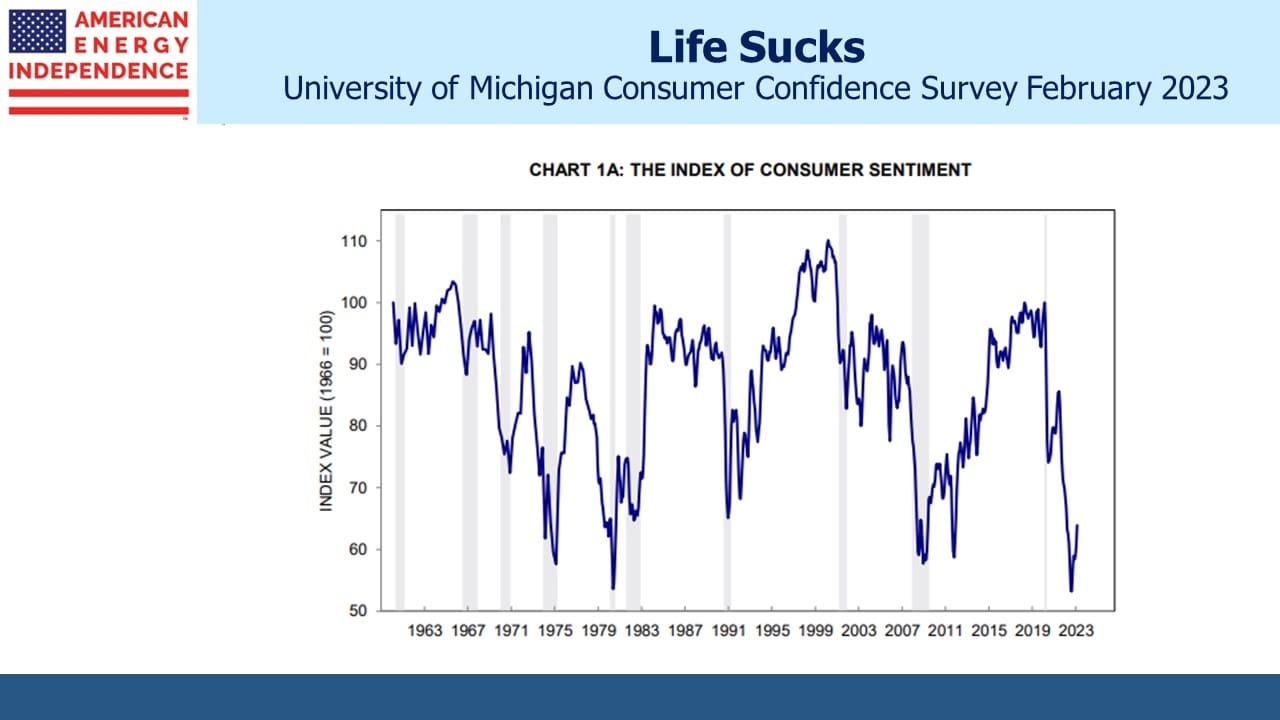

But it’s not supported by other surveys. For example, the University of Michigan index of consumer sentiment goes back to the 1950s and is very negative. The more plausible interpretation is that many people feel life sucks and it’s going to get worse.

Why do people feel like that? Jobs remain plentiful. We’re not at war. The pandemic is over. Things have been worse. Inflation has lowered real living standards, but it’s declining without the economy falling into the perennially forecast recession.

Maybe it’s our increasingly partisan politics which affords extremists in both parties outsized influence.

In March 2020 the pandemic was unfolding. We didn’t know how deadly it might be and dire comparisons were made with the Spanish flu of 1918. We were under the tyranny of lockdowns. Equity markets, especially energy, were collapsing. That was a moment when negative feelings about the future were understandable.

And yet, consumer sentiment was higher than it is now.

Economically, America is hitting it out of the park. The Economist gushes that, “The world’s biggest economy is leaving its peers ever further in the dust.” We’re 58% of G7 GDP compared with 40% in 1990. Even though China has grown enormously, our share of global GDP is roughly unchanged over the same period. Average incomes in Mississippi, America’s poorest state, are higher than in France adjusted for purchasing power. Tell anyone who thinks the American economy is in poor shape that they could be worse off – they could live in the EU.

The 2008 Great Financial Crisis, 1990-1 first Iraq war and recession and the 1979 Iranian capture of US embassy staff were all times when consumer sentiment was understandably negative. People feel as downbeat as at those times, if not more so.

Maybe we just expect more out of life.

Among our family archives is a series of letters sent from the field hospital in northern France where my great grandfather, Harry Lack, lay dying of wounds during World War I in 1917. The letters were sent by the head nurse to my great grandmother, recounting how fondly her husband was talking about her and their baby boy. 84 years later I read them for the first time sitting next to my grandfather, who never met his father. Consumer sentiment wasn’t measured then, but low readings wouldn’t have been shocking.

There have been plenty of times in American history where the outlook wasn’t as bright as it is today.

The Economist warns that “…the more that Americans think their economy is a problem in need of fixing, the more likely their politicians are to mess up the next 30 years.”

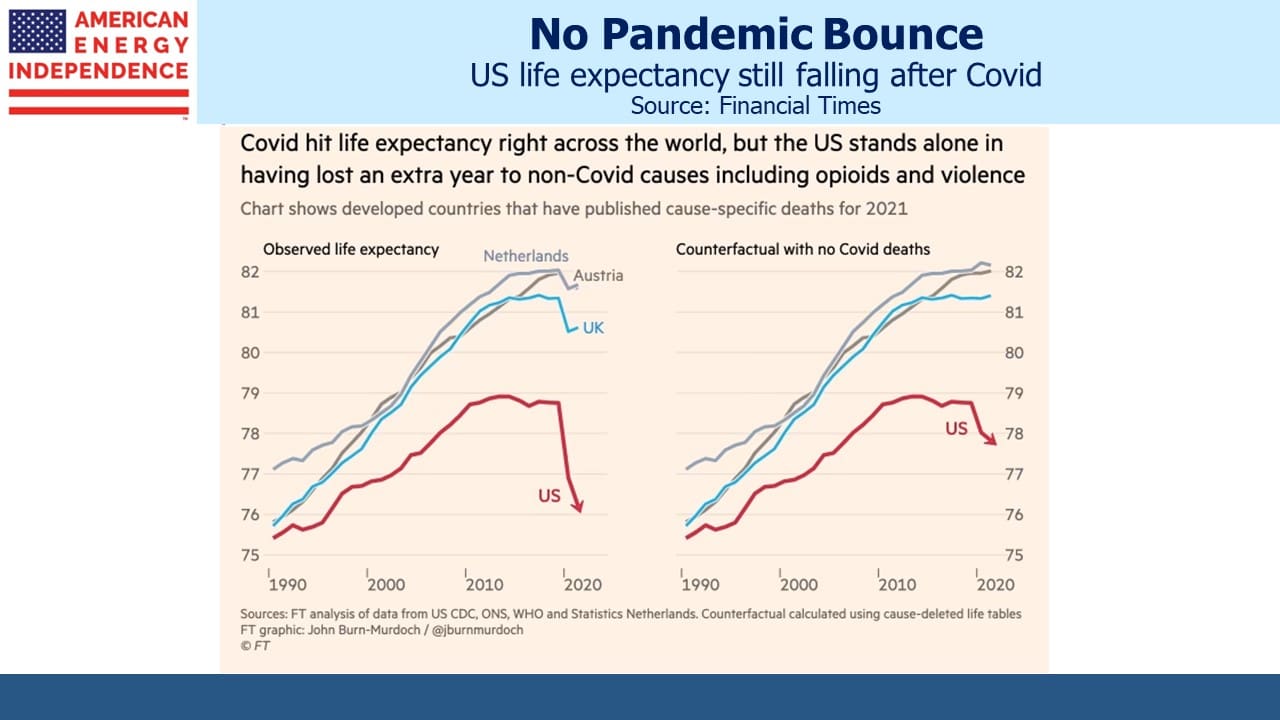

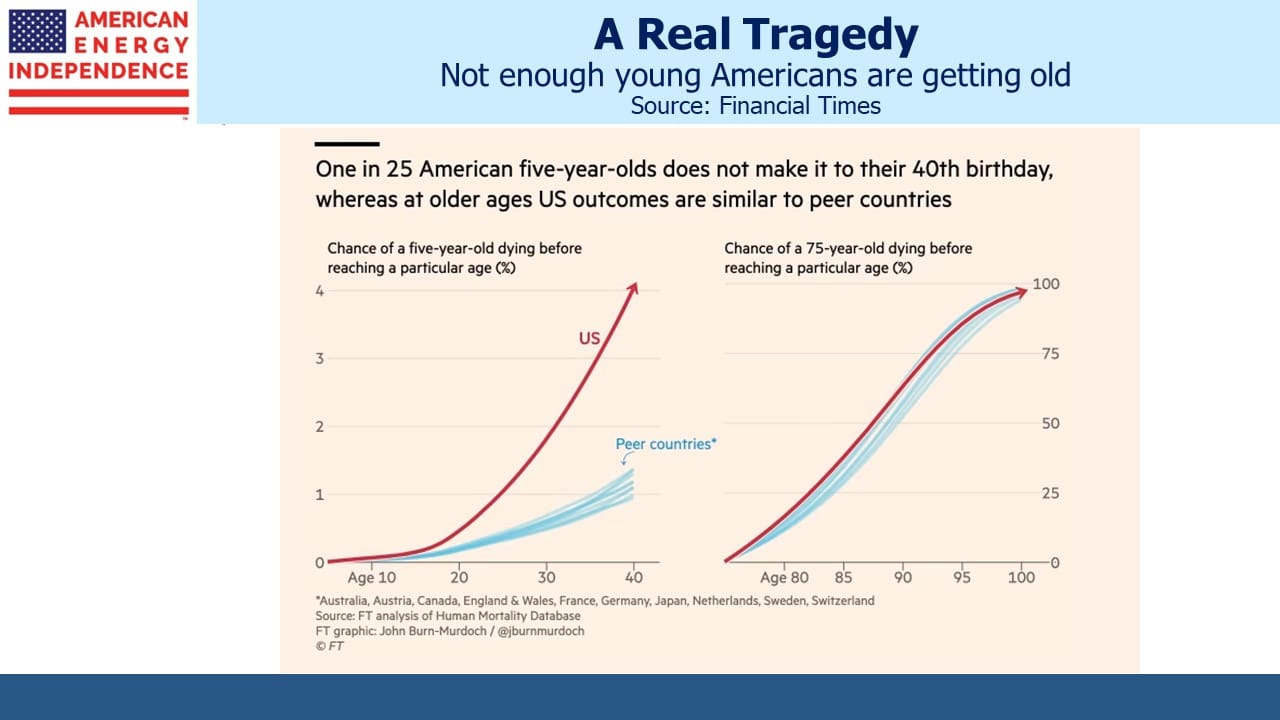

There is one meaningful and tragic negative: life expectancy, which fell in most countries during Covid, has continued to deteriorate in the US by contrast with other rich countries. Even more troubling is that young people are dying. Only 24 out of 25 five-year-olds in America can expect to turn 40, a shockingly high fatality rate 4X that of peer countries. Drugs, notably opioids, are behind this. School shootings are probably another factor since gun violence is now a bigger cause of death among children than automobile accidents. By contrast, older Americans enjoy life expectancy similar to peer countries.

Negativity over too many young people dying could be forgiven if that was driving morose feelings. But there’s not much evidence that it is the main cause. Moreover, we can solve this problem ourselves as we have so many others in the past.

I moved here from the UK in 1982 drawn by Americans’ sunny optimism, epitomized by my first president Ronald Reagan. To this immigrant, the country’s prospects look at least as bright as they did then. The only political ad in history worth rewatching is It’s Morning Again in America from Reagan’s 1984 presidential campaign. It’s always morning in America.

Don’t be swayed by negativity. America’s best days are still ahead.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Sadly, many of us feel as though the era of America’s greatness is expiring and we will be like the Greek, Roman and British Empires in the disintegration of our greatness. The current political agenda of the left wing controlled Biden Administration is accelerating this trend.