A Closer Look At Canada’s Newest Pipeline

/

I was perusing energy podcasts the other day. Disappointingly they all seemed to be about renewables – nothing about where over 80% of the world’s energy comes from today. Hopefully I started listening to one by Shell, but quickly realized it’s part of their PR campaign to convince people they’re fully committed to the energy transition while they struggle to make any money outside of their fossil fuels business.

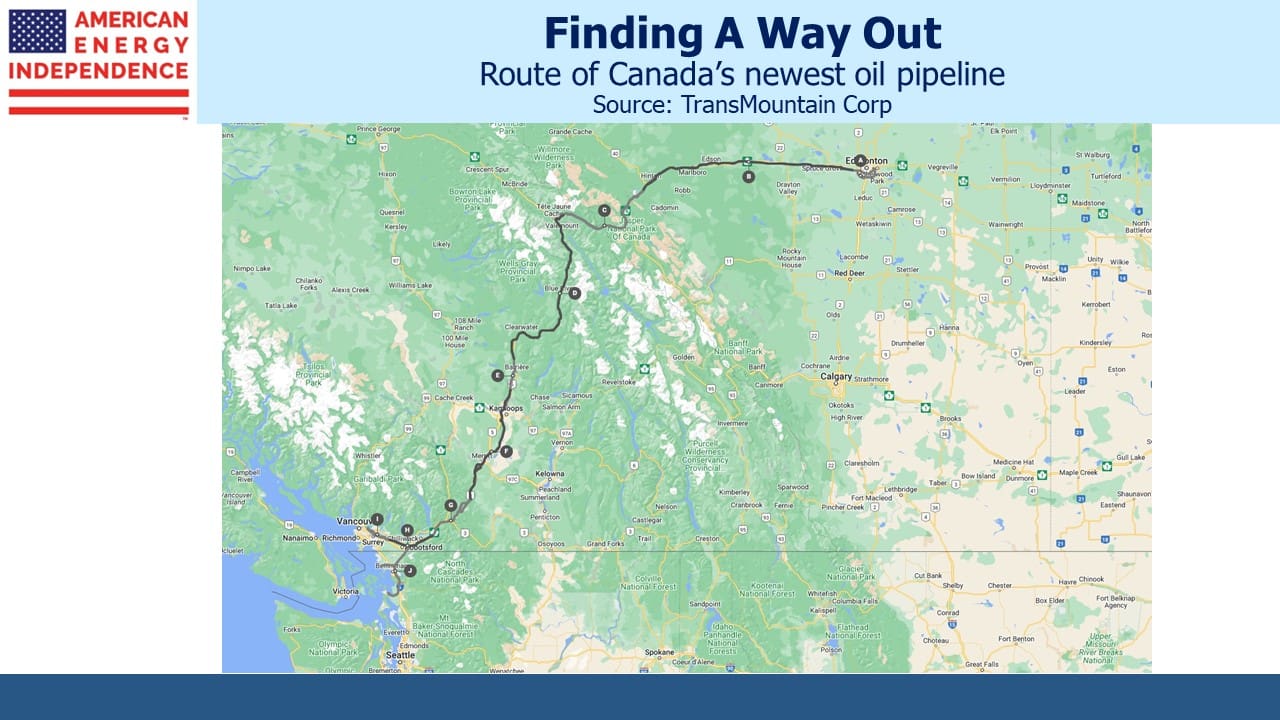

Then I stumbled on an interview with Dawn Farrell, President and CEO of Trans Mountain Corporation (TMC). Originally called TMX, this was a project begun by Kinder Morgan to expand crude capacity on the existing pipeline connecting Edmonton, Alberta with Burnaby, British Columbia.

As we chronicled several times over the years (see Canada’s Failing Energy Strategy), Kinder Morgan eventually tired of navigating the politics between oil-rich Alberta and liberal British Columbia. Canada has long struggled to get its crude oil to market. The Keystone XL expansion was finally killed off by Joe Biden as soon as he became president in a slap to our ally. The Western Canada Sedimentary Basin crude benchmark trades below WTI – sometimes as much as $30. The Canadian Federal government decided completing TMX was in the national interest and bought it from KMI in 2018.

It is now finished. Dawn Farrell explains what it was like to oversee a project backed with theoretically unlimited government funds.

The cost grew from an estimated C$7BN to C$29BN (C$34BN including interest expense), although Farrell notes that the scope increased somewhat. The complexity of building infrastructure isn’t always apparent to those not directly involved.

The route included 47KM of steep slopes with a 15% grade. If not correctly built the pipeline will over time come apart in such terrain. Oil is moved through pipelines in batches of varying grades. Nitrogen has to be inserted between each batch to ensure no gaps open up in between them.

Farrell said they encountered 360 archeological sites, making them probably the largest dig in Canadian history. Every time a new one was encountered work stopped while archeologists were brought in.

Representatives of First Nations, Canada’s indigenous people, were involved at every step. They have stronger rights that native Americans and their consent was needed at numerous points for the project to proceed. TMC employed an ambassador who spent countless days courting First Nations leaders. They were awarded 10% of the jobs and may eventually own a stake in TMC.

Archeologists uncovered 250K artifacts that were mostly First Nations ancestors dating back as much as 1,500 years.

TMC moved 27,000 birds’ nests. They relocated 1.5 million amphibians. Biologists were ever present supervising the process. They passed through nine golf courses, all of which Farrell reports were restored to their previous condition. They met the needs of 69 regulatory agencies.

TMC expanded the oil loading facilities at Vancouver. An estimated 100 whales live in nearby waters, so all ships operate at lower-than-normal speed and employ specialized sonar which is audible to whales, reducing the odds of contact.

TMC increased TransMountain’s capacity from 300 Thousand Barrels per Day (KB/D) to 890KB/D. Filling the pipeline took 24 days and 4.2 million barrels of oil, but it’s now operational.

Canadian politics is more liberal than the US, but there are still plenty of realists up north who recognize that the world will need gasoline, jet fuel, diesel, lubricants and asphalt for the rest of our lives.

The cancelation of Keystone XL was intended to appease climate extremists, but it didn’t stop Canadian oil getting to market. It’s simply going west instead of south, with no US benefit. Similarly, the LNG permit pause won’t stop countries buying natural gas, but it will increase coal consumption by emerging countries in Asia. Democrat energy policies are often more about optics than results.

TMC was a huge infrastructure project with numerous stakeholders including landowners, regulators, oil shippers, indigenous tribes and environmentalists. Past struggles include: Energy Transfer’s Dakota Access pipeline which was fiercely opposed by indigenous tribes; Equitrans’ Mountain Valley Pipeline which suffered numerous judicial delays; and the Cardinal-Hickory Creek transmission line which environmentalists opposed even though it will bring solar and wind power to population centers in Iowa and Wisconsin.

TMX in China would have been different. Building energy infrastructure in rich, western countries is excruciatingly complex. Federal permit reform has support from both political parties but remains unaddressed. Until the process is improved it will impede the energy transition. There’s much more of this ahead for western nations as we electrify more of our energy consumption.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Simon-

One of your most interesting essays, and that’s saying something.