Last Year’s Favorite Blog Posts

We enjoy the feedback from our blog readers, which along with the pageviews inform future topics. Looking back over last year’s posts, natural gas growth, the challenges facing renewables and obstructionist climate extremists were among the themes that resonated most.

The most popular post was The Inflationary Energy Transition, which reviewed how US electricity prices have been rising. This ought to shock renewables proponents, because we’re constantly told that solar and wind are cheaper than conventional energy. The overwhelming absence of supporting evidence has done little to silence this crowd. Indeed, the International Energy Agency (IEA), which has adopted the mantle of renewables cheerleader, reiterated this belief last year. Hopefully under Trump the US will cut its funding.

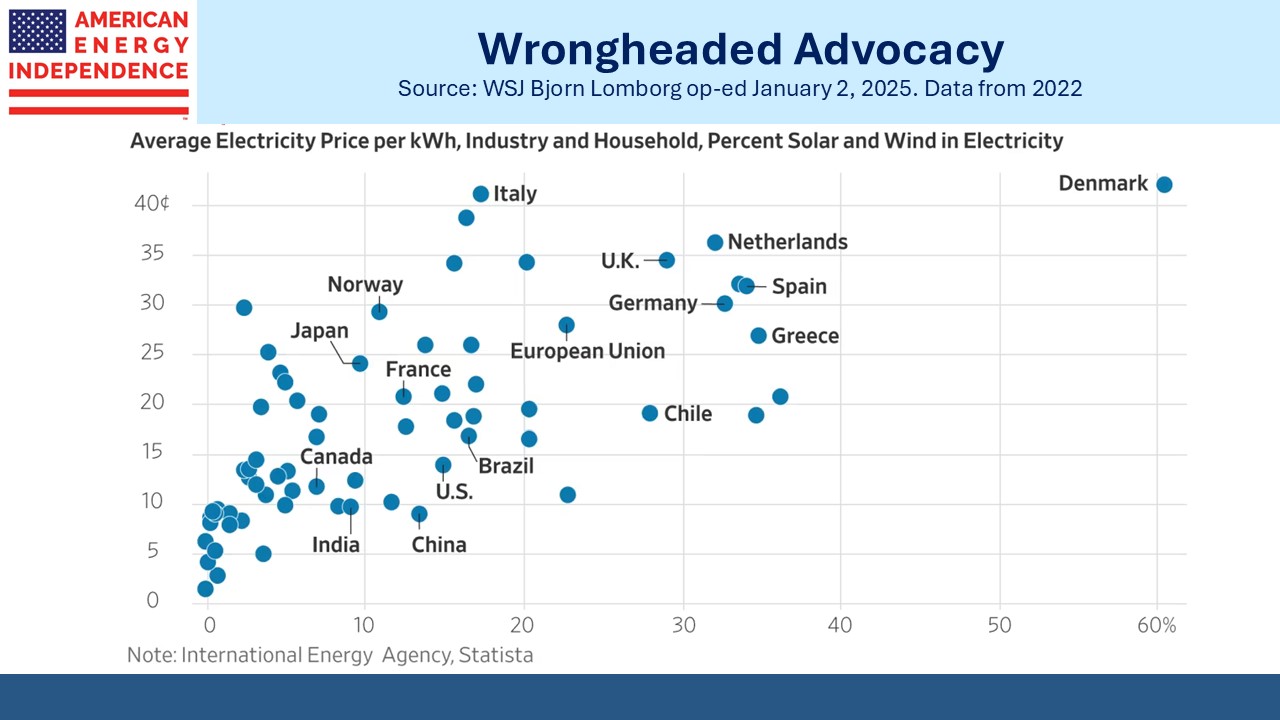

An op-ed in the WSJ last week by Bjorn Lomberg included a chart showing that electricity prices rise with solar and wind penetration all over the world.

If the IEA and others would simply say that renewables cost more and are a better choice because of rising CO2 levels, at least they’d have credibility on the issue. But by misrepresenting the economics they’ve lost any right to be taken seriously.

A Concentrated Bet On Renewables Stumbles showed how Costa Rica’s grid has moved almost fully to renewables, led by hydropower at 73%. A drought blamed on El Nino forced daily power cuts on consumers. Renewables Are An Energy Footnote showed how modest the impact of solar and wind has been in the US in spite of enormous subsidies and glowing media coverage. Natural gas production has increased 8X renewables over the past decade, and even if you eliminate exports and just count the gas that’s consumed domestically, it’s still 4X as big.

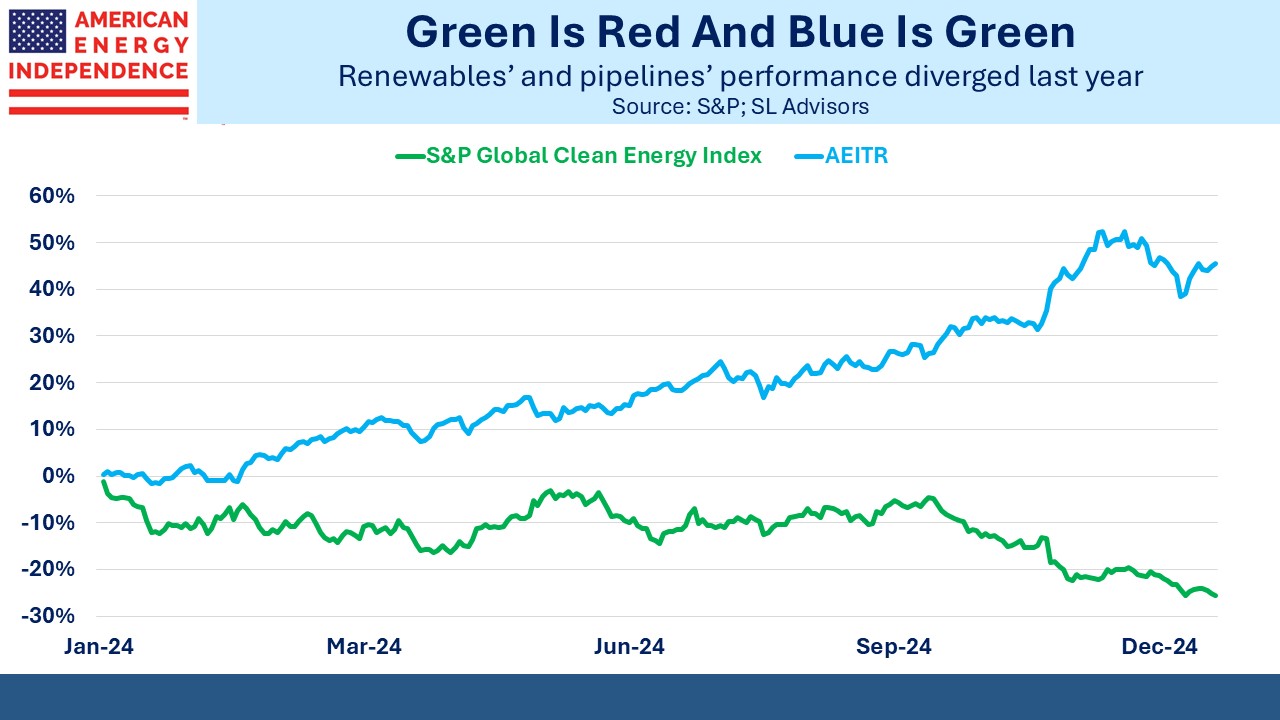

What became clear to us last year is that we are experiencing The Natural Gas Energy Transition, One day we’ll run out. One day perhaps everything will run on electricity from nuclear plants. But over any meaningful forecast period natural gas demand will continue to grow. Investment returns last year reflected this. The S&P Global Clean Energy Index was –25% last year. Midstream energy infrastructure was +45%. On Thursday there were new reports of closures among German solar firms.

The Energy Transition Towards Natural Gas showed how the US is benefitting from this, at least in those regions where energy policy hasn’t been hijacked by progressives (ie New England and the Pacific northwest). For more, see Blue State Energy Policies.

Sierra Club Shoots Itself In The Foot showed how environmental extremists’ use of the courts to slow projects was likely to prolong use of coal across developing countries where energy demand continues to grow. NextDecade’s (NEXT) construction of an LNG export terminal in Brownsville, TX was cast under some uncertainty due to the ruling. The stock lost almost half its value in the days following.

However, by the election it had recouped some of that and Trump’s victory propelled it higher. In recent days it’s back to its levels prior to the August court ruling, as investors have concluded that the project will continue to completion with minimal if any delay.

In this video (watch Let’s End The Sierra Club) we noted how they’re even against nuclear power with a set of dystopian policies that would impoverish billions of people and cause widespread starvation.

We’ve long believed that natural gas would remain a crucial source of energy for the foreseeable future. It seemed to us that greater renewables penetration would require natural gas to provide reliable energy for when it’s not sunny and windy. Slow renewables growth simply means greater use of reliable gas. Both themes are at work. Natural Gas Demand Keeps Growing and A Gassier World explained why.

And in 2024 the demands of data centers for reliable power added to the strong fundamentals.

Consequently, Drilling Down On AI was one of our most read blog posts. The Coming Fight Over Powering AI reminds that power demand growth is on a trajectory that will challenge the ability of utilities to add necessary infrastructure.

Last year not a single client commented on the relationship between crude oil and midstream – unsurprisingly, since oil finished down on the year. We reviewed this in Oil And Pipelines Look Less Like Fred And Ginger. Persistently strong operating performance and reduced leverage have finally broken whatever connection existed – and that only arose at times of strong energy sector sentiment (usually negative).

Someone once said that if you want to understand a topic, write a book about it, the point being that the research required will make you an expert. Writing a blog is similar, and astute readers can be relied upon to catch any sloppy analysis. It’s also an enjoyable part of my job.

Thank you for the regular feedback.

We have two have funds that seek to profit from this environment: