A Concentrated Bet On Renewables Stumbles

/

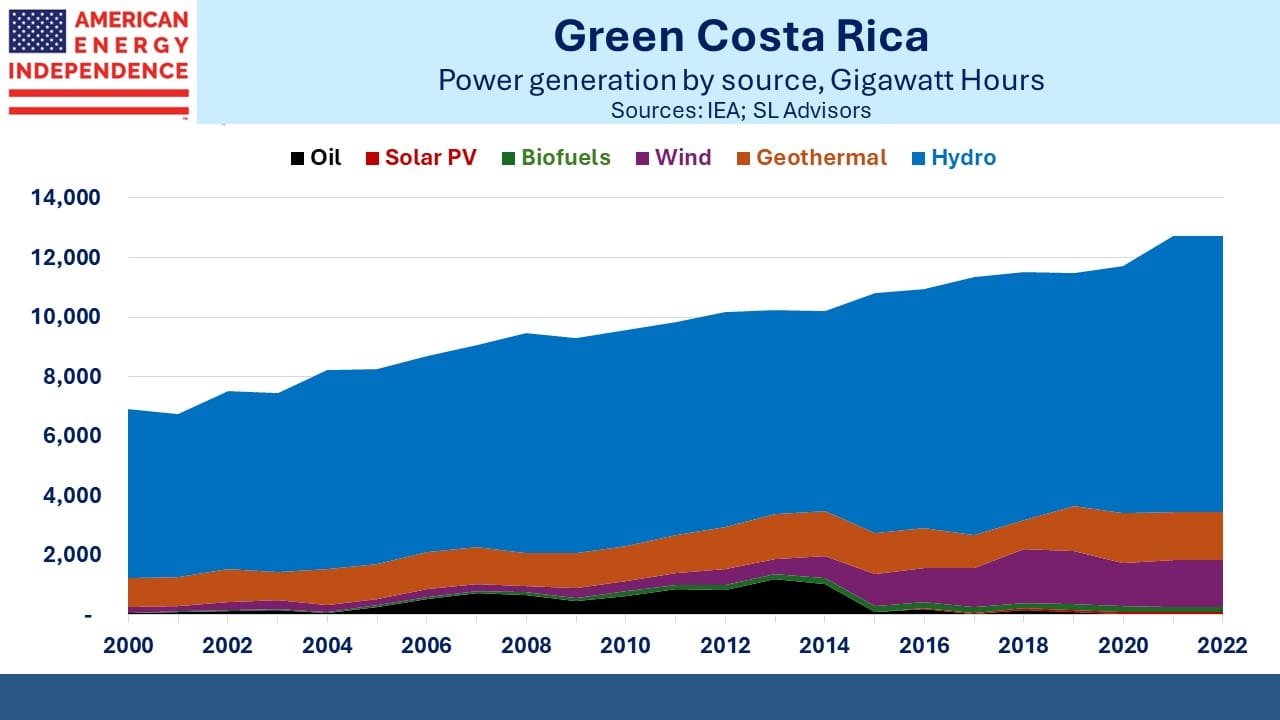

Costa Rica, a central American country of five million, has a proud history of strong environmental policies. Their electricity comes almost entirely from renewable sources. Hydro is 73%, with geothermal providing most of the rest. Solar and wind are minor. Over the past decade they have reduced oil from 12% to virtually zero.

Costa Rica’s success in moving to a power grid free of fossil fuels is hailed as an example to emulate by those who would have the rest of us forego reliable energy. A year ago Spain’s University of Navarra praised them for, “driving the global commitment to overcome hydrocarbons.”

The thinking goes that if relatively poor Costa Rica (per capita GDP $18K) can do this, rich countries like the US ($85K) or groups like the EU ($42K) should be able to with their greater resources.

Except that Costa Rica introduced power cuts this week. The country is enduring a drought, which some blame on El Nino. Reservoir levels are low, and so is power from hydro. Customers have been told to expect daily outages of two to three hours.

Neighboring countries like Nicaragua or Panama that might normally provide electricity are struggling with the same problem, so don’t have any excess. Ecuador is also rationing electricity, and Bogota, Colombia’s capital, is rationing water.

If it rains normal service may resume within a week. It is their rainy season. Weather-dependent power can fail to deliver. The last time they had outages was in 2007.

There are virtually no oil or gas power plants able to pick up the slack. Their rejection of dispatchable energy is absolute. However, Costa Rica’s President Rodrigo Chaves is less enamored of past policies and has suggested they may wish to develop domestic natural gas reserves. Many of their political leaders believe they need to diversify their sources of energy.

Costa Rica generates 16 million tonnes of CO2 equivalent annually, around 0.04% of the world’s total. So it’s safe to say that any energy policy the country followed would have an inconsequential effect on global emissions. ClimateActionTracker rates countries based on their efforts and is a tough grader. They rate Costa Rica “Almost Sufficient”.

As to whether their example is inspiring similar selfless efforts by others, such an evaluation is inherently subjective. However, we’ll go out on a limb and postulate that China, where new coal plants are being added roughly every three weeks, is not inclined to follow Costa Rica’s lead.

Their citizens will suffer the consequences of undiversified energy sources without changing global emissions through deed or example. Nonetheless, it is by all accounts a wonderful place to visit, and if Costa Ricans find power outages an acceptable price to pay for a little virtue-signaling, their tourists will probably agree.

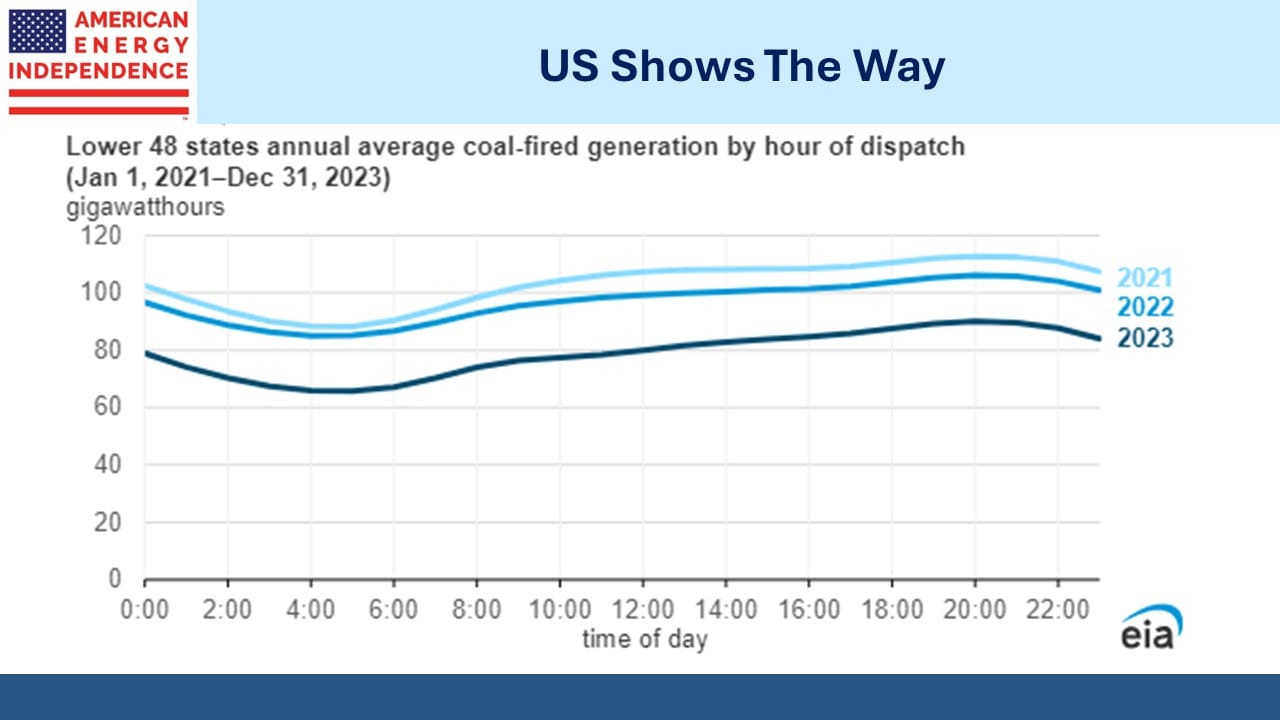

Coal consumption for electricity generation continues to fall in the US, setting an example for developing countries to follow. It’s how we’re reducing emissions. Natural gas continues to replace coal in providing baseload power. Meanwhile net exports of coal were the highest in five years, providing further evidence that the Administration maintains an ambivalent posture on climate change.

Earlier this week I had the great pleasure to catch up with long-time investors Ian Dietz and Paul Morse from Alliance Global Partners in New York, along with Justin Morcom, our Catalyst regional sales partner. There’s a steady drumbeat of unfortunate stories that contribute to some New Yorkers feeling less safe than before the pandemic. I found midtown Manhattan to be unthreateningly normal on a weekday lunchtime.

Clients are drawn to midstream energy infrastructure by the 6% yields, augmented by dividend growth (2-3%) and buybacks (1-2%) that in our opinion offer a reasonable prospect of a 9-11% pa total return. It’s safe to say that clients of Dietz and Morse have done well out of their advisors’ early insight into the sector’s potential.

We had much in common during our lunch, including a bullish outlook for the sector.

EV’s are seeing tepid US growth. Inadequate charging infrastructure and poor battery life are dissuading buyers who just want to reliably get from A to B. Many would be surprised to learn that crude oil demand is on track to set another record this year of around 103 million barrels per day. Gasoline demand from developing countries and global aviation are two important drivers. Slowing EV demand is another.

As recently as last year the International Energy Agency was predicting that global gasoline demand had peaked in 2019, pre-pandemic. Like many of their forecasts, this one has been revised.

Natural gas demand growth adds to the positive outlook – over the next six years LNG exports will require an additional 12 Billion Cubic Feet per Day (BCF/D) as new terminals come online. Data centers could take another 6 BCF/D for increased electricity.

Midstream energy infrastructure is well positioned to keep providing more of what the world wants — reliable energy.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!