Political Energy

/

FERC recently approved a request by Williams Companies to expand its Transco natural gas pipeline in New Jersey. As is usually the case, environmental extremists have been opposing this and other enhancements to the state’s energy infrastructure even though Williams, a commercial enterprise, is presumably meeting increased demand for its services.

Of the seven fossil fuel projects opposed by fringe extremist group Empower NJ, the one that residents surely most strongly support is the proposal to widen 60 miles of the NJ Turnpike and 64 miles of the Garden State Parkway. New Jersey is the most densely populated state in America at 1,259 people per square mile, not far behind the Netherlands at 1,355.

America has vast open areas, but not in the northeast. The situation is not helped by liberal policies that promote high-density, low-income housing. It’s likely that the people opposed to reliable energy like Empower NJ are the same ones who believe everyone who wants a home in New Jersey is entitled to one, regardless of whether that creates even more traffic on our major freeways and need for infrastructure.

Widening our highways is scarcely a fossil fuel project, and is necessary because, improbably, people keep moving to the state. Nonetheless, population growth lags the rest of the country. Therefore, New Jersey’s Congressional representation has been shrinking too. Anecdotally and otherwise it’s clear high earners, who are also high taxpayers, are leaving for states where the weather and politics are sunnier.

Empower NJ opposes expansions to the state’s natural gas infrastructure. Williams Companies recently won FERC approval to add 829 Mcf/Day of capacity to their Transco pipeline network. Empower NJ wants Governor Phil Murphy to block the Transco expansion mentioned above and other important projects. Although the governor may step in, so far he hasn’t. To be left of NJ’s governor is to be truly on the fringe of coherent thought.

Meanwhile, Goldman Sachs estimates that the mis-named Inflation Reduction Act (IRA) will cost $1.2TN, more than three times the CBO’s estimate. Energy companies are rushing to create business lines that will benefit from the many tax credits.

The promise of enormous tax credits in the IRA has boosted lobbying efforts by the energy sector, which had been falling for several years. Pharmaceuticals spend more, but the gap is closing.

Climate extremists have long promised with no empirical evidence that solar and wind are cheaper than natural gas. If this was the case our power supply would be dominated by renewables, which it isn’t. The tax credits in the IRA should make intermittent energy so appealing that further investments in oil and gas must offer extraordinarily compelling returns to compete.

Occidental’s Direct Air Capture (DAC) plans were covered recently in the WSJ. They’re building the world’s biggest DAC facility in Texas and plan to add dozens more. DAC has its critics, who contend that the 0.04% concentration of CO2 in ambient air makes capturing it uneconomic. Occidental’s ambitions extend to selling carbon credits to businesses that can’t reduce emissions (such as airlines). The IRA provides tax credits of $180 per ton for DAC CO2 permanently sequestered underground.

Groups like Empower NJ, more properly named DePower NJ, are pursuing a philosophy of making life miserable for everyone by impeding needed expansions to reliable energy. They lament completed projects such as new gas power plants and pipeline enhancements. They’re trying to foist on us the dysfunctional policies of Massachusetts and New York where access to natural gas is impeded but still needed.

The surest way to lower emissions is to use less energy, most effectively achieved by shrinking NJ’s population. Empower NJ could perform a great service to the Garden State by relocating their dystopian supporters out of the state.

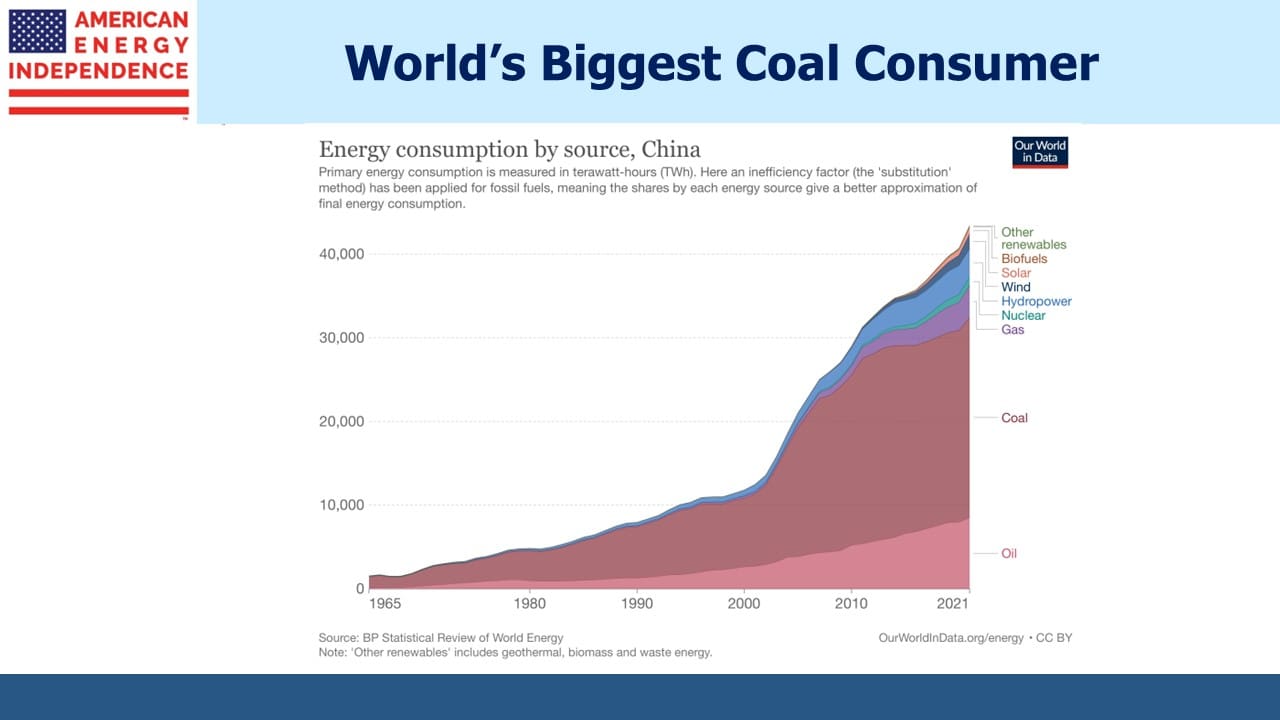

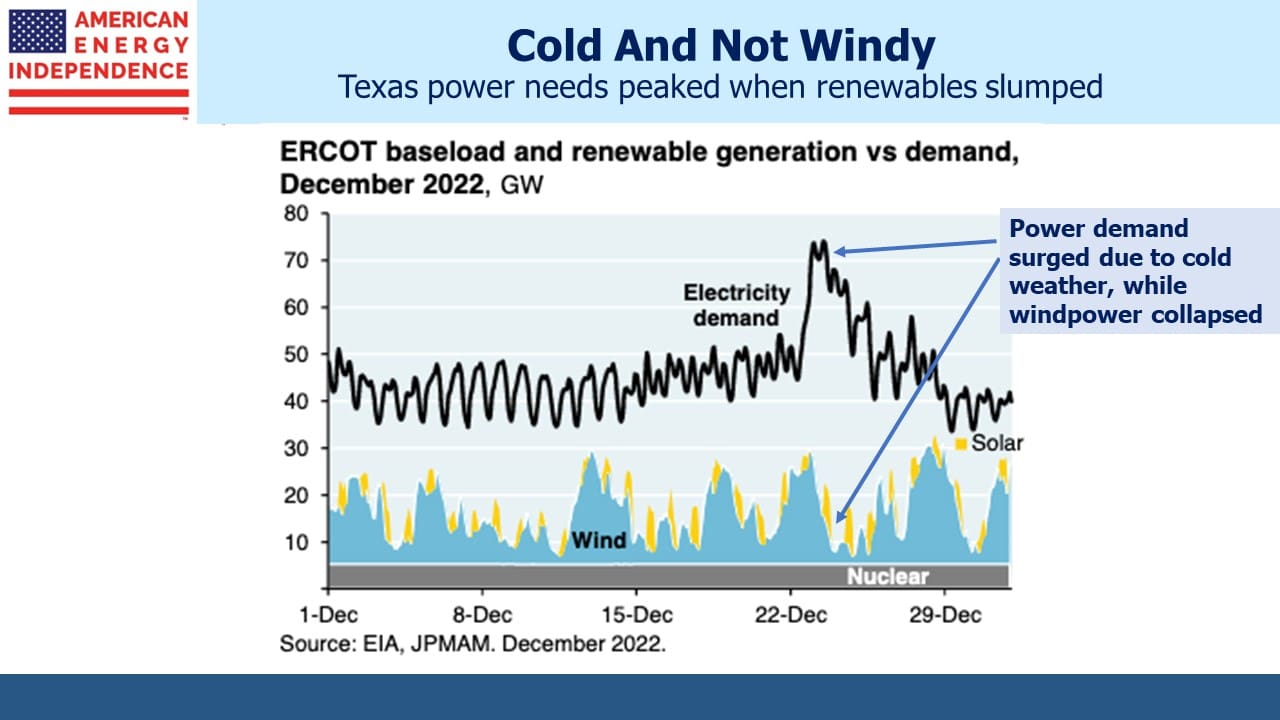

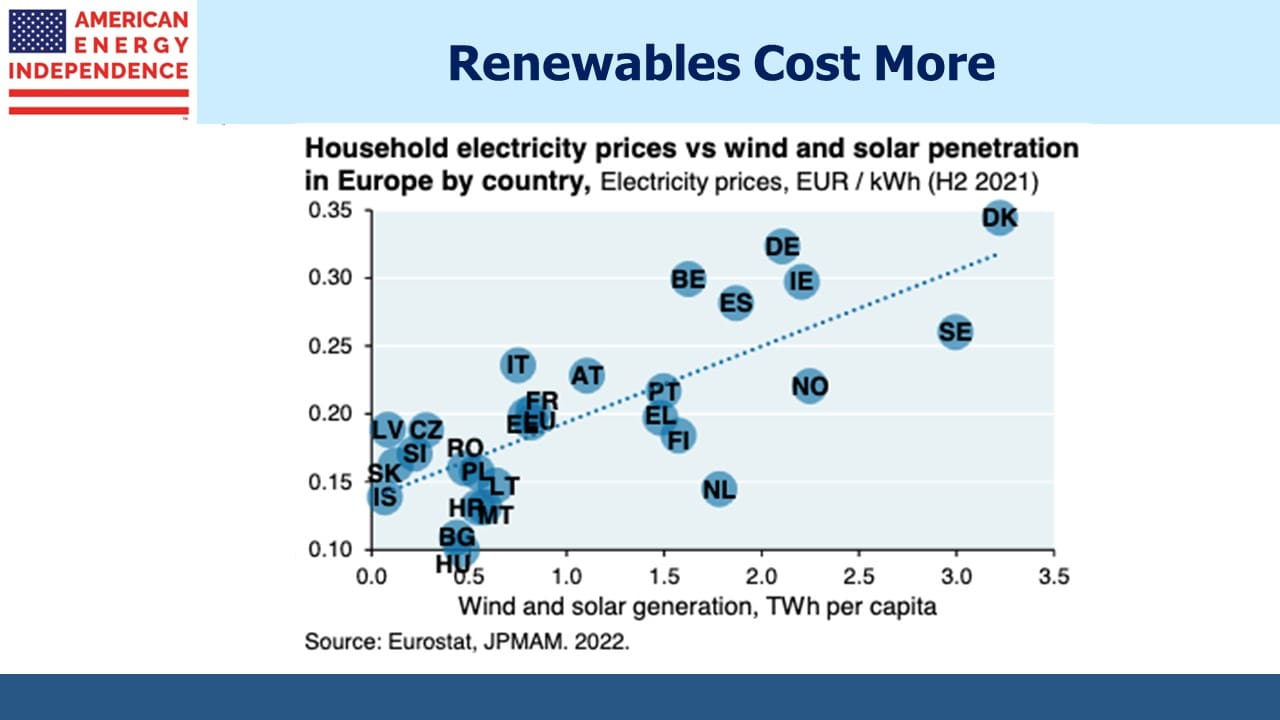

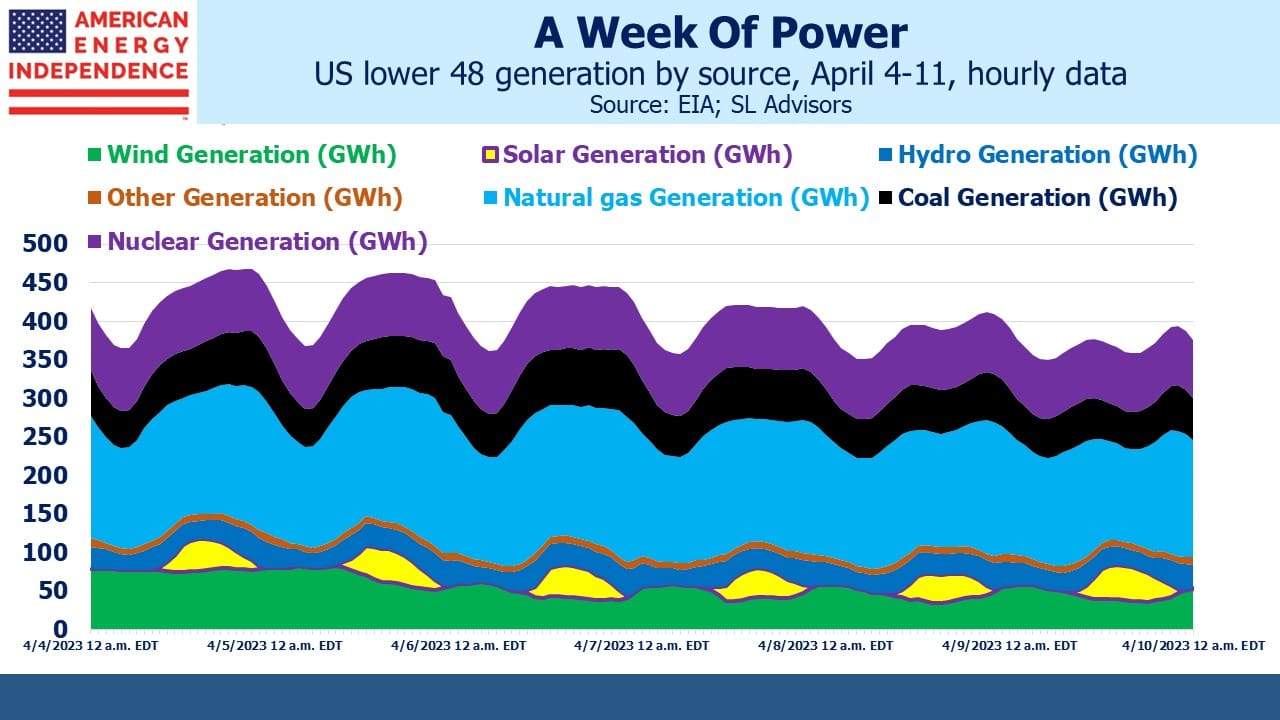

The charts below provide a helpful reminder of key points in considering the world’s use of energy.

China is by far the biggest user of coal, the most prolific source of greenhouse gases. Meaningful progress on climate change won’t happen without China’s participation. Energy consumption has never fallen in human history, yet UN forecasts showing emissions falling assume this will happen.

Output from renewables has an unfortunate tendency to slump during extreme weather when it’s most needed.

Higher renewables penetration equals more expensive electricity. This may be a price worth paying to reduce emissions, but climate extremists ignore it.

Daily power demand follows a predictable cycle, peaking around dinner time. Solar peaks at noon. Wind is unpredictable but is often highest at night.

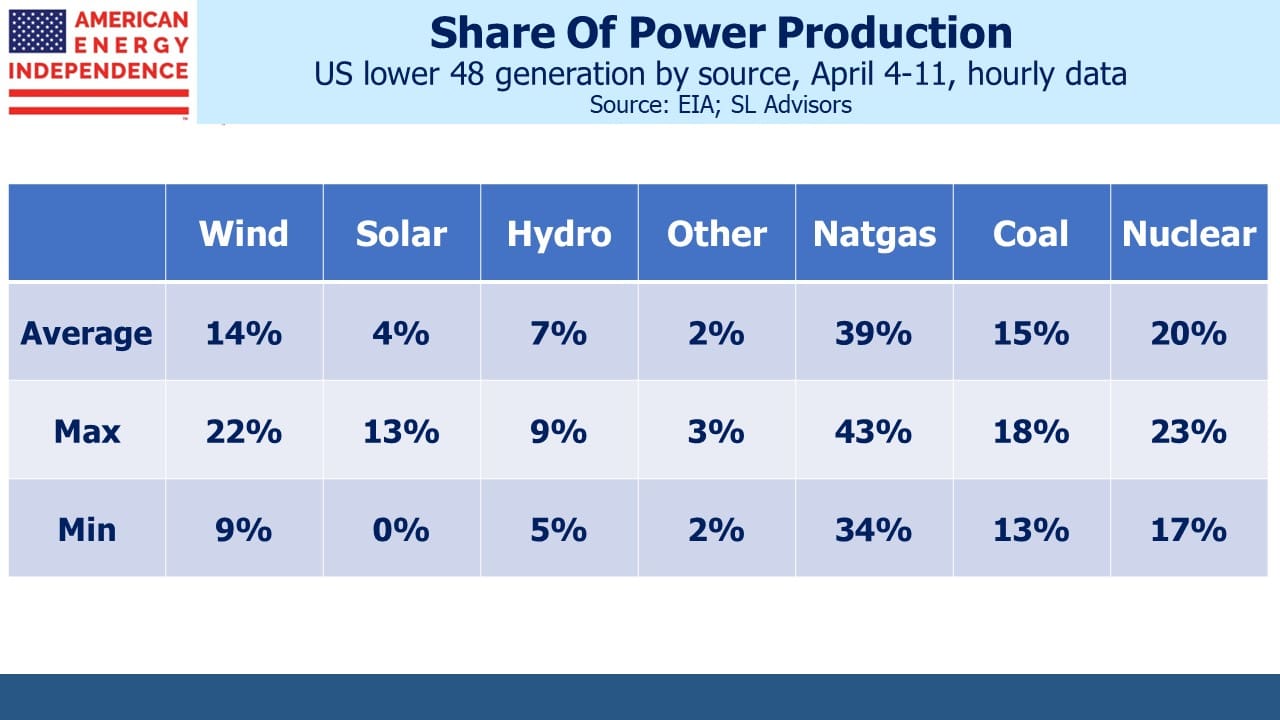

Solar and wind contribution to total power generation varies widely and unpredictably. The challenge this creates for grid operators balancing supply with demand increases sharply with more renewables.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!