Worrying Inflation Forecasts

In early April JPMorgan reacted to Liberation Day by forecasting a recession in the second half of the year. They assumed the tariffs would cause a drop in business investment. They also raised their inflation forecast. They didn’t reckon on the President’s tariff flexibility, and so dropped their recession call following the 90 day moratorium agreed with China.

Nonetheless, it looks as if 10% tariffs will be the minimum to sell into the US. The Fed thinks this may boost inflation in the short term. They banished the word “transitory” in 2022 when the inflation spurt started to look permanent. But they may settle on “temporary” to explain tariff inflation.

Barry Knapp of Ironsides Macroeconomics believes tariffs won’t boost inflation because money supply growth is much lower than during the pandemic-inspired fiscal uber-stimulus. However, the budget negotiations in Congress don’t incorporate much fiscal discipline, hence the Moody’s downgrade.

Bond investors have long granted the US a free pass on our dismal budget trajectory. Lending the Federal government long term funds at 4-5% has never appealed to me, but foreign central banks, sovereign wealth funds and other institutions own $TNs of our debt.

Economist Ken Rogoff, who recently published Our Dollar, Your Problem estimates that the dollar’s reserve currency status reduces the yields on our bonds by around 0.5%. With $36TN of indebtedness that’s worth $180BN annually. The jump in yields that followed the downgrade won’t help.

The University of Michigan consumer survey revealed a startling jump in inflation expectations last month (see Stagflation). A quarter of respondents think five-year inflation will exceed 10%. The average is 4.1%, the highest it’s been in over thirty years. That’s not good for those expecting the Fed to pursue multiple rate cuts this year.

It turns out that the survey’s a good predictor. The one-year outlook and annual inflation three months later have a correlation of 0.7. It may be somewhat self-fulfilling in that consumers behave consistent with their expectations. As the chart shows, they track each other closely and actual inflation reliably follows the forecast.

Given his background in real estate and penchant for debt-financed tax cuts, Trump is unlikely to be too concerned about higher inflation. Your blogger’s investments are arranged accordingly.

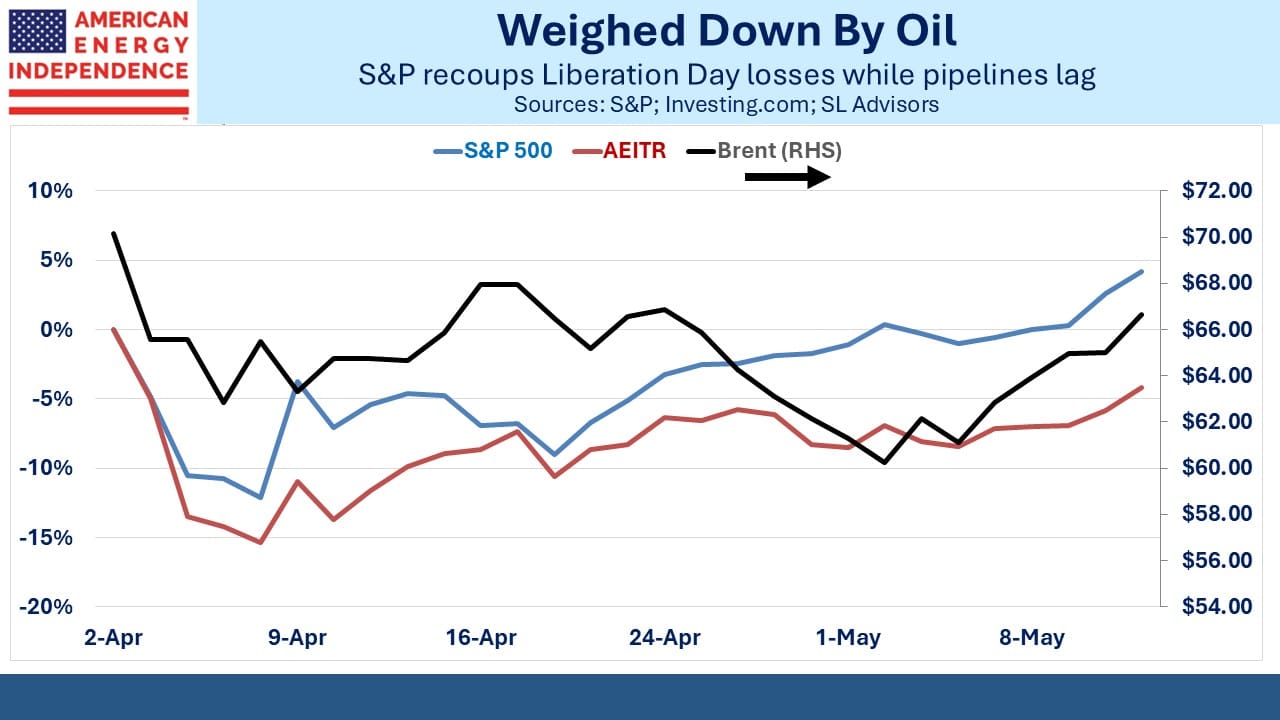

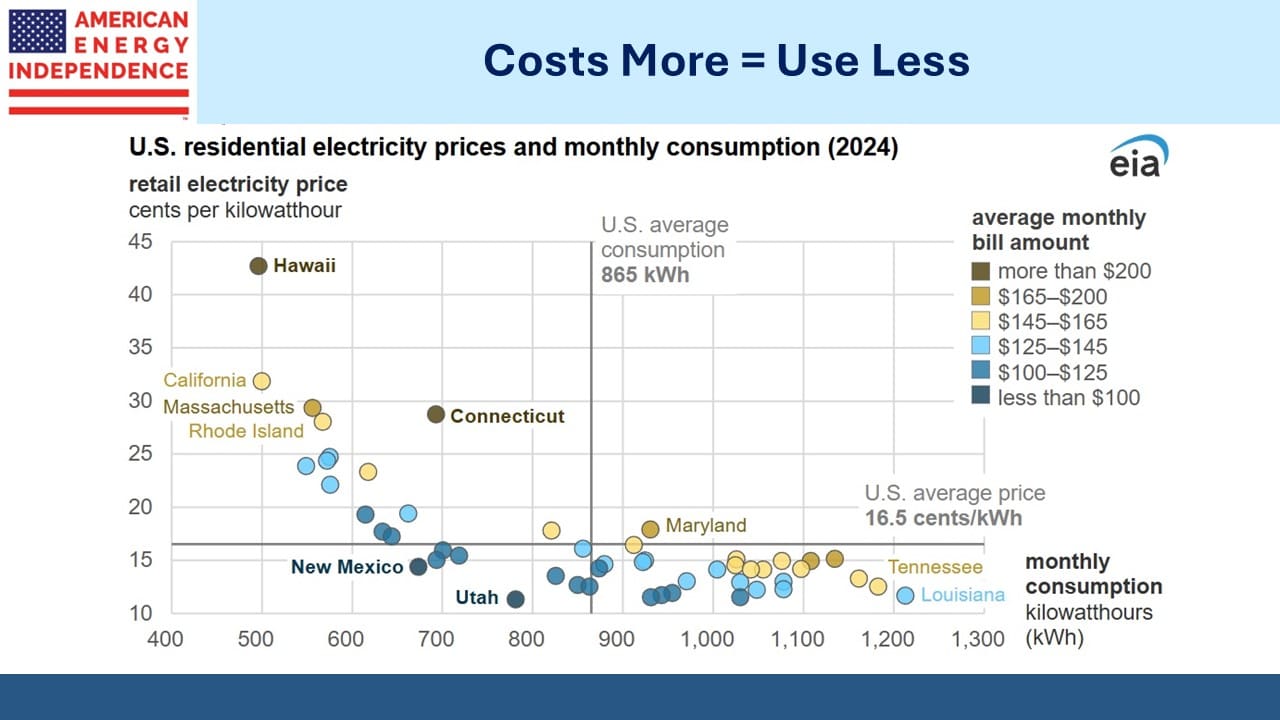

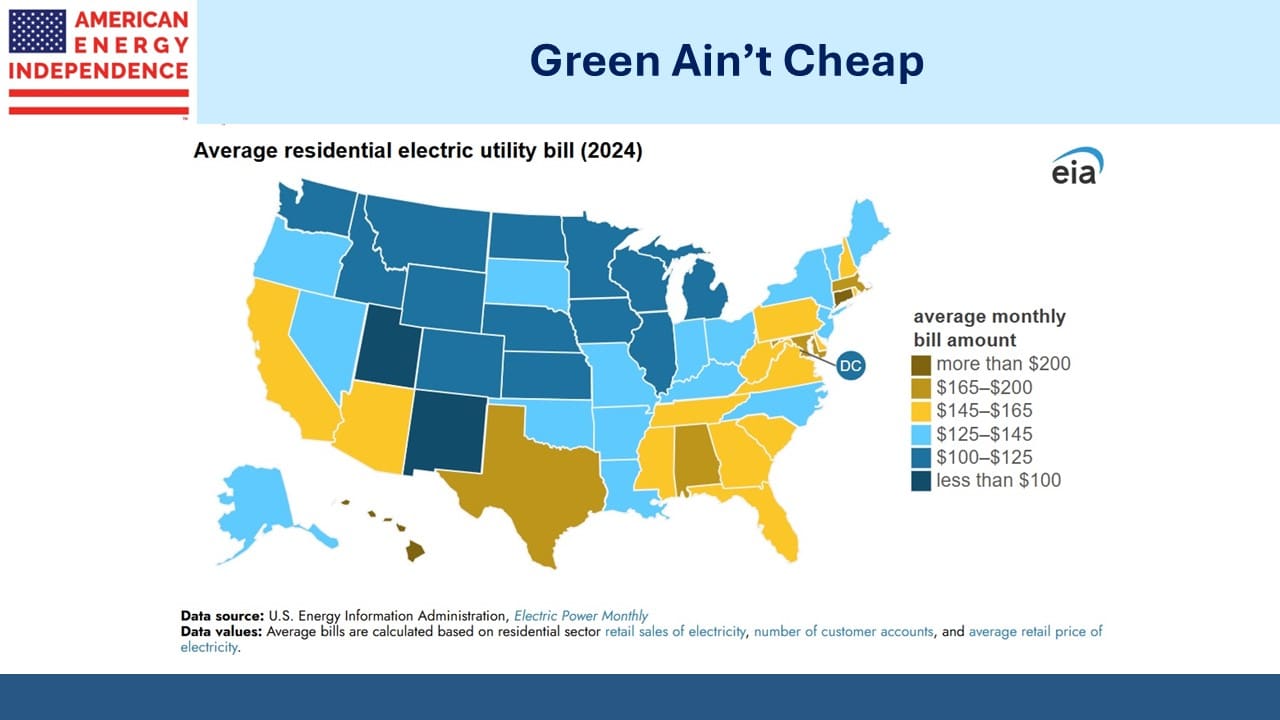

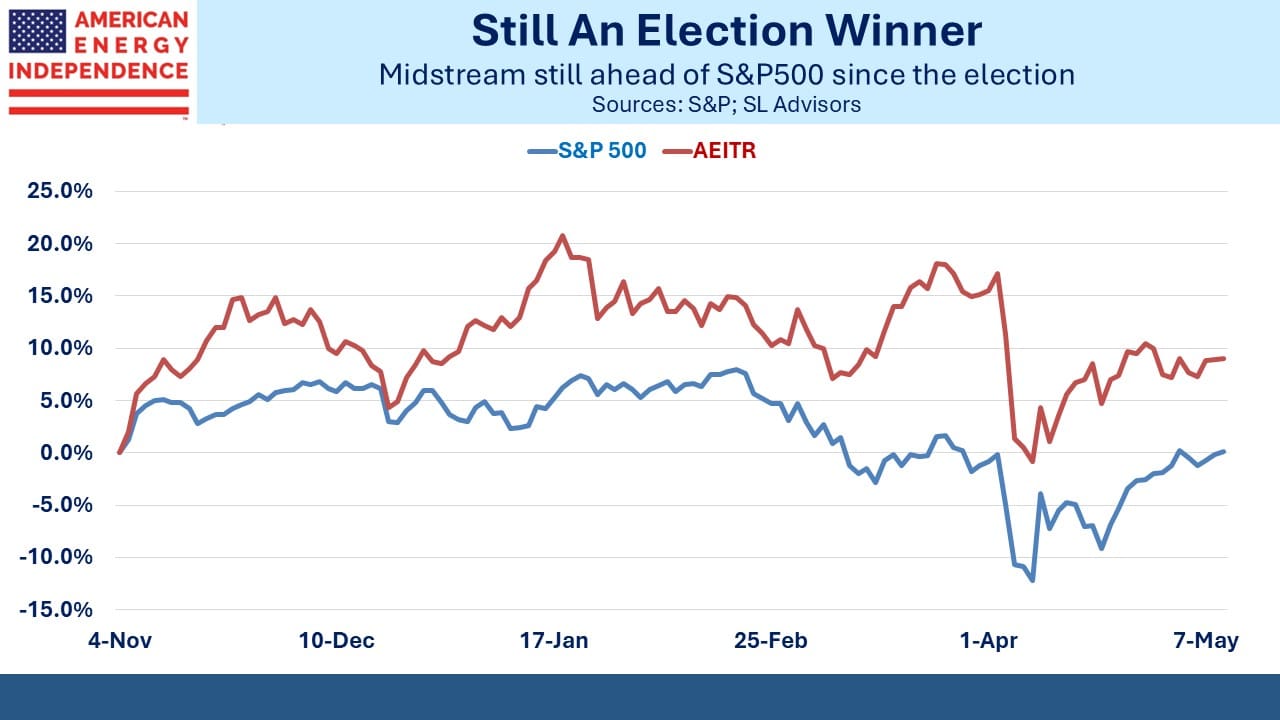

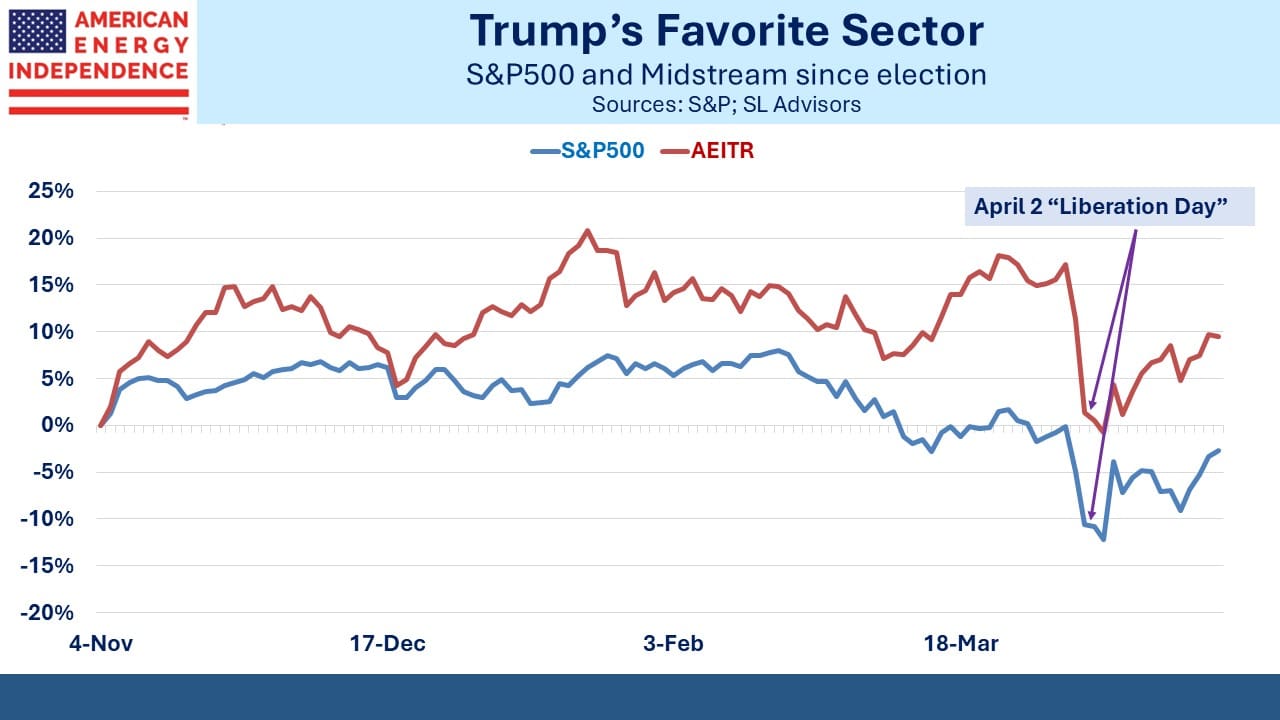

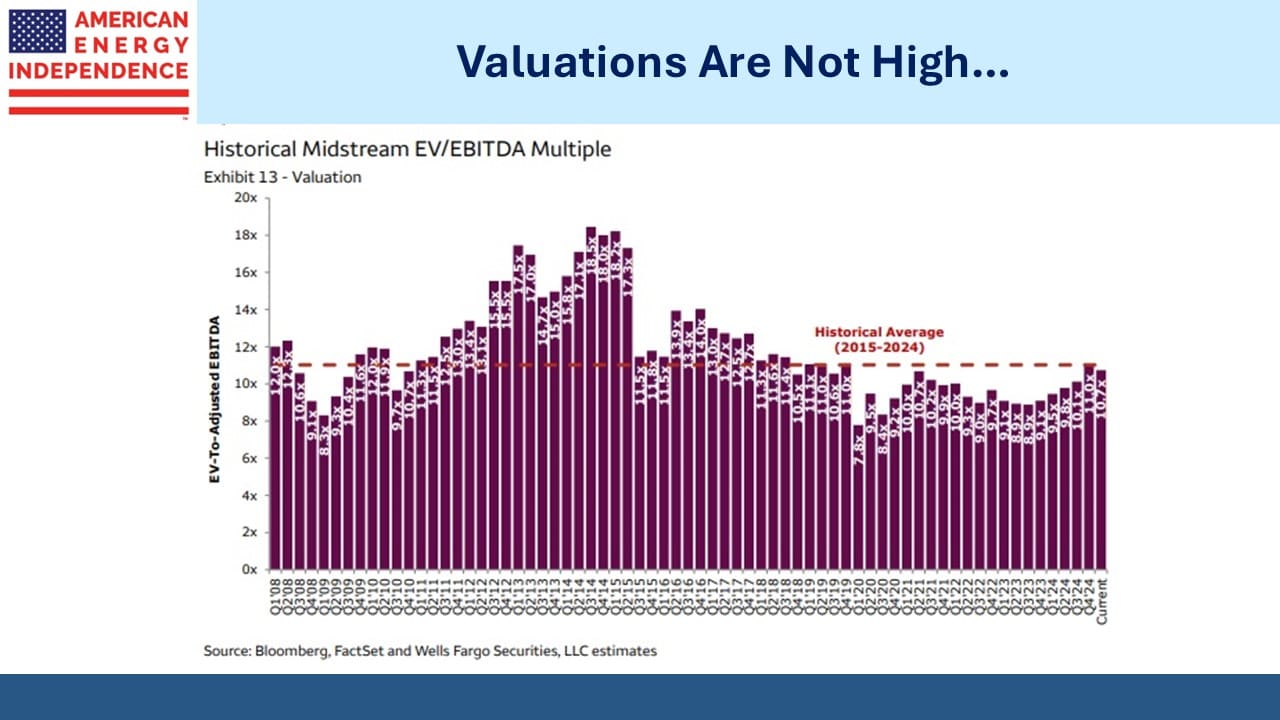

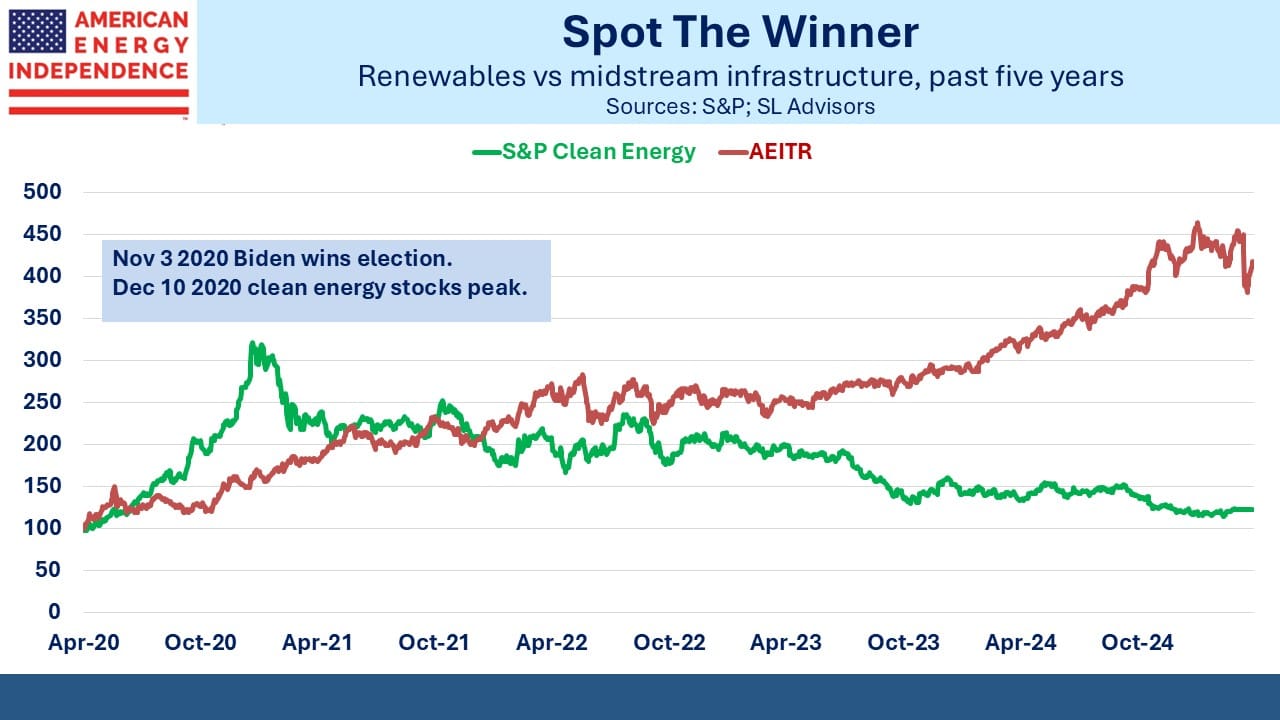

For owners of pipelines, inflation isn’t the scourge that it is for most investors. Companies generally have pricing power because of limited alternatives, with the regulations designed to curb excesses while assuring an adequate return on invested capital.

In 2022 the ceiling on fee hikes for liquids pipelines was 13.3%, which supported subsequent earnings growth. The Bureau of Labor Statistics began publishing a natural gas pipeline transportation index three years ago. It’s volatile. The most recent year-on-year increase was 4.2%.

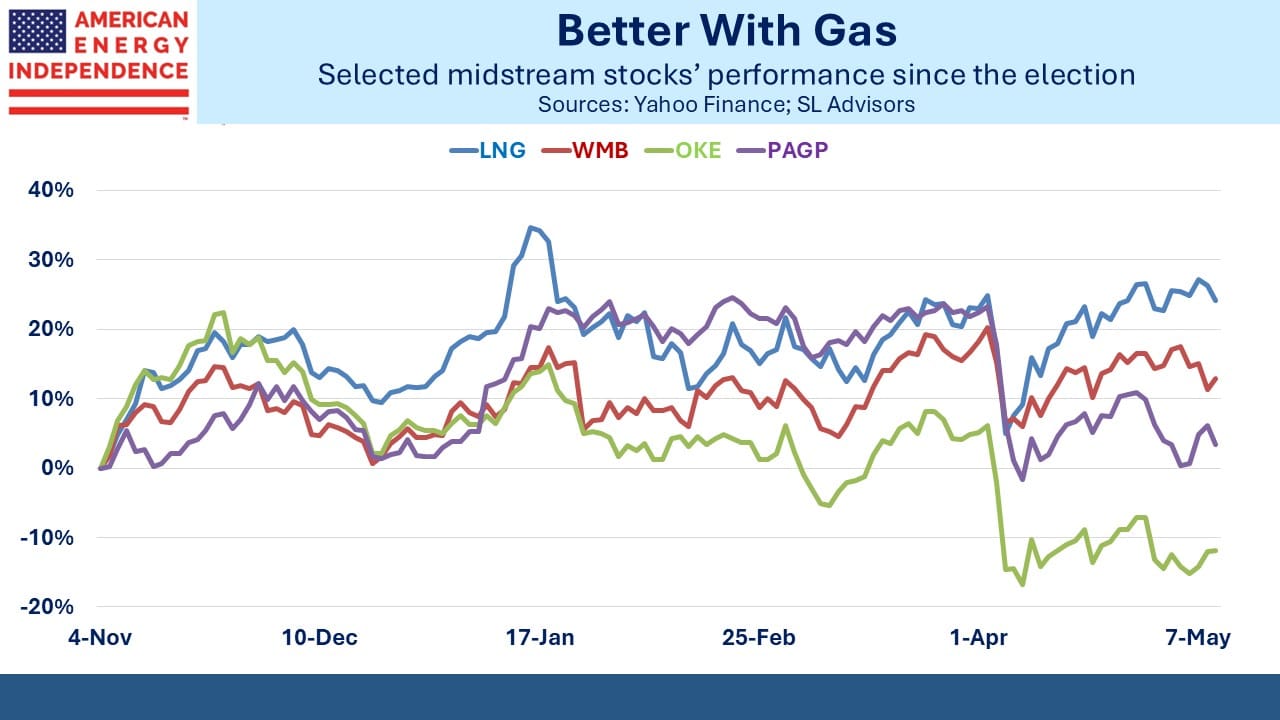

Forecasts of peak oil production from shale have weighed on midstream recently. But the outlook for natural gas production remains strong. Morgan Stanley reports that Enterprise Products Partners expects 1.5 Billion Cubic Feet per day (BCF/D) of additional associated gas from the Permian over the next two years. Targa Resources expect 0.8-1.2 BCF/D over the next one year.

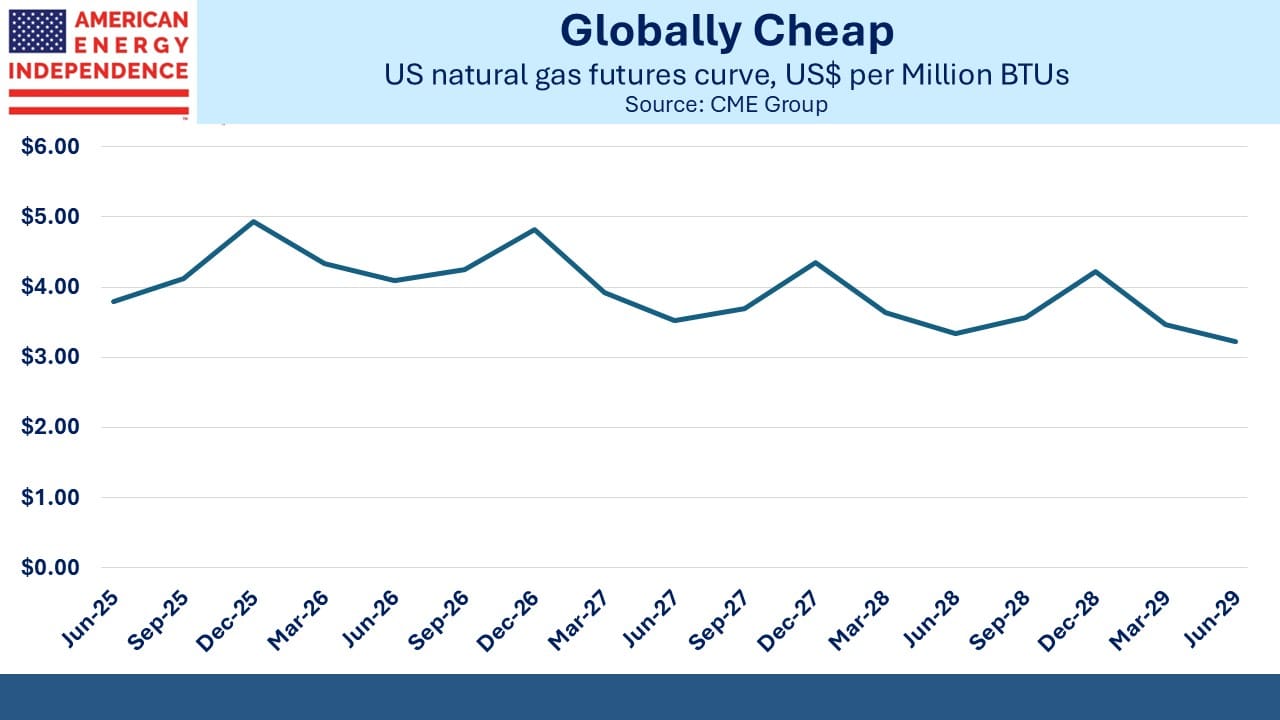

In spite of this, Morgan Stanley’s E&P team thinks the domestic market will be short 3 BCF/D next year because of growing Liquefied Natural Gas (LNG) demand. The Golden Pass LNG export terminal owned by Qatar and Exxon Mobil is expected to begin production late this year or early 2026. It has a capacity of 2.4 BCF/D.

Although we often remind investors that pipelines are generally not that exposed to commodity prices, unmet demand for natural gas is unlikely to be an adverse scenario.

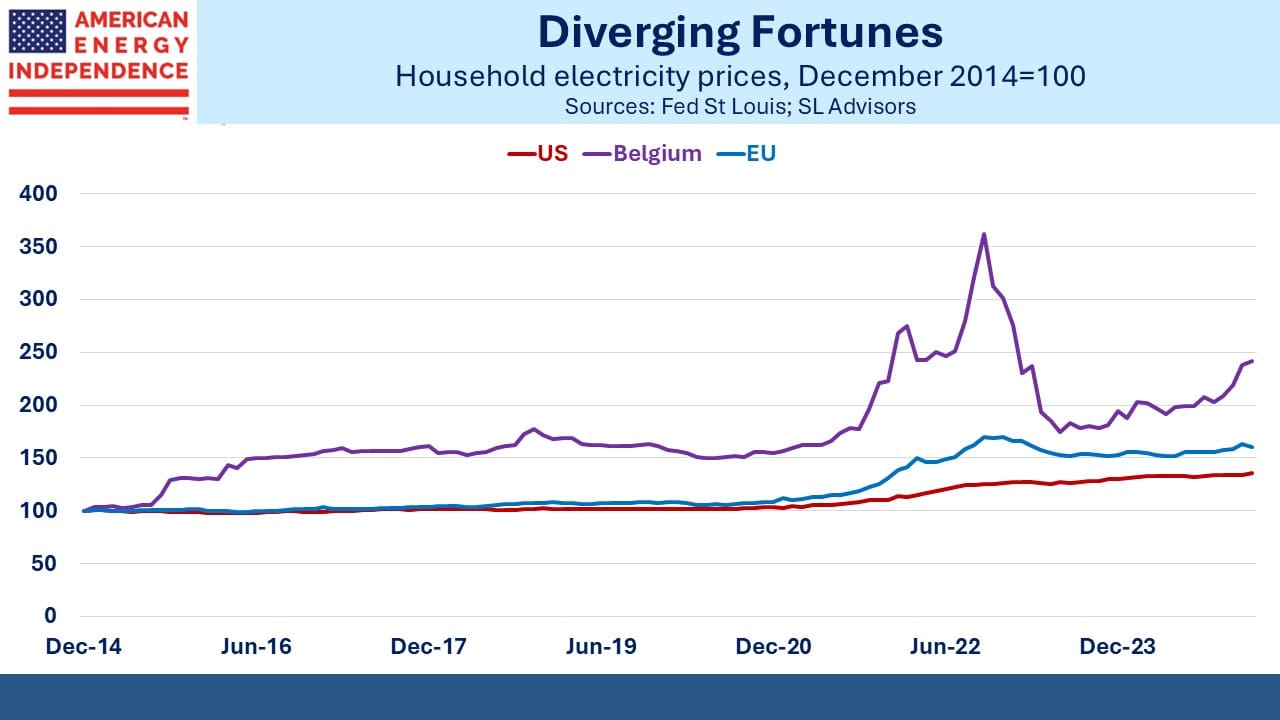

Taiwan closed down their last nuclear reactor recently and is seeking imports of LNG as a replacement. Following the Fukushima disaster in 2011, public concern about nuclear energy increased. Unfortunately, this has left the country almost completely dependent on imported hydrocarbons. In 2023 Taiwan relied on gas and coal for 80% of its electricity. Solar and wind were 8%.

Progressives must regard this as a policy win. They are best described by an Oscar Wilde quote: “Some cause happiness wherever they go; others, whenever they go.”

More accurate is to quote JPMorgan’s Mike Cambalest who wrote in March:

“What was Taiwan thinking by shutting down nuclear power which has fallen from 50% to 5% of generation? Taiwan is now one of the most energy dependent countries in the world, resulting in rising economic costs if China were to impose a blockade.”

Inflation and more natural gas demand are a good combination for midstream.

We have two have funds that seek to profit from this environment:

Energy Mutual Fund Energy ETF