Energy Transfer: Cutting Your Payout, Not Mine

Too few writers covering energy infrastructure admit to the many distribution cuts inflicted on MLP holders. Instead, they identify numerous other problems whose resolution will draw in buyers. Incentive Distribution Rights (IDRs), the payments made by MLPs to their General Partners (GP), have drawn scorn for the past couple of years. Eliminating them is fashionable and now virtually complete, with only a handful of holdouts. Other solutions include self-funding growth projects. Common practice was for MLPs to pay out most of their cash and raise equity for new projects. It worked until the new projects became big. The Shale Revolution was responsible for that. Selling non-core assets is another piece of advice – it’s rarely controversial. Few companies admit that any assets are non-core, until selling them.

All this free advice is directed both publicly and privately to help draw in new investors and lift stock prices. What’s rarely mentioned are the widespread and substantial cuts in distributions that have alienated the income-seeking MLP investor base. Alerian has a chart showing “AMZ Normalized Distributions Paid”, which shows a cumulative 25% cut 2015-17, if you do the math. Dividends on AMLP are down 34% from their high in 2014, although you won’t find this on their website. Promises have been broken, and the buyers know this.

One reason others don’t dwell too much on this issue is that many distribution cuts have been via mergers and simplifications. When a lower yielding GP acquires its MLP, the MLP investors are subjected to a “backdoor” distribution cut through owning a new security with a lower yield than the one they gave up.

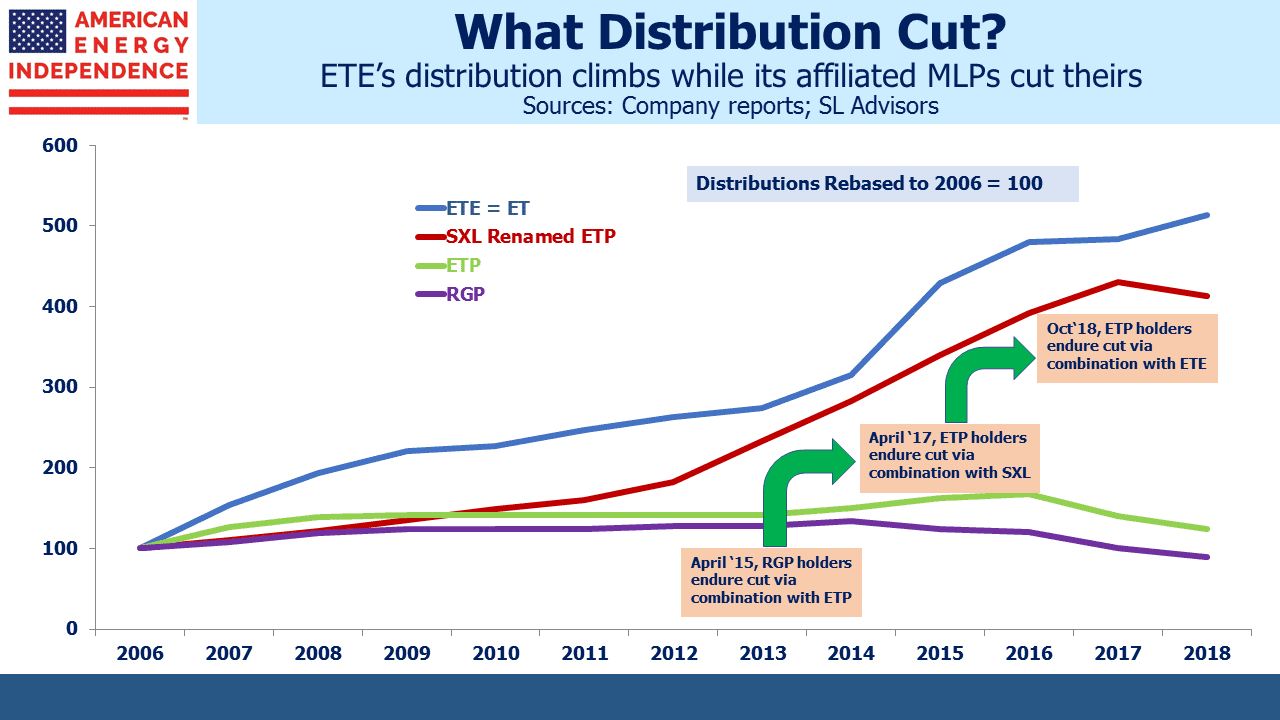

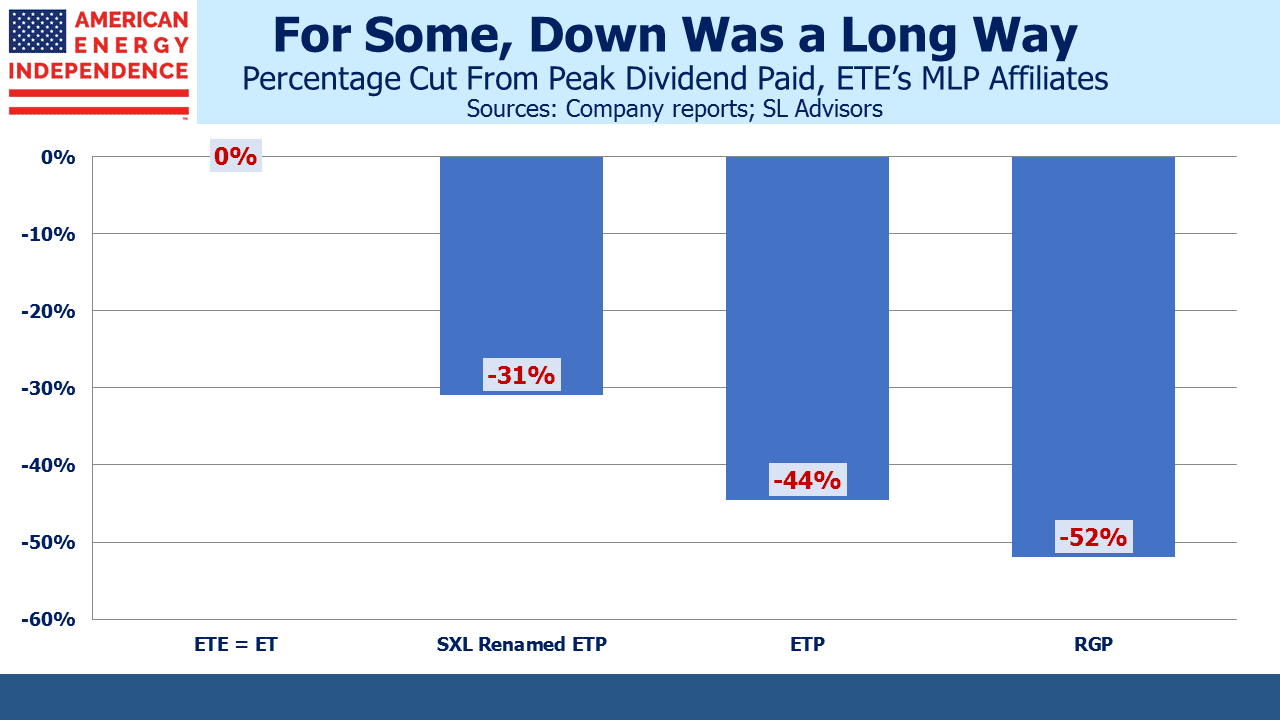

Energy Transfer has excelled at imposing such “stealth distribution cuts”. Over the past four years they’ve rolled four publicly traded entities into one. In each case, the lower-yielding entity acquired the higher-yielding one, resulting in a lower distribution for investors in the acquiree.

What’s striking is to overlay the normalized distribution history of the four entities: Energy Transfer Equity (ETE), Energy Transfer Partners (ETP), Sunoco Logistics (SXL) and Regency Partners (RGP). ETE is the surviving entity, now renamed Energy Transfer (ET).

ETE investors have seen a five-fold increase in distributions since 2006, a 13% compounded annual growth rate. They’ve increased distributions every year. That shouldn’t be surprising, because ETE was always the vehicle of choice for CEO Kelcy Warren and the management team. SXL holders had a good run – in 2016 they folded in higher-yielding ETP but retained the ETP name, which gave them a 14% distribution growth rate to that point. But then they were “Kelcy’d”, as ETP adopted ETE’s lower payout in a subsequent combination, leading to a 31% effective cut. Original investors in ETP and RGP did worse.

ET’s price peaked in 2015 (it was ETE back then), when Kelcy embarked on his ultimately unsuccessful attempt to buy Williams Companies (WMB). It’s a measure of how far sentiment has fallen, in that ETE’s yield briefly dipped below 3% in May 2015. Since then, its distribution has risen from $1.02 to $1.22. They dodged the WMB deal, have reduced leverage, completed the Dakota Access Pipeline and expect to cover their distribution by 1.7-1.9X next year. Nonetheless, today ET yields 8.5%, with an estimated 2019 Distributable Cash Flow yield of 15.9%. No wonder Kelcy Warren is back in buying the stock.

It’s true that ET’s management has earned a reputation for self-dealing. During the protracted WMB merger negotiations , ETE issued very attractive convertible preferred securities to the senior executives, but didn’t make them available to other ETE investors (see Will Energy Transfer Act with Integrity?). Although they won the resulting class action lawsuit, it’s clear that if management can get away with something that benefits them but not shareholders, they will. Even so, the current valuation seems excessively pessimistic.

Kinder Morgan (KMI) and Plains All American (PAGP) drew unwelcome attention for each delivering two distribution cuts to their investors. KMI’s first cut was through combining with their MLP in the technique later used by ETE. They followed this up with a second, unambiguous cut in response to rating agency concerns over leverage. PAGP’s management administered two direct cuts, stunning investors both times. Oneok (OKE), Targa (TRGP), Semgroup (SEMG), and Enlink (ENLC) all folded in their respective MLPs, delivering backdoor distribution cuts to their MLP holders but maintaining their dividends at the GP level. But many others avoided cutting their dividends at all. Antero Midstream (AMGP), Tallgrass (TGE) and Western Gas (WGP) all rolled up their MLPs with no change in payouts.

None of the Canadian midstream companies cut their dividends, reflecting their more conservative approach. This highlights that the distribution cuts were due to the flawed MLP practice of paying out virtually all available cash flow, relying on tapping the capital markets for growth projects. There were a few exceptions, but in general MLP distribution cuts were not due to deteriorating fundamentals in the midstream sector.

MLPs are still cutting payouts. Distributions on AMLP, which is MLP-only and tracks the Alerian MLP Infrastructure Index, are down 6.9% this year. By contrast, distributions on the American Energy Independence Index, which includes the biggest North American pipeline corporations and MLPs and is therefore more representative of the overall sector, are up 6.6%.

We are invested in AMGP, ENLC, ET, KMI, OKE, PAGP, SEMG, TGE, TRGP, WGP and WMB. We are short AMLP.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

That’s a fine article and an accurate analysis of why I sold ETP many years ago and won’t invest with Kelcy Warren now, no matter how undervalued ET may be. There are a few nuances you might want to note. KMI acquired the MLPs controlled by Kinder by having the C corporation acquire the MLPs, thereby imposing an income tax on the unit holders of the MLPs. On the other hand ET acquired the other MLPs while still retaining its own MLP status, inflicting no income tax burden on the unit holders of the acquired partnerships. And while TGE acquired its controlled MLPs while still retaining its partnership status it subsequently elected to be taxed as a C corporation even though in structure it remains a limited partnership. It should be noted that TGE estimates that it will bear no corporate income tax burden for about ten years and its distributions are almost entirely (about 90%) tax deferred.

Very noble to avoid Kelcy Warren, even moral. However, most investors are interested in opportunities for profit. I would suggest that ET is oversold today and provides a much higher likelihood of significant profit, notwithstanding the board’s seeming “indifference” to the “shareholders first” imperative.

A entire generation of investors need to die before this sector gains any new investors.