The Natural Gas Energy Transition

/

The long term demand outlook for natural gas continues to improve. India is likely to double its consumption by 2040, and much of that will rely on imports of Liquefied Natural Gas (LNG). This will offset coal consumption, lowering local pollution as well as CO2 emissions.

The International Energy Agency (IEA), normally a tireless promoter of renewables, is warning that insufficient investment in new gas production risks supply shortages. They blame regulatory challenges for impeding the growth of much-needed LNG exports. The White House should take note.

The US is seeing the fastest growth in new gas-fired power production in years, as utilities gear up for rising electricity demand from data centers. The renaissance that nuclear power is enjoying is a positive step, but the deals announced by Microsoft, Google and Amazon won’t deliver power until the 2030s. Data centers are being built now.

The media coverage of the energy transition is so relentlessly one-sided that you might think the constructive outlook for natural gas is a minority view. Current US exports of LNG should double over the next five years, from 13 Billion Cubic Feet per Day (BCF/D) to around 25 BCF/D. Domestic prices remain low, at around $2.50 per Million BTUs (MMBTUs). The European TTF benchmark is around $13 and the Asian JKM above $13.50. Increased US exports will close some of the regional price gap.

November 2026 US natural gas futures are at $3.80 per MMBTU, around $1.30 above spot prices. In a sign that prices may need to rise, on Friday the Energy Information Administration (EIA) reported that the output of dry gas from shale formations is on track to be down this year. This would be the first time since the EIA started tracking such data in 2000.

As our investors and blog readers know, we are biased towards natural gas. The belief that solar and wind would soon displace hydrocarbons as the world’s most important source of energy never convinced us. Energy demand is growing, driven by developing countries seeking higher living standards.

Media articles routinely hail the growth in solar and wind capacity, and yet that growth hasn’t even been sufficient to meet the demand for new energy. Hydrocarbons have provided around 80% of the world’s primary energy for decades and it’s barely changed during the 21st century.

The truth is the only energy transition going on is to natural gas.

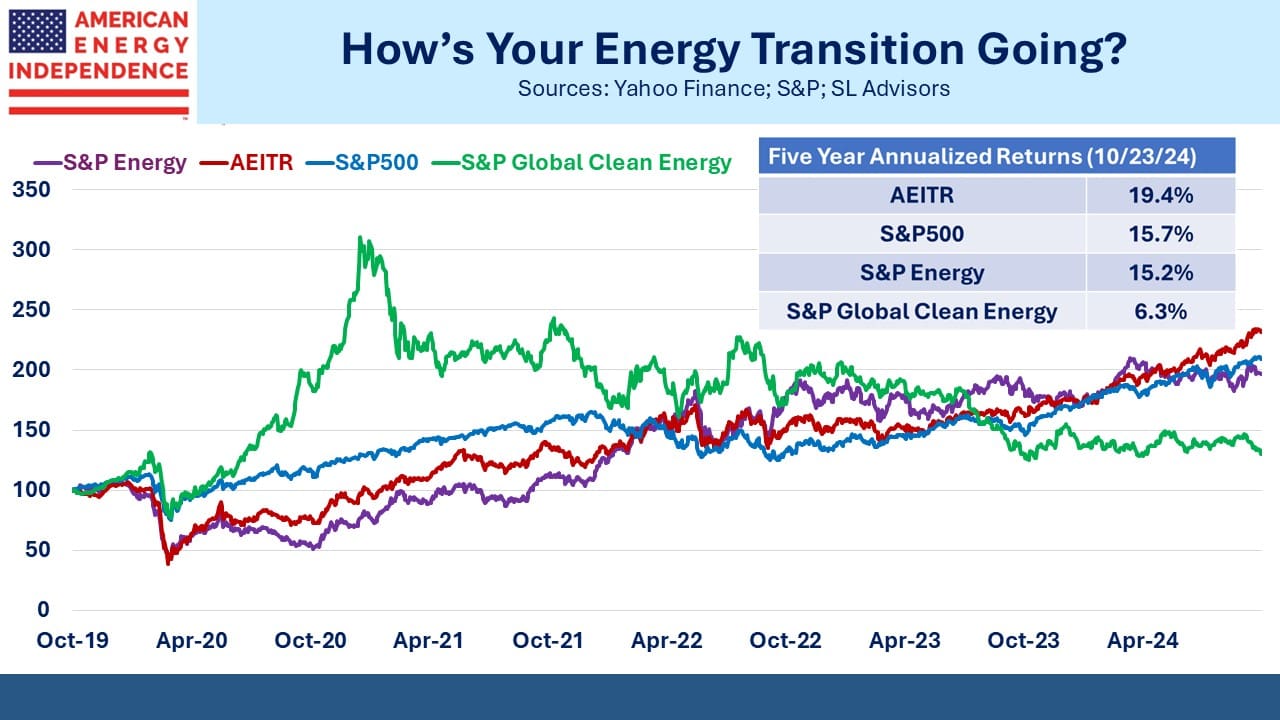

Moreover, renewables are a lousy business. As we often note, if you want to make a small fortune, invest a big one in clean energy. Going back five years to before the pandemic briefly hit energy stocks, the S&P Global Clean Energy index has significantly underperformed both the S&P500 and traditional energy.

Midstream Energy Infrastructure, as defined by the American Energy Independence Index, has delivered triple the return.

BP, continuing its embrace of energy realism, is looking to sell its onshore US wind business for $2BN. Last year they wrote down their offshore US wind business by $1.1BN. “Ultimately, offshore wind in the US is fundamentally broken,” said the company’s former renewables chief Anja-Isabel Dotzenrath last November. She left BP in April.

It’s hard to find pure-play investments that offer a leveraged bet on growing gas demand. Natural gas futures are priced substantially above spot prices. E&P companies are an obvious choice. Range Resources (RRC) produces natural gas, Natural Gas Liquids (NGLs) and a modest amount of oil from the Marcellus and Utica shales in Appalachia. Although they hedge their output over the next year or two, a sustained increase in gas prices would clearly benefit them.

Unfortunately, RRC trades at 2X book value. Its hydrocarbon reserves are valued on its balance sheet using current prices, but the stock is priced at a significant premium. Other peer companies aren’t much better.

LNG export companies offer a good way to bet on higher export volumes. Cheniere dominates the sector, handling half the volumes we send overseas. The Administration’s pause on new export permits, which JPMorgan CEO Jamie Dimon called “naive”, will be lifted under a new Trump administration. Just as betting markets are signaling a Trump victory, there are signs that traders are buying stocks that will benefit from more coherent regulation.

NextDecade dropped sharply in the summer when an environmental group persuaded a judge to issue a stay on a permit issued by FERC (see Sierra Club Shoots Itself In The Foot). Although presidents have limited ability to impact volumes of oil and gas output, investors will welcome the more thoughtful implementation of energy regulation that will return to the White House with Trump. NextDecade is one stock that has rallied recently on such hopes.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

The LNG export permit pause was already lifted, way back in July.

“The order by Judge James Cain said administration officials are ‘enjoined and restrained’ from ‘halting and/or pausing the approval process’ for the permits, ‘effective immediately, to remain in effect pending the final resolution of this case, or until further orders from this Court, the United States Court of Appeal, or the Supreme Court of the United States.’ The authorizations allow exports to countries that lack free trade agreements with the US, and they are critical because such countries make up most of the global LNG market.”

Also, don’t bet on a Trump victory. Fortunately Harris is a realist who will be more interested in improving the economy than chasing after Green dreams.