Some Banks Are Having To Pay More

/

I’m the treasurer for our co-op in Naples, FL. I recently asked our local bank to pay a more competitive rate on our cash balance, which is well over the $250K FDIC insurance limit. Their deposit rate for business accounts was 0.5%, and maybe because Silicon Valley Bank (SVB) had just failed they quickly raised it to 3%.

This is still inadequate, and I’m not done with them yet. Banks are notoriously sluggish in raising rates when the Fed’s tightening. Depositors are slothful in demanding competitive rates. The margin below treasury bills can be thought of as the fee for banking services, although the cost in foregone interest income is more than most depositors would tolerate if asked to write a check for the amount.

Banks don’t make it easy either. Parking cash in treasury bills requires a brokerage account and the ability to easily move money back and forth. Dual sign-off for transactions is often required on business accounts. It can quickly become an administrative headache to earn a competitive rate, and banks know this.

SVB’s failure exposed imprudent risk management, but it prompted depositors to consider where their money sits and what it’s earning. Money has flowed out of regional banks, some of it to the systemically important banks (“too big to fail”). We assume deposits are fully guaranteed even though they’re legally not. There’s a de facto guarantee because allowing depositors to suffer a loss in bankruptcy might lead to another financial crisis. Size matters. A bank deemed small enough to fail is not the place to be.

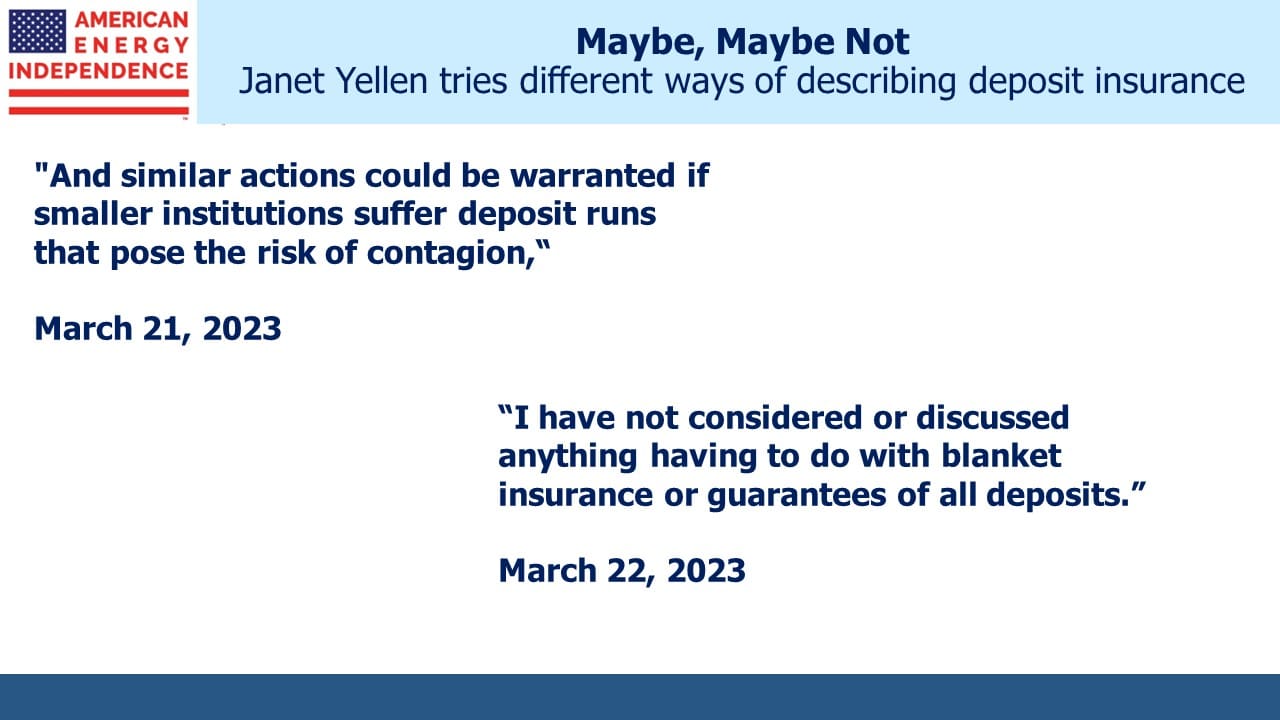

Extending FDIC insurance requires legislation, so Treasury Secretary Janet Yellen makes confusing pronouncements. Unable to explicitly guarantee every deposit, she nonetheless leaves the impression that she would.

There are increasing signs that regional banks, those not deemed too big to fail but nonetheless enjoying an implicit guarantee of their deposits, are being squeezed on both sides. They’re being forced to offer depositors higher rates, since their customers are no longer as slothful. SVB’s failure started with customers leaving for higher rates.

On the asset side, the banking system’s increasing duration risk has become problematic given the Fed’s rapid tightening. SVB’s reach for yield ultimately rendered them insolvent. Although they were an outlier in unsecured deposits and interest rate risk, markets and regulators are now pondering the unrealized losses in bond portfolios across the system. Sticky deposits are normally believed to have increased in value when rates rise because of the lethargy with which banks increase the rates they’re paying. But today’s altered dynamic looks likely to force more competitive practices on banks.

Schwab is a good example. Last year they changed their default option for client cash balances to Charles Schwab Bank rather than money market funds. This allowed them to pay low rates and invest the cash in bonds, picking up the spread. This is similar to SVB, but Schwab wasn’t as reckless.

Nonetheless, in their earnings on Monday Schwab revealed that the size of deposit outflows had caught them by surprise, forcing them to borrow money at wholesale rates to fund their bond portfolio. Banks have long argued that revaluing their assets down in response to higher rates without recognizing the implicit higher value in sticky deposits presents an unfair, biased picture. But the problem is that the long duration of liabilities isn’t contractual, it’s just assumed based on history.

Commercial and Industrial loans have dipped in the past several weeks, a first sign of risk appetites being reined in. Banks know regulators will look more closely at duration risk on securities and loans, casting a chill on their willingness to extend credit.

This is what’s behind the gap between where the market expects Fed policy to go and the FOMC’s projections. Tighter financial conditions have increased recession risk. Such differences are usually resolved at the cost of the FOMC’s reputation for forecasting accuracy.

On a different topic, Texas is confronting the problems that come with being the leading state in windpower generation. Storm Uri in early 2021 that caused widespread power outages led some renewables champions to note that natural gas plants stopped producing along with windpower, and that it was incorrect to blame the debacle on intermittent power.

Nonetheless, the Texas state legislature has concluded that more natural gas power plants are just what is needed to prevent a repeat. Having subsidized windmills they’re now going to subsidize reliable power to stabilize the grid. The intermittency of solar and wind creates problems for systems that become too dependent on them. Note that they didn’t opt to invest in battery back-up to compensate for this shortcoming. Instead, lawmakers in Texas have concluded that reliable, dispatchable power is what’s needed.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Simon,

re declining lending levels. I suspect that some of this recent decline is the response to well funded borrowers making treasury calls. As the interest rate resets, they look at their spare cash (rainy day money) and conclude that it is worth paying off some of the borrowings.