Gas Projections Keep Going Up

/

On Thursday morning Williams Companies released their earnings without the rumored announcement of a Behind The Meter (BTM) deal. The stock briefly dipped as algos reacted to the news release but was soon rallying because the broad outlook for natural gas demand remains strong.

It’s turning into a global high tech arms race. Proliferation of data centers is driven by two factors: (1) every country wants to control the physical location of the AI that’s increasingly viewed as crucial to growth (2) keeping the physical distance between data centers and users short enough to eliminate any noticeable latency.

Last week French President Macron announced that 1 Gigawatt of nuclear power would be dedicated to support $BNs in investments in AI projects. Along with other initiatives from Brookfield Asset Management and Middle Eastern investors, these will be part of $113BN in commitments that Macron will unveil next week.

The reliance on nuclear power, which provides over 60% of France’s electricity, is the European way of building data centers while maintaining fealty to their green ambitions. Macron even offered his own version of drill baby, drill: “Plug baby, plug.”

Vice President JD Vance was at a French AI summit warning against Europe’s desire to impose regulations that would affect US technology companies.

The proliferation of new data centers is making it hard to estimate the growth in global power demand. The Energy Transfer deal with Cloudburst announced on Monday promised 450 Billion BTUs of natural gas every day to run a gas turbine. This is almost 0.5% of daily US gas production, a huge amount (see AI Demand Ramps Up).

However, there was some confusion because reports estimated this would produce 1.2 Gigawatts (GW) of power daily, whereas most observers would expect the amount of natural gas contemplated to produce three times as much power.

ET’s earnings call includes the term “data center” 27 times, reflective of the mix of questions the management team fielded from analysts. They’ve received requests from 70 prospective data centers across 12 states. If each one was the same size as the Cloudburst BTM agreement (ie 0.45 Billion Cubic Feet per Day, BCF/D) that would add up to 31 BCF/D of gas demand.

It shows the uncertainty around forecasts related to data centers. Wells Fargo revised their ten year growth forecast for US natural gas consumption from 12 BCF/D to 11 BCF/D in the wake of the DeepSeek news a couple of weeks ago (see Pipelines And The Jevons Paradox).

The 1 BCF/D reduction by Wells Fargo suggests a precision that doesn’t exist for 2035 gas consumption. They’re simply registering their view that DeepSeek is a net negative to earlier projections.

Data centers need 24X7 power which is why they’re not planning to rely on solar and wind. Even combined cycle natural gas plants have downtime for maintenance – typically around 5%. Diesel generators and batteries are typically planned for back-up. Using batteries 5% of the time seems much more sensible than the 60-70% that they’re needed for weather-dependent solar and wind.

ET’s CEO Marshall “Mackie” McCrea couldn’t resist commenting: “How wonderful is life after this election when we have a President and an administration that loves this country that fully recognizes how blessed we are with…fossil fuel resources.”

The International Energy Agency (IEA) published a report forecasting global electricity demand will grow at 4% per annum to 2027. 85% of this growth is expected to be in emerging economies. The additional 3,500 Terrawatt Hours of power needed is equivalent to adding a new Japan every year.

The US is expected to continue the 2% growth of last year following a couple of decades of flat consumption. GDP and the population grow, but energy efficiencies offset the increase in power demand that would otherwise result.

In 2023 EU power demand slumped to the levels of two decades ago and only managed 1.4% growth last year. European industry still pays around 2X the US price for electricity and 50% more than China.

The IEA is forecasting 1% annual growth in global natural gas power generation through 2027. This is probably too low. Last year was +2.6%. The IEA retains their cheerleading role for renewables.

We’ve been bulls on natural gas demand for years. We think even we underestimated the potential.

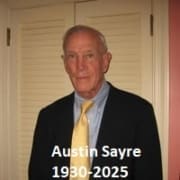

Finally, we were very saddened to lose long-time friend Austin Sayre who died peacefully at the age of 94. Austin asked me to manage his portfolio back in 2009 when I wasn’t giving any thought to managing other people’s money. He was our first client.

Austin was witness to my early efforts at golf, having generously offered to sponsor me at our local club in New Jersey. When I once took seven strokes on a par 3, he memorably commented, “You sure got your moneysworth on that hole!”

Austin was an unfailingly charming and upbeat man. I feel privileged to have known him. Austin will be sorely missed by many people. A life well lived.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

I also knew Austin. He was a foundry customer of mine. We had many long conversations of similar interests.

Also, knew Ann , his daughter in when we lived in Mountainville .