Inflation vs Regional Bank Crisis

/

This Friday’s inflation update will include the monthly Personal Consumption Expenditures (PCE) deflator and the Q1 Employment Cost Index (ECI). The Fed prefers the PCE because its weights are dynamic. When apples rise in price relative to oranges, CPI assumes no change in behavior, whereas some substitution towards oranges is to be expected. PCE picks this up.

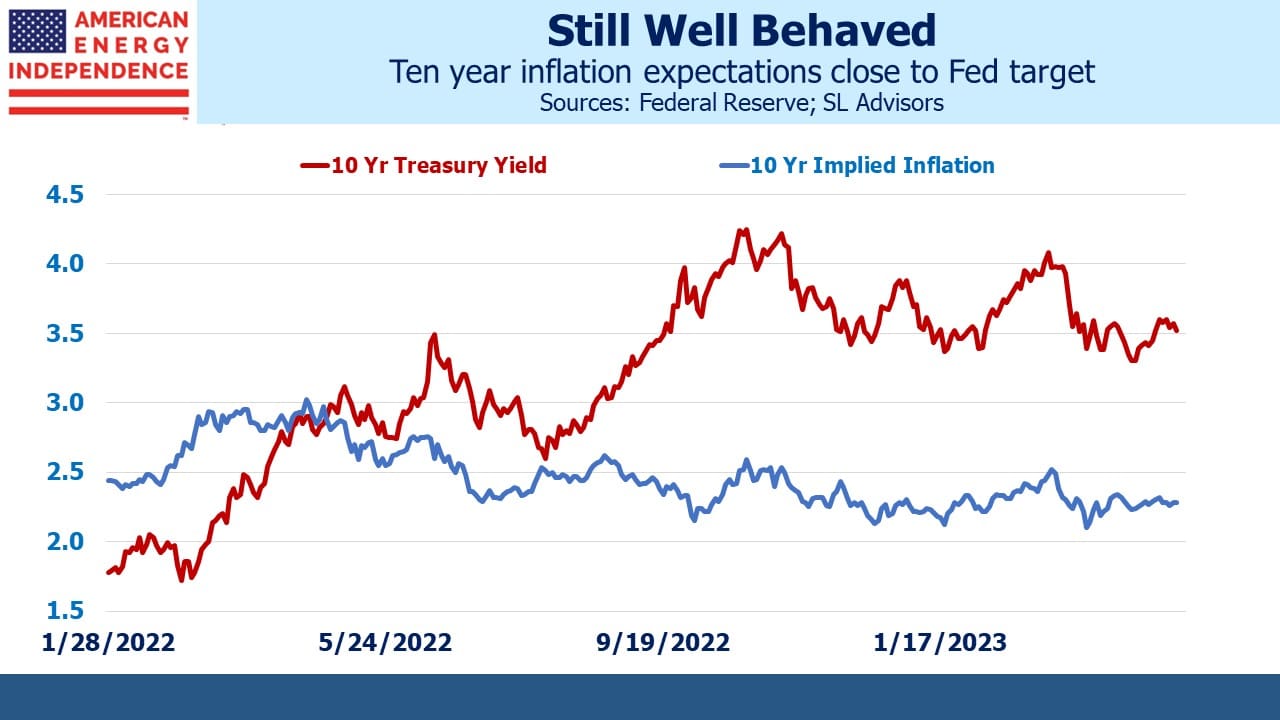

Long term inflation expectations are remarkably low. The difference between treasury yields and TIPs is one measure of what investors expect consumer prices to do. By this measure, 2.3% inflation over the next decade is the market forecast. Since the next twelve months will be higher, expected inflation for the subsequent nine years is close to 2%. This is based on the CPI, since that’s the underlying index for TIPs. Since PCE inflation typically runs 0.2-0.3% below CPI, the Fed could declare victory anytime by noting benign expectations.

A few months ago (see Can Pay Raises Keep Up With Inflation?) we pondered the seasonal adjustment factors to the ECI. Most workers get annual pay raises around year-end. The seasonal adjustment factors will already pick this up. However, elevated inflation means higher annual raises than normal, so the seasonal adjustment factors may be inadequate.

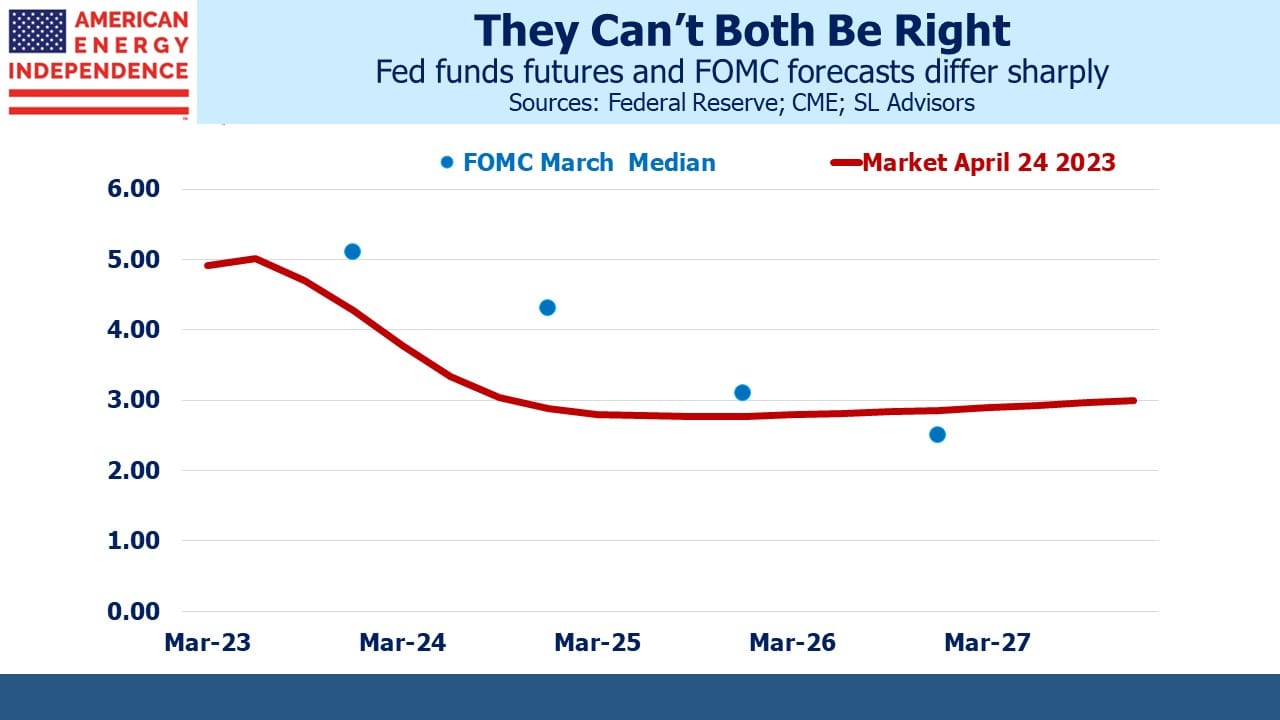

JPMorgan is forecasting 1.1% for the Q1 ECI, up slightly from Q4 which was 1.0% after three successive declines. Interest rate futures continue to forecast that the Fed will be cutting rates by the end of the summer. The FOMC projection materials envisage a Fed Funds rate 1% higher than the market by the end of next year. Current market pricing is inadequate for a disappointment on inflation.

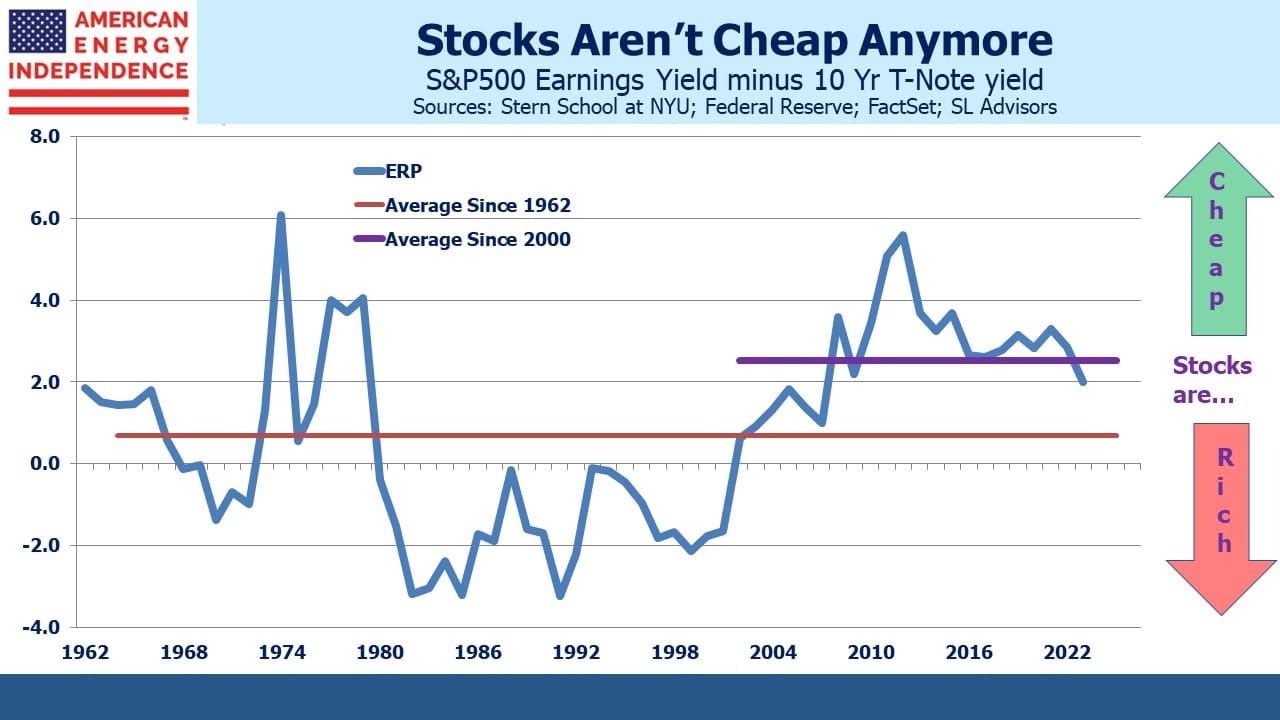

The Equity Risk Premium (ERP), defined here as the 2023 earnings yield minus ten year treasuries, sits below its 20+ year average. This measure shows stocks to be expensive. They’d need to drop at least 10% to put the ERP at neutral. This leaves the market vulnerable to higher yields.

Alternatively, the ERP could move higher to its long run average by yields falling. The ten year treasury would need to drop to 2.9%. Yields have been implausibly low for many years, so they could fall further. It’s not a bet we’d make.

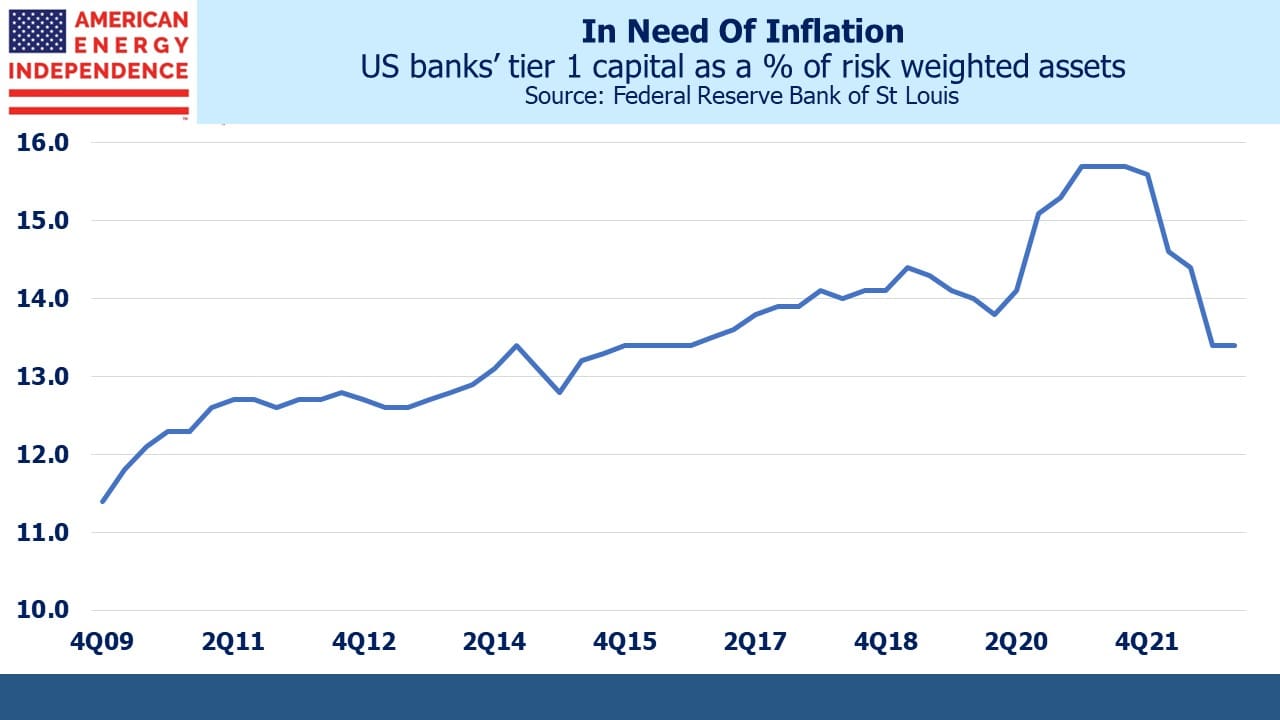

The regional banking crisis and Silicon Valley Bank’s abrupt collapse caused a sharp revision in the rate outlook. Having worked in banking for much of my career, I can well imagine the anticipation of regulatory scrutiny that will cause all but the biggest (ie systemically important) banks to review their interest rate risk and reliance on large, non-FDIC guaranteed deposits. Simply the knowledge that interest rate risk will draw more questions than in the past will make many banks more cautious about extending fixed rate loans.

The sharp drop in Tier 1 capital as a percent of risk-weighted assets is another consideration that is likely to cause tighter terms on new exposure.

There are also signs that depositors are not being quite so tolerant of banks underpaying on deposits.

First Republic is the latest bank having to issue reassurances that they have ample liquidity – once you have to respond to such fears it’s usually too late.

The market expects banks’ reduced risk appetites and competition for deposits to hurt the economy. The Fed believes the broader economic risks are minor. Such differences are usually resolved at the costs of the FOMC’s forecasting reputation, but that already looks fully priced in to the futures market.

Bonds had begun to offer at least a modest return, but the recent drop in long term yields is moving the asset class closer to the returnless risk state that has prevailed for years.

Stocks aren’t cheap vs bonds, and while that implies fixed income is attractive, the Fed still owns $8TN of government debt from Quantitative Easing, so is distorting yields.

Behavioral finance teaches that investors often make mistakes due to overconfidence. It’s a human trait, and one more common in men than women I regret to say, that opinions about how many jellybeans are in a jar, sports outcomes and the year-end level of the stock market are held with greater conviction than they should be. Humility around one’s market forecast would seem especially important during current circumstances.

Earnings season is upon us, and we expect that it will reaffirm the solid position of midstream energy infrastructure companies. With dividend yields of 5%+, two times covered by free cash flow, improving leverage of 3.5X Debt:EBITDA and still low growth capex for most names, the prospects for this sector look more assured than for many others.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

You should post more of your video’s on YouTube. It will take some time, but eventually you would gain a following.