Tariffs Not Biting Yet

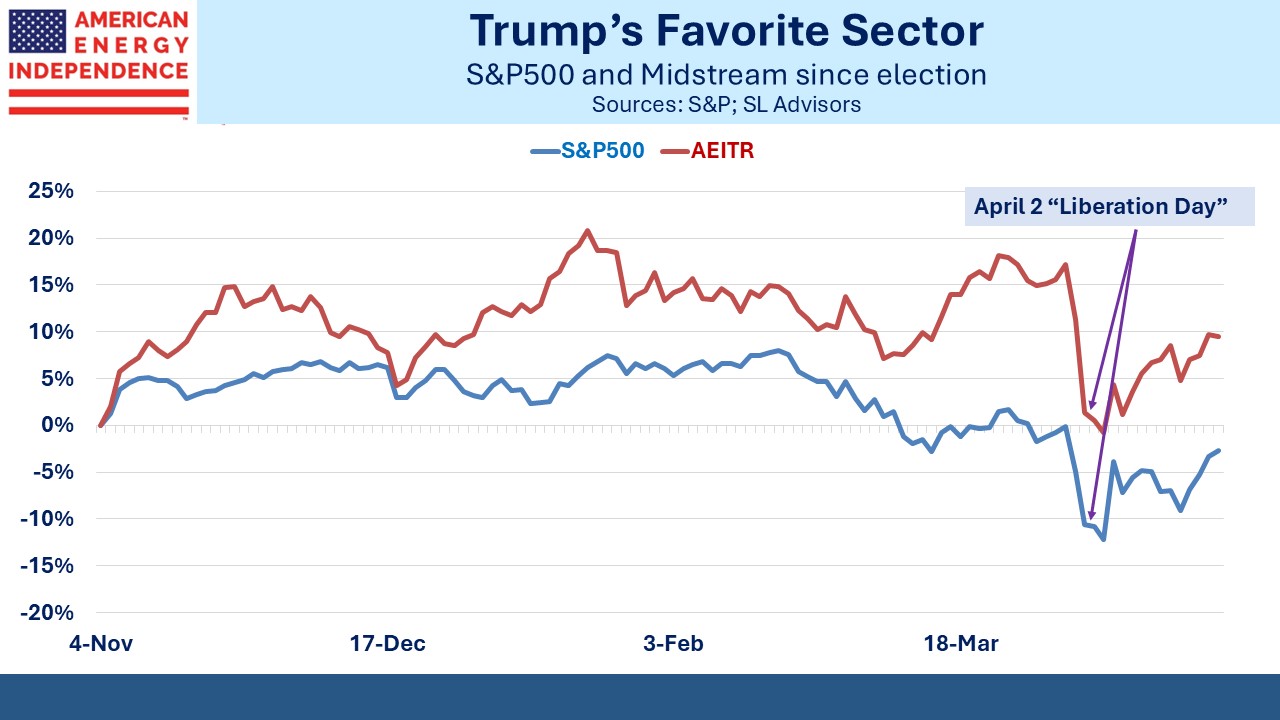

On Friday the market achieved a welcome milestone in that the S&P500 rose above its pre-Liberation Day level. The unemployment report suggested that we’re not yet falling into a recession. Signs that trade negotiations with China may start was encouraging.

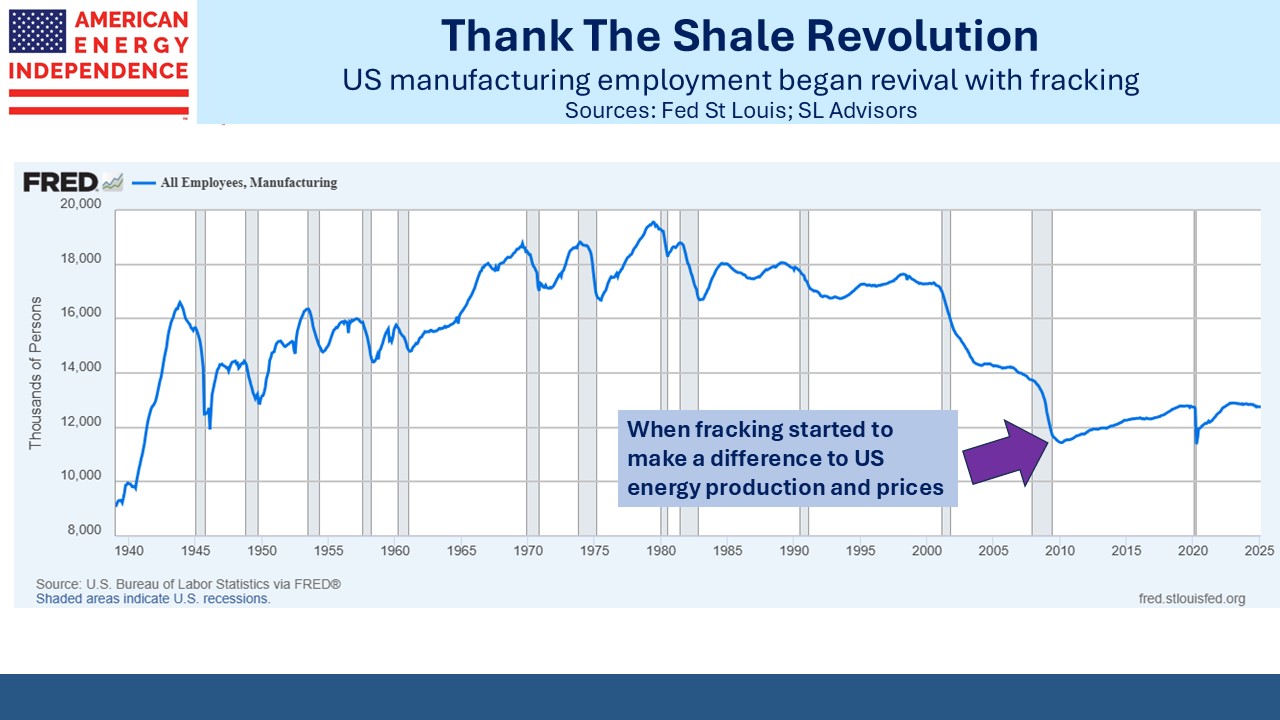

Midstream earnings have been coming in with little discernible impact from the tariff trauma. Worth noting is that TC Energy (TRP) is investing $0.9BN adding capacity to their ANR gas pipeline which connects Texas and Louisiana to the midwest. It’s to provide power for data centers and TRP estimates a 6X EBITDA multiple which is pretty accretive. AI-driven demand for natural gas still seems robust. They don’t see much near-term impact from tariffs.

Oneok reaffirmed 2025 full year guidance of $8-8.45BN and is close to a 10% EBITDA growth forecast for 2026. Targa Resources modestly beat expectations and reaffirmed full year EBITDA guidance of $4.7-4.9BN. 1Q adjusted EBITDA was +22% versus the prior year. They noted that they had accelerated purchases of steel to limit the exposure of capital projects already under way to tariffs.

On the Enterprise Products earnings call, co-CEO Jim Teague spoke to the uncertainty caused by tariffs. Many companies have suspended earnings guidance for the year, although no midstream companies have. Teague said, “I have the core belief that when the dust settles the aim of this administration’s policies, laws and regulations is intended to promote U.S. energy, not just for the next four years, but for decades.”

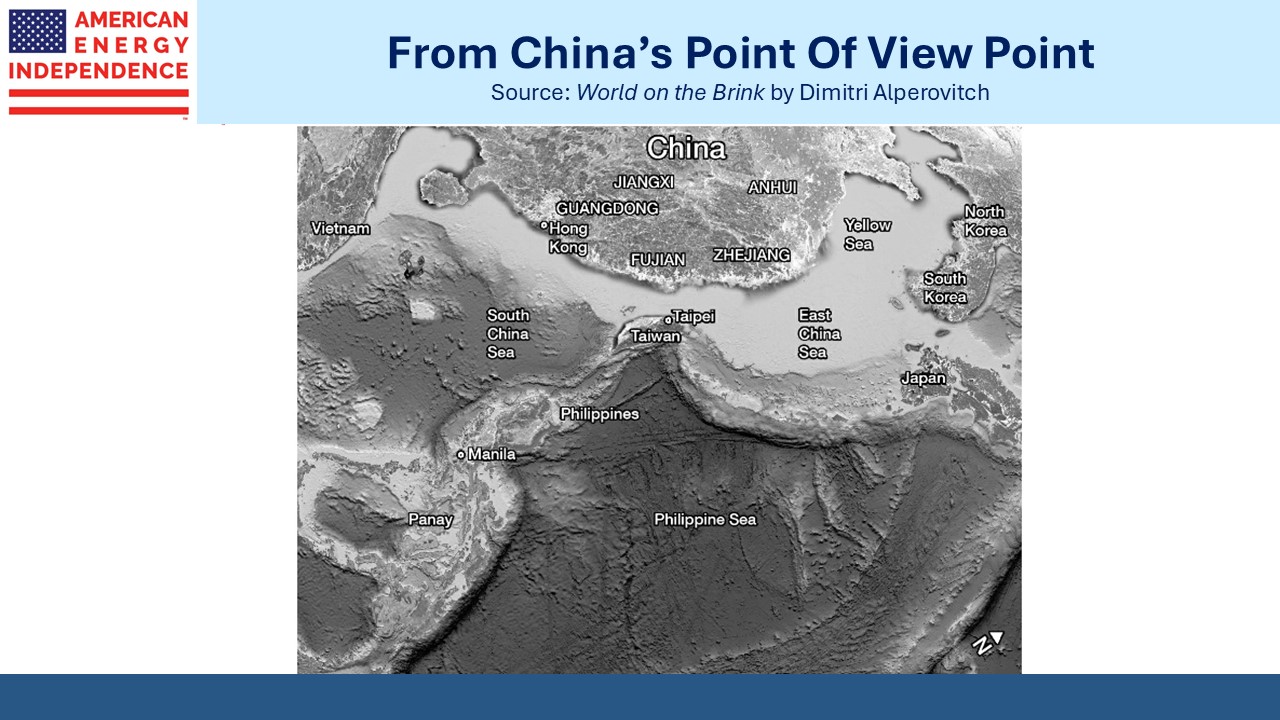

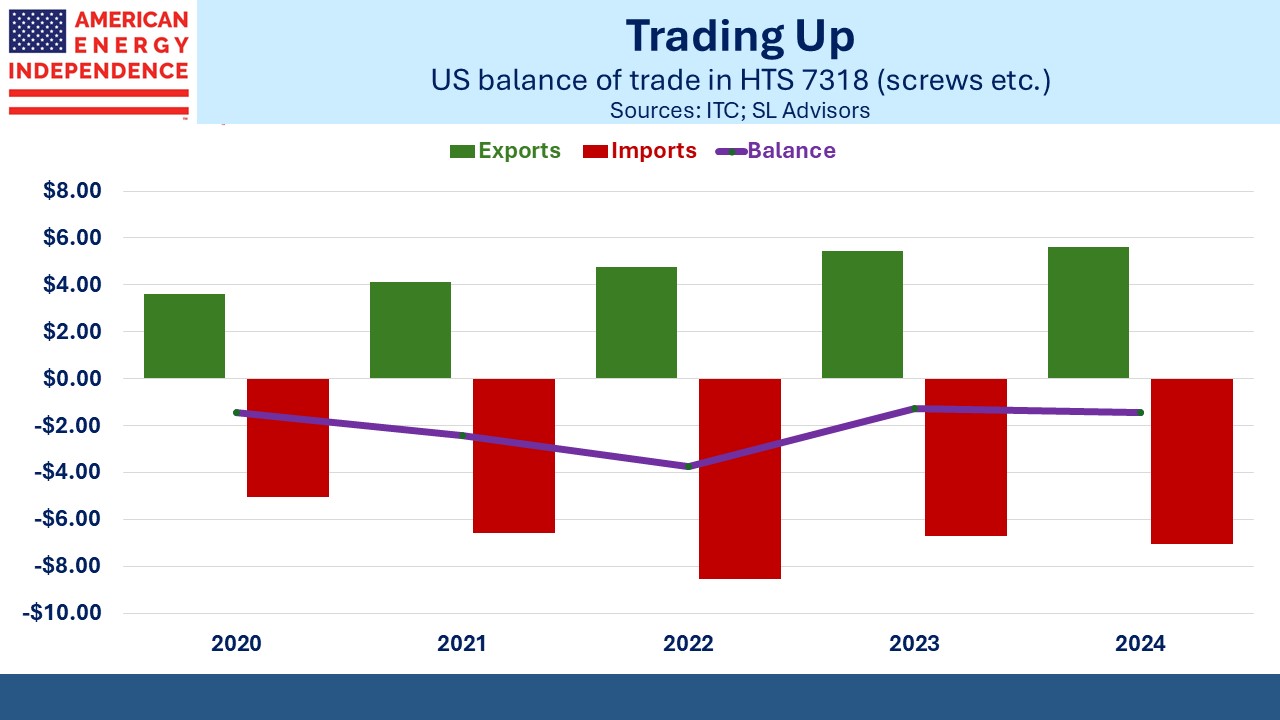

EPD is one of America’s biggest exporters of hydrocarbons. Along with Energy Transfer and Targa Resources they own 90% of the LPG export capacity along the US gulf coast. EPD is a significant exporter of ethane, and China is a significant buyer as feedstock for their petrochemical industry.

EPD said they have no contracts with any Chinese entities, which will come as good news to EPD investors. Volumes are typically routed through international trading companies. Moreover, the ethane tariffs that China initially said they’d impose look set to be lifted, since there are few near term alternatives to buying ethane from America.

What’s notable about all these companies’ earnings is that when asked about tariffs they focused very narrowly on the possible impact on their own purchases. Midstream executives are not overly concerned about declining volumes of hydrocarbons. As we’ve noted before, energy quantities are surprisingly stable (see Midstream Is About Volumes). In addition, if China imposes tariffs on US imports, flows will generally be rerouted to minimize the impact. And in the case of ethane, China’s dependence makes an import tax self-defeating.

The Tony Blair Institute for Global Change published The Climate Paradox: Why We Need to Reset Action on Climate Change last week. Tony Blair became a political pariah after leading the UK into the 2nd Iraq war in 2003 on a futile search for weapons of mass destruction. He’s been repairing his reputation ever since.

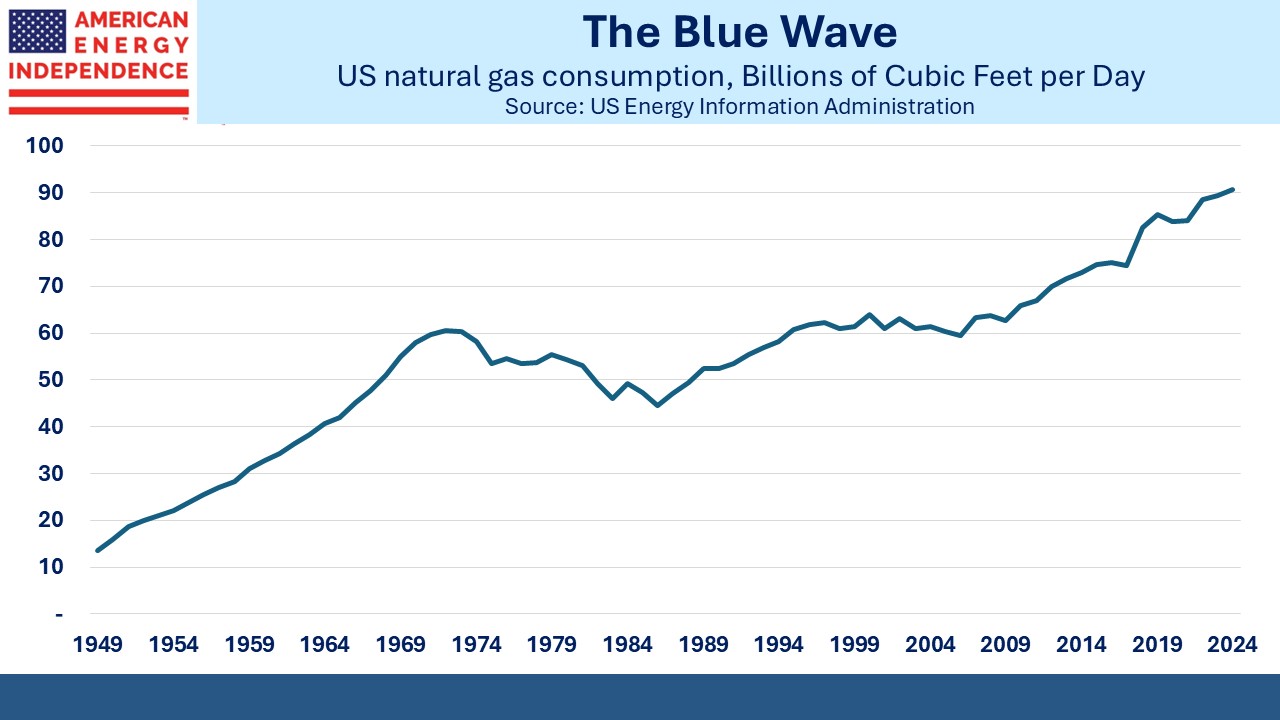

The Climate Paradox is a welcome addition. In the US neither political party has much useful to say on the topic. Democrats beholden to left-wing progressives maintain that solar and wind will solve everything. Republicans generally ignore the issue entirely. Blair has upset fellow left-wingers, which is usually time well spent, by asserting that rising CO2 levels prove the current approach is failing. His policy prescriptions include accepting that hydrocarbon use will continue to rise and we need to invest heavily in carbon capture.

Most significantly, he notes that regardless of the past history of CO2 emissions, the growth is coming from emerging economies led by China and India. Therefore, efforts to reduce emissions should start there.

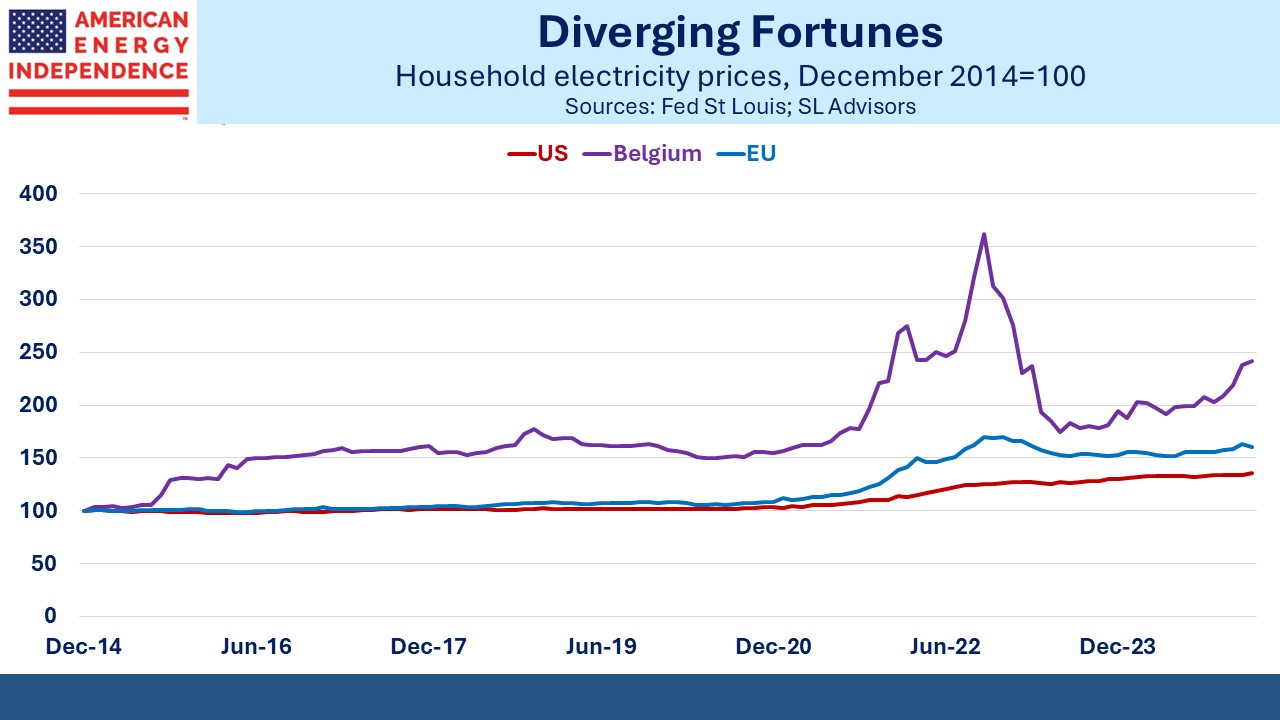

Like the EU, the UK’s energy policies mean they’ll incur the cost of decarbonization without seeing the benefit, a sure way to lose popular support. California is following a similar path. Cutting emissions while China raises theirs was embraced by left-wing climate negotiators but never made sense to the rest of us.

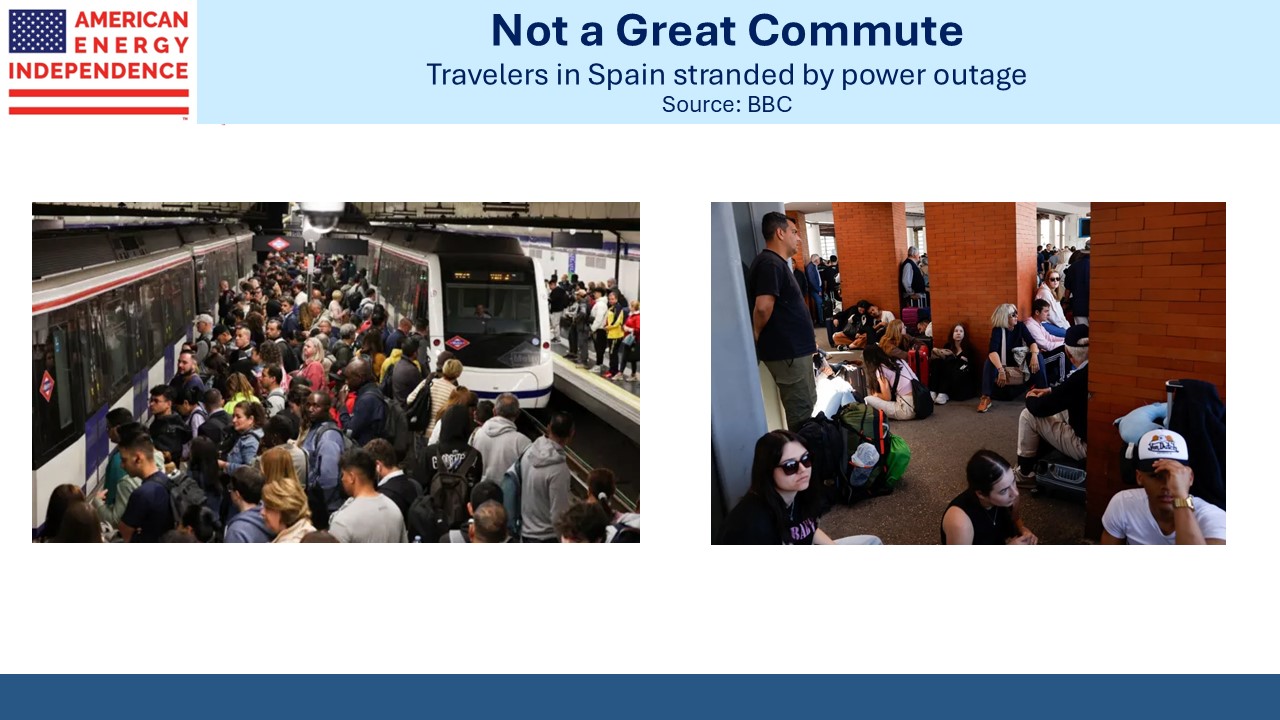

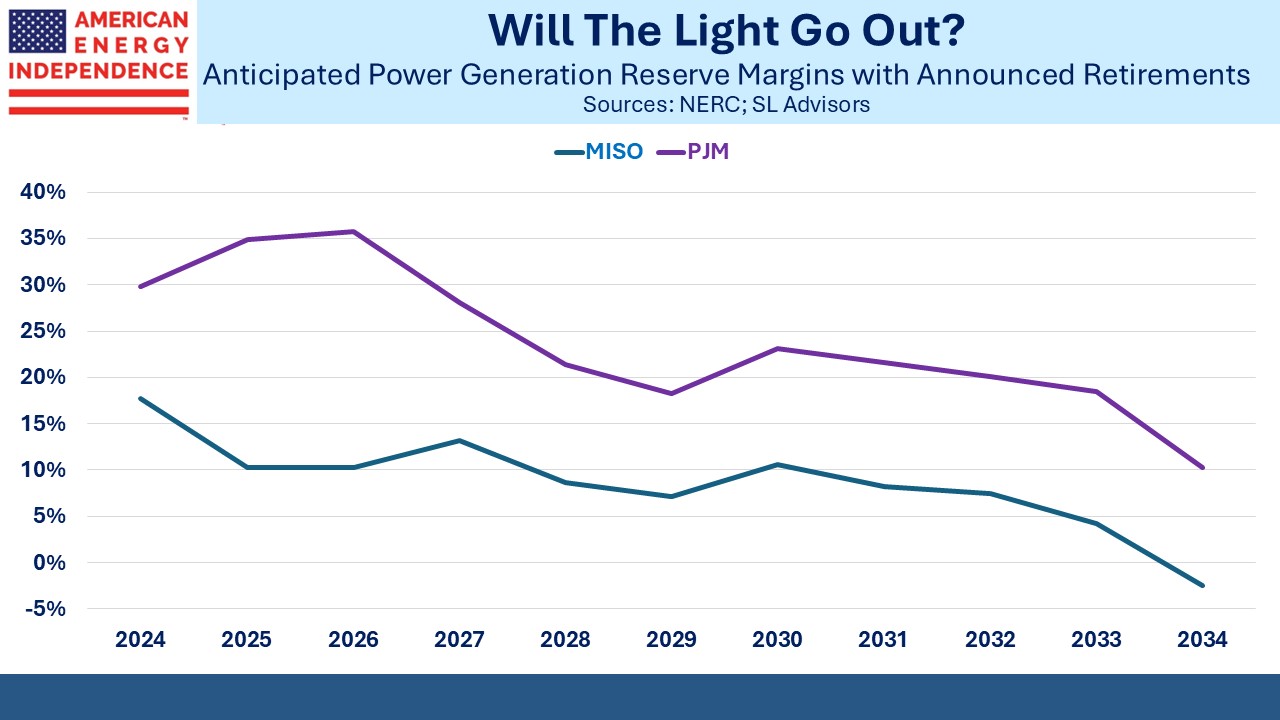

Spain’s recent blackout was likely caused by over-reliance on solar power whose volatile output crashed the system. The all-renewables advocates keep losing credibility with voters worldwide.

Tony Blair has made a refreshing contribution to the climate change debate, one that aligns with our conviction that natural gas consumption will continue to grow for the foreseeable future.

Finally, most journalists and bloggers occasionally struggle for a topic but usually come up with something. I recently came across this BBC report that is a contender for least newsworthy story of the year. Rest assured that if your blogger ever plumbs such journalistic depths, readers will be sure to let me know.

We have two have funds that seek to profit from this environment: