Last Year’s Favorite Blog Posts

/

We enjoy the feedback from our blog readers, which along with the pageviews inform future topics. Looking back over last year’s posts, natural gas growth, the challenges facing renewables and obstructionist climate extremists were among the themes that resonated most.

The most popular post was The Inflationary Energy Transition, which reviewed how US electricity prices have been rising. This ought to shock renewables proponents, because we’re constantly told that solar and wind are cheaper than conventional energy. The overwhelming absence of supporting evidence has done little to silence this crowd. Indeed, the International Energy Agency (IEA), which has adopted the mantle of renewables cheerleader, reiterated this belief last year. Hopefully under Trump the US will cut its funding.

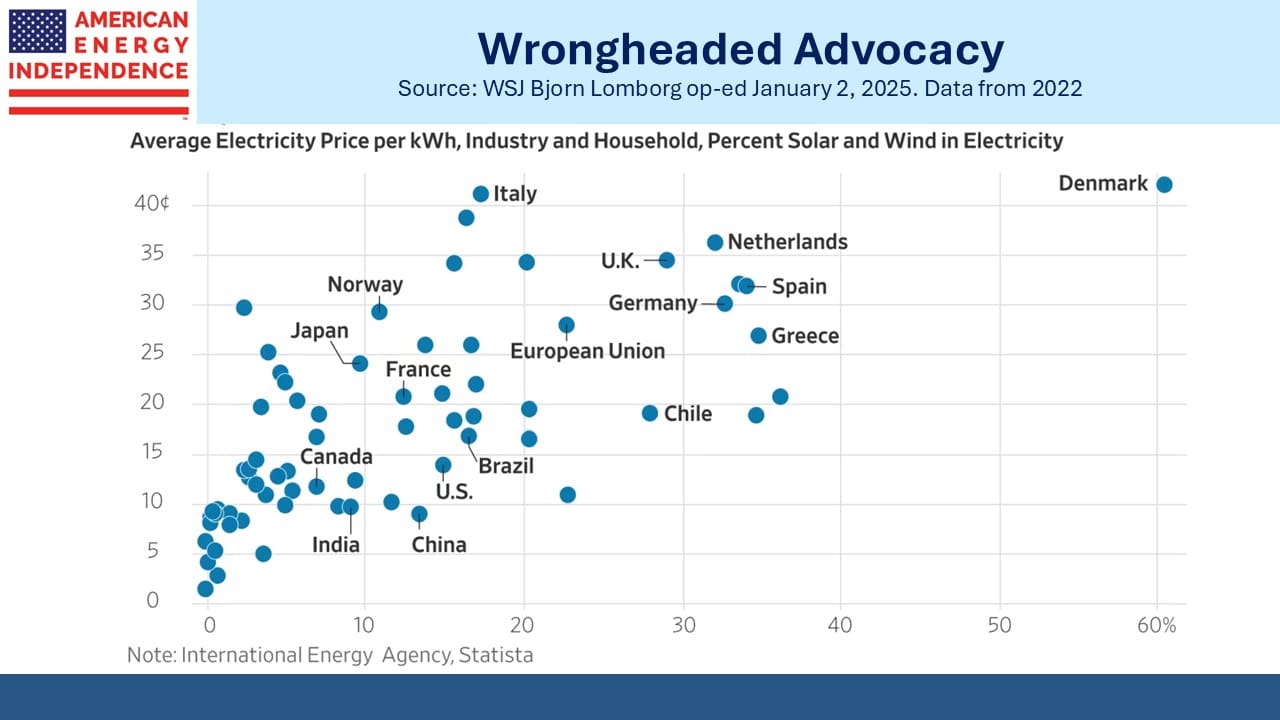

An op-ed in the WSJ last week by Bjorn Lomberg included a chart showing that electricity prices rise with solar and wind penetration all over the world.

If the IEA and others would simply say that renewables cost more and are a better choice because of rising CO2 levels, at least they’d have credibility on the issue. But by misrepresenting the economics they’ve lost any right to be taken seriously.

A Concentrated Bet On Renewables Stumbles showed how Costa Rica’s grid has moved almost fully to renewables, led by hydropower at 73%. A drought blamed on El Nino forced daily power cuts on consumers. Renewables Are An Energy Footnote showed how modest the impact of solar and wind has been in the US in spite of enormous subsidies and glowing media coverage. Natural gas production has increased 8X renewables over the past decade, and even if you eliminate exports and just count the gas that’s consumed domestically, it’s still 4X as big.

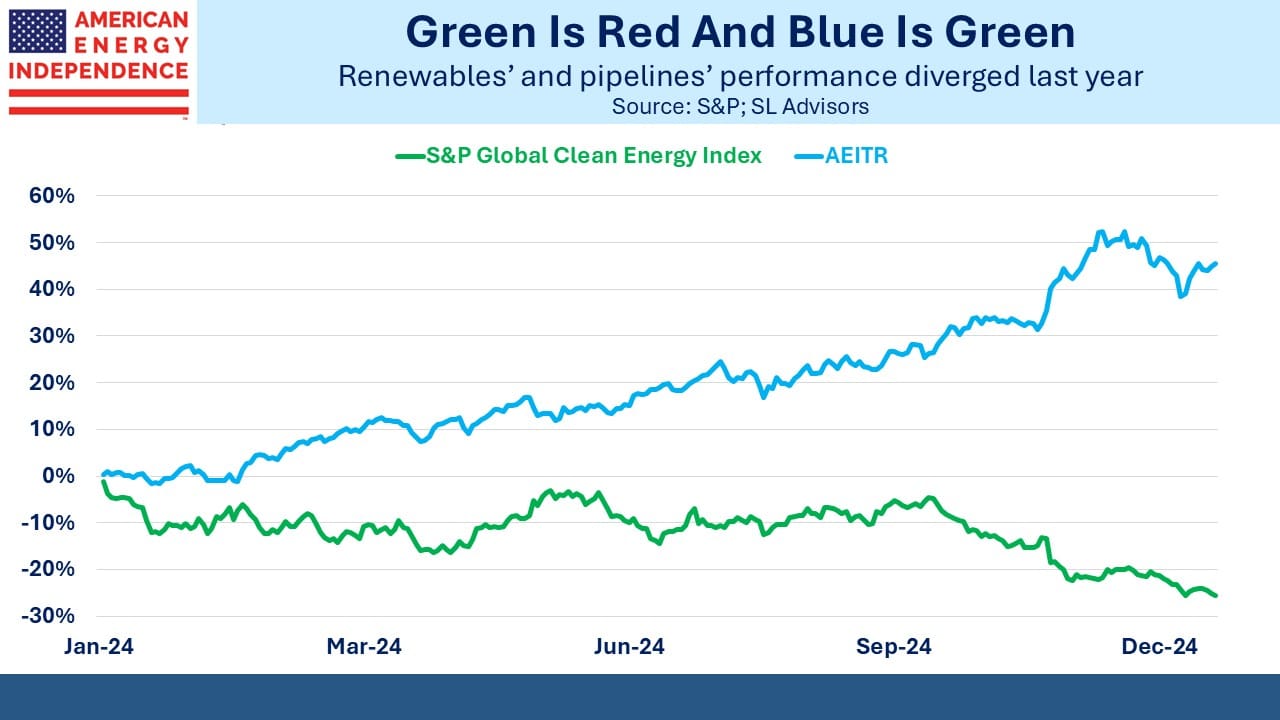

What became clear to us last year is that we are experiencing The Natural Gas Energy Transition, One day we’ll run out. One day perhaps everything will run on electricity from nuclear plants. But over any meaningful forecast period natural gas demand will continue to grow. Investment returns last year reflected this. The S&P Global Clean Energy Index was –25% last year. Midstream energy infrastructure was +45%. On Thursday there were new reports of closures among German solar firms.

The Energy Transition Towards Natural Gas showed how the US is benefitting from this, at least in those regions where energy policy hasn’t been hijacked by progressives (ie New England and the Pacific northwest). For more, see Blue State Energy Policies.

Sierra Club Shoots Itself In The Foot showed how environmental extremists’ use of the courts to slow projects was likely to prolong use of coal across developing countries where energy demand continues to grow. NextDecade’s (NEXT) construction of an LNG export terminal in Brownsville, TX was cast under some uncertainty due to the ruling. The stock lost almost half its value in the days following.

However, by the election it had recouped some of that and Trump’s victory propelled it higher. In recent days it’s back to its levels prior to the August court ruling, as investors have concluded that the project will continue to completion with minimal if any delay.

In this video (watch Let’s End The Sierra Club) we noted how they’re even against nuclear power with a set of dystopian policies that would impoverish billions of people and cause widespread starvation.

We’ve long believed that natural gas would remain a crucial source of energy for the foreseeable future. It seemed to us that greater renewables penetration would require natural gas to provide reliable energy for when it’s not sunny and windy. Slow renewables growth simply means greater use of reliable gas. Both themes are at work. Natural Gas Demand Keeps Growing and A Gassier World explained why.

And in 2024 the demands of data centers for reliable power added to the strong fundamentals.

Consequently, Drilling Down On AI was one of our most read blog posts. The Coming Fight Over Powering AI reminds that power demand growth is on a trajectory that will challenge the ability of utilities to add necessary infrastructure.

Last year not a single client commented on the relationship between crude oil and midstream – unsurprisingly, since oil finished down on the year. We reviewed this in Oil And Pipelines Look Less Like Fred And Ginger. Persistently strong operating performance and reduced leverage have finally broken whatever connection existed – and that only arose at times of strong energy sector sentiment (usually negative).

Someone once said that if you want to understand a topic, write a book about it, the point being that the research required will make you an expert. Writing a blog is similar, and astute readers can be relied upon to catch any sloppy analysis. It’s also an enjoyable part of my job.

Thank you for the regular feedback.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

So the question is not that the WSJ, or for that matter the Economist (sorry on the latter) is so wrong/incorrect when interpreting the “facts”, but Why? I understand the narrative, but why the constant doubling down on a “lie”. Anyway, Happy New Year and enjoy reading you commentaries. Take care