Pipelines Are Cheap; Stocks Are Not

/

Market strategists often point out that valuations aren’t a good timing tool, but it’s still worth staying on top of whether the market is cheap or not. Stocks were having a good year leading into the election, and the Republican sweep took the market another leg higher. Residents of Naples, FL, our winter home, are politically right of center with a demeanor that is unfailingly cheerful, for good reason because it’s a beautiful place.

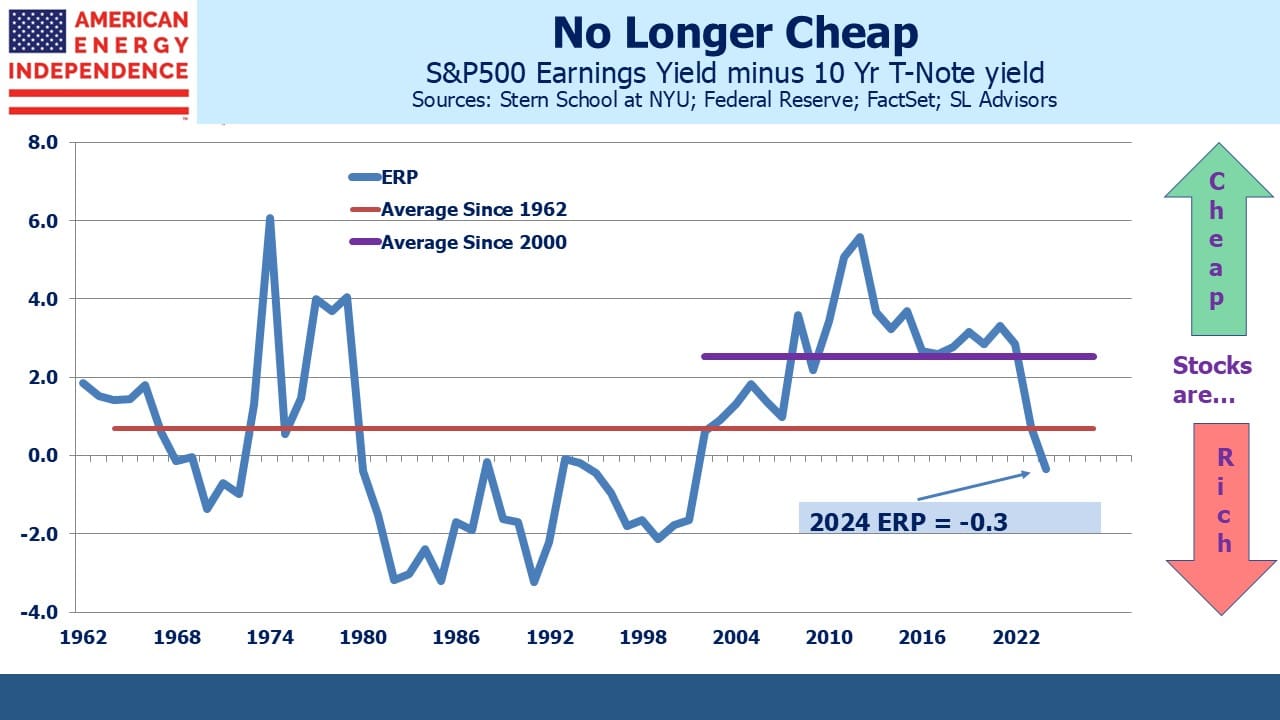

So, my friends at the golf club are nowadays exhibiting even more good cheer than normal, with happiness from the election and with their portfolios easily offsetting the clean-up cost of two recent hurricanes. My hope is that their sunny disposition continues indefinitely because they’re so much fun to be around. But I’m also watching the Equity Risk Premium (ERP).

With both the S&P500 and bond yields rising at the same time, valuation was never going to be compelling. What’s striking is that the ERP (defined here as the yield spread between S&P500 earnings and the ten-year treasury) is the least attractive in at least twenty years. This blog has noted that stocks aren’t that cheap to bonds for at least the past year, which is why we don’t employ a market-timing overlay across any of our portfolios.

The Cyclically Adjusted Price Earnings (CAPE) model popularized by Robert Shiller also shows stocks to be expensive. This has been true for several years, demonstrating the weakness in valuation as a timing tool. Nonetheless, CAPE has a good record in predicting future ten year returns from stocks, as shown in this article from 2020. Since then the market’s continued strong returns have discredited the analysis somewhat, but a tool with a robust history going back 80 years or so is still worth considering.

Markets can remain expensive for a long time. Factset is forecasting earnings growth of 15% next year which would be the best since 2021 when profits rebounded from the pandemic. The current optimism is well founded. But it’s hard to make a case for declining bond yields given the outlook for the deficit, tariffs and deported illegal immigrants.

By contrast, midstream energy infrastructure remains cheap, and to this blogger offers a good chance of continuing to outperform the broader market as it has done for the past five years. A recent Bloomberg article noted that labor productivity in oil and gas extraction has improved faster than any other sector over the past decade. Continued innovation in shale has led to increasing output per well and fewer rigs employed while production continues to reach new highs.

Finally, some notes from my partner Henry Hoffman who attended the TD Energy Conference in New York last week:

The conference featured an insightful discussion between John Miller of Washington Research Group and Dustin Meyer, who oversees Policy and Regulatory Affairs at the American Petroleum Institute.

A key point of discussion was the impact of energy policy on recent elections. Meyer noted that while the primary concerns were immigration and inflation, he attributed part of the inflation issues to the Biden Administration’s climate initiatives. He criticized the increased regulatory burdens and climate mandates, highlighting their contribution to rising costs and inefficiencies.

Meyer expressed concern that industry professionals are unclear about compliance expectations under the current EPA, describing the administration’s approach as disjointed with extensive, yet unclear, directives. He also touched on the Inflation Reduction Act, labeling it as a partisan effort that indiscriminately funnels funds into various clean energy projects without a clear strategy. Meyer mentioned a division within the Republican Party over whether to repeal the act or retain elements that are gaining GOP support, such as the tax credit for carbon capture, known as 45Q.

On the topic of U.S. LNG, a representative from Cheniere’s Investor Relations conveyed optimism about the growth prospects for U.S. LNG. He underscored Cheniere’s significant role, accounting for half of the U.S.’s LNG 15bcf/d of exports, equivalent to two LNG tankers daily from their facilities alone. He highlighted Cheniere’s consumption of 7-8% of all U.S. natural gas and affirmed the company’s capability to continue expansion at their target of 7x EBITDA build multiple. He anticipated that the halts on issuing non-FTA licenses by the DOE would be quickly reversed under a new Trump administration.

In a separate session, NextDecade’s CFO, Brent Wahl, shared optimism about U.S. LNG export growth. Specific to RGLNG, he expects no hurdles from FERC for a SEIS by next year and hopeful for a reversal of the DCCCA’s 3-judge panel’s vacatur sooner. Wahl also noted strong support from stakeholders for continuing with Train 4 once permitting challenges are addressed.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!